National Fuel Gas Company (“National Fuel” or the “Company”)

(NYSE:NFG) today announced consolidated earnings for its fourth

quarter and fiscal year ended September 30, 2009, of $27.0 million

or $0.33 per share, and $100.7 million or $1.25 per share,

respectively.

HIGHLIGHTS

- Operating results before items

impacting comparability (“Operating Results”) for the fourth

quarter of fiscal 2009 of $29.8 million, or $0.36 per share,

decreased $13.5 million from the prior fiscal year. A 28% decrease

in average commodity prices realized this quarter in the

Exploration and Production segment was the main driver of the

decrease in earnings.

- Operating Results for fiscal

2009 of $210.5 million, or $2.60 per share, decreased $57.7 million

from the prior fiscal year. A 22% decrease in average commodity

prices realized over the entire year in the Exploration and

Production segment was the main driver of the decrease in

earnings.

- Production in the Exploration

and Production segment for the current quarter increased over 20%

compared to the prior year’s fourth quarter. Comparing the fourth

quarter of 2009 to the fourth quarter of 2008, Appalachian

production increased 29%, California production increased 6%, and

Gulf of Mexico production increased 38%. Total production for

fiscal 2009 was 42.5 billion cubic feet equivalent (“Bcfe”).

- Seneca flare tested its second

company-operated Marcellus Shale horizontal well at an average rate

of 4.7 million cubic feet per day (“MMcfd”) over a 7-day period. To

date Seneca has drilled four horizontal Marcellus Shale wells and

fracture stimulated and tested two, at a combined rate for those

two wells of over 10 MMcfd.

- Seneca’s reserve replacement

ratio for the year was 160%. In Appalachia 341% of production was

replaced. Seneca added 21.2 Bcfe of Marcellus Shale Proved Reserves

at a Finding & Development Cost of $1.28 per thousand cubic

feet (“Mcf”), excluding the cost of lease acquisitions.

- Phase 1 of Midstream

Corporation’s Covington Gathering System is expected to be

completed and transporting Marcellus production to market by mid

November (a construction time of less than 6 months).

- Seneca is accelerating its

drilling plans in the Marcellus shale during fiscal 2010. A second

Seneca-operated horizontal drilling rig will arrive later this

month. We are now estimating a total of 50 to 60 horizontal wells

will be drilled in fiscal 2010, approximately half of which will be

operated by EOG in the joint venture. The Company is revising its

GAAP earnings guidance for fiscal 2010 to a range of $2.30 to $2.65

per share. The previous guidance range had been $2.30 to $2.60.

This guidance includes an increase in the upper end of our oil and

gas production range for the Exploration and Production segment.

The production range is now 42 to 50 Bcfe and is based on an

assumed average NYMEX price, exclusive of basis differential, of

$5.00 per Million British Thermal Units (“MMBtu”) for natural gas

and $75.00 per barrel (“Bbl”) for crude oil. The previous

production range was 42 to 48 Bcfe.

- A conference call is scheduled

for Friday, November 6, 2009, at 11:00 a.m. Eastern Time.

MANAGEMENT COMMENTS

David F. Smith, Chief Executive Officer and President of

National Fuel Gas Company stated: “Overall, the fourth quarter was

an excellent one for National Fuel. While commodity prices

certainly impacted the level of earnings in our Exploration and

Production segment, we had an outstanding quarter from an operating

point of view, with production up 20% over the prior year.”

“More importantly, we continue to make great progress on our

strategic initiatives in Appalachia. We have now completed two

Seneca-operated horizontal wells in the Marcellus, and are very

pleased with the results of each of the wells. Just as significant,

we are also completing construction of the Covington Gathering

System, which will get that production to market, and expect to

place it in service by mid November. We have substantial running

room in the Marcellus, and I firmly believe our accomplishments

this quarter demonstrate that National Fuel has the people,

knowledge and skills to capitalize on this exciting

opportunity.”

SUMMARY OF RESULTS

National Fuel had consolidated earnings for the quarter ended

September 30, 2009, of $27.0 million or $0.33 per share, a decrease

of $16.3 million, or $0.19 per share, from the prior year’s fourth

quarter earnings. (Note: all references to earnings per share are

to diluted earnings per share, all amounts are stated in U.S.

dollars and all amounts used in the discussions of earnings and

operating results before items impacting comparability (“Operating

Results”) are stated on an after tax basis, unless otherwise

noted.)

Consolidated earnings for the fiscal year ended September 30,

2009, of $100.7 million, or $1.25 per share, decreased $168.0

million, or $1.93 per share, from the prior year, where earnings

were $268.7 million, or $3.18 per share. The per share amounts

reflect a lower number of shares outstanding in the current quarter

and fiscal year to date resulting mainly from the impact of the

Company’s repurchase of approximately 5.2 million shares of

National Fuel common stock in the prior fiscal year.

Three Months Fiscal Year Ended

September 30, Ended September 30, 2009

2008 2009 2008 (in

thousands except per share amounts)

Reported GAAP earnings $

26,998 $ 43,266 $ 100,708 $ 268,728

Items impacting

comparability1: Gain on sale of turbine (586 )

Impairment of oil and gas producing properties 108,207 Impairment

of investment in partnership 1,085 Impairment of landfill gas

assets 2,786 2,786 Gain on life insurance policies (2,312 )

Operating Results $ 29,784 $ 43,266 $

210,474 $ 268,142

Reported GAAP earnings

per share $ 0.33 $ 0.52 $ 1.25 $ 3.18

Items impacting

comparability1: Gain on sale of turbine (0.01 )

Impairment of oil and gas producing properties 1.34 Impairment of

investment in partnership 0.01 Impairment of landfill gas assets

0.03 0.03 Gain on life insurance policies (0.03 )

Operating Results $ 0.36 $ 0.52 $ 2.60

$ 3.17

1 See discussion of these individual items below.

As outlined in the table above, certain items included in GAAP

earnings impacted the comparability of the Company’s financial

results when comparing the quarter and fiscal year ended September

30, 2009, to the comparable periods in fiscal 2008. Excluding these

items, Operating Results for the current fourth quarter of $29.8

million, or $0.36 per share, decreased $13.5 million, or $0.16 per

share. Excluding these items, operating results for the fiscal year

ended September 30, 2009, of $210.5 million, or $2.60 per share,

decreased $57.7 million, or $0.57 per share. Items impacting

comparability will be discussed in more detail within the

discussion of segment earnings below.

DISCUSSION OF RESULTS BY SEGMENT

(The following discussion of earnings for each segment is

summarized in a tabular form in this report. It may be helpful to

refer to those tables while reviewing this discussion.)

Exploration and Production

Segment

The Exploration and Production segment operations are carried

out by Seneca Resources Corporation (“Seneca”). Seneca explores

for, develops and purchases natural gas and oil reserves in

California, in the Appalachian region, and in the Gulf of

Mexico.

The Exploration and Production segment’s earnings in the fourth

quarter of fiscal 2009 of $28.1 million, or $0.34 per share,

decreased $10.1 million, or $0.12 per share, when compared with the

prior year’s fourth quarter.

Crude oil and natural gas production for the current quarter of

11.3 Bcfe increased over 20 percent compared to the prior year’s

fourth quarter. Production increased 29 percent in Appalachia, 38

percent in the Gulf of Mexico and six percent in California. The

increase in Appalachia is largely due to the continued development

by Seneca of its Upper Devonian acreage. The increase in Gulf of

Mexico production is mostly due to the return to production of

wells that were shut in due to hurricanes in the fourth quarter of

fiscal 2008. The increase in California production is mainly due to

the acquisition of Ivanhoe Energy’s U.S. oil and gas subsidiary

this quarter.

In spite of higher production, lower crude oil and natural gas

prices realized after hedging caused earnings to decrease. For the

quarter ended September 30, 2009, the weighted average oil price

received by Seneca (after hedging) was $71.39 per Bbl, a decrease

of $15.90 per Bbl from the prior year’s quarter. The weighted

average natural gas price received by Seneca (after hedging) for

the quarter ended September 30, 2009, was $6.00 per Mcf, a decrease

of $3.41 per Mcf.

Aside from the change in production and pricing, several other

items impacted earnings, including higher depletion expense (due

mostly to the increase in production), lower other operating

expenses (which was attributable mostly to a decrease in plugging

and abandonment cost), and the negative impact of period-to-period

mark-to-market adjustments to recognize hedge ineffectiveness on

certain derivative financial instruments used to hedge prices on

Seneca’s oil and gas.

The Exploration and Production segment’s loss of $10.2 million,

or $0.13 per share, for the fiscal year ended September 30, 2009,

compares to earnings of $146.6 million, or $1.73 per share, for the

fiscal year ended September 30, 2008. The decrease in earnings was

largely due to a non-cash charge of $108.2 million in the first

quarter of fiscal 2009 to write down the value of Seneca’s oil and

natural gas producing properties.

Seneca uses the full cost method of accounting for determining

the book value of its oil and natural gas properties. This

accounting method requires that Seneca perform a quarterly “ceiling

test” to compare the present value of future revenues from its oil

and natural gas reserves based on period end spot prices (the

“ceiling”) with the book value of those reserves at the balance

sheet date. If the book value of the reserves exceeds the ceiling

calculation, a non-cash charge, or impairment, must be recorded in

order to reduce the book value of the reserves to the calculated

ceiling. The impairment was mainly driven by a significant decrease

in commodity prices. At September 30, 2009 pricing, the ceiling

exceeded the book value of the Company’s oil and gas properties by

approximately $212 million.

Excluding the impact of the ceiling test charge in the first

quarter of fiscal year 2009, Operating Results for the fiscal year

ended September 30, 2009, of $98.0 million or $1.21 per share

decreased $48.6 million, or $0.52 per share, from the prior

year.

Overall production for fiscal year ended September 30, 2009, of

42.5 Bcfe increased four percent from 40.8 Bcfe in the prior fiscal

year. Lower production in the Gulf of Mexico as a result of

Hurricane Ike related curtailments during the year, was offset by

increases of 10 percent in Appalachia and seven percent in

California.

For the fiscal year ended September 30, 2009, the weighted

average oil price received by Seneca (after hedging) was $64.94 per

Bbl, a decrease of $16.81 per Bbl from the prior fiscal year. The

weighted average natural gas price received by Seneca (after

hedging) for fiscal year ended September 30, 2009, was $6.94 per

Mcf, a decrease of $2.11 per Mcf.

Other items impacting Operating Results for the fiscal year

ended September 30, 2009, were lower depletion and lease operating

expense (“LOE”) and higher general and administrative expenses

(“G&A”). Lower income taxes also had a positive impact on

earnings for the current fiscal year. The decrease in depletion

expense was mainly due to a lower depletable base resulting from

the ceiling test impairment recorded in the first quarter of fiscal

2009 described above. The decrease in LOE is due to lower steam

fuel costs in California and lower production taxes in the Gulf of

Mexico. The increase in G&A expenses is due to additional

staffing and other costs in the East division, and a bad debt

charge related to a customer bankruptcy in California.

Seneca continues to evaluate and aggressively develop the

Company’s significant Marcellus Shale acreage. Seneca flare tested

its second company-operated Marcellus Shale horizontal well at an

average rate of 4.7 MMcfd over a 7-day period. To date Seneca has

drilled four horizontal Marcellus Shale wells and fracture

stimulated and tested two, at a combined rate of over 10 MMcfd.

Pipeline and Storage

Segment

The Pipeline and Storage segment operations are carried out by

National Fuel Gas Supply Corporation (“Supply Corporation”) and

Empire Pipeline, Inc. (“Empire”). These companies provide natural

gas transportation and storage services to affiliated and

non-affiliated companies through an integrated system of pipelines

and underground natural gas storage fields in western New York and

western Pennsylvania.

The Pipeline and Storage segment’s earnings of $5.8 million, for

the quarter ended September 30, 2009, decreased $7.4 million when

compared with the same period in the prior fiscal year. The

decrease was primarily due to lower efficiency gas revenues, mainly

the result of lower commodity prices and lower transported volumes

during the quarter. Higher transportation revenues from the Empire

Connector, which was placed in service in mid December 2008,

partially offset this decrease. Higher interest expense and a lower

allowance for funds used during construction (“AFUDC”) in the

fourth quarter of the current fiscal year and a higher effective

tax rate also contributed to the decrease in earnings compared to

the prior year’s fourth quarter.

The Pipeline and Storage segment’s earnings of $47.4 million for

the fiscal year ended September 30, 2009, decreased $6.8 million

when compared with the prior fiscal year. Higher transportation

revenues, mainly the result of incremental revenue from the Empire

Connector, which was placed in service in mid December 2008 and the

addition of several new contracts for firm transportation services

were more than offset by lower efficiency gas revenues due to lower

natural gas prices, higher depreciation expense, higher interest

expense and lower AFUDC related to the construction of the Empire

Connector in the prior fiscal year.

Utility Segment

The Utility segment operations are carried out by National Fuel

Gas Distribution Corporation (“Distribution”), which sells or

transports natural gas to customers located in western New York and

northwestern Pennsylvania. The Utility segment’s loss of $1.6

million, or $0.02 per share, for the quarter ended September 30,

2009, compares to a loss of $0.8 million, or $0.01 per share, for

the quarter ended September 30, 2008.

The New York Division’s loss increased $2.4 million due to

higher interest expense. In the Pennsylvania Division, earnings

increased $1.6 million. The increase is mainly due to lower

operating expenses compared to the fourth quarter of fiscal 2008

partially offset by higher interest expense.

The Utility segment’s earnings of $58.7 million for the fiscal

year ended September 30, 2009, decreased $2.8 million compared to

the fiscal year ended September 30, 2008. Earnings in

Distribution’s New York Division for the fiscal year ended

September 30, 2009, of $37.7 million decreased $3.0 million

compared to the prior year. Lower margins in the first quarter of

fiscal 2009 primarily as a result of the rate design change

approved by the New York State Public Service Commission’s December

28, 2007 rate order and higher interest expense more than offset

the impact of lower operating expenses.

For the fiscal year ended September 30, 2009, earnings in

Distribution’s Pennsylvania Division of $21.0 million were nearly

flat compared to the prior year. The positive impact of colder

weather and lower operating expenses was mostly offset by lower

customer usage per account and a higher effective tax rate.

Energy Marketing

National Fuel Resources, Inc. (“NFR”) comprises the Company’s

Energy Marketing segment. NFR markets natural gas to industrial,

wholesale, commercial, public authority and residential customers

primarily in western and central New York and northwestern

Pennsylvania, offering competitively priced natural gas to its

customers.

The Energy Marketing segment’s loss for the quarter ended

September 30, 2009, of $0.3 million decreased from a loss of $1.2

million for the fourth quarter of last year. The improved results

are primarily due to an increase in margin.

The Energy Marketing segment’s earnings for the fiscal year

ended September 30, 2009, of $7.2 million increased $1.3 million

compared to the prior year. An increase in margin and lower

operating expenses due to lower bad debt expense were somewhat

offset by higher state income taxes.

The Energy Marketing segment’s reported sales volume for fiscal

2009 was 4.7 Bcf higher than the reported sales volume for fiscal

2008. The increase in sales volume was due to physical gas sales

transactions that NFR undertook at the Niagara pipeline delivery

point to offset certain basis risks that NFR was exposed to under

fixed basis commodity purchase contracts for Appalachian

production. Such offsetting transactions had the effect of

increasing revenue and volume sold, but the impact on earnings was

minimal.

Corporate and All

Other

The Corporate and All Other category includes the following

active, wholly owned subsidiaries of the Company: Highland Forest

Resources, Inc., a corporation that markets high quality hardwoods

from New York and Pennsylvania land holdings; Horizon LFG, Inc., a

corporation engaged, through subsidiaries, in the purchase,

processing, transportation and sale of landfill gas; and Horizon

Power, Inc., a corporation that develops and owns independent

electric generation facilities that are fueled by natural gas or

landfill gas.

The Corporate and All Other category had a loss of $4.9 million

for the quarter ended September 30, 2009 compared to a loss of $6.2

million in the prior year’s fourth quarter. The comparability of

the results for the quarter ended September 30, 2009, is impacted

by a $2.8 million impairment of one of the landfill gas sites that

transported landfill gas to a now idle manufacturing plant in

Oakridge, Missouri. Excluding this item, Operating Results

increased $4.1 million. Higher margins from timber operations due

to the lower cost basis of the current quarter’s harvest, lower

operating expenses, higher interest income and lower income taxes

were the primary reasons for the decreased loss. The positive

impact of these items was partially offset by lower income from

unconsolidated subsidiaries and higher interest expense.

The Corporate and All Other category loss for the fiscal year

ended September 30, 2009, was $2.2 million, compared to the prior

year’s earnings of $0.6 million. The comparability of the results

for the fiscal year ended September 30, 2009, is impacted by a $0.6

million gain in the second quarter of fiscal 2008 related to the

sale of a gas-powered turbine that the Company had previously

planned to use in the development of a co-generation plant, and in

fiscal 2009, by the $2.8 million landfill gas site impairment

charge described above, a $2.3 million gain recognized on executive

life insurance policies and a $1.1 million impairment in the value

of Horizon Power’s 50 percent investment in Energy Systems North

East, LLC, a partnership that owns an 80-megawatt combined cycle,

natural gas-fired power plant in the town of North East,

Pennsylvania. Excluding these items, Operating Results were a loss

of $0.7 million for the current fiscal year compared to break even

results in fiscal 2008. Lower margins from the timber operations as

a result of decreased sales volumes and prices, lower margins in

the landfill gas operations, a decrease in income from

unconsolidated subsidiaries, lower interest income and higher

interest expense contributed to the decrease in Operating Results.

The non-recurrence of expenses related to the proxy contest in

fiscal 2008, and lower income taxes partially offset the decrease

in Operating Results.

EARNINGS GUIDANCE

The Company is revising its GAAP earnings guidance for fiscal

2010 to a range of $2.30 to $2.65 per share. The previous guidance

range had been $2.30 to $2.60. This guidance includes an increase

in the upper end of our oil and gas production range for the

Exploration and Production segment. The production range is now 42

to 50 Bcfe and is based on an assumed average NYMEX price,

exclusive of basis differential, of $5.00 per MMBtu for natural gas

and $75.00 per Bbl for crude oil. The previous production range was

42 to 48 Bcfe.

EARNINGS TELECONFERENCE

The Company will host a conference call on Friday, November 6,

2009, at 11 a.m. (Eastern Time) to discuss this announcement. There

are two ways to access this call. For those with Internet access,

visit the investor relations page at National Fuel’s Web site at

investor.nationalfuelgas.com.

For those without Internet access, access is also provided by

dialing (toll-free) 1-866-578-5801, and using the passcode

“70464736.” For those unable to listen to the live conference call,

a replay will be available at approximately 2 p.m. (Eastern Time)

at the same Web site link and by phone at (toll free) 888-286-8010

using passcode “75925727.” Both the webcast and telephonic replay

will be available until the close of business on Friday, November

13, 2009.

National Fuel is an integrated energy company with $4.8 billion

in assets comprised of the following four operating segments:

Exploration and Production, Pipeline and Storage, Utility, and

Energy Marketing. Additional information about National Fuel is

available on its Internet Web site:

http://www.nationalfuelgas.com or through its investor

information service at 1-800-334-2188.

The Securities and Exchange Commission (the “SEC”) currently

permits oil and gas companies, in their filings with the SEC, to

disclose only proved reserves that a company has demonstrated by

actual production or conclusive formation tests to be economically

and legally producible under existing economic and operating

conditions. The Company uses the terms “probable,” “possible,”

“resource potential” and other descriptions of volumes of reserves

or resources potentially recoverable through additional drilling or

recovery techniques that the SEC’s guidelines would prohibit us

from including in filings with the SEC. These estimates are by

their nature more speculative than estimates of proved reserves

and, accordingly, are subject to substantially greater risk of

being actually realized. Investors are urged to consider closely

the disclosure in our Form 10-K and Forms 10-Q, available at

www.nationalfuelgas.com. You can also obtain these forms on the

SEC’s website at www.sec.gov.

Certain statements contained herein, including those regarding

estimated future earnings, and statements that are identified by

the use of the words “anticipates,” “estimates,” “expects,”

“forecasts,” “intends,” “plans,” “predicts,” “projects,”

“believes,” “seeks,” “will,” “may” and similar expressions, are

“forward-looking statements” as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company’s expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: financial and economic conditions, including the

availability of credit, and their effect on the Company’s ability

to obtain financing on acceptable terms for working capital,

capital expenditures and other investments; occurrences affecting

the Company’s ability to obtain financing under credit lines or

other credit facilities or through the issuance of commercial

paper, other short-term notes or debt or equity securities,

including any downgrades in the Company’s credit ratings and

changes in interest rates and other capital market conditions;

changes in economic conditions, including global, national or

regional recessions, and their effect on the demand for, and

customers’ ability to pay for, the Company’s products and services;

the creditworthiness or performance of the Company’s key suppliers,

customers and counterparties; economic disruptions or uninsured

losses resulting from terrorist activities, acts of war, major

accidents, fires, hurricanes, other severe weather, pest

infestation or other natural disasters; changes in actuarial

assumptions, the interest rate environment and the return on

plan/trust assets related to the Company’s pension and other

post-retirement benefits, which can affect future funding

obligations and costs and plan liabilities; changes in demographic

patterns and weather conditions; changes in the availability and/or

price of natural gas or oil and the effect of such changes on the

accounting treatment of derivative financial instruments or the

valuation of the Company’s natural gas and oil reserves;

impairments under the SEC’s full cost ceiling test for natural gas

and oil reserves; uncertainty of oil and gas reserve estimates;

factors affecting the Company’s ability to successfully identify,

drill for and produce economically viable natural gas and oil

reserves, including among others geology, lease availability,

weather conditions, shortages, delays or unavailability of

equipment and services required in drilling operations, and the

need to obtain governmental approvals and permits and comply with

environmental laws and regulations; significant differences between

the Company’s projected and actual production levels for natural

gas or oil; changes in the availability and/or price of derivative

financial instruments; changes in the price differentials between

oil having different quality and/or different geographic locations,

or changes in the price differentials between natural gas having

different heating values and/or different geographic locations;

inability to obtain new customers or retain existing ones;

significant changes in competitive factors affecting the Company;

changes in laws and regulations to which the Company is subject,

including tax, environmental, safety and employment laws and

regulations; governmental/regulatory actions, initiatives and

proceedings, including those involving acquisitions, financings,

rate cases (which address, among other things, allowed rates of

return, rate design and retained natural gas), affiliate

relationships, industry structure, franchise renewal, and

environmental/safety requirements; unanticipated impacts of

restructuring initiatives in the natural gas and electric

industries; significant differences between the Company’s projected

and actual capital expenditures and operating expenses, and

unanticipated project delays or changes in project costs or plans;

the nature and projected profitability of pending and potential

projects and other investments, and the ability to obtain necessary

governmental approvals and permits; ability to successfully

identify and finance acquisitions or other investments and ability

to operate and integrate existing and any subsequently acquired

business or properties; significant changes in tax rates or

policies or in rates of inflation or interest; significant changes

in the Company’s relationship with its employees or contractors and

the potential adverse effects if labor disputes, grievances or

shortages were to occur; changes in accounting principles or the

application of such principles to the Company; the cost and effects

of legal and administrative claims against the Company or activist

shareholder campaigns to effect changes at the Company; increasing

health care costs and the resulting effect on health insurance

premiums and on the obligation to provide other post-retirement

benefits; or increasing costs of insurance, changes in coverage and

the ability to obtain insurance. The Company disclaims any

obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof.

NATIONAL FUEL GAS COMPANY RECONCILIATION OF

CURRENT AND PRIOR YEAR GAAP EARNINGS QUARTER ENDED SEPTEMBER

30, 2009 Exploration &

Pipeline & Energy

Corporate / (Thousands of Dollars) Production

Storage Utility Marketing

All Other Consolidated

Fourth

quarter 2008 GAAP earnings $ 38,227 $ 13,218 $ (756 ) $ (1,191

) $ (6,232 ) $ 43,266

Drivers of operating results

Higher (lower) crude oil prices (9,077 ) (9,077 ) Higher (lower)

natural gas prices (13,377 ) (13,377 ) Higher (lower) natural gas

production 6,797 6,797 Higher (lower) crude oil production 7,381

7,381 Higher (lower) processing plant revenues (888 ) (888 )

Derivative mark to market adjustment (1,555 ) (1,555 ) Lower

(higher) lease operating expenses (499 ) (499 ) Lower (higher)

depreciation / depletion (998 ) (297 ) (1,295 ) Higher

(lower) transportation revenues 2,124 2,124 Higher (lower)

efficiency gas revenues (3,102 ) (3,102 ) Lower (higher) operating

expenses 1,351 (333 ) 1,849 1,280 4,147 Higher (lower)

income from unconsolidated subsidiaries (514 ) (514 ) Higher

(lower) margins 903 2,836 3,739 Higher (lower) AFUDC* (2,656

) (2,656 ) Higher (lower) interest income (909 ) 1,263 354 (Higher)

lower interest expense 686 (1,954 ) (2,395 ) (1,771 ) (5,434 )

Lower (higher) income tax expense / effective tax rate 1,050

(1,491 ) 829 388 All other / rounding (61 )

267 (337 )

(55 ) 171

(15 )

Fourth quarter 2009 operating results 28,128

5,776 (1,639 ) (343 ) (2,138 ) 29,784

Items impacting

comparability: Impairment of landfill gas assets

(2,786 ) (2,786 )

Fourth

quarter 2009 GAAP earnings $ 28,128 $

5,776 $ (1,639 ) $ (343 )

$ (4,924 ) $ 26,998 *

AFUDC = Allowance for Funds Used During Construction

NATIONAL FUEL GAS COMPANY RECONCILIATION OF CURRENT AND

PRIOR YEAR GAAP EARNINGS PER SHARE QUARTER ENDED SEPTEMBER

30, 2009

Exploration & Pipeline &

Energy Corporate / Production Storage

Utility Marketing All Other

Consolidated

Fourth quarter 2008 GAAP earnings

$ 0.46 $ 0.16 $ (0.01 ) $ (0.01 ) $ (0.08 ) $ 0.52

Drivers of operating results Higher (lower) crude oil prices

(0.11 ) (0.11 ) Higher (lower) natural gas prices (0.16 ) (0.16 )

Higher (lower) natural gas production 0.08 0.08 Higher (lower)

crude oil production 0.09 0.09 Higher (lower) processing plant

revenues (0.01 ) (0.01 ) Derivative mark to market adjustment (0.02

) (0.02 ) Lower (higher) lease operating expenses (0.01 ) 0.02 0.01

Lower (higher) depreciation / depletion (0.01 ) - (0.01 )

Higher (lower) transportation revenues 0.03 0.03 Higher (lower)

efficiency gas revenues (0.04 ) (0.04 ) Lower (higher) operating

expenses 0.02 - 0.02 - 0.04 Higher (lower) income from

unconsolidated subsidiaries (0.01 ) (0.01 ) Higher (lower)

margins 0.01 0.03 0.04 Higher (lower) AFUDC* (0.03 ) (0.03 )

Higher (lower) interest income (0.01 ) 0.02 0.01 (Higher) lower

interest expense 0.01 (0.02 ) (0.03 ) (0.02 ) (0.06 ) Lower

(higher) income tax expense / effective tax rate 0.01 (0.02 ) 0.01

- All other / rounding (including impact of lower weighted

average shares) - (0.01 )

- -

- (0.01 )

Fourth

quarter 2009 operating results 0.34 0.07 (0.02 ) - (0.03 ) 0.36

Items impacting comparability: Impairment of landfill gas

assets

(0.03 )

(0.03 )

Fourth quarter 2009 GAAP earnings $ 0.34

$ 0.07 $ (0.02 ) $

- $ (0.06 ) $ 0.33

* AFUDC = Allowance for Funds Used During Construction

NATIONAL FUEL GAS COMPANY RECONCILIATION OF

CURRENT AND PRIOR YEAR GAAP EARNINGS YEAR ENDED SEPTEMBER

30, 2009 Exploration &

Pipeline & Energy

Corporate / (Thousands of Dollars) Production

Storage Utility Marketing

All Other Consolidated

Fiscal

2008 GAAP earnings $ 146,612 $ 54,148 $ 61,472 $ 5,889 $ 607 $

268,728

Items impacting comparability: Gain on sale of

turbine

(586 ) (586

)

Fiscal 2008 operating results 146,612 54,148 61,472 5,889

21 268,142

Drivers of operating results Higher

(lower) crude oil prices (36,858 ) (36,858 ) Higher (lower) natural

gas prices (30,579 ) (30,579 ) Higher (lower) natural gas

production (342 ) (342 ) Higher (lower) crude oil production 16,110

16,110 Higher (lower) processing plant revenues (3,827 ) (3,827 )

Lower (higher) lease operating expenses 2,646 2,646 Lower (higher)

depreciation / depletion 913 (1,459 ) (546 ) Higher (lower)

transportation revenues 9,719 9,719 Higher (lower) efficiency gas

revenues (7,487 ) (7,487 ) Lower (higher) operating expenses (1,680

) 3,544 359 4,945 7,168 Higher (lower) usage (2,307 ) (2,307

) Colder weather in Pennsylvania 2,146 2,146 Regulatory true-up

adjustments (222 ) (222 ) Higher (lower) income from

unconsolidated subsidiaries (1,997 ) (1,997 ) Higher (lower)

margins (1,419 ) 1,514 (4,051 ) (3,956 ) Higher (lower)

AFUDC* (1,994 ) (1,994 ) Higher (lower) interest income (5,519 )

(632 ) (6,151 ) (Higher) lower interest expense 5,381 (5,069 )

(3,076 ) (3,111 ) (5,875 ) Lower (higher) income tax expense

/ effective tax rate 4,229 (1,501 ) (391 ) 4,304 6,641 All

other / rounding 883 (500 )

27 (205 )

(162 ) 43

Fiscal 2009 operating results 97,969 47,358 58,664 7,166

(683 ) 210,474

Items impacting comparability: Gain on life

insurance policies 2,312 2,312 Impairment of investment in

partnership (1,085 ) (1,085 ) Impairment of landfill gas assets

(2,786 ) (2,786 ) Impairment of oil and gas properties

(108,207 )

(108,207 )

Fiscal 2009 GAAP earnings $ (10,238 ) $ 47,358

$ 58,664 $ 7,166

$ (2,242 ) $ 100,708

* AFUDC = Allowance for Funds Used During Construction

NATIONAL FUEL GAS COMPANY RECONCILIATION OF

CURRENT AND PRIOR YEAR GAAP EARNINGS PER SHARE YEAR ENDED

SEPTEMBER 30, 2009 Exploration

& Pipeline &

Energy Corporate / Production

Storage Utility Marketing

All Other Consolidated

Fiscal 2008

GAAP earnings $ 1.73 $ 0.64 $ 0.73 $ 0.07 $ 0.01 $ 3.18

Items impacting comparability: Gain on sale of turbine

(0.01 ) (0.01 )

Fiscal 2008 operating results 1.73 0.64 0.73 0.07 - 3.17

Drivers of operating results Higher (lower) crude oil

prices (0.46 ) (0.46 ) Higher (lower) natural gas prices (0.38 )

(0.38 ) Higher (lower) natural gas production - - Higher (lower)

crude oil production 0.20 0.20 Higher (lower) processing plant

revenues (0.05 ) (0.05 ) Lower (higher) lease operating expenses

0.03 0.03 Lower (higher) depreciation / depletion 0.01 (0.02 )

(0.01 ) Higher (lower) transportation revenues 0.12 0.12

Higher (lower) efficiency gas revenues (0.09 ) (0.09 ) Lower

(higher) operating expenses (0.02 ) 0.04 - 0.06 0.08 Higher

(lower) usage (0.03 ) (0.03 ) Colder weather in Pennsylvania 0.03

0.03 Regulatory true-up adjustments - - Higher (lower)

income from unconsolidated subsidiaries (0.02 ) (0.02 )

Higher (lower) margins (0.02 ) 0.02 (0.05 ) (0.05 ) Higher

(lower) AFUDC* (0.02 ) (0.02 ) Higher (lower) interest income (0.07

) (0.01 ) (0.08 ) (Higher) lower interest expense 0.07 (0.06 )

(0.04 ) (0.04 ) (0.07 ) Lower (higher) income tax expense /

effective tax rate 0.05 (0.02 ) - 0.05 0.08 All other /

rounding (including impact of lower weighted average shares)

0.10 0.02

0.04 - (0.01 )

0.15

Fiscal 2009 operating

results 1.21 0.59 0.73 0.09 (0.02 ) 2.60

Items impacting

comparability: Gain on life insurance policies 0.03 0.03

Impairment of investment in partnership (0.01 ) (0.01 ) Impairment

of landfill gas assets (0.03 ) (0.03 ) Impairment of oil and gas

properties (1.34 )

(1.34 )

Fiscal 2009 GAAP earnings $ (0.13 ) $

0.59 $ 0.73 $ 0.09

$ (0.03 ) $ 1.25 * AFUDC

= Allowance for Funds Used During Construction

NATIONAL

FUEL GAS COMPANY AND SUBSIDIARIES

(Thousands of Dollars, except per share amounts) Three

Months Ended Twelve Months Ended September 30, September 30,

(Unaudited) (Unaudited)

SUMMARY OF OPERATIONS

2009 2008 2009

2008 Operating Revenues $ 278,933 $ 397,858 $

2,057,852 $ 2,400,361 Operating Expenses:

Purchased Gas 60,611 152,816 1,001,782 1,235,157 Operation and

Maintenance 92,251 107,228 402,856 432,871 Property, Franchise and

Other Taxes 15,454 17,379 72,163 75,585 Depreciation, Depletion and

Amortization 45,695 41,286 173,410 170,623 Impairment of Oil and

Gas Producing Properties - -

182,811 - 214,011 318,709 1,833,022 1,914,236

Operating Income 64,922 79,149 224,830 486,125 Other

Income (Expense): Income from Unconsolidated Subsidiaries 646 1,437

3,366 6,303 Impairment of Investment in Partnership - - (1,804 ) -

Interest Income 1,418 2,459 5,776 10,815 Other Income 118 2,394

6,576 7,376 Interest Expense on Long-Term Debt (22,062 ) (18,055 )

(79,419 ) (70,099 ) Other Interest Expense (2,484 )

339 (7,497 ) (3,870 ) Income Before

Income Taxes 42,558 67,723 151,828 436,650 Income Tax

Expense 15,560 24,457 51,120

167,922

Net Income Available for

Common Stock $ 26,998 $ 43,266 $ 100,708 $

268,728

Earnings Per Common Share: Basic $

0.34 $ 0.54 $ 1.26 $ 3.27 Diluted $

0.33 $ 0.52 $ 1.25 $ 3.18

Weighted Average Common Shares: Used in Basic Calculation

80,240,861 80,858,668 79,649,965

82,304,335 Used in Diluted Calculation

81,607,864 82,896,107 80,628,685

84,474,839

NATIONAL FUEL GAS COMPANY

AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS

(Unaudited) September 30,

September 30, (Thousands of Dollars) 2009

2008

ASSETS Property,

Plant and Equipment $ 5,183,527 $ 4,873,969 Less - Accumulated

Depreciation, Depletion and Amortization 2,051,482

1,719,869 Net Property, Plant and Equipment

3,132,045 3,154,100

Current Assets: Cash and Temporary Cash Investments 408,053 68,239

Cash Held in Escrow 2,000 - Hedging Collateral Deposits 848 1

Receivables - Net 144,466 185,397 Unbilled Utility Revenue 18,884

24,364 Gas Stored Underground 55,862 87,294 Materials and Supplies

- at average cost 24,520 31,317 Unrecovered Purchased Gas Costs -

37,708 Other Current Assets 68,474 65,158 Deferred Income Taxes

53,863 - Total Current Assets

776,970 499,478 Other

Assets: Recoverable Future Taxes 138,435 82,506 Unamortized Debt

Expense 14,815 13,978 Other Regulatory Assets 530,913 189,587

Deferred Charges 2,737 4,417 Other Investments 78,503 80,640

Investments in Unconsolidated Subsidiaries 16,257 16,279 Goodwill

5,476 5,476 Intangible Assets 21,536 26,174 Prepaid Post-Retirement

Benefit Costs - 21,034 Fair Value of Derivative Financial

Instruments 44,817 28,786 Other 6,625

7,732 Total Other Assets 860,114

476,609 Total Assets $ 4,769,129 $

4,130,187

CAPITALIZATION AND LIABILITIES

Capitalization: Comprehensive Shareholders' Equity Common Stock, $1

Par Value Authorized - 200,000,000 Shares; Issued and Outstanding -

80,499,915 Shares and 79,120,544 Shares, Respectively $ 80,500 $

79,121 Paid in Capital 602,839 567,716 Earnings Reinvested in the

Business 948,293 953,799 Total

Common Shareholders' Equity Before Items of Other Comprehensive

Income (Loss) 1,631,632 1,600,636 Accumulated Other Comprehensive

Income (Loss) (42,396 ) 2,963 Total

Comprehensive Shareholders' Equity 1,589,236 1,603,599 Long-Term

Debt, Net of Current Portion 1,249,000

999,000 Total Capitalization 2,838,236

2,602,599 Current and Accrued Liabilities:

Notes Payable to Banks and Commercial Paper - - Current Portion of

Long-Term Debt - 100,000 Accounts Payable 90,723 142,520 Amounts

Payable to Customers 105,778 2,753 Dividends Payable 26,967 25,714

Interest Payable on Long-Term Debt 32,031 22,114 Customer Advances

24,555 33,017 Other Accruals and Current Liabilities 36,305 45,220

Deferred Income Taxes - 1,871 Fair Value of Derivative Financial

Instruments 2,148 1,362 Total

Current and Accrued Liabilities 318,507

374,571 Deferred Credits: Deferred Income Taxes

663,876 634,372 Taxes Refundable to Customers 67,046 18,449

Unamortized Investment Tax Credit 3,989 4,691 Cost of Removal

Regulatory Liability 105,546 103,100 Other Regulatory Liabilities

120,229 91,933 Pension and Other Post-Retirement Liabilities

415,888 78,909 Asset Retirement Obligations 91,373 93,247 Other

Deferred Credits 144,439 128,316

Total Deferred Credits 1,612,386

1,153,017 Commitments and Contingencies -

- Total Capitalization and Liabilities $ 4,769,129

$ 4,130,187

NATIONAL FUEL GAS

COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

CASH FLOWS (Unaudited) Twelve

Months Ended September 30, (Thousands of Dollars)

2009 2008

Operating Activities: Net Income Available for

Common Stock $ 100,708 $ 268,728 Adjustments to Reconcile Net

Income to Net Cash Provided by Operating Activities: Impairment of

Oil and Gas Producing Properties 182,811 - Depreciation, Depletion

and Amortization 173,410 170,623 Deferred Income Taxes (2,521 )

72,496 Income from Unconsolidated Subsidiaries, Net of Cash

Distributions (466 ) 1,977 Impairment of Investment in Partnership

1,804 - Excess Tax Benefits Associated with Stock-Based

Compensation Awards (5,927 ) (16,275 ) Other 17,443 4,858 Change

in: Hedging Collateral Deposits (847 ) 4,065 Receivables and

Unbilled Utility Revenue 47,658 (16,815 ) Gas Stored Underground

and Materials and Supplies 43,598 (22,116 ) Unrecovered Purchased

Gas Costs 37,708 (22,939 ) Prepayments and Other Current Assets

2,921 (36,376 ) Accounts Payable (61,149 ) 32,763 Amounts Payable

to Customers 103,025 (7,656 ) Customer Advances (8,462 ) 10,154

Other Accruals and Current Liabilities 17,059 (3,641 ) Other Assets

(35,140 ) (11,887 ) Other Liabilities

(4,201 ) 54,817 Net Cash

Provided by Operating Activities $ 609,432

$ 482,776 Investing

Activities: Capital Expenditures ($309,930 ) ($397,734 ) Investment

in Subsidiary, Net of Cash Acquired (34,933 ) - Investment in

Partnership (1,317 ) - Cash Held in Escrow (2,000 ) 58,397 Net

Proceeds from Sale of Oil and Gas Producing Properties 3,643 5,969

Other (2,806 )

4,376 Net Cash Used in Investing Activities

($347,343 )

($328,992 ) Financing Activities: Excess Tax Benefits

Associated with Stock-Based Compensation Awards $ 5,927 $ 16,275

Shares Repurchased under Repurchase Plan - (237,006 ) Net Proceeds

from Issuance of Long-Term Debt 247,780 296,655 Reduction of

Long-Term Debt (100,000 ) (200,024 ) Dividends Paid on Common Stock

(104,158 ) (103,683 ) Proceeds From Issuance of Common Stock

28,176

17,432 Net Cash Provided by (Used In) Financing Activities

$ 77,725

($210,351 ) Net Increase / (Decrease) in Cash and Temporary Cash

Investments 339,814 (56,567 ) Cash and Temporary Cash Investments

at Beginning of Period 68,239

124,806 Cash and Temporary Cash

Investments at September 30 $ 408,053

$ 68,239

NATIONAL FUEL GAS

COMPANY AND SUBSIDIARIES SEGMENT OPERATING

RESULTS AND STATISTICS (UNAUDITED)

Three Months Ended Twelve Months

Ended (Thousands of Dollars, except per share amounts) September

30, September 30,

EXPLORATION AND PRODUCTION

SEGMENT

2009 2008 Variance

2009 2008 Variance Operating

Revenues $ 101,349 $ 117,931 $ (16,582

) $ 382,758 $ 466,760 $ (84,002 )

Operating Expenses: Operation and Maintenance: General and

Administrative Expense 6,910 5,925 985 29,374 24,600 4,774 Lease

Operating Expense 17,013 14,223 2,790 53,957 55,335 (1,378 ) All

Other Operation and Maintenance Expense 2,460 5,523 (3,063 ) 11,059

13,250 (2,191 ) Property, Franchise and Other Taxes (Lease

Operating Expense) 935 2,956 (2,021 ) 8,657 11,350 (2,693 )

Depreciation, Depletion and Amortization 23,658 22,122 1,536 90,816

92,221 (1,405 ) Impairment of Oil and Gas Producing Properties

- - -

182,811 - 182,811

50,976 50,749

227 376,674 196,756

179,918 Operating Income 50,373

67,182 (16,809 ) 6,084 270,004 (263,920 ) Other Income

(Expense): Interest Income 244 1,642 (1,398 ) 2,430 10,921 (8,491 )

Other Income - - - - 18 (18 ) Other Interest Expense (7,915

) (8,970 ) 1,055 (33,368

) (41,645 ) 8,277 Income

(Loss) Before Income Taxes 42,702 59,854 (17,152 ) (24,854 )

239,298 (264,152 ) Income Tax Expense (Benefit) 14,574

21,627 (7,053 )

(14,616 ) 92,686 (107,302 ) Net

Income (Loss) $ 28,128 $ 38,227 $

(10,099 ) $ (10,238 ) $ 146,612 $ (156,850 )

Net Income (Loss) Per Share (Diluted) $ 0.34 $

0.46 $ (0.12 ) $ (0.13 ) $ 1.73

$ (1.86 ) Three Months Ended

Twelve Months Ended September 30, September 30,

PIPELINE AND STORAGE SEGMENT

2009 2008 Variance

2009 2008 Variance Revenues from

External Customers $ 31,573 $ 33,181 $ (1,608 ) $ 137,478 $ 135,052

$ 2,426 Intersegment Revenues 19,770

20,164 (394 ) 81,795

81,504 291 Total Operating

Revenues 51,343 53,345

(2,002 ) 219,273 216,556

2,717 Operating Expenses: Purchased Gas

(5 ) 2 (7 ) 132 (10 ) 142 Operation and Maintenance 20,268 19,755

513 70,814 70,632 182 Property, Franchise and Other Taxes 4,681

4,224 457 17,470 16,763 707 Depreciation, Depletion and

Amortization 8,699 8,242

457 35,115 32,871

2,244 33,643

32,223 1,420 123,531

120,256 3,275

Operating Income 17,700 21,122 (3,422 ) 95,742 96,300 (558 )

Other Income (Expense): Interest Income 52 116 (64 ) 995 843 152

Other Income (411 ) 2,251 (2,662 ) 2,780 4,796 (2,016 ) Interest

Expense on Long-Term Debt - - - - (31 ) 31 Other Interest Expense

(6,821 ) (3,813 ) (3,008 )

(21,580 ) (13,752 ) (7,828 )

Income Before Income Taxes 10,520 19,676 (9,156 ) 77,937

88,156 (10,219 ) Income Tax Expense 4,744

6,458 (1,714 ) 30,579

34,008 (3,429 ) Net Income $

5,776 $ 13,218 $ (7,442 ) $ 47,358

$ 54,148 $ (6,790 ) Net Income

Per Share (Diluted) $ 0.07 $ 0.16 $

(0.09 ) $ 0.59 $ 0.64 $ (0.05 )

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES

SEGMENT OPERATING RESULTS AND STATISTICS (UNAUDITED)

Three Months Ended Twelve Months Ended (Thousands of Dollars,

except per share amounts) September 30, September 30,

UTILITY SEGMENT

2009 2008 Variance

2009 2008 Variance Revenues from

External Customers $ 87,587 $ 127,464 $ (39,877 ) $ 1,097,550 $

1,194,657 $ (97,107 ) Intersegment Revenues 2,135

2,044 91 15,474

15,612 (138 ) Total

Operating Revenues 89,722 129,508

(39,786 ) 1,113,024

1,210,269 (97,245 ) Operating

Expenses: Purchased Gas 31,185 65,215 (34,030 ) 713,174 800,474

(87,300 ) Operation and Maintenance 36,104 44,765 (8,661 ) 191,192

202,745 (11,553 ) Property, Franchise and Other Taxes 9,392 9,726

(334 ) 44,215 45,476 (1,261 ) Depreciation, Depletion and

Amortization 10,005 9,661

344 39,675 39,113

562 86,686 129,367

(42,681 ) 988,256

1,087,808 (99,552 ) Operating Income

3,036 141 2,895 124,768 122,461 2,307 Other Income

(Expense): Interest Income 1,138 1,148 (10 ) 2,486 1,836 650 Other

Income 161 278 (117 ) 924 1,161 (237 ) Other Interest Expense

(9,597 ) (5,913 ) (3,684 )

(32,417 ) (27,683 ) (4,734 )

Income (Loss) Before Income Taxes (5,262 ) (4,346 ) (916 )

95,761 97,775 (2,014 ) Income Tax Expense (Benefit) (3,623 )

(3,590 ) (33 ) 37,097

36,303 794 Net Income

(Loss) $ (1,639 ) $ (756 ) $ (883 ) $ 58,664

$ 61,472 $ (2,808 ) Net Income (Loss)

Per Share (Diluted) $ (0.02 ) $ (0.01 ) $ (0.01 ) $

0.73 $ 0.73 $ -

Three Months Ended Twelve Months Ended September 30,

September 30,

ENERGY MARKETING SEGMENT

2009 2008 Variance

2009 2008 Variance Revenues from

External Customers $ 47,318 $ 109,821 $ (62,503 ) $ 397,763 $

549,932 $ (152,169 ) Intersegment Revenues 558

1,300 (742 ) 558

1,300 (742 ) Total Operating Revenues

47,876 111,121

(63,245 ) 398,321 551,232

(152,911 ) Operating Expenses: Purchased Gas 47,292

111,926 (64,634 ) 380,677 535,917 (155,240 ) Operation and

Maintenance 1,446 1,396 50 6,014 6,566 (552 ) Property, Franchise

and Other Taxes 19 18 1 41 50 (9 ) Depreciation, Depletion and

Amortization 11 11

- 42 42 -

48,768 113,351

(64,583 ) 386,774 542,575

(155,801 ) Operating Income (Loss) (892 )

(2,230 ) 1,338 11,547 8,657 2,890 Other Income (Expense):

Interest Income 12 30 (18 ) 79 323 (244 ) Other Income 24 58 (34 )

225 264 (39 ) Other Interest Expense (6 ) (42

) 36 (215 ) (175 )

(40 ) Income (Loss) Before Income Taxes (862 ) (2,184

) 1,322 11,636 9,069 2,567 Income Tax Expense (Benefit) (519

) (993 ) 474 4,470

3,180 1,290 Net Income

(Loss) $ (343 ) $ (1,191 ) $ 848 $ 7,166

$ 5,889 $ 1,277 Net

Income (Loss) Per Share (Diluted) $ - $ (0.01 )

$ 0.01 $ 0.09 $ 0.07 $

0.02

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES SEGMENT OPERATING RESULTS AND

STATISTICS (UNAUDITED)

Three Months Ended Twelve Months

Ended September 30, September 30,

ALL OTHER

2009 2008 Variance

2009 2008 Variance Revenues from

External Customers $ 10,887 $ 9,262 $ 1,625 $ 41,409 $ 53,265 $

(11,856 ) Intersegment Revenues - 3,864

(3,864 ) 3,890

14,115 (10,225 ) Total Operating Revenues

10,887 13,126

(2,239 ) 45,299 67,380

(22,081 ) Operating Expenses: Purchased Gas 3,918

2,942 976 8,456 10,883 (2,427 ) Operation and Maintenance 7,395

12,609 (5,214 ) 35,547 45,998 (10,451 ) Property, Franchise and

Other Taxes 358 384 (26 ) 1,498 1,662 (164 ) Depreciation,

Depletion and Amortization 3,148 1,078

2,070 7,066

5,687 1,379 14,819

17,013 (2,194 ) 52,567

64,230 (11,663 )

Operating Income (Loss) (3,932 ) (3,887 ) (45 ) (7,268 ) 3,150

(10,418 ) Other Income (Expense): Income from Unconsolidated

Subsidiaries 646 1,437 (791 ) 3,366 6,303 (2,937 ) Impairment of

Investment in Partnership - - - (1,804 ) - (1,804 ) Interest Income

40 311 (271 ) 583 1,232 (649 ) Other Income 264 10 254 302 1,062

(760 ) Other Interest Expense (551 ) (855 )

304 (2,471 ) (3,782 )

1,311 Income (Loss) Before Income Taxes

(3,533 ) (2,984 ) (549 ) (7,292 ) 7,965 (15,257 ) Income Tax

Expense (Benefit) (1,508 ) (1,413 )

(95 ) (5,221 ) 2,186

(7,407 ) Net Income (Loss) $ (2,025 ) $ (1,571 )

$ (454 ) $ (2,071 ) $ 5,779 $ (7,850 )

Net Income (Loss) Per Share (Diluted) $ (0.02 ) $

(0.02 ) $ - $ (0.03 ) $ 0.07 $

(0.10 )

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES SEGMENT OPERATING RESULTS AND

STATISTICS (UNAUDITED)

Three Months Ended Twelve Months Ended

(Thousands of Dollars, except per share amounts) September 30,

September 30,

CORPORATE

2009 2008 Variance

2009 2008 Variance Revenues from

External Customers $ 219 $ 199 $ 20 $ 894 $ 695 $ 199 Intersegment

Revenues 1,003 962

41 4,065 3,844

221 Total Operating Revenues 1,222

1,161 61 4,959

4,539 420

Operating Expenses: Operation and Maintenance 2,342 4,097 (1,755 )

10,024 18,013 (7,989 ) Property, Franchise and Other Taxes 69 71 (2

) 282 284 (2 ) Depreciation, Depletion and Amortization 174

172 2 696

689 7 2,585

4,340 (1,755 )

11,002 18,986 (7,984 )

Operating Loss (1,363 ) (3,179 ) 1,816 (6,043 ) (14,447 )

8,404 Other Income (Expense): Interest Income 22,518 20,304

2,214 84,761 85,084 (323 ) Other Income 80 (203 ) 283 2,345 75

2,270 Interest Expense on Long-Term Debt (22,062 ) (18,055 ) (4,007

) (79,419 ) (70,068 ) (9,351 ) Other Interest Expense (180 )

(1,160 ) 980 (3,004 )

(6,257 ) 3,253 Loss

Before Income Taxes (1,007 ) (2,293 ) 1,286 (1,360 ) (5,613 ) 4,253

Income Tax Expense (Benefit) 1,892

2,368 (476 ) (1,189 )

(441 ) (748 ) Net Loss $ (2,899 ) $ (4,661 )

$ 1,762 $ (171 ) $ (5,172 ) $ 5,001

Net Loss Per Share (Diluted) $ (0.04 ) $ (0.06

) $ 0.02 $ - $ (0.06 ) $ 0.06

Three Months Ended Twelve Months Ended

September 30, September 30,

INTERSEGMENT ELIMINATIONS

2009 2008 Variance

2009 2008 Variance Intersegment

Revenues $ (23,466 ) $ (28,334 ) $ 4,868 $

(105,782 ) $ (116,375 ) $ 10,593

Operating Expenses: Purchased Gas (21,779 ) (27,269 ) 5,490

(100,657 ) (112,107 ) 11,450 Operation and Maintenance

(1,687 ) (1,065 ) (622 ) (5,125

) (4,268 ) (857 ) (23,466 )

(28,334 ) 4,868 (105,782

) (116,375 ) 10,593

Operating Income - - - - - - Other Income (Expense):

Interest Income (22,586 ) (21,092 ) (1,494 ) (85,558 ) (89,424 )

3,866 Other Interest Expense 22,586

21,092 1,494 85,558

89,424 (3,866 ) Net

Income $ - $ - $ - $ -

$ - $ - Net Income Per Share

(Diluted) $ - $ - $ - $ -

$ - $ -

NATIONAL FUEL GAS

COMPANY AND SUBSIDIARIES SEGMENT INFORMATION

(Continued) (Thousands of Dollars)

Three Months Ended Twelve Months Ended

September 30, September 30, (Unaudited) (Unaudited) Increase

Increase 2009 2008 (Decrease) 2009

2008 (Decrease)

Capital

Expenditures: Exploration and Production (1) $ 36,612 $

51,644 $ (15,032 ) $ 188,290 $ 192,187 $ (3,897 ) Pipeline and

Storage (3) 15,264 59,316 (44,052 ) 50,118 165,520 (115,402 )

Utility 15,798 18,621 (2,823 ) 56,178 57,457 (1,279 ) Energy

Marketing -

18 (18 ) 25 39 (14

) Total Reportable Segments 67,674 129,599 (61,925 ) 294,611

415,203 (120,592 ) All Other (2) 5,401 182 5,219 8,406 1,485 6,921

Corporate 148 138 10 297 221 76 Eliminations - -

- (344 ) (2,407 ) 2,063

Total Capital Expenditures $ 73,223 $ 129,919 $ (56,696 ) $ 302,970

$ 414,502 $ (111,532 ) (1) Amount for

the quarter and year ended September 30, 2009 includes $9.1 million

of accrued capital expenditures, the majority of which was in the

Appalachian region. This amount has been excluded from the

Consolidated Statement of Cash Flows at

September 30, 2009 since it

represents a non-cash investing activity at that date.

(2) Amount for the quarter and year ended September 30, 2009

includes $0.7 million of accrued capital expenditures related to

the construction of the Midstream Covington Gathering System. This

amount has been excluded from the Consolidated Statement of Cash

Flows at September 30, 2009 since it represents a non-cash

investing activity at that date. (3) Amount for the year

ended September 30, 2009 excludes $16.8 million of capital

expenditures related to the Empire Connector project accrued at

September 30, 2008 and paid during the year ended September 30,

2009. This amount was excluded from the Consolidated Statement of

Cash Flows at September 30, 2008 since it represented a non-cash

investing activity at that date. The amount has been included in

the Consolidated Statement of Cash Flows at September 30, 2009.

DEGREE DAYS

Percent Colder (Warmer) Than:

Three Months Ended September 30

Normal 2009 2008 Normal Last Year

Buffalo, NY 178 143 102 (19.7 ) 40.2 Erie, PA 135 112 42

(17.0 ) 166.7

Twelve Months Ended September 30

Buffalo, NY 6,692 6,701 6,277 0.1 6.8 Erie, PA 6,243 6,176

5,779 (1.1 ) 6.9

NATIONAL FUEL GAS COMPANY AND

SUBSIDIARIES

EXPLORATION AND PRODUCTION

INFORMATION

Three Months Ended Twelve Months Ended

September 30, September 30, Increase Increase 2009

2008 (Decrease) 2009 2008 (Decrease)

Gas Production/Prices:

Production (MMcf) Gulf Coast 2,767 2,165 602 9,886 11,033 (1,147 )

West Coast 999 1,029 (30 ) 4,063 4,039 24 Appalachia 2,271

1,732 539 8,335 7,269

1,066 Total Production 6,037 4,926

1,111 22,284 22,341 (57 )

Average Prices (Per Mcf) Gulf Coast $ 3.61 $ 11.57 $ (7.96 ) $ 4.54

$ 10.03 $ (5.49 ) West Coast 3.36 9.54 (6.18 ) 3.91 8.71 (4.80 )

Appalachia 4.09 11.27 (7.18 ) 5.52 9.73 (4.21 ) Weighted Average

3.75 11.04 (7.29 ) 4.79 9.70 (4.91 ) Weighted Average after Hedging

6.00 9.41 (3.41 ) 6.94 9.05 (2.11 )

Oil Production/Prices:

Production (Thousands of Barrels) Gulf Coast 170 96 74 640 505 135

West Coast 691 635 56 2,674 2,460 214 Appalachia 17

17 - 59 105 (46 ) Total

Production 878 748 130 3,373

3,070 303 Average Prices (Per

Barrel) Gulf Coast $ 65.50 $ 123.54 $ (58.04 ) $ 54.58 $ 107.27 $

(52.69 ) West Coast 62.56 108.32 (45.76 ) 50.90 98.17 (47.27 )

Appalachia 59.08 114.20 (55.12 ) 56.15 97.40 (41.25 ) Weighted

Average 63.06 110.40 (47.34 ) 51.69 99.64 (47.95 ) Weighted Average

after Hedging 71.39 87.29 (15.90 ) 64.94 81.75 (16.81 )

Total Production (MMcfe) 11,305 9,414 1,891

42,522 40,761 1,761

Selected Operating Performance

Statistics:

General & Administrative Expense per Mcfe (1) $ 0.61 $ 0.63 $

(0.02 ) $ 0.69 $ 0.60 $ 0.09 Lease Operating Expense per Mcfe (1) $

1.59 $ 1.82 $ (0.23 ) $ 1.47 $ 1.64 $ (0.17 ) Depreciation,

Depletion & Amortization per Mcfe (1) $ 2.09 $ 2.35 $ (0.26 ) $

2.14 $ 2.26 $ (0.12 )

(1)

Refer to the table titled, "Segment Operating Results and

Statistics (Unaudited)," for the General and Administrative

Expense, Lease Operating Expense and Depreciation, Depletion, and

Amortization Expense for the Exploration and Production segment.

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES

EXPLORATION AND PRODUCTION

INFORMATION

Hedging Summary for

Fiscal 2010

SWAPS

Volume

Average Hedge Price

Oil 1.7 MMBBL $74.59 / BBL Gas 15.6 BCF $6.90 / MCF

Hedging Summary for Fiscal 2011

SWAPS

Volume

Average Hedge Price

Oil 0.6 MMBBL $66.54 / BBL Gas 12.6 BCF $7.22 / MCF

Hedging Summary for Fiscal 2012

SWAPS

Volume

Average Hedge Price

Oil 0.3 MMBBL $62.95 / BBL Gas 8.8 BCF $7.49 / MCF

Gross Wells in Process of

Drilling

Twelve Months Ended September 30,

2009

Total

Gulf

West

East

Company

Wells in Process - Beginning of Period Exploratory

1.00 0.00 24.00 25.00 Developmental 1.00 1.00 123.00 125.00

Wells Commenced Exploratory 0.00 0.00 28.00 28.00

Developmental 0.00 26.00 198.00 224.00

Wells Completed

Exploratory 1.00 0.00 2.00 3.00 Developmental 0.00 27.00 250.00

277.00

Wells Plugged & Abandoned Exploratory 0.00 0.00

3.00 3.00 Developmental 1.00 0.00 0.00 1.00

Wells in Process -

End of Period Exploratory 0.00 0.00 47.00 47.00 Developmental

0.00 0.00 71.00 71.00

Net Wells in Process of

Drilling

Twelve Months Ended September 30,

2009

Total

Gulf

West

East

Company

Wells in Process - Beginning of Period Exploratory

0.29 0.00 23.00 23.29 Developmental 0.30 1.00 122.00 123.30

Wells Commenced Exploratory 0.00 0.00 21.50 21.50

Developmental 0.00 26.00 197.00 223.00

Wells Completed

Exploratory 0.29 0.00 2.00 2.29 Developmental 0.00 27.00 250.00

277.00

Wells Plugged & Abandoned Exploratory 0.00 0.00

3.00 3.00 Developmental 0.30 0.00 0.00 0.30

Wells in Process -

End of Period Exploratory 0.00 0.00 39.50 39.50 Developmental

0.00 0.00 69.00 69.00

NATIONAL FUEL GAS COMPANY

AND SUBSIDIARIES

EXPLORATION AND PRODUCTION

INFORMATION

Reserve Quantity Information

Gas MMcf U.S. Gulf Coast West Coast

Appalachian Total Region Region Region Company

Proved Developed and Undeveloped Reserves: September 30, 2008

24,641 72,860 128,398 225,899 Extensions and Discoveries 6,698

3,282 49,249 59,229 Revisions of Previous Estimates 9,407 488

(19,484 ) (9,589 ) Production (9,886 ) (4,063 ) (8,335 ) (22,284 )

Purchases of Minerals in Place - 392 - 392 Sales of Minerals in

Place (4,693 ) - - (4,693 )

September 30, 2009 26,167 72,959 149,828 248,954 Proved

Developed Reserves: September 30, 2008 18,242 68,453 115,824

202,519 September 30, 2009 18,051 67,603 120,579 206,233

Oil Mbbl U.S. Gulf Coast West Coast Appalachian Total Region

Region Region Company Proved Developed and

Undeveloped Reserves: September 30, 2008 1,358 44,444 396 46,198

Extensions and Discoveries 302 896 15 1,213 Revisions of Previous

Estimates 447 43 (41 ) 449 Production (640 ) (2,674 ) (59 ) (3,373

) Purchases of Minerals in Place - 2,115 - 2,115 Sales of Minerals

in Place (15 ) - - (15 )

September 30, 2009 1,452 44,824 311 46,587 Proved Developed

Reserves: September 30, 2008 1,313 37,224 357 38,894

September 30, 2009 1,194 37,711 285 39,190

NATIONAL FUEL

GAS COMPANY AND SUBSIDIARIES Pipeline

& Storage Throughput- (millions of cubic feet - MMcf)

Three Months Ended Twelve Months Ended

September 30, September 30, Increase 2009 2008 Decrease 2009 2008

(Decrease) Firm Transportation - Affiliated 10,473 10,997 (524 )

109,884 107,846 2,038 Firm Transportation - Non-Affiliated 41,298

59,071 (17,773 ) 246,887 245,327 1,560 Interruptible Transportation

512 1,354 (842 ) 4,070 5,197 (1,127 ) 52,283 71,422 (19,139 )

360,841 358,370 2,471

Utility Throughput -

(MMcf) Three Months Ended Twelve Months Ended September 30,

September 30, Increase Increase 2009 2008 (Decrease) 2009

2008 (Decrease) Retail Sales: Residential Sales 3,835 3,583 252

58,835 57,463 1,372 Commercial Sales 567 571 (4 ) 9,551 9,769 (218

) Industrial Sales 16 29 (13 ) 515 552 (37 ) 4,418 4,183 235 68,901

67,784 1,117 Off-System Sales - 895 (895 ) 513 5,686 (5,173 )

Transportation 7,275 8,301 (1,026 ) 59,751 64,267 (4,516 ) 11,693

13,379 (1,686 ) 129,165 137,737 (8,572 )

Energy Marketing

Volumes Three Months Ended Twelve Months Ended September 30,

September 30, Increase Increase 2009 2008 (Decrease)

2009 2008 (Decrease) Natural Gas (MMcf) 10,400 8,931 1,469

60,858 56,120 4,738

NATIONAL FUEL GAS COMPANY

AND SUBSIDIARIES FISCAL 2010 EARNINGS GUIDANCE AND

SENSITIVITY

Earnings per share sensitivity to changes Fiscal 2010

(Diluted earnings per share guidance*) from prices used in

guidance* ^ $1 change per MMBtu gas $5 change per Bbl

oil Earnings Range Increase Decrease Increase Decrease

Consolidated Earnings $2.30 - $2.65 + $0.06 - $0.06 + $0.07 - $0.07

* Please refer to forward looking

statement footnote featured earlier in this document.

^ This sensitivity table is current as of November 6, 2009

and only considers revenue from the Exploration and Production

segment's crude oil and natural gas sales. This revenue is based

upon pricing used in the Company's earnings forecast. For its

fiscal 2010 earnings forecast, the Company is utilizing flat NYMEX

equivalent commodity pricing, exclusive of basis differential, of

$5 per MMBtu for natural gas and $75 per Bbl for crude oil. The

sensitivities will become obsolete with the passage of time,

changes in Seneca's production forecast, changes in basis

differential, as additional hedging contracts are entered into, and

with the settling of hedge contracts at their maturity.

NATIONAL FUEL GAS COMPANY AND SUBSIDIARIES

Quarter Ended September 30

(unaudited)

2009 2008 Operating Revenues $ 278,933,000 $

397,858,000 Net Income Available for Common Stock $

26,998,000 $ 43,266,000 Earnings Per Common Share: Basic $

0.34 $ 0.54 Diluted $ 0.33 $ 0.52 Weighted Average Common

Shares: Used in Basic Calculation 80,240,861

80,858,668 Used in Diluted Calculation 81,607,864

82,896,107

Twelve Months Ended September 30

(unaudited)

Operating Revenues $ 2,057,852,000 $ 2,400,361,000

Net Income Available for Common Stock $ 100,708,000 $ 268,728,000

Earnings Per Common Share: Basic $ 1.26 $ 3.27 Diluted $

1.25 $ 3.18 Weighted Average Common Shares: Used in Basic

Calculation 79,649,965 82,304,335 Used in Diluted

Calculation 80,628,685 84,474,839

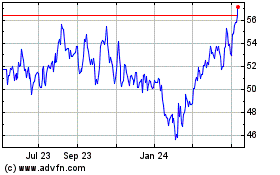

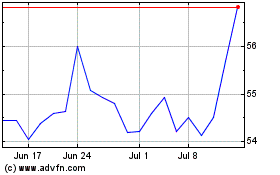

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From May 2024 to Jun 2024

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2023 to Jun 2024