0001788717FALSE00017887172023-06-302023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 30, 2023

F45 Training Holdings Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | | 001-40590 (Commission File Number) | | 84-2529722 (I.R.S. Employer Identification No.) |

| | | | |

3601 South Congress Avenue, Building E Austin, Texas 78704 (Address of Principal Executive Offices) (737) 787-1955 (Registrant's telephone number, including area code) |

| (Former Name or Former Address, if Changed Since Last Report) |

| | | | | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR § 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR § 240.14a-12) |

☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR § 210.14d-2(b)) |

☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR § 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, par value $0.00005 per share | | FXLV | | NYSE |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2). |

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On June 30, 2023, F45 Training Holdings Inc., a Delaware corporation (the “Company”), as borrower, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent and Australian Security Trustee, entered into a Fourth Amendment to Amended and Restated Credit Agreement, dated June 30, 2023 (the “Fourth Amendment”), amending the Amended and Restated Credit Agreement dated as of August 13, 2021, as amended by that certain First Amendment to Amended and Restated Credit Agreement dated as of December 20, 2021, as amended by that certain Second Amendment to Amended and Restated Credit Agreement dated as of May 13, 2022 and as amended by that certain Third Amendment to Amended and Restated Credit Agreement dated as of February 14, 2023 (as the same may be amended, restated, supplemented, or otherwise modified from time to time, the “JPM Credit Agreement”). Pursuant to the Fourth Amendment, the lenders have agreed to extend the deadlines under the JPM Credit Agreement with respect to delivery of the Company’s audited financial statements for the year ended December 31, 2022 (the “2022 Financial Statements”), financial statements for the quarter ended March 31, 2023 (collectively with the 2022 Financial Statements, the “Financial Statements”), financial statements for the quarter ended June 30, 2023, together with the accompanying compliance certificates, and financial projections, to August 31, 2023, subject to the terms and conditions set forth in the Fourth Amendment.

On June 30, 2023, the Company, as borrower, the lenders party thereto and Alter Domus (US) LLC as administrative agent, entered into a Consent Under Subordinated Credit Agreement, dated June 30, 2023 (the “Credit Agreement Consent”) under the Subordinated Credit Agreement, dated as of February 14, 2023, by and among the Company, as borrower, the other loan parties party thereto, the lenders party thereto and Alter Domus (US) LLC, as administrative agent and as Australian security trustee (the “Subordinated Credit Agreement”). Pursuant to the Credit Agreement Consent, the lenders have agreed to extend the deadlines under the Subordinated Credit Agreement with respect to delivery of the Company’s Financial Statements and financial statements for the quarter ended June 30, 2023, together with the accompanying compliance certificates, and financial projections, to August 31, 2023, subject to the terms and conditions set forth in the Credit Agreement Consent.

As the Company reported in its Form 12b-25 filed with the Securities and Exchange Commission on March 16, 2023 and its Form 12b-25 filed with the Securities and Exchange Commission on May 10, 2023, the Company has been unable to complete the Financial Statements because (i) the Company requires time to complete certain items with respect to the Company’s financial statement preparation and review processes, including management’s assessment of the effectiveness of the Company’s internal controls over financial reporting for the periods covered by the Financial Statements and (ii) as reported in Item 4.02 below, the Company has not completed its ongoing analysis of certain historical financial statements of the Company. The Company is not currently in a position to complete the Financial Statements, or file its Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”) or its Quarterly Report on Form 10-Q for the period ended March 31, 2023 (the “Form 10-Q”), but the Company continues to work expeditiously to conclude its review and will file the 2022 Form 10-K and the Form 10-Q as soon as practicable.

The foregoing summaries of the Fourth Amendment and the Credit Agreement Consent do not purport to be a complete description of the Fourth Amendment and Credit Agreement Consent and are qualified in its entirety by reference to the full text of the Fourth Amendment and Credit Agreement Consent, copies of which are attached hereto as Exhibit 10.1 and Exhibit 10.2 and incorporated herein by reference.

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On July 5, 2023, the Audit Committee of the Board of Directors (the “Audit Committee”) of the Company concluded, after considering the recommendations of management, that the Company’s previously issued consolidated financial statements and related disclosures as of and for the year ended December 31, 2021 contained in the Company’s Annual Report on Form 10-K, and the associated report of the Company’s independent registered public accounting firm, Deloitte & Touche LLP, and the condensed consolidated financial statements and related disclosures contained in the Quarterly Reports on Form 10-Q as of and for the first three quarters of the year ended December 31, 2022 (collectively, the “Non-Reliance Periods”) should no longer be relied upon due to misstatements contained in such financial statements for which such financial statements will be restated. The Company’s management and Audit Committee discussed the misstatements and conclusion to restate the financial statements for the Non-Reliance Periods with its independent auditors.

The Audit Committee’s conclusion was based on the Company’s determination that material errors were made during the Non-Reliance Periods related to recognition of revenue under Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (“ASC 606”). The errors resulted from incorrect conclusions regarding (i) the identification and recognition of performance obligations for customer contracts and (ii) the assessment of criteria of a contract under ASC 606. The extent of the errors and any resulting adjustments is not yet known as the Company’s analysis has not been completed; however, the Company expects that its net loss for the Non-Reliance Periods will increase materially as a result of these changes.

The Company is unable at this time to estimate the amount and effect of any required restatements of the financial statements for the Non-Reliance Periods. The Company continues to work expeditiously to conclude its analysis and complete any required restatement of its financial statements for the Non-Reliance Periods as soon as practicable.

The Audit Committee, the Board of Directors, and management of the Company have begun implementing measures to enhance processes and controls and continue to evaluate appropriate remediation actions. In addition, management continues to assess the effect of any restatements on the Company’s internal controls over financial reporting and its disclosure controls and procedures. The Company expects to report one or more material weaknesses following the completion of its analysis discussed above.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | Fourth Amendment to Amended and Restated Credit Agreement, dated as of August 13, 2021, by and among F45 Training Holdings Inc., the other Loan Parties thereto, the Lenders party thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent and Australian Security Trustee, dated June 30, 2023. |

| 10.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Dated: July 7, 2023 | | | F45 Training Holdings Inc. |

| | | | |

| | | By: | /s/ Patrick Grosso |

| | | | Patrick Grosso |

| | | | Chief Legal Officer |

FOURTH AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT

THIS FOURTH AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT (this “Agreement”) is made and entered into as of June 30, 2023, by and among F45 TRAINING HOLDINGS INC., a Delaware corporation (the “Borrower”), the Lenders party hereto, and JPMORGAN CHASE BANK, N.A., as Administrative Agent and Australian Security Trustee (the “Administrative Agent”).

W I T N E S E T H :

WHEREAS, the Borrower, the other Loan Parties party thereto, the Lenders, and Administrative Agent have executed and delivered that certain Amended and Restated Credit Agreement dated as of August 13, 2021, as amended by that certain First Amendment to Amended and Restated Credit Agreement dated as of December 20, 2021, as amended by that certain Second Amendment to Amended and Restated Credit Agreement dated as of May 13, 2022, and as amended by that certain Third Amendment to Amended and Restated Credit Agreement dated as of February 14, 2023 (as the same may be amended, restated, supplemented, or otherwise modified from time to time, the “Credit Agreement”).

WHEREAS, the Borrower has requested that the Administrative Agent and the Lenders consent to an extension of the delivery date for certain financial statements due under the Credit Agreement and amend certain provisions of the Credit Agreement as set forth herein, and the Administrative Agent and the Lenders party hereto have agreed to such amendments, subject to the terms and conditions hereof.

NOW, THEREFORE, for and in consideration of the above premises and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the parties hereto, Borrower, the Administrative Agent, and the Lenders party hereto hereby covenant and agree as follows:

SECTION 1. Definitions. Unless otherwise specifically defined herein, each term used herein (and in the recitals above) which is defined in the Credit Agreement shall have the meaning assigned to such term in the Credit Agreement. Each reference to “hereof,” “hereunder,” “herein,” and “hereby” and each other similar reference and each reference to “this Agreement” and each other similar reference contained in the Credit Agreement from and after the date hereof refer to the Credit Agreement as amended hereby.

SECTION 2. Amendment to Credit Agreement.

(a) Section 1.01 of the Credit Agreement is hereby amended to add the following definitions thereto in appropriate alphabetical order:

“RPA Advisors” means Restructuring Partners & Associates LLC.

(b) Section 5.06 of the Credit Agreement is amended to add the following as a new clause (d) at the end thereof:

(d) The Borrower shall, commencing with the week ending July 14, 2023, and continuing each week thereafter have a reoccurring telephonic status call with RPA Advisors (and such other persons as the Administrative Agent may request), which calls will discuss, among other things, the status of the ongoing audit and review of the Borrower’s current and historical financial statements.

SECTION 3. Consent. The due dates for (i) the audited consolidated balance sheet and related statements of operations, stockholders’ equity, cash flows and other financial statements

for the 2022 fiscal year due March 31, 2023 as set forth in Section 5.01(a) of the Credit Agreement, (ii) the consolidated balance sheet and related statements of operations, stockholders’ equity and cash flows as of the end of the first fiscal quarter of 2023 due May 15, 2023 as forth in Section 5.01(b) of the Credit Agreement, (iii) the consolidated balance sheet and related statements of operations, stockholders’ equity and cash flows as of the end of the second fiscal quarter of 2023 due August 15, 2023 as forth in Section 5.01(b) of the Credit Agreement, (iv) each accompanying Compliance Certificate as set forth in Section 5.01(c) of the Credit Agreement, and (v) the revised financial Projections for the Borrower and its Subsidiaries on a month-by-month basis covering the two-year period commencing on the Third Amendment Effective Date and containing a supporting narrative which describes in detail all underlying assumptions of such revised Projections as forth in Section 5.15(f) of the Credit Agreement, are each hereby extended to August 31, 2023.

SECTION 4. Conditions Precedent. This Agreement shall become effective only upon satisfaction of the following conditions precedent on or before the date hereof:

(a) execution and delivery of this Agreement by the Borrower, the Administrative Agent, and the Required Lenders;

(b) execution and delivery by the Guarantors of the Consent, Reaffirmation, and Agreement of Guarantors attached hereto;

(c) the Borrower shall have paid to the Administrative Agent, an amendment fee in the amount of $105,000 payable to the Administrative Agent, for the ratable benefit of the Lenders that execute the Agreement prior to July 1, 2023; and

(d) payment of RPA Advisors’ and Holland & Knight’s respective outstanding fees and costs.

SECTION 5. Miscellaneous Terms.

(a) Loan Document. For avoidance of doubt, the Borrower, the Administrative Agent, and the Lenders party hereto hereby acknowledge and agree that this Agreement is a Loan Document.

(b) Effect of Agreement. Except as set forth expressly hereinabove, all terms of the Credit Agreement and the other Loan Documents shall be and remain in full force and effect, and shall constitute the legal, valid, binding, and enforceable obligations of the Loan Parties. Except to the extent otherwise expressly set forth herein, the amendments set forth herein shall have prospective application only from and after the date of this Agreement.

(c) No Novation or Mutual Departure. The Borrower expressly acknowledges and agrees that (i) there has not been, and this Agreement does not constitute or establish, a novation with respect to the Credit Agreement or any of the other Loan Documents, or a mutual departure from the strict terms, provisions, and conditions thereof, other than with respect to the amendments contained in Section 2 above, and (ii) nothing in this Agreement shall affect or limit the Administrative Agent or any Lender’s right to demand payment of liabilities owing from any Loan Party to Administrative Agent or the Lenders under, or to demand strict performance of the terms, provisions and conditions of, the Credit Agreement and the other Loan Documents, to exercise any and all rights, powers, and remedies under the Credit Agreement or the other Loan Documents or at law or in equity, or to do any and all of the foregoing, immediately at any time after the occurrence

of a Default or an Event of Default under the Credit Agreement or the other Loan Documents.

(d) Ratification. The Borrower (i) hereby restates, ratifies, and reaffirms each and every term, covenant, and condition set forth in the Credit Agreement and the other Loan Documents to which it is a party effective as of the date hereof and (ii) restates and renews each and every representation and warranty heretofore made by it in the Credit Agreement and the other Loan Documents as fully as if made on the date hereof and with specific reference to this Agreement and any other Loan Documents executed or delivered in connection herewith (except with respect to representations and warranties made as of an expressed date, in which case such representations and warranties shall be true and correct in all material respects as of such date).

(e) No Default. To induce the Administrative Agent and the Lenders to enter into this Agreement and to continue to make advances pursuant to the Credit Agreement (subject to the terms and conditions thereof), the Borrower hereby acknowledges and agrees that, as of the date hereof, and after giving effect to the terms hereof, there exists (i) no Default or Event of Default, and (ii) no right of offset, defense, counterclaim, claim, or objection in favor of the Borrower or any other Loan Party or arising out of or with respect to any of the Loans or other obligations of any Borrower or any other Loan Party owed to the Administrative Agent or the Lenders under the Credit Agreement or any other Loan Document.

(f) Conduct of Lender; Release of Claims. The Borrower and its Affiliates, successors, assigns, and legal representatives (collectively, the “Releasors”), acknowledge and agree that through the date hereof, each Secured Party has acted in good faith and has conducted itself in a commercially reasonable manner in its relationships with the Releasors in connection with this Agreement and in connection with the Secured Obligations, the Credit Agreement, and the other Loan Documents, and the obligations and liabilities of the Releasors existing thereunder or arising in connection therewith, and the Releasors hereby waive and release any claims to the contrary. The Releasors hereby release, acquit, and forever discharge each Secured Party and its Affiliates (including, without limitation, its parent and its subsidiaries) and their respective officers, directors, employees, agents, attorneys, advisors, successors and assigns, both present and former (collectively, the “Secured Party Affiliates”) from any and all manner of losses, costs, defenses, damages, liabilities, deficiencies, actions, causes of action, suits, debts, controversies, damages, judgments, executions, claims, demands, and expenses whatsoever, asserted or unasserted, known or unknown, foreseen or unforeseen, in contract, tort, law or equity (generically, “Claims”), that any Releasor has or may have against any Secured Party and/or any Secured Party Affiliate by reason of any action, failure to act, event, statement, accusation, assertion, matter, or thing whatsoever arising from or based on facts occurring prior to the effectiveness of this Agreement that arises out of or is connected to the Loan Documents or the Secured Obligations. Each of the Releasors hereby unconditionally and irrevocably agrees that it will not sue any Secured Party or any Secured Party Affiliate on the basis of any Claim released, remised, and discharged by such Releasor pursuant to this paragraph. If any Releasor or any of their respective successors, assigns or other legal representatives violates the foregoing covenant, each Releasor, for itself and its successors, assigns, and legal representatives, agrees to pay, in addition to such other damages as any Secured Party or any Secured Party Affiliate may sustain as a result of such violation, all reasonable and documented attorneys’ fees and costs incurred by any Secured Party or any Secured Party Affiliate as a result of such violation.

(g) Counterparts. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which counterparts, taken together, shall constitute but one and the same instrument. This Agreement may be executed by each party on separate copies, which copies, when combined so as to include the signatures of all parties, shall constitute a single counterpart of the Agreement.

(h) Fax or Other Transmission. Delivery by one or more parties hereto of an executed counterpart of this Agreement via facsimile, telecopy or other electronic method of transmission pursuant to which the signature of such party can be seen (including Adobe Corporation’s Portable Document Format or PDF) shall have the same force and effect as the delivery of an original manually executed counterpart of this Agreement or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any Applicable Law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. Any party delivering an executed counterpart of this Agreement by facsimile or other electronic method of transmission shall also deliver an original executed counterpart thereof, but the failure to do so shall not affect the validity, enforceability, or binding effect of this Agreement. The words “execution,” “signed,” “signature,” and words of like import in this Agreement shall be deemed to include electronic signatures or the keeping of records in electronic form.

(i) Recitals Incorporated Herein. The preamble and the recitals to this Agreement are hereby incorporated herein by this reference.

(j) Section References. Section titles and references used in this Agreement shall be without substantive meaning or content of any kind whatsoever and are not a part of the agreements among the parties hereto evidenced hereby.

(k) Further Assurances. The Borrower agrees to take, at Borrower’s expense, such further actions as Administrative Agent shall reasonably request from time to time to evidence the amendments set forth herein and the transactions contemplated hereby.

(l) Governing Law. This Agreement shall be governed by and construed and interpreted in accordance with the internal laws of the State of New York but excluding any principles of conflicts of law or other rule of law that would cause the application of the law of any jurisdiction other than the laws of the State of New York.

(m) Severability. Any provision of this Agreement which is prohibited or unenforceable shall be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof in that jurisdiction or affecting the validity or enforceability of such provision in any other jurisdiction.

[SIGNATURES ON FOLLOWING PAGES.]

IN WITNESS WHEREOF, the Borrower, the Administrative Agent, and the Lenders party hereto have caused this Agreement to be duly executed under seal by its duly authorized officer as of the day and year first above written.

| | |

BORROWER: |

|

F45 TRAINING HOLDINGS INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

[JPMORGAN/F45 -- FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | |

ADMINISTRATIVE AGENT AND LENDERS: |

|

JPMORGAN CHASE BANK, N.A., individually, and as Administrative Agent, Australian Security Trustee, Lender, Swingline Lender and Issuing Bank |

|

By: /s/ Eleftherios Karsos |

Name: Eleftherios Karsos |

Title: Authorized Officer |

[JPMORGAN/F45 -- FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | |

U.S. BANK NATIONAL ASSOCIATION, successor by merger to MUFG UNION BANK, N.A., as a Lender |

|

By: /s/ Christopher D. Zumberge |

Name: Christopher D. Zumberge |

Title: Senior Vice President |

[JPMORGAN/F45 -- FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

CONSENT, REAFFIRMATION, AND AGREEMENT OF GUARANTORS

Each of the undersigned (a) acknowledges receipt of the foregoing Fourth Amendment to Amended and Restated Credit Agreement (the “Agreement”); (b) consents to the execution and delivery of the Agreement; and (c) reaffirms all of its obligations and covenants under the Credit Agreement (as defined in the Agreement) or the Guarantees, as applicable (in each case, as amended, restated, supplemented, or otherwise modified from time to time) and all of its other obligations under the Loan Documents to which it is a party, and, agrees that none of its obligations and covenants shall be reduced or limited by the execution and delivery of the Agreement or any of the other instruments, agreements or other documents executed and delivered pursuant thereto.

This Consent, Reaffirmation, and Agreement of Guarantors (this “Consent”) may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which counterparts, taken together, shall constitute but one and the same instrument. This Consent may be executed by each party on separate copies, which copies, when combined so as to include the signatures of all parties, shall constitute a single counterpart of the Consent. Delivery by one or more parties hereto of an executed counterpart of this Consent via facsimile, telecopy or other electronic method of transmission pursuant to which the signature of such party can be seen (including Adobe Corporation’s Portable Document Format or PDF) shall have the same force and effect as the delivery of an original manually executed counterpart of this Consent or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any Applicable Law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. Any party delivering an executed counterpart of this Consent by facsimile or other electronic method of transmission shall also deliver an original executed counterpart thereof, but the failure to do so shall not affect the validity, enforceability, or binding effect of this Consent. The words “execution,” “signed,” “signature,” and words of like import in this Consent shall be deemed to include electronic signatures or the keeping of records in electronic form.

This Consent, Reaffirmation, and Agreement of Guarantors shall be deemed executed under seal.

As of [______, 2023]

| | |

GUARANTORS: |

|

| F45 TRAINING CANADA LIMITED |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | |

| F45 STUDIO EMPLOYMENT LLC a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| F45 U, LLC a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| F45 TRAINING INCORPORATED a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| AVALON HOUSE HOLDINGS, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| AVALON HOUSE, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| MALIBU CREW HOLDINGS, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | |

| MALIBU CREW, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| FS8 HOLDINGS, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| FS8, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| US BRAND FUND OPERATIONS INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| F45 US BRAND FUND INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| F45 INTERMEDIATE HOLDCO, LLC, a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | |

| F45 SPV FINANCE COMPANY, LLC, a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| F45 HQ STUDIO INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| FS8 HQ STUDIO INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| F45 TRAINING OPERATIONS SUPPORT, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| F45 TRAINING REAL ESTATE OPERATIONS, INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | |

| SOCO TRAINING LABS, LLC, a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| ROSCOE VILLAGE TRAINING LLC, a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

| PP TRAINING LLC, a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | |

FS VENICE LLC a Delaware limited liability company |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

| | | | | | | | |

Executed by F45 AUS HOLD CO PTY LTD ACN 620 135 426 in accordance with section 127 of the Corporations Act 2001: | | |

Tom Dowd | |

/s/ Tom Dowd |

| Name of sole director | | Signature of sole director who states that the company does not have a company secretary |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | | | | | | | |

Executed by FLYHALF AUSTRALIA HOLDING COMPANY PTY LTD ACN 632 249 131 in accordance with section 127 of the Corporations Act 2001: | | |

Tom Dowd | |

/s/ Tom Dowd |

| Name of sole director | | Signature of sole director who states that the company does not have a company secretary |

| | | | | | | | |

Executed by FLYHALF ACQUISITION COMPANY PTY LTD ACN 632 252 110 in accordance with section 127 of the Corporations Act 2001: | | |

Tom Dowd | |

/s/ Tom Dowd |

| Name of sole director | | Signature of sole director who states that the company does not have a company secretary |

| | | | | | | | |

Executed by F45 HOLDINGS PTY LTD ACN 616 570 506 in accordance with section 127 of the Corporations Act 2001: | | |

Tom Dowd | |

/s/ Tom Dowd |

| Name of sole director | | Signature of sole director who states that the company does not have a company secretary |

| | | | | | | | |

Executed by F45 ROW HOLD CO PTY LTD ACN 620 135 480 in accordance with section 127 of the Corporations Act 2001: | | |

Tom Dowd | |

/s/ Tom Dowd |

| Name of sole director | | Signature of sole director who states that the company does not have a company secretary |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | | | | | | | |

Executed by F45 TRAINING PTY LTD ACN 162 731 900 in accordance with section 127 of the Corporations Act 2001: | | |

Tom Dowd | |

/s/ Tom Dowd |

| Name of sole director | | Signature of sole director who states that the company does not have a company secretary |

| | | | | | | | |

EXECUTED by AVALON HOUSE PTY LTD ACN 648 626 000, in accordance with section 127 of the Corporations Act 2001 (Cth): /s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

| | | | | | | | |

EXECUTED by MALIBU CREW PTY LTD ACN 648 626 975, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | | | | | | | |

EXECUTED by FS8 PTY LTD ACN 646 184 125, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

| | | | | | | | |

EXECUTED by VIVE ACTIVE BROOKVALE PTY LTD ACN 617 814 963, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | | | | | | | |

EXECUTED by VIVE ACTIVE DOUBLE BAY PTY LTD ACN 628 294 075, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

| | | | | | | | |

EXECUTED by VIVE ACTIVE NEUTRAL BAY PTY LTD ACN 645 784 078, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

| | | | | | | | |

EXECUTED by SURF AND TURF HOLDINGS PTY. LIMITED ACN 612 337 541, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

| | | | | | | | |

EXECUTED by F45 OPERATIONS (AUSTRALIA) PTY LTD ACN 633 677 808, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

| | | | | | | | |

EXECUTED by F45 AUSTRALIA BRAND FUND PTY LTD ACN 664 382 209, in accordance with section 127 of the Corporations Act 2001 (Cth):

/s/ Tom Dowd | |

/s/ Tom Dowd |

| Signature of company secretary / director (delete as applicable) | | Signature of director |

| | |

| Tom Dowd | | Tom Dowd |

| Name | | Name |

[JPMORGAN/F45 -- CONSENT, REAFFIRMATION, AND AGREEMENT TO

FOURTH AMENDMENT TO A&R CREDIT AGREEMENT]

CONSENT UNDER SUBORDINATED CREDIT AGREEMENT

THIS CONSENT UNDER SUBORDINATED CREDIT AGREEMENT (this “Agreement”) is made and entered into as of June 30, 2023, by and among F45 TRAINING HOLDINGS INC., a Delaware corporation (the “Borrower”), the Lenders party hereto, and ALTER DOMUS (US) LLC, in its capacity as administrative agent for the Secured Parties (the “Administrative Agent”).

W I T N E S E T H :

WHEREAS, the Borrower, the other Loan Parties party thereto, the Lenders, the Australian Security Trustee and the Administrative Agent have executed and delivered that certain Subordinated Credit Agreement, dated as of February 14, 2023 (as the same may be amended, restated, supplemented, or otherwise modified from time to time, the “Credit Agreement”).

WHEREAS, the Borrower has requested that the Administrative Agent and the Lenders consent to an extension of the delivery date for certain financial statements due under the Credit Agreement, and the Administrative Agent and the Lenders party hereto have agreed to such consent, subject to the terms and conditions hereof.

NOW, THEREFORE, for and in consideration of the above premises and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the parties hereto, Borrower, the Administrative Agent, and the Lenders party hereto hereby covenant and agree as follows:

SECTION 1. Definitions. Unless otherwise specifically defined herein, each term used herein (and in the recitals above) which is defined in the Credit Agreement shall have the meaning assigned to such term in the Credit Agreement. Each reference to “hereof,” “hereunder,” “herein,” and “hereby” and each other similar reference and each reference to “this Agreement” and each other similar reference contained in the Credit Agreement from and after the date hereof refer to the Credit Agreement as amended hereby.

SECTION 2. Consent. The due dates for (i) the audited consolidated balance sheet and related statements of operations, stockholders’ equity, cash flows and other financial statements due March 31, 2023 as set forth in Section 5.01(a) of the Credit Agreement, (ii) the consolidated balance sheet and related statements of operations, stockholders’ equity and cash flows as of the end of the first fiscal quarter of 2023 due May 15, 2023 as forth in Section 5.01(b) of the Credit Agreement, (iii) the consolidated balance sheet and related statements of operations, stockholders’ equity and cash flows as of the end of the second fiscal quarter of 2023 due August 15, 2023 as forth in Section 5.01(b) of the Credit Agreement, (iv) each accompanying Compliance Certificate as set forth in Section 5.01(c) of the Credit Agreement, and (v) the revised financial Projections for the Borrower and its Subsidiaries on a month-by-month basis covering the two-year period commencing on the Effective Date and containing a supporting narrative which describes in detail all underlying assumptions of such revised Projections as forth in Section 5.15(e) of the Credit Agreement, are each hereby extended to August 31, 2023.

SECTION 3. Conditions Precedent. This Agreement shall become effective only upon satisfaction of the following conditions precedent on or before the date hereof:

(a) execution and delivery of this Agreement by the Borrower, the Administrative Agent, and each of the Lenders; and

(b) the Borrower shall have paid the Administrative Agent’s fees, outstanding legal fees, and costs incurred in connection with this Agreement.

SECTION 4. Conduct of Administrative Agent and Lenders; Release of Claims. The Loan Parties and their Affiliates, successors, assigns, and legal representatives (collectively, the “Releasors”), acknowledge and agree that through the date hereof, each Secured Party has acted in good faith and has conducted itself in a commercially reasonable manner in its relationships with the Releasors in connection with this Agreement and in connection with the Secured Obligations, the Credit Agreement, and the other Loan Documents, and the obligations and liabilities of the Releasors existing thereunder or arising in connection therewith, and the Releasors hereby waive and release any claims to the contrary. The Releasors hereby release, acquit, and forever discharge each Secured Party and its Affiliates (including, without limitation, its parent and its subsidiaries) and their respective officers, directors, employees, agents, attorneys, advisors, successors and assigns, both present and former (collectively, the “Secured Party Affiliates”) from any and all manner of losses, costs, defenses, damages, liabilities, deficiencies, actions, causes of action, suits, debts, controversies, damages, judgments, executions, claims, demands, and expenses whatsoever, asserted or unasserted, known or unknown, foreseen or unforeseen, in contract, tort, law or equity (generically, “Claims”), that any Releasor has or may have against any Secured Party and/or any Secured Party Affiliate by reason of any action, failure to act, event, statement, accusation, assertion, matter, or thing whatsoever arising from or based on facts occurring prior to the effectiveness of this Agreement that arises out of or is connected to the Loan Documents or the Secured Obligations. Each of the Releasors hereby unconditionally and irrevocably agrees that it will not sue any Secured Party or any Secured Party Affiliate on the basis of any Claim released, remised, and discharged by such Releasor pursuant to this paragraph. If any Releasor or any of their respective successors, assigns or other legal representatives violates the foregoing covenant, each Releasor, for itself and its successors, assigns, and legal representatives, agrees to pay, in addition to such other damages as any Secured Party or any Secured Party Affiliate may sustain as a result of such violation, all reasonable and documented attorneys’ fees and costs incurred by any Secured Party or any Secured Party Affiliate as a result of such violation.

SECTION 5. Miscellaneous Terms.

(a) Loan Document. For avoidance of doubt, the Borrower, the Administrative Agent, and the Lenders party hereto hereby acknowledge and agree that this Agreement is a Loan Document.

(b) Effect of Agreement. Except as set forth expressly hereinabove, all terms of the Credit Agreement and the other Loan Documents shall be and remain in full force and effect, and shall constitute the legal, valid, binding, and enforceable obligations of the Loan Parties. Except to the extent otherwise expressly set forth herein, the amendments and waiver set forth herein shall have prospective application only from and after the date of this Agreement.

(c) No Novation or Mutual Departure. The Borrower expressly acknowledges and agrees that (i) there has not been, and this Agreement does not constitute or establish, a novation with respect to the Credit Agreement or any of the other Loan Documents, or a mutual departure from the strict terms, provisions, and conditions thereof, other than with respect to the consent contained in Section 2 above, and (ii) nothing in this Agreement shall affect or limit the Administrative Agent or any Lender’s right to demand payment of liabilities owing from any Loan Party to Administrative Agent or the Lenders under, or to demand strict performance of the terms, provisions and conditions of, the Credit Agreement and the other Loan Documents, to exercise any and all rights, powers, and remedies under the Credit Agreement or the other Loan Documents or at law or in equity,

or to do any and all of the foregoing, immediately at any time after the occurrence of a Default or an Event of Default under the Credit Agreement or the other Loan Documents.

(d) Ratification. The Borrower (i) hereby restates, ratifies, and reaffirms each and every term, covenant, and condition set forth in the Credit Agreement and the other Loan Documents to which it is a party effective as of the date hereof and (ii) restates and renews each and every representation and warranty heretofore made by it in the Credit Agreement and the other Loan Documents as fully as if made on the date hereof and with specific reference to this Agreement and any other Loan Documents executed or delivered in connection herewith (except with respect to representations and warranties made as of an expressed date, in which case such representations and warranties shall be true and correct in all material respects as of such date).

(e) No Default. To induce the Administrative Agent and the Lenders to enter into this Agreement and to continue to make advances pursuant to the Credit Agreement (subject to the terms and conditions thereof), the Borrower hereby acknowledges and agrees that, as of the date hereof, and after giving effect to the terms hereof (including the waiver herein), there exists (i) no Default or Event of Default, and (ii) no right of offset, defense, counterclaim, claim, or objection in favor of the Borrower or any other Loan Party or arising out of or with respect to any of the Loans or other obligations of any Borrower or any other Loan Party owed to the Administrative Agent or the Lenders under the Credit Agreement or any other Loan Document.

(f) Counterparts. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which counterparts, taken together, shall constitute but one and the same instrument. This Agreement may be executed by each party on separate copies, which copies, when combined so as to include the signatures of all parties, shall constitute a single counterpart of the Agreement.

(g) Fax or Other Transmission. Delivery by one or more parties hereto of an executed counterpart of this Agreement via facsimile, telecopy or other electronic method of transmission pursuant to which the signature of such party can be seen (including Adobe Corporation’s Portable Document Format or PDF) shall have the same force and effect as the delivery of an original manually executed counterpart of this Agreement or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. Any party delivering an executed counterpart of this Agreement by facsimile or other electronic method of transmission shall also deliver an original executed counterpart thereof, but the failure to do so shall not affect the validity, enforceability, or binding effect of this Agreement. The words “execution,” “signed,” “signature,” and words of like import in this Agreement shall be deemed to include electronic signatures or the keeping of records in electronic form.

(h) Recitals Incorporated Herein. The preamble and the recitals to this Agreement are hereby incorporated herein by this reference.

(i) Section References. Section titles and references used in this Agreement shall be without substantive meaning or content of any kind whatsoever and are not a part of the agreements among the parties hereto evidenced hereby.

(j) Further Assurances. The Borrower agrees to take, at the Borrower’s expense, such further actions as Administrative Agent shall reasonably request from time to time to evidence the amendments and waiver set forth herein and the transactions contemplated hereby.

(k) Governing Law. This Agreement shall be governed by and construed and interpreted in accordance with the internal laws of the State of New York but excluding any principles of conflicts of law or other rule of law that would cause the application of the law of any jurisdiction other than the laws of the State of New York.

(l) Severability. Any provision of this Agreement which is prohibited or unenforceable shall be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof in that jurisdiction or affecting the validity or enforceability of such provision in any other jurisdiction.

[SIGNATURES ON FOLLOWING PAGES.]

IN WITNESS WHEREOF, the Borrower, the Administrative Agent, and the Lenders party hereto have caused this Agreement to be duly executed under seal by its duly authorized officer as of the day and year first above written.

| | |

BORROWER: |

|

F45 TRAINING HOLDINGS INC., a Delaware corporation |

|

By: /s/ Patrick Grosso |

| Name: Patrick Grosso |

| Title: Chief Legal Officer |

[F45 – CONSENT UNDER SUBORDINATED CREDIT AGREEMENT]

| | |

ADMINISTRATIVE AGENT: |

|

ALTER DOMUS (US) LLC, as Administrative Agent |

|

By: /s/ Winnalynn N. Kantaris |

Name: Winnalynn N. Kantaris |

Title: Associate General Counsel |

[F45 – CONSENT UNDER SUBORDINATED CREDIT AGREEMENT]

| | |

LENDERS: |

|

| KENNEDY LEWIS CAPITAL PARTNERS MASTER FUND II LP |

|

By: Kennedy Lewis GP II LLC, its general partner |

|

By: /s/ Anthony Pasqua |

Name: Anthony Pasqua |

Title: Authorized Signatory |

| | |

| KENNEDY LEWIS CAPITAL PARTNERS MASTER FUND III LP |

|

By: Kennedy Lewis GP III LLC, its general partner |

|

By: /s/ Anthony Pasqua |

Name: Anthony Pasqua |

Title: Authorized Signatory |

[F45 – CONSENT UNDER SUBORDINATED CREDIT AGREEMENT]

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

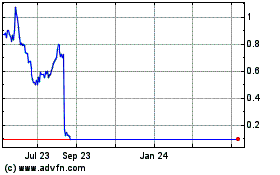

F45 Training (NYSE:FXLV)

Historical Stock Chart

From Apr 2024 to May 2024

F45 Training (NYSE:FXLV)

Historical Stock Chart

From May 2023 to May 2024