Motorola Solutions, Inc. (MSI) - Bull of the Day

September 07 2011 - 8:00PM

Zacks

We upgrade our recommendation on

Motorola Solutions, Inc.

(MSI) to Outperform. The company reported excellent financial

results for the second quarter of 2011. The company is a market

leader in the lucrative U.S. Public Safety market. While the

federal budgetary pressures are anticipated to continue, the state

and local level agencies have become a major growth driver for

Motorola Solutions.

The company's business model remains compelling and we believe

the company will be able to maintain its current top-line growth in

the future primarily due to the critical nature of the public

safety network in the U.S. and massive growth potential in the

Middle East. Furthermore, Motorola Solutions boasts a healthy cash

flow.

The company has also enhanced its shareholders value through a

regular dividend policy and the initiation of a major share buyback

program. We therefore, have upgraded our rating to Outperform with

a target price of $49, based on 22x our fiscal 2011 earnings

estimate, approaching the industry average.

MOTOROLA SOLUTN (MSI): Free Stock Analysis Report

Zacks Investment Research

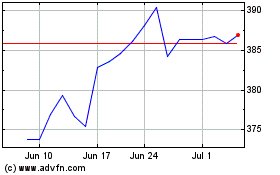

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From May 2024 to Jun 2024

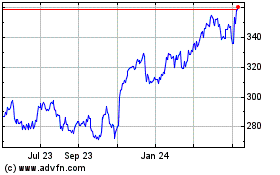

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Jun 2023 to Jun 2024