Current Report Filing (8-k)

April 04 2022 - 4:18PM

Edgar (US Regulatory)

000002547500000254752022-04-042022-04-040000025475us-gaap:CommonClassAMember2022-04-042022-04-040000025475us-gaap:CommonClassBMember2022-04-042022-04-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 4, 2022

CRAWFORD & COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Georgia

(State or Other Jurisdiction of Incorporation)

|

|

|

1-10356 |

|

58-0506554 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

5335 Triangle Parkway, Peachtree Corners, Georgia |

|

30092 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(404) 300-1000

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Class A Common Stock — $1.00 Par Value |

CRD-A |

New York Stock Exchange, Inc. |

Class B Common Stock — $1.00 Par Value |

CRD-B |

New York Stock Exchange, Inc. |

Item 7.01. Regulation FD Disclosure

Segment Realignment

In connection with the realignment of management responsibilities on January 1, 2022, the Company has realigned its operating segments by moving to a geographic reporting structure consisting of North America Loss Adjusting, International Operations, Broadspire, and Platform Solutions. The Company's revised reportable segments are comprised of the following:

•North America Loss Adjusting, which services the North American property and casualty market. This is comprised of the previously reported Crawford Loss Adjusting segment in the U.S. and Canada, including Global Technical Services and edjuster. Additionally, the Canadian operations will include all operations within that country, including those previously reported within the Crawford TPA Solutions and Crawford Platform Solutions segments.

•International Operations, which services the global property and casualty market outside North America. This is comprised of the previously reported Crawford Loss Adjusting segment outside of North America, including Crawford Legal Services which was previously within the Crawford TPA Solutions segment. The International Operations will include all operations within the respective countries, including those previously reported within the Crawford TPA Solutions and Crawford Platform Solutions segments.

•Broadspire, which provides third party administration for workers' compensation, auto and liability, disability absence management, medical management, and accident and health to corporations, brokers and insurers in the U.S.

•Platform Solutions, which consists of the Contractor Connection, Networks, and Subrogation service lines in the U.S. The Networks service line includes Catastrophe operations and WeGoLook.

The Company’s financial statements for the succeeding interim and annual periods will disclose the reportable segments under the new basis with prior periods restated to reflect the change. Attached hereto as Exhibit 99.1 and incorporated herein by this reference are the historical results of operations for 2021, 2020, and 2019 and for each quarter of 2021, 2020, and 2019 revised to conform to the current presentation of the Company’s reportable segments.

Segment Expenses

Our discussion and analysis of segment operating expenses is comprised of two components: "Direct Compensation, Fringe Benefits & Non-Employee Labor" and "Expenses Other Than Direct Compensation, Fringe Benefits & Non-Employee Labor."

"Direct Compensation, Fringe Benefits & Non-Employee Labor" includes direct compensation, payroll taxes, and benefits provided to the employees of each segment, as well as payments to outsourced service providers that augment our staff in each segment. As a service company, these costs represent our most significant and variable operating expenses.

As part of our segment realignment, costs of certain administrative functions that are dedicated to a specific segment, such as aspects of management, sales and client development, are now included as direct costs of each operating segment based on geography. Certain prior year and quarterly amounts among the Company's reportable segments have been reclassified to conform to the current presentation. Previously, direct compensation, payroll taxes, and benefits for these administrative functions were recorded as indirect costs and allocated to each operating segment based on usage and reflected within "Expenses Other Than Direct Compensation, Fringe Benefits & Non-Employee Labor" of each operating segment.

In addition to allocated corporate and shared costs, "Expenses Other Than Direct Compensation, Fringe Benefits & Non-Employee Labor" includes travel and entertainment, office rent and occupancy costs, automobile expenses, office operating expenses, data processing costs, cost of risk, professional fees, and amortization and depreciation expense other than amortization of acquisition-related intangible assets.

Item 9.01. Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

2

The information contained in this current report on Form 8-K and in the accompanying exhibits shall not be incorporated by reference into any filing of the Company with the SEC, whether made before or after the date hereof, regardless of any general incorporation by reference language in such filing, unless expressly incorporated by specific reference to such filing. The information, including the exhibits hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

CRAWFORD & COMPANY |

|

(Registrant) |

|

|

|

|

|

By: |

|

/s/ W. BRUCE SWAIN |

|

|

|

W. Bruce Swain |

|

|

|

Executive Vice President - |

|

|

|

Chief Financial Officer |

|

|

|

|

Dated: April 4, 2022 |

|

|

|

3

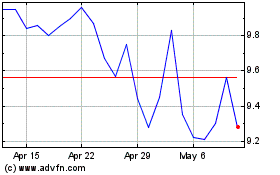

Crawford (NYSE:CRD.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

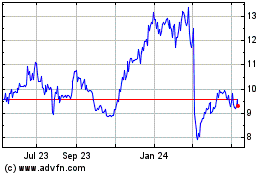

Crawford (NYSE:CRD.A)

Historical Stock Chart

From Jul 2023 to Jul 2024