On Wednesday, markets enjoyed their best three-day winning streak

in three months as investor sentiment was boosted by news that the

Greek austerity plan had been approved by the nation’s lawmakers.

This would not only enable Greece avoid a debt default but would

also help the global markets avoid bearish sentiments

The Dow Jones Industrial

Average (DJIA) moved up 0.6% to settle at 12,261.42. The Standard

& Poor 500 (S&P 500) jumped 0.8% to finish the day at

1,307.41. The tech-laden Nasdaq Composite Index settled at

2,740.49, after surging 0.4%. The fear-gauge CBOE Volatility Index

(VIX) slid 9.9% to settle at 17.27. On the New York Stock Exchange,

Amex and Nasdaq, consolidated volumes were 7.19 billion shares,

well below the daily average so far this year of 7.57 billion. The

breadth of the market was dominated by the advancers as for every

seven stocks that rose on the NYSE, only three were on the

declining side. For the week, the benchmarks are all trading in

positive territory with the Dow, S&P 500 and the Nasdaq up

2.7%, 3.1% and 3.3%, respectively.

Over the past three days,

markets have been able to recoup much of the losses suffered this

month, which was largely caused by fears of euro-zone debt crisis.

The Dow that fluctuated over and below the psychological level of

12, 000, looks fairly stable for the moment. Many had feared that

the S&P 500 would decline to its March low of 1, 250. But, the

index has now climbed over 1, 300 and is up 3.96% year-to-date.

However, the index is down 4.12% from its April high.

With not much happening on

the domestic front, the optimistic mood was primarily attributable

to news of the Greek parliament voting in favor of the austerity

plan which entails spending cuts, tax hikes and state asset sales.

Though violence broke out in Athens, the parliament voted 155 to

138 in favor of the austerity plan. The five-year plan that was

finalised by the European Union and the International Monetary Fund

last week, was a prerequisite for Greece to receive the next

installment of the country's bailout package. Greek Prime Minister

George Papandreou faced a formidable task as he attempted to push

through the austerity plan which was absolute necessary to prevent

a debt default.

On the domestic front, a day

after the S&P/Case-Shiller Home Price Indices presented a rosy

picture of the housing sector, it was time for the National

Association of Realtors (NAR) to lift the mood. The NAR reported a

significant rebound in pending home sales for May as it jumped 8.2%

to a reading of 88.8 in May from an upwardly revised 82.1 in April.

It was also up 13.4% from a reading of 78.3 in May 2010. NAR

reported all regions experienced an increase from a year ago,

pointing to higher housing activity in the second half of the year.

Lawrence Yun, NAR chief economist, said: “Some markets have made a

rapid turnaround, going from soft activity to contract signings

rising by more than 30 percent from a year ago, including areas

such as Hartford, Conn.; Indianapolis; Minneapolis; Houston; and

Seattle.”

In intra-day trading, markets

wobbled and threatened to lose their gains while the Nasdaq dropped

into the red, but strength from the financial, materials and energy

lifted the broader markets to ensure a finish in the green. Bank of

America Corporation (NYSE:BAC) was one of the leading gainers in

the financial sector after it reached a settlement with investors

regarding disputes related to mortgage securities. The bank’s stock

jumped 3.0% and other winners included, Citigroup, Inc. (NYSE:C),

The Goldman Sachs Group, Inc. (NYSE:GS), JPMorgan Chase & Co.

(NYSE:JPM), Morgan Stanley (NYSE:MS), U.S. Bancorp (NYSE:USB) and

American Express Company (NYSE:AXP), gaining 3.4%, 2.5%, 2.3%,

4.8%, 1.9% and 2.6%, respectively.

Coming to materials stocks,

Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), Western Copper

Corp. (AMEX:WRN), Newmont Mining Corp. (NYSE:NEM), Augusta Resource

Corp. (AMEX:AZC), Sterlite Industries (India) Ltd. (NYSE:SLT) and

Taseko Mines Ltd. (AMEX:TGB) gained 2.3%, 3.0%, 1.4%, 9.3%, 2.5%

and 5.2%, respectively.

Transocean Ltd. (NYSE:RIG)

lifted the energy sector, jumping 3.7%. Other gainers were Nabors

Industries Ltd. (NYSE:NBR), Helmerich & Payne Inc. (NYSE:HP),

Chevron Corp. (NYSE:CVX), BP plc (NYSE:BP), Hess Corporation

(NYSE:HES) and Suncor Energy Inc. (NYSE:SU) and they were up by

1.0%, 2.3%, 0.9%, 1.7%, 2.1% and 1.2%, respectively.

AMER EXPRESS CO (AXP): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

FREEPT MC COP-B (FCX): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

HELMERICH&PAYNE (HP): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

MORGAN STANLEY (MS): Free Stock Analysis Report

NABORS IND (NBR): Free Stock Analysis Report

NEWMONT MINING (NEM): Free Stock Analysis Report

TRANSOCEAN LTD (RIG): Free Stock Analysis Report

STERLITE INDUST (SLT): Free Stock Analysis Report

TASEKO MINES LT (TGB): Free Stock Analysis Report

US BANCORP (USB): Free Stock Analysis Report

Zacks Investment Research

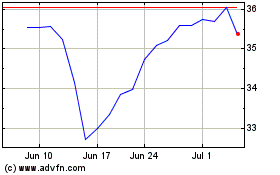

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Apr 2024 to May 2024

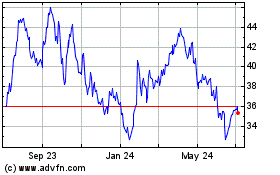

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2023 to May 2024