National Fuel Announces Significant Third Quarter Charge; Company to Issue Third Quarter Earnings Report on August 3, 2006

July 20 2006 - 8:15AM

Business Wire

National Fuel Gas Company ("National Fuel" or the "Company") (NYSE:

NFG) today announced that the decline in market prices for natural

gas at June 30, 2006, will require Seneca Resources Corporation

("Seneca"), the Company's wholly owned exploration and production

subsidiary, to record a non-cash charge to write-down the value of

its Canadian oil and natural gas producing properties. Like many

independent exploration and production companies, Seneca uses the

full cost method of accounting for determining the book value of

its oil and natural gas properties. This method requires that

Seneca perform a quarterly "ceiling test" to compare, on a

country-by-country basis, the present value of future revenues from

its oil and natural gas reserves based on current market prices

(the "ceiling") with the book value of those reserves at the

balance sheet date. If the book value of the reserves in any

country exceeds the ceiling, a non-cash charge must be recorded to

reduce the book value of the reserves to the calculated ceiling. As

disclosed in National Fuel's second quarter earnings release, at

March 31, 2006, the book value of Seneca's Canadian reserves (of

which more than 80% are natural gas) nearly equaled the ceiling.

New York Mercantile Exchange ("NYMEX") natural gas prices were

$7.21/MMBtu on March 31, but declined to $6.10/MMBtu at June 30,

2006. The book value of Seneca's Canadian reserves is now expected

to exceed the ceiling calculated as of June 30, 2006. As a result,

Seneca is required to record an after-tax impairment charge which

is expected to be in the range of US$35 million to $40 million or

$0.41 to $0.47 per diluted share.* David F. Smith, President and

Chief Operating Officer of National Fuel Gas Company, stated: "The

decline in natural gas prices since the end of March required this

write down of the value of Seneca's Canadian assets to reflect

market prices as of the end of June. We nonetheless expect to meet

our fiscal 2006 production estimates of 46-51 Bcfe.* We are also

currently reviewing our capital budget and potential prospects in

Canada for the remainder of this fiscal year and for fiscal 2007."*

National Fuel is in the process of completing its quarter-end

closing procedures and will update its earnings guidance for the

remainder of the fiscal year in its third quarter earnings report,

which is scheduled to be released in the evening of August 3, 2006.

Preliminary earnings guidance for fiscal 2007 will also be provided

in that release. The Company will discuss its third quarter

earnings release in a financial analyst conference call on Friday

August 4, 2006, at 11:00 a.m. EDST. There are two ways to access

this call. For those with Internet access, the live webcast can be

accessed via National Fuel's website, www.nationalfuelgas.com at

the "For Investors" link at the top of the homepage. For those

without Internet access, the call may be accessed by dialing

(toll-free) 1-866-825-3354 and using the passcode "12960669." For

those unable to listen to the live conference call, a replay will

be available approximately one hour after the conclusion of the

call at the same website link and by phone at (toll-free)

1-888-286-8010 using passcode "44573014." Both the webcast and

telephonic replay will be available until the close of business on

Friday, August 11, 2006. National Fuel is an integrated energy

company with $3.9 billion in assets comprised of the following five

operating segments: Utility, Pipeline and Storage, Exploration and

Production, Energy Marketing, and Timber. Additional information

about National Fuel is available on its Internet Web site:

www.nationalfuelgas.com or through its investor information service

at 1-800-334-2188. Certain statements contained herein, including

those which are designated with an asterisk ("*") and those which

use words such as "anticipates," "estimates," "expects," "intends,"

"plans," "predicts," "projects," and similar expressions, are

"forward-looking statements" as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company's expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: changes in laws and regulations to which the Company is

subject, including changes in tax, environmental, safety and

employment laws and regulations, and changes in laws and

regulations relating to repeal of the Public Utility Holding

Company Act of 1935; changes in economic conditions, including

economic disruptions caused by terrorist activities, acts of war or

major accidents; changes in demographic patterns and weather

conditions, including the occurrence of severe weather, such as

hurricanes; changes in the availability and/or price of natural gas

or oil and the effect of such changes on the accounting treatment

or valuation of derivative financial instruments or the Company's

natural gas and oil reserves; impairments under the Securities and

Exchange Commission's full cost ceiling test for natural gas and

oil reserves; changes in the availability and/or price of

derivative financial instruments; changes in the price

differentials between various types of oil; failure of the price

differential between heavy sour crude oil and light sweet crude oil

to return to its historical norm; inability to obtain new customers

or retain existing ones; significant changes in competitive factors

affecting the Company; governmental/regulatory actions, initiatives

and proceedings, including those involving acquisitions,

financings, rate cases (which address, among other things, allowed

rates of return, rate design and retained gas), affiliate

relationships, industry structure, franchise renewal, and

environmental/safety requirements; unanticipated impacts of

restructuring initiatives in the natural gas and electric

industries; significant changes from expectations in actual capital

expenditures and operating expenses and unanticipated project

delays or changes in project costs or plans; the nature and

projected profitability of pending and potential projects and other

investments; occurrences affecting the Company's ability to obtain

funds from operations, debt or equity to finance needed capital

expenditures and other investments, including any downgrades in the

Company's credit ratings; uncertainty of oil and gas reserve

estimates; ability to successfully identify and finance

acquisitions or other investments and ability to operate and

integrate existing and any subsequently acquired business or

properties; ability to successfully identify, drill for and produce

economically viable natural gas and oil reserves; significant

changes from expectations in the Company's actual production levels

for natural gas or oil; regarding foreign operations, changes in

trade and monetary policies, inflation and exchange rates, taxes,

operating conditions, laws and regulations related to foreign

operations, and political and governmental changes; significant

changes in tax rates or policies or in rates of inflation or

interest; significant changes in the Company's relationship with

its employees or contractors and the potential adverse effects if

labor disputes, grievances or shortages were to occur; changes in

accounting principles or the application of such principles to the

Company; the cost and effects of legal and administrative claims

against the Company; or increasing costs of insurance, changes in

coverage and the ability to obtain insurance. The Company disclaims

any obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events.

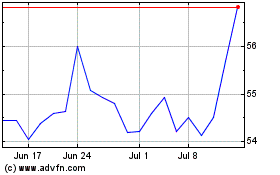

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From May 2024 to Jun 2024

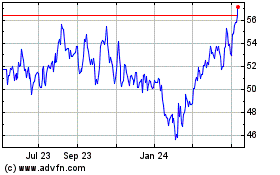

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2023 to Jun 2024