Dow Jones, S&P, Nasdaq, Steep Drops By FedEx, Nike May Weigh On Wall Street

March 21 2025 - 9:05AM

IH Market News

The major U.S. index futures for the Dow Jones, S&P and

Nasdaq are currently pointing to a lower open on Friday, with

stocks likely to add to the modest losses posted during Thursday’s

choppy session.

The downward momentum on Wall Street comes amid ongoing concerns

about the economic outlook along with rising geopolitical tensions

and uncertainty about the impact of President Donald Trump’s

tariffs.

A steep drop by shares of FedEx (NYSE:FDX) is also likely to

weigh on the markets, with the delivery giant plunging by 9.0

percent in pre-market trading.

The slump by FedEx comes after the company reported slightly

weaker than expected fiscal third quarter earnings and lowered its

full-year earnings guidance due to “continued weakness and

uncertainty in the U.S. industrial economy.”

Shares of Nike (NYSE:NKE) are also tumbling by 7.1 percent in

pre-market trading after the athletic apparel and footwear giant

reported fiscal third quarter results that beat estimates but

forecast a decrease in sales in the current quarter.

Chipmaker Micron Technology (NASDAQ:MU) is also seeing notable

pre-market weakness even though the company reported better than

expected fiscal second quarter results and provided upbeat

guidance.

Overall trading activity may be somewhat subdued, however, with

a lack of major U.S. economic data likely to keep some traders on

the sidelines.

After recovering from an initial move to the downside, stocks

showed a lack of direction over the course of the trading session

on Thursday. The major averages swung back and forth across the

unchanged line before eventually closing modestly lower.

The Nasdaq fell 59.16 points or 0.3 percent to 17,691.63 and the

S&P 500 dipped 12.40 points or 0.2 percent to 5,662.89, while

the narrower Dow posted an even more modest loss, edging down 11.31

points or less than a tenth of a percent to 41,953.32.

The modestly lower close on Wall Street came amid lingering

concerns about the economic outlook following the Federal Reserve’s

monetary policy announcement on Wednesday.

The Fed announced its widely expected decision to leave interest

rates unchanged, but forecasts suggest officials still expect to

resume cutting rates later this year.

However, the Fed officials also lowered their projections for

GDP growth in 2025 to 1.7 percent from 2.1 percent and raised their

forecasts for consumer price growth this year to 2.7 percent from

2.5 percent.

Fed Chair Jerome Powell said during his post-meeting press

conference that a “good part” of the higher inflation forecast is

due to tariffs.

Selling pressure was relatively subdued, however, as a report

from the National Association of Realtors unexpectedly showing a

significant rebound by existing home sales helped ease concerns

about the strength of the economy.

NAR said existing home sales surged by 4.2 percent to an annual

rate of 4.26 million in February after tumbling by 4.7 percent to a

revised rate of 4.09 million in January.

The sharp increase surprised economists, who had expected

existing home sales to slump by another 3.2 percent to an annual

rate of 3.95 million from the 4.08 million originally reported for

the previous month.

Airline stocks moved significantly lower over the course of the

session, dragging the NYSE Arca Airline Index down by 1.7

percent.

Considerable weakness also emerged among biotechnology stocks,

as reflected by the 1.2 percent loss posted by the NYSE Arca

Biotechnology Index.

Networking and computer hardware stocks also showed notable

moves to the downside, while most of the other major sectors showed

more modest moves on the day.

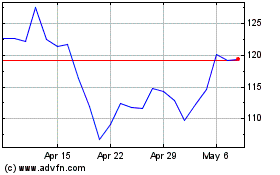

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Feb 2025 to Mar 2025

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Mar 2025