National Fuel Pipeline Unit Files Settlement of Complaint at FERC

November 17 2006 - 5:15PM

Business Wire

National Fuel Gas Supply Corporation (�Supply Corporation�), the

wholly-owned interstate pipeline subsidiary of National Fuel Gas

Company (NYSE: NFG) (�the Company�), today announced that it has

filed at the Federal Energy Regulatory Commission (�FERC�) a

stipulation and agreement as an offer of settlement of a complaint

filed in April 2006 under Sections 5(a) and 13 of the Natural Gas

Act. The filed stipulation states that the settlement is supported

by all the parties who brought the complaint (the Public Service

Commission of the State of New York, the Pennsylvania Public

Utility Commission and the Pennsylvania Office of Consumer

Advocate) and several other active parties. The filing states that

Supply Corporation believes the proposed settlement will be

uncontested, and asks FERC to approve it without modification after

a comment period that will run through December 18, 2006. The terms

of the proposed settlement would be effective following approval by

FERC. The settlement makes no change to Supply Corporation�s rates

except for an agreed-upon change in its gas retention allowances.

Other features of the settlement include: All participants have

reached a negotiated resolution of all the issues raised or which

could have been raised in the proceeding. Supply Corporation�s gas

retention allowances on transportation services will decrease from

2% to 1.4%, amounting to a reduction in excess �efficiency gas�

quantities of approximately 1,500,000 dekatherms (�dth�) per year.*

With respect to the period of time between December 1, 2006 and the

effective date of the settlement, Supply Corporation will refund

the value of the additional gas retained under its current

transportation retention allowances (i.e., the difference between

2% and 1.4%). Supply Corporation is authorized to continue to sell

efficiency gas and retain the proceeds. After a five-year general

rate case moratorium, Supply Corporation will make a rate case

filing to be effective December 1, 2011. Supply Corporation�s

annual depreciation rate for transmission plant will decrease to

2.9%, and its annual depreciation rate for storage plant will

decrease to 2.23%, which will decrease annual depreciation expense

by about $5.63 million.* Supply Corporation�s rate allowance for

post-retirement medical expenses will increase from about $4.7

million per year to $11 million per year, including the five-year

amortization of a related regulatory asset that had built up to

approximately $12.43 million since a previous rate settlement. This

increase in rate allowance will be an increase in annual expense.

The entire rate allowance will continue to be set aside in

designated funds for the sole purpose of paying Supply

Corporation�s post-retirement medical expenses. Depending on actual

post-retirement medical expense going forward, a new regulatory

asset or liability will be created over the next five years to be

recovered or credited in the next rate case. Supply Corporation�s

tariff provisions on discounting gas retention allowances will be

amended so as to be consistent with FERC�s current policy limiting

�fuel discounts.� The earnings guidance for the 2007 Fiscal Year

included in the Company�s November 9, 2006 earnings report took

into account the expected impact of this settlement and, therefore,

no changes to that earnings guidance are necessary as a result of

this filing. Supply Corporation comprises the largest portion of

the Pipeline and Storage segment of National Fuel Gas Company. The

operations of Empire State Pipeline are also part of National Fuel

Gas Company�s Pipeline and Storage segment, but Empire State

Pipeline was not cited in these pleadings. Supply Corporation owns

and operates 2,972 miles of natural gas pipelines and 32 natural

gas storage fields, including four that are co-owned with

non-affiliated companies. National Fuel Gas Company is an

integrated energy company with $3.7 billion in assets comprised of

the following five operating segments: Utility, Pipeline and

Storage, Exploration and Production, Energy Marketing, and Timber.

Additional information about National Fuel Gas Company is available

on its Internet Web site: http://www.nationalfuelgas.com or through

its investor information service at 1-800-334-2188. * - Certain

statements contained herein, including those which are designated

with an asterisk ("*") and those which use words such as

"anticipates," "estimates," "expects," "intends," "plans,"

"predicts," "projects," and similar expressions, are

"forward-looking statements" as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company's expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: changes in laws and regulations to which the Company is

subject, including changes in tax, environmental, safety and

employment laws and regulations; changes in economic conditions,

including economic disruptions caused by terrorist activities, acts

of war or major accidents; changes in the availability and/or price

of natural gas or oil; inability to obtain new customers or retain

existing ones; governmental/regulatory actions, initiatives and

proceedings, including those involving acquisitions, financings,

rate cases (which address, among other things, allowed rates of

return, rate design and retained gas), affiliate relationships,

industry structure, franchise renewal, and environmental/safety

requirements; significant changes in tax rates or policies or in

rates of inflation or interest; or changes in accounting principles

or the application of such principles to the Company. The Company

disclaims any obligation to update any forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events. National Fuel Gas

Supply Corporation ("Supply Corporation"), the wholly-owned

interstate pipeline subsidiary of National Fuel Gas Company (NYSE:

NFG) ("the Company"), today announced that it has filed at the

Federal Energy Regulatory Commission ("FERC") a stipulation and

agreement as an offer of settlement of a complaint filed in April

2006 under Sections 5(a) and 13 of the Natural Gas Act. The filed

stipulation states that the settlement is supported by all the

parties who brought the complaint (the Public Service Commission of

the State of New York, the Pennsylvania Public Utility Commission

and the Pennsylvania Office of Consumer Advocate) and several other

active parties. The filing states that Supply Corporation believes

the proposed settlement will be uncontested, and asks FERC to

approve it without modification after a comment period that will

run through December 18, 2006. The terms of the proposed settlement

would be effective following approval by FERC. The settlement makes

no change to Supply Corporation's rates except for an agreed-upon

change in its gas retention allowances. Other features of the

settlement include: -- All participants have reached a negotiated

resolution of all the issues raised or which could have been raised

in the proceeding. -- Supply Corporation's gas retention allowances

on transportation services will decrease from 2% to 1.4%, amounting

to a reduction in excess "efficiency gas" quantities of

approximately 1,500,000 dekatherms ("dth") per year.* With respect

to the period of time between December 1, 2006 and the effective

date of the settlement, Supply Corporation will refund the value of

the additional gas retained under its current transportation

retention allowances (i.e., the difference between 2% and 1.4%).

Supply Corporation is authorized to continue to sell efficiency gas

and retain the proceeds. -- After a five-year general rate case

moratorium, Supply Corporation will make a rate case filing to be

effective December 1, 2011. -- Supply Corporation's annual

depreciation rate for transmission plant will decrease to 2.9%, and

its annual depreciation rate for storage plant will decrease to

2.23%, which will decrease annual depreciation expense by about

$5.63 million.* -- Supply Corporation's rate allowance for

post-retirement medical expenses will increase from about $4.7

million per year to $11 million per year, including the five-year

amortization of a related regulatory asset that had built up to

approximately $12.43 million since a previous rate settlement. This

increase in rate allowance will be an increase in annual expense.

The entire rate allowance will continue to be set aside in

designated funds for the sole purpose of paying Supply

Corporation's post-retirement medical expenses. Depending on actual

post-retirement medical expense going forward, a new regulatory

asset or liability will be created over the next five years to be

recovered or credited in the next rate case. -- Supply

Corporation's tariff provisions on discounting gas retention

allowances will be amended so as to be consistent with FERC's

current policy limiting "fuel discounts." The earnings guidance for

the 2007 Fiscal Year included in the Company's November 9, 2006

earnings report took into account the expected impact of this

settlement and, therefore, no changes to that earnings guidance are

necessary as a result of this filing. Supply Corporation comprises

the largest portion of the Pipeline and Storage segment of National

Fuel Gas Company. The operations of Empire State Pipeline are also

part of National Fuel Gas Company's Pipeline and Storage segment,

but Empire State Pipeline was not cited in these pleadings. Supply

Corporation owns and operates 2,972 miles of natural gas pipelines

and 32 natural gas storage fields, including four that are co-owned

with non-affiliated companies. National Fuel Gas Company is an

integrated energy company with $3.7 billion in assets comprised of

the following five operating segments: Utility, Pipeline and

Storage, Exploration and Production, Energy Marketing, and Timber.

Additional information about National Fuel Gas Company is available

on its Internet Web site: http://www.nationalfuelgas.com or through

its investor information service at 1-800-334-2188. * - Certain

statements contained herein, including those which are designated

with an asterisk ("*") and those which use words such as

"anticipates," "estimates," "expects," "intends," "plans,"

"predicts," "projects," and similar expressions, are

"forward-looking statements" as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company's expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: changes in laws and regulations to which the Company is

subject, including changes in tax, environmental, safety and

employment laws and regulations; changes in economic conditions,

including economic disruptions caused by terrorist activities, acts

of war or major accidents; changes in the availability and/or price

of natural gas or oil; inability to obtain new customers or retain

existing ones; governmental/regulatory actions, initiatives and

proceedings, including those involving acquisitions, financings,

rate cases (which address, among other things, allowed rates of

return, rate design and retained gas), affiliate relationships,

industry structure, franchise renewal, and environmental/safety

requirements; significant changes in tax rates or policies or in

rates of inflation or interest; or changes in accounting principles

or the application of such principles to the Company. The Company

disclaims any obligation to update any forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events.

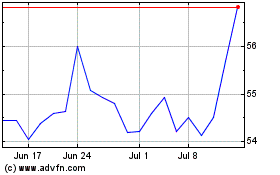

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From May 2024 to Jun 2024

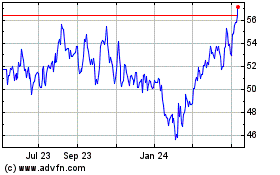

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2023 to Jun 2024