Telus Misses, Guides Higher - Analyst Blog

August 08 2011 - 9:45AM

Zacks

The second largest Canadian telecommunications company,

Telus Corporation (TU) has reported second quarter

adjusted earnings per ADS of $0.99 (C$0.96 per share), missing the

Zacks Consensus Estimate by a penny. Adjusted earnings increased

5.5% from C$0.91 in the year-ago quarter.

Adjusted earnings exclude an income tax benefit of 3 Canadian

cents.

Total revenue increased 6.4% year over year to C$2.554 billion

($2.639 billion), striding ahead of the Zacks Consensus Estimate of

$2.616 billion. The year-over-year increase was attributable to

higher revenues from wireless and wireline data services. Adjusted

EBITDA upped 2.7% year over year to C$950 million ($983 million).

The improved revenue was partially offset by high costs associated

with the growth in wireline Optik TV services and retain wireless

subscribers.

Segment Results

Wireless revenues spiked 9.6% year

over year to C$1.34 billion ($1.38 billion) in the reported quarter

driven by increases of 8.8% in network revenue and 21% in equipment

and other revenue.

Within network revenue, data revenue jumped 48.9% year over year

on strong adoption of smartphones and related data plans, increased

mobile Internet devices and tablets, and higher roaming revenues.

Voice revenue slid 3.7% year over year, due to falling voice

average revenue per user (ARPU).

In the reported quarter, ARPU grew 2.5% year over year to

C$58.88 ($60.83), primarily attributable to higher data ARPU (up

39% year over year) partly offset by lower voice ARPU (down 9.3%).

The monthly subscriber churn (customer switch) deteriorated to

1.67% from 1.45% in the year-ago quarter, reflecting the loss of

the federal contract and increased price competition from new

entrants and existing national competitors.

Net wireless subscriber addition was 94,000, reflecting a 24.2%

year-over-year decrease following the loss of a federal service

contract. Telus added 2,000 net pre-paid customers in the second

quarter, representing a 15.6% year-over-year decline. Net post-paid

subscriber addition was 92,000, down 15.6% year over year.

Telus had 7.1 million wireless subscribers, including 5.9

million post-paid customers and $1.2 million prepaid customers at

the end of the second quarter.

Wireline revenues rose 3% year over

year to C$1.261 billion ($1.30 billion) due to declines in voice

local and long distance revenues, partially compensated by data and

other services and equipment revenue growth. Data revenues

increased 14% year over year to C$635 million ($646 million) owing

to healthy TV subscriber growth, higher Internet services and

enhanced data services, increased data equipment sales as well as

newly consolidated managed workplace revenues.

Voice local revenues fell 8.7% year over year to C$380 million

($393 million) while voice long-distance revenue dropped 10.3% to

C$122 million ($126 million) due to lower revenues from basic

access, ongoing industry-wide price competition, substitution to

wireless and Internet-based services, as well as declining

residential access lines.

Telus added 46,000 TV subscribers to reach 403,000 customers (up

76.8% year over year). The massive growth can be credited to the

ongoing success of the Optik TV brand, improved installation,

enhanced service and expanded broadband coverage. Net high-speed

Internet subscriber additions shot up more than four folds year

over year to 13,000 (reaching 1.2 million in service) driven

by the success of Optik TV and Optik high-speed Internet service

launched in June 2010, as well as continued broadband footprint

expansion and speed enhancement.

Total network access lines declined 4.2% year over year to 3.68

million in the reported quarter, resulting from intense cable

competition and wireless substitution.

Cash Flow

Telus generated free cash flow of C$286 million in the reported

quarter, up 19.7% year over year. Capital expenditure was C$456

million compared with C$397 million in the year-ago quarter.

Dividend

The company will pay a quarterly dividend of C$0.55 on October 3

to shareholders of record as of September 9. The dividend

represents a 10% increment over the year-ago period.

Outlook

Telus revised its outlook for 2011 taking strong second quarter

results into account. The company raised its consolidated revenue

guidance to C$10.225–C$10.425 billion from C$9.925–C$10.225

billion, representing a 4% to 6% growth on a year-over-year basis.

Telus reiterated its EBITDA guidance of C$3.675–C$3.875 billion (up

1% to 6% year over year) and earnings per share guidance between

C$3.50 and C$3.90 (up 7% to 19% year over year). The company also

raised its consolidated capital expenditure guidance to C$1.8

billion from C$1.7 billion.

Telus expects Wireless revenues to grow 8–10% to C$5.4–C$5.5

billion and EBITDA to grow 6–11% to C$2.15–C$2.25 billion for 2011.

For the Wireline segment, Telus expects revenue to grow 1–3% to

C$4.825–C$4.925 billion and EBITDA to decline 6% to C$1.525–C$1.625

billion.

Our Analysis

We remain encouraged by Telus’ prospects in wireless data growth

given new devices, technology upgrades, strong adoption of

smartphones, deployment of HSPA+ Dual Cell technology and the

expected launch of 4G+ LTE network in 2012, which are expected to

fuel Wireless revenue growth. Popular smartphones like BlackBerry

and iPhone (launched in late 2009) will provide Telus a competitive

advantage over other dominant players such as Rogers

Communication (RCI) and BCE Inc.

(BCE).

On the Wireline side, the company’s continued investments to

widen the footprint of its fiber optic network i.e. Optik TV and

High Speed Internet services will boost its profitability. In

addition, we are encouraged by the company’s improved confidence

related to 2011 earnings and free cash flow with cost reduction

plans and further investments in broadband infrastructure expansion

and upgrade.

However, the weak Canadian economy, accelerated access line

erosion in the Wireline segment, an increasingly competitive

domestic wireless market and reduced wireless data plans will

continue to weigh on future earnings.

We are currently maintaining our long-term Neutral

recommendation on Telus. For the short term (1–3 months), the stock

retains a Zacks # 2 (Buy) Rank.

BCE INC (BCE): Free Stock Analysis Report

ROGERS COMM CLB (RCI): Free Stock Analysis Report

TELUS CORP (TU): Free Stock Analysis Report

Zacks Investment Research

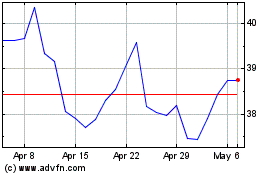

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Apr 2024 to May 2024

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From May 2023 to May 2024