Current Report Filing (8-k)

October 06 2021 - 1:42PM

Edgar (US Regulatory)

false

0001042187

0001042187

2021-10-06

2021-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 6, 2021

YUNHONG CTI LTD.

(Exact Name Of Registrant As Specified In Its Charter)

Illinois

(State or Other Jurisdiction of Incorporation)

|

000-23115

|

|

36-2848943

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

22160 N. Pepper Road Lake Barrington, Illinois

|

|

60010

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(847) 382-1000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value per share

|

|

CTIB

|

|

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On September 30, 2021 (the “Closing Date”), Yunhong CTI Ltd. (the “Company”) entered into a loan and security agreement (the “Agreement”) by and between itself and Line Financial Corp. (the “Lender”), which provides for a senior secured financing consisting of a revolving credit facility (the “Revolving Credit Facility) in an aggregate principal amount of up to $6 million (the “Maximum Revolver Amount”) and term loan facility (the “Term Loan Facility”) in an aggregate principal amount of $731,250 (“Term Loan Amount” and, together with the Revolving Credit Facility, the “Senior Facilities”). Proceeds of loans borrowed under the Senior Facilities will be used to repay the Company's prior senior secured credit facility and for the Company’s working capital. The Senior Facilities are secured by substantially all assets of the Company.

Interest on the Senior Facilities shall be the prime rate published from time to time published in the Wall Street Journal, plus 1.95% per annum, accruing daily and payable monthly. Interest shall be calculated on the basis of a 360-day year for the actual number of days elapsed. The Term Loan Facility shall be repaid by the Company to Lender in 48 equal monthly installments of principal and interest, each in the amount of $15,234.38, commencing on November 1, 2021, and continuing on the first day of each month thereafter until the Term Loan Maturity Date (as defined in the Agreement). In addition, the Company paid the Lender a loan fee of 1.25% of the Maximum Revolver Amount and the Term Loan Amount upon the execution of the Agreement.

The Senior Facilities mature on the second anniversary of the Closing Date and shall automatically be extended for successive periods of one year each, unless the Company or the Lender gives the other written notice of termination not less than 90 days prior to the end of such term or renewal term, as applicable. If the Senior Facilities are renewed, the Company shall pay the Lender a renewal fee of 1.25% of the Maximum Revolver Amount and the Term Loan Amount upon each renewal on the anniversary of the Closing Date. The Company has the option to prepay the Term Loan Facility (together with all accrued but unpaid interest and a Term Loan Prepayment Fee (as defined the Agreement) in whole, but not in part, upon not less than 60 days prior written notice to the Lender.

The Senior Facilities require that the Company shall, commencing December 31, 2021, maintain Tangible Net Worth (as defined in the Agreement) of at least $4,000,000 or greater (“Minimum Tangible Net Worth”). Minimum Tangible Net Worth may be adjusted downward by the Lender, from time to time, in its sole and absolute discretion, based on the effect of non-cash charges and other factors on the calculation of Tangible Net Worth.

The Senior Facilities contain certain affirmative and negative covenants that limit the ability of the Company, among other things and subject to certain significant exceptions, to incur debt or liens, make investments, enter into certain mergers, consolidations, and acquisitions, pay dividends and make other restricted payments, or make capital expenditures exceeding $1,000,000 in the aggregate in any fiscal year.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

Item No. 9.01 – Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated:

|

October 6, 2021

|

YUNHONG CTI LTD.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jennifer Connerty

|

|

|

|

Name:

|

Jennifer Connerty

|

|

|

|

Title:

|

Chief Financial Officer

|

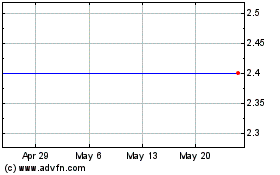

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Apr 2024 to May 2024

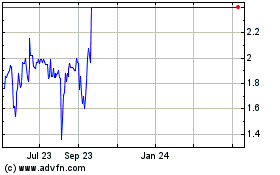

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From May 2023 to May 2024