2nd UPDATE: Corporates Bring At Least $1.75 Billion Of Bonds To Market

March 01 2011 - 4:25PM

Dow Jones News

Companies approached the U.S. dollar market Tuesday with a view

to selling at least $1.75 billion of investment-grade corporate

bonds, according to people familiar with the transactions on

tap.

Industrial gases producer Praxair Inc. (PX) and French financial

services firm Compagnie de Financement Foncier both announced

benchmark-sized deals--for a minimum of $500 million each; data

center provider Digital Realty Trust L.P. brought a $400 million

deal, increased from a planned $250 million; and the credit arm of

motorcycle maker Harley-Davidson Inc. (HOG) raised $450 million, up

from $350 million planned.

Praxair's bonds, which mature in March 2021 and are rated A2 by

Moody's Investors Service and A by Standard & Poor's, priced at

a slight discount to yield 4.105% or 0.67 percentage point over

comparable Treasurys. Initial guidance had been 0.70 percentage

point over the risk-free rate.

Proceeds are expected to help it repay short-term debt, fund

share buybacks or be used for other general corporate purposes. The

deal was led by Bank of America Merrill Lynch and Citigroup as

active bookrunners, and Deutsche Bank Securities and HSBC as

passive bookrunners.

Compagnie de Financement Foncier, a unit of Credit

Foncier--which is in turn owned by French conglomerate Groupe

BPCE--also has a benchmark-sized bond, maturing March 2014 and

rated AAA by all three ratings agencies. That sale is being led by

Barclays Capital, BNP Paribas, Citi, J.P. Morgan Chase & Co.

and Natixis. Price guidance is in the area of 0.85 percentage point

over midswaps, people familiar with the deal said.

Digital Realty Trust L.P.'s 10-year senior unsecured bonds

priced to yield 5.279%, or 1.85 percentage points over

Treasurys--inside price guidance of 1.875 percentage points, people

familiar said. The bonds will be fully guaranteed by its general

partner, Digital Realty Trust Inc. That deal, led by Morgan

Stanley, Citi, BofA, Credit Suisse and Deutsche Bank, will help the

issuer repay borrowings on its revolving credit facility, acquire

more properties, fund developments and increase its working

capital. As of Dec. 31, the firm had borrowed $333.5 million on its

revolver, it said in a regulatory filing.

Meanwhile, Harley-Davidson Financial Services Inc. sold

five-year bonds guaranteed by Harley-Davidson Credit Corp. via

Citi, Deutsche Bank and J.P. Morgan. The bonds priced to yield

3.888% or 1.75 percentage points over Treasurys. Proceeds will be

used to pay down commercial paper debt. The bonds are rated Baa1 by

Moody's, BBB by S&P and BBB+ by Fitch Ratings.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com

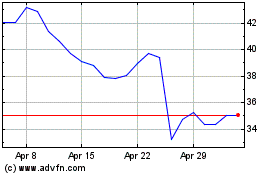

Harley Davidson (NYSE:HOG)

Historical Stock Chart

From May 2024 to Jun 2024

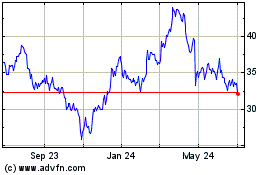

Harley Davidson (NYSE:HOG)

Historical Stock Chart

From Jun 2023 to Jun 2024