Brown & Brown, Inc. (NYSE: BRO) today announced that it earned

net income for the second quarter of 2010 of $41,185,000, or $0.29

per share, an increase of 1.3% from the $40,668,000, or $0.29 per

share, reported for the quarter ended June 30, 2009. Total revenue

for the quarter ended June 30, 2010 was $243,665,000, compared with

2009 second-quarter revenue of $246,369,000.

Total revenue for the six months ended June 30, 2010 was

$495,938,000, compared with total revenue for the first half of

2009 of $509,949,000. Net income for the six-month period ended

June 30, 2010 was $85,313,000, or $0.59 per share, compared with

$88,680,000, or $0.63 per share for the same period of 2009.

J. Powell Brown, President and Chief Executive Officer of Brown

& Brown, Inc., noted, "The insurance marketplace continues to

bump around. Exposure units and insurance premium rates remain

'soft' with no significant changes anticipated in the foreseeable

future. The increase in our quarterly earnings in the face of such

a challenging environment is a tribute to the dedication and

ability of our decentralized local office teams."

Brown & Brown, Inc. and its subsidiaries offer a broad range

of insurance and reinsurance products and services, as well as risk

management, third party administration, managed health care, and

Medicare set-aside services and programs. Providing service to

business, public entity, quasi-public entity, individual, trade and

professional association clients nationwide, the Company is ranked

by Business Insurance magazine as the United States' sixth largest

independent insurance intermediary. The Company's Web address is

www.bbinsurance.com.

This press release may contain certain statements relating to

future results which are forward-looking statements, including

those relating to future financial results and to acquisition

opportunities. These statements are not historical facts, but

instead represent only the Company's current belief regarding

future events, many of which, by their nature, are inherently

uncertain and outside of the Company's control. It is possible that

the Company's actual results, financial condition and achievements

may differ, possibly materially, from the anticipated results,

financial condition and achievements contemplated by these

forward-looking statements. Further information concerning the

Company and its business, including factors that potentially could

materially affect the Company's financial results and condition, as

well as its other achievements, are contained in the Company's

filings with the Securities and Exchange Commission. Some factors

include: general economic conditions around the country; downward

commercial property and casualty premium pressures; the effects of

legislative and regulatory changes in Florida pertaining to the

insurance industry, including those relating to coastal property

coverages; the competitive environment; the integration of the

Company's operations with those of businesses or assets the Company

has acquired or may acquire in the future and the failure to

realize the expected benefits of such integration; the potential

occurrence of a disaster that affects certain areas of the States

of California, Florida, Indiana, Michigan, New Jersey, New York,

Pennsylvania, Texas and/or Washington, where significant portions

of the Company's business are concentrated; and the cost and impact

on the Company of previously disclosed regulatory inquiries

regarding industry and Company practices with respect to

compensation received from insurance carriers. All forward-looking

statements made herein are made only as of the date of this

release, and the Company does not undertake any obligation to

publicly update or correct any forward-looking statements to

reflect events or circumstances that subsequently occur or of which

the Company hereafter becomes aware.

Brown & Brown, Inc.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(unaudited)

For the Three Months For the Six Months

Ended June 30 Ended June 30

-------------------- --------------------

2010 2009 2010 2009

--------- ---------- --------- ----------

REVENUES

Commissions and fees $ 241,053 $ 244,595 $ 491,727 $ 508,559

Investment income 346 460 677 770

Other income (loss), net 2,266 1,314 3,534 620

--------- ---------- --------- ----------

Total revenues 243,665 246,369 495,938 509,949

--------- ---------- --------- ----------

EXPENSES

Employee compensation and

benefits 121,372 122,625 243,555 249,966

Non-cash stock-based

compensation 1,780 1,695 3,735 3,511

Other operating expenses 33,622 35,620 69,955 71,484

Amortization 12,650 12,519 25,203 24,904

Depreciation 3,129 3,299 6,382 6,632

Interest 3,632 3,632 7,240 7,266

Change in estimated acquisition

earn-out payables (533) - (1,229) -

--------- ---------- --------- ----------

Total expenses 175,652 179,390 354,841 363,763

--------- ---------- --------- ----------

Income before income taxes 68,013 66,979 141,097 146,186

Income taxes 26,828 26,311 55,784 57,506

--------- ---------- --------- ----------

Net income $ 41,185 $ 40,668 $ 85,313 $ 88,680

========= ========== ========= ==========

Net income per share:

Basic $ 0.29 $ 0.29 $ 0.60 $ 0.63

========= ========== ========= ==========

Diluted $ 0.29 $ 0.29 $ 0.59 $ 0.63

========= ========== ========= ==========

Weighted average number of

shares outstanding:

Basic 137,685 136,939 137,654 136,937

========= ========== ========= ==========

Diluted 139,105 137,304 138,937 137,261

========= ========== ========= ==========

Dividends declared per share $ 0.0775 $ 0.075 $ 0.155 $ 0.150

========= ========== ========= ==========

Brown & Brown, Inc.

INTERNAL GROWTH SCHEDULE

Core Commissions and Fees(1)

Three Months Ended June 30, 2010

(in thousands)

(unaudited)

Quarter Quarter Total Total Less Internal Internal

Ended Ended Net Net Acquisition Net Net

6/30/10 6/30/09 Change Growth% Revenues Growth$ Growth%

--------- --------- -------- ------ ------- -------- ------

Florida

Retail $ 42,320 $ 43,910 $ (1,590) (3.6)% $ 19 $ (1,609) (3.7)%

National

Retail 80,093 78,638 1,455 1.9 % 3,078 (1,623) (2.1)%

Western

Retail 23,885 24,459 (574) (2.3)% 1,558 (2,132) (8.7)%

--------- --------- -------- ------- --------

Total

Retail 146,298 147,007 (709) (0.5)% 4,655 (5,364) (3.6)%

--------- --------- -------- ------- --------

Wholesale

Brokerage 41,385 41,409 (24) (0.1)% 434 (458) (1.1)%

Professional

Programs 9,343 9,734 (391) (4.0)% - (391) (4.0)%

Special

Programs 27,854 30,893 (3,039) (9.8)% 188 (3,227) (10.4)%

--------- --------- -------- ------- --------

Total

National

Programs 37,197 40,627 (3,430) (8.4)% 188 (3,618) (8.9)%

--------- --------- -------- ------- --------

Services 9,729 8,259 1,470 17.8 % 1,442 28 0.3 %

--------- --------- -------- ------- --------

Total Core

Commissions

and Fees

(1) $ 234,609 $ 237,302 $ (2,693) (1.1)% $ 6,719 $ (9,412) (4.0)%

========= ========= ======== ======= ========

Reconciliation of Internal Growth Schedule

to Total Commissions and Fees

Included in the Consolidated Statements of Income

for the Three Months Ended June 30, 2010 and 2009

(in thousands)

(unaudited)

Quarter Quarter

Ended Ended

6/30/10 6/30/09

----------- -----------

Total core commissions and fees(1) $ 234,609 $ 237,302

Contingent commissions 6,444 6,806

Divested business - 487

----------- -----------

Total commission & fees $ 241,053 $ 244,595

=========== ===========

(1) Total core commissions and fees are our total commissions and fees less

(i) profit-sharing contingent commissions (revenue derived from special

revenue-sharing commissions from insurance companies based upon the

volume and the growth and/or profitability of the business placed with

such companies during the prior year), and (ii) divested business

(commissions and fees generated from offices, books of business or

niches sold by the Company or terminated).

Brown & Brown, Inc.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

(unaudited)

June 30, December 31,

2010 2009

----------- -----------

ASSETS

Current assets:

Cash and cash equivalents $ 293,011 $ 197,113

Restricted cash and investments 145,848 155,257

Short-term investments 8,135 8,213

Premiums, commissions and fees receivable 233,597 209,462

Deferred income taxes - 11,791

Other current assets 28,670 31,863

----------- -----------

Total current assets 709,261 613,699

Fixed assets, net 60,074 61,467

Goodwill 1,103,998 1,074,397

Amortizable intangible assets, net 457,939 468,862

Other assets 5,540 5,801

----------- -----------

Total assets $ 2,336,812 $ 2,224,226

=========== ===========

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Premiums payable to insurance companies $ 356,355 $ 310,296

Premium deposits and credits due customers 34,437 37,715

Accounts payable 24,704 17,431

Accrued expenses and other liabilities 82,820 96,387

Current portion of long-term debt 5,766 17,124

----------- -----------

Total current liabilities 504,082 478,953

Long-term debt 250,000 250,209

Deferred income taxes, net 124,667 115,609

Other liabilities 18,969 9,581

Shareholders' equity:

Common stock, par value $0.10 per share;

authorized 280,000 shares; issued and

outstanding 142,224 at 2010 and 142,076 at 2009 14,222 14,208

Additional paid-in capital 273,781 267,856

Retained earnings 1,151,088 1,087,805

Accumulated other comprehensive income 3 5

----------- -----------

Total shareholders' equity 1,439,094 1,369,874

----------- -----------

Total liabilities and shareholders' equity $ 2,336,812 $ 2,224,226

=========== ===========

Cory T. Walker Chief Financial Officer (386) 239-7250

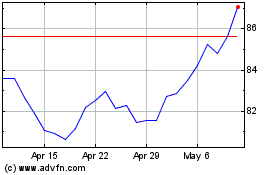

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2024 to May 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From May 2023 to May 2024