Pepsi to Add Brazilian Cookies - Analyst Blog

January 03 2012 - 9:15AM

Zacks

In a move to strengthen its

foothold in Brazil, U.S. beverage major PepsiCo

International (PEP) plans to purchase local cookie maker

Marilan Alimentos. The potential deal follows the acquisition of

yet another Brazilian cookie company, Grupo Mabel in November,

2011.

According to the Valor Economico

newspaper, Marilan Alimentos has asked for a price between 600

million reais ($320 million) to 800 million reais ($426.6 million).

M. Dias Branco SA, Campbell Soup Co. (CPB) and

Bunge Ltd. (BG), are also interested for the bid,

but they feel that the price range asked by the cookie maker is too

high to concede to.

Based in Marilan, Sao Paulo,

Marilan Alimentos S/A. is the country’s fourth largest maker of

cookies. Its products include salted snacks, classical Italian,

filled, classic, and sandwich biscuits; and butter cookies, cream

crackers, and toasts. As per the most recent reports available,

Marilan Alimentos generated revenue of $219.56 million in 2009.

According to the analysts, the

acquisition will give the world’s largest beverage and snacks

maker, the number two position in the Brazilian biscuit market.

Brazil is the second largest cookie and cracker producing nation in

the world.

In the Brazilian cookie market,

PepsiCo will have to compete with Nestle, which holds a 21% share

in the market, Grupo Arcor with a 16.4% share and Pandurata

Alimentos with a 16.1% share in the Brazilian market.

The retail giant continues to push

deeper into the emerging market of Latin America. In September

2011, it opened a new manufacturing plant in Feira de Santana, in

the Northeast of Brazil that is expected to generate about 400

direct and indirect jobs in the region. It also acquired Dilexis, a

traditional manufacturer of cookies and crackers in Argentina.

In November 2011, PepsiCo acquired

Grupo Mabel, for an undisclosed price. However, according to

Bloomberg, sources with knowledge of the deal said that the retail

giant would pay $450 million for the acquisition.

PepsiCo’s diverse portfolio ranging

from sodas and snacks to juices, combined with its ability to

innovate and launch products suited to the requirements of the

local markets drove better-than-expected results in the recently

ended quarter. Moreover, strong sales in emerging markets helped

blunt the impact of ongoing weakness at home.

Currently, we prefer to be Neutral

on Pepsi’s stock. However, Pepsi holds a Zacks #4 Rank, which

translates into a short-term ‘Sell’ rating.

BUNGE LTD (BG): Free Stock Analysis Report

CAMPBELL SOUP (CPB): Free Stock Analysis Report

PEPSICO INC (PEP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

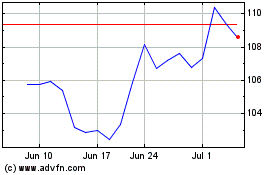

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

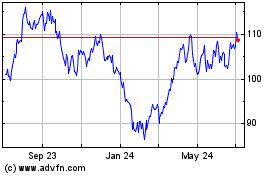

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024