CVR Energy Provides Update to Operational Statistics and Financial Information for its Petroleum and Renewables Businesses

May 14 2024 - 4:19PM

CVR Energy, Inc. (“CVR Energy” or the “Company”) (NYSE: CVI) today

announced its outlook for certain operational statistics and

financial information for its Petroleum and Renewables businesses

for the second quarter of 2024. This information was not included

in the announcement of the results of the first quarter of 2024, as

the Company was not yet able to determine the impacts from a fire

the Wynnewood Refinery experienced the day prior to the

announcement. As previously announced, the fire was extinguished

shortly after it started, no employees or contractors were injured,

and the operations at the Coffeyville Refinery were not impacted by

the fire. After further assessment of this incident, it was

determined the damages were limited to pipe racks and pumps in the

area of the naphtha processing units, which damage to the pipe rack

impacted service to other units. Currently, one crude unit, the

fluid catalytic cracker, and the alkylation unit have been

restarted and a reformer is in the process of starting up. The

Company does not currently expect the fire to have a material

impact to its overall financial position, and management expects

that operations should return to normal by the end of the second

quarter of 2024.

Q2 2024 Outlook

The table below summarizes our outlook for

certain operational statistics and financial information for the

second quarter of 2024. See “Forward-Looking Statements” below.

| |

Q2 2024 |

| |

Low |

|

High |

| Petroleum |

|

|

|

|

Total throughput (bpd) |

|

170,000 |

|

|

|

190,000 |

|

|

Direct operating expenses (in millions) (1) |

$ |

105 |

|

|

$ |

115 |

|

|

Turnaround (2) |

|

5 |

|

|

|

10 |

|

| |

|

|

|

| Renewables (3) |

|

|

|

|

Total throughput (in millions of gallons) |

|

7 |

|

|

|

10 |

|

|

Direct operating expenses (in millions) (1) |

$ |

8 |

|

|

$ |

12 |

|

| |

|

|

|

| Capital Expenditures (in

millions) (2) |

|

|

|

|

Petroleum |

$ |

35 |

|

|

$ |

50 |

|

|

Renewables (3) |

|

3 |

|

|

|

6 |

|

__________________

|

(1) |

Direct operating expenses are shown exclusive of depreciation and

amortization, turnaround expenses, and inventory valuation

impacts. |

|

(2) |

Turnaround and capital expenditures are disclosed on an accrual

basis. |

|

(3) |

Renewables reflects the Wynnewood renewable diesel unit and

spending on the Wynnewood renewable feedstock pretreater project.

As of March 31, 2024, Renewables does not meet the definition of a

reportable segment as defined under Accounting Standards

Codification Topic 280. |

|

|

|

Forward-Looking StatementsThis

news release may contain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Statements concerning current estimates, expectations and

projections about future results, performance, prospects,

opportunities, plans, actions and events and other statements,

concerns, or matters that are not historical facts are

“forward-looking statements,” as that term is defined under the

federal securities laws. These forward-looking statements include,

but are not limited to, statements regarding future: impacts from

the fire the Wynnewood Refinery including but not limited to

impacts to employees, contractors, assets, equipment and other

units (from the pipe rack or otherwise); operations at the

Coffeyville Refinery; restart and continued operation of the

Wynnewood Refinery including but not limited to the crude unit, the

fluid catalytic cracker, the alkylation unit and the reformer; our

overall financial position; the return to normal operations at

Wynnewood by the end of the second quarter of 2024 or at all;

throughput, direct operating expenses, capital expenses,

depreciation and amortization, turnaround expenses, and inventory

valuation impacts for each of our petroleum and renewables

businesses; and other matters. You can generally identify

forward-looking statements by our use of forward-looking

terminology such as “outlook,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “intend,”

“may,” “might,” “plan,” “potential,” “predict,” “seek,” “should,”

or “will,” or the negative thereof or other variations thereon or

comparable terminology. These forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. Investors are cautioned that

various factors may affect these forward-looking statements,

including (among others) demand for fossil fuels and price

volatility of crude oil, other feedstocks and refined products;

potential operating hazards, including the impacts of fires at our

facilities; costs of compliance with existing or new laws and

regulations and potential liabilities arising therefrom; our

controlling shareholder’s intention regarding ownership of our

common stock and potential strategic transactions involving us or

CVR Partners; general economic and business conditions; political

disturbances, geopolitical instability and tensions; impacts of

plant outages and weather conditions and events; and other risks.

For additional discussion of risk factors which may affect our

results, please see the risk factors and other disclosures included

in our most recent Annual Report on Form 10-K, any subsequently

filed Quarterly Reports on Form 10-Q and our other Securities and

Exchange Commission (“SEC”) filings. These and other risks may

cause our actual results, performance or achievements to differ

materially from any future results, performance or achievements

expressed or implied by these forward-looking statements. Given

these risks and uncertainties, you are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements included in this news release are made only as of the

date hereof. CVR Energy disclaims any intention or obligation to

update publicly or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

to the extent required by law.

About CVR Energy, Inc.

Headquartered in Sugar Land, Texas, CVR Energy

is a diversified holding company primarily engaged in the

renewables, petroleum refining and marketing business as well as in

the nitrogen fertilizer manufacturing business through its interest

in CVR Partners. CVR Energy subsidiaries serve as the general

partner and own 37 percent of the common units of CVR Partners.

Investors and others should note that CVR Energy

may announce material information using SEC filings, press

releases, public conference calls, webcasts and the Investor

Relations page of its website. CVR Energy may use these channels to

distribute material information about the Company and to

communicate important information about the Company, corporate

initiatives and other matters. Information that CVR Energy posts on

its website could be deemed material; therefore, CVR Energy

encourages investors, the media, its customers, business partners

and others interested in the Company to review the information

posted on its website.

For further information, please contact:

Investor RelationsRichard

RobertsCVR Energy, Inc.(281)

207-3205InvestorRelations@CVREnergy.com

Media RelationsBrandee

StephensCVR Energy, Inc. (281)

207-3516MediaRelations@CVREnergy.com

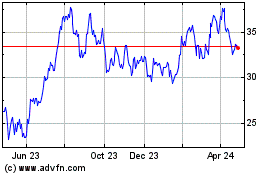

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Apr 2024 to May 2024

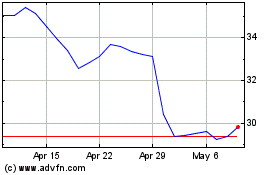

CVR Energy (NYSE:CVI)

Historical Stock Chart

From May 2023 to May 2024