Pioneer Natural Resources Company (NYSE:PXD) (“Pioneer”

or “the Company”) today announced the Company has signed an

agreement with a subsidiary of Carmeuse Holding S.A. (Luxemburg) to

acquire its U.S. industrial sands business, Carmeuse Industrial

Sands (“CIS”), for approximately $297 million, before normal

closing adjustments.

CIS is the number one producer of Hickory frac sand (Brady

Brown®) used as proppant for fracture stimulating oil and gas wells

in the U.S. Hickory sand is considered to be the highest quality

brown sand for fracture stimulation. CIS’ sand mine in Brady,

Texas, has more than 30 years of proven brown sand reserve life and

is the industry’s largest resource base for brown sand in the U.S.

The Brady mine currently has sales capacity of approximately one

million tons annually.

Scott Sheffield, Chairman and CEO, stated, “When Carmeuse

recently announced plans to sell its U.S. sand business, we viewed

this as a strategic opportunity to secure high-quality, low-cost

and logistically advantaged brown sand supply to support our

growing fracture stimulation requirements in three of our four core

Texas growth assets – the Spraberry vertical, horizontal Wolfcamp

Shale and Barnett Shale Combo plays. The acquisition complements

Pioneer’s vertical integration strategy, which is reducing

execution risk and controlling costs. By securing supply at below

market prices, we expect to reduce annual capital spending by $65

million to $70 million based on our estimated sand requirements and

current market prices.”

Pioneer’s annual demand for proppant to support the Company’s

fracture stimulation operations is forecasted to increase from 1.2

million tons in 2012 to 1.6 million tons in 2015 as drilling

activity continues to ramp up in the Spraberry vertical, horizontal

Wolfcamp Shale, Eagle Ford Shale and Barnett Shale Combo plays.

Seventy percent to eighty percent of the Company’s forecasted

proppant demand is brown sand for the Spraberry vertical,

horizontal Wolfcamp Shale and Barnett Shale Combo plays. Pioneer’s

primary source for brown sand is CIS’ Brady mine. Prior to the

acquisition, the Company expected approximately 700 thousand tons,

or 60%, of its forecasted 2013 brown sand requirements to be

sourced from this location.

The supply of brown sand is expected to continue to be tight as

a result of increasing shale play drilling, with the price of brown

sand expected to escalate further as the growth in demand for this

proppant outpaces new supplies. Other brown sand mines are

primarily supplying large service companies. White and resin coated

sand alternatives are more than two times and seven times the cost

of Brady sand (inclusive of transportation), respectively, and are

not necessary for most Spraberry vertical, horizontal Wolfcamp

Shale and Barnett Shale Combo fracture stimulations.

Assuming Pioneer could replace its current brown sand supply at

market prices and would have to substitute its incremental brown

sand requirements (300 thousand tons in 2013) with white sand due

to lack of brown sand availability, Pioneer estimates that it will

save $65 million to $70 million per year by acquiring CIS. After

taking into account an additional $10 million of annual cash flow

from CIS’ other assets, Pioneer’s total annual savings are

estimated to be $75 million to $80 million.

The acquisition also provides Pioneer with significant upside

potential. First, output from the Brady mine can be doubled from

one million tons per year to two million tons per year, which would

support any future increases in Spraberry vertical, horizontal

Wolfcamp Shale and Barnett Shale Combo drilling activity above the

Company’s currently announced drilling growth plans. Second, CIS

has 23 million tons of white sand reserves in Wisconsin, where

plans to develop a mine with a production capacity of up to one

million tons per year are being progressed.

CIS is led by a highly experienced and technically proficient

management team with more than 150 years of experience in the

industrial sands business. This management team has agreed to join

Pioneer.

The acquisition will be funded from available cash and is

expected to close late in the first quarter or early in the second

quarter of 2012.

CIS’ other assets, which make up a relatively small portion of

the industrial sands business, include two outlets (Bakersfield,

California and Colorado Springs, Colorado) for other grades of sand

produced in Brady, two sand mines in Ohio (Glass Rock and Millwood)

which produce oilfield and industrial sands, one sand mine in

California (Orange County) which produces construction and

recreational sand, and an oilfield cement material processing plant

in Riverside, California.

Conference Call

On Monday, March 5, 2012, at 10:00 a.m. Central Time, Pioneer

will hold a conference call and webcast to discuss the CIS

acquisition, with an accompanying presentation. Instructions for

listening to the call and viewing the presentation are shown

below.

Internet: www.pxd.comSelect “Investors,” then “Investor

Presentations” to listen to the discussion and view the

presentation.

Telephone: Dial (877) 795-3599 confirmation code: 7784081 five

minutes before the call. View the presentation via Pioneer’s

internet address above.

A replay of the webcast will be archived on Pioneer’s website. A

telephone replay will be available through March 23 by dialing

(888) 203-1112 confirmation code: 7784081.

Pioneer is a large independent oil and gas exploration and

production company, headquartered in Dallas, Texas, with operations

in the United States. For more information, visit Pioneer’s website

at www.pxd.com.

This news release contains forward-looking statements within the

meaning of the safe harbor provisions of Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act.

These statements include any statement that does not relate

strictly to historical facts. In particular, statements, express or

implied, regarding the benefits of, and synergies from, the CIS

acquisition and Pioneer’s sand requirements, future growth

opportunities and financial condition and results of operation are

forward-looking statements. These forward-looking statements are

based on management’s current plans, expectations, estimates,

assumptions and beliefs concerning future events. While our

management considers these plans, expectations, estimates,

assumptions and beliefs to be reasonable, they are inherently

difficult to predict and subject to a number of risks and

uncertainties. These risks and uncertainties include, but are not

limited to, the satisfactory completion of all conditions precedent

to the closing of the proposed CIS acquisition in accordance with

the terms and conditions of the purchase agreement, risks related

to mineral estimates, fluctuation of prices for sand and the risks

discussed in the “Risk Factors” sections of, as well as any other

cautionary language in, Pioneer’s public filings with the

Securities and Exchange Commission (SEC). Actual results may differ

materially from those expressed or implied in the forward-looking

statements contained in this news release. Each forward-looking

statement in this news release speaks only as of the date of this

news release, and Pioneer undertakes no obligation to update or

revise any such statement except as required by law.

Our pending CIS acquisition may not be consummated. The closing

of the acquisition is subject to certain regulatory conditions and

customary closing conditions, and the acquisition agreement may, in

certain circumstances, be terminated.

Inaccuracies in estimates of mineral reserves and resource

deposits could result in lower than expected supplies and sales and

higher than expected costs. The proved reserve estimates contained

in this news release have been calculated in compliance with the

SEC’s Industry Guide 7 and are based on an independent review by

mining and geological consultants engaged by CIS in 2011. However,

commercial sand reserve estimates are necessarily imprecise and

depend to some extent on statistical inferences drawn from

available drilling data, which may prove unreliable. There are

numerous uncertainties inherent in estimating quantities and

qualities of commercial sand reserves and resources and costs to

mine recoverable reserves, including many factors beyond Pioneer’s

control. Estimates of economically recoverable commercial sand

reserves necessarily depend on a number of factors and assumptions,

all of which may vary considerably from actual results, such

as:

- geological and mining conditions and/or

effects from prior mining that may not be fully identified by

available data or that may differ from experience;

- assumptions concerning future prices of

commercial sand products, operating costs, mining technology

improvements, development costs and reclamation costs; and

- assumptions concerning future effects

of regulation, including the issuance of required permits and taxes

by governmental agencies.

Pioneer Natural Resources (NYSE:PXD)

Historical Stock Chart

From Apr 2024 to May 2024

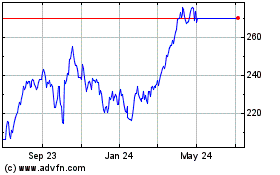

Pioneer Natural Resources (NYSE:PXD)

Historical Stock Chart

From May 2023 to May 2024