PORTERVILLE, Calif., April 20 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced its financial results for the quarter ended March 31,

2009. Net income for the quarter was $2.7 million, resulting in a

10.03% return on average equity and a 0.83% return on average

assets, which management expects will compare favorably to peer

financial institutions. Net income and diluted earnings per share

improved substantially from the fourth quarter of 2008, but

declined relative to the year-ago quarter mainly due to a higher

loan loss provision and higher non-interest expenses. Notable

balance sheet changes during the first quarter of 2009 include an

increase of $58 million, or 6%, in branch deposit balances, a $24

million decline in wholesale-sourced brokered deposits, a $55

million drop in Federal Home Loan Bank (FHLB) borrowings, a $17

million drop in cash and due from banks, and an increase of $15

million in non-performing assets. The increase in non-performing

assets was due primarily to an $11 million real estate loan that

was placed on non-accrual during the quarter, although the loan is

well-collateralized based on current appraisals. "Despite continued

market uncertainties, our financial performance was close to

internal projections for the first quarter of 2009 and our capital

ratios continue to strengthen, providing further validation of the

Board's decision not to apply for bailout money from the U.S.

Treasury," commented James C. Holly, President and CEO. "One

pleasant surprise was an influx of deposit dollars in the first

quarter, as our rock-solid capital position, higher FDIC insurance

limits, and our participation in CDARS (which can provide

individual depositors with FDIC insurance coverage of $50 million

or more), have finally reacted together with the deposit

initiatives we put in place over the past couple of years to

attract money into the safety and security of deposits," he noted.

"Moreover," Mr. Holly added, "we have seen other positive

developments in the midst of the current economic turbulence: At

the National level, in addition to a temporary increase in FDIC

deposit insurance limits, there seems to be a recognition of the

systemic risks created by 'too big to fail' institutions and a

movement toward a more equitable deposit insurance assessment

system; and, at the local level, the instability around us has

created opportunities to selectively supplement our capable staff

with additional experienced bankers, and we are actively

investigating branch expansion opportunities in anticipation of an

economic rebound within the next year or two." Financial Highlights

While service charges on deposits were up, the Company's net income

for the first quarter of 2009 was negatively impacted by a drop in

other non-interest income, net interest margin compression, a

higher provision for loan and lease losses, and higher non-interest

expense relative to the first quarter of 2008. Net interest income

was slightly lower in the first quarter of 2009 than in the first

quarter of 2008. While average interest-earning assets were $80

million higher, an increase of 7%, the lift created by higher

earning assets was offset by a lower net interest margin. The

Company's net interest margin dropped by 35 basis points, to 4.80%

in the first quarter of 2009 from 5.15% in the first quarter of

2008, for the following reasons: We had $265,000 in net interest

reversals on loans placed on non-accrual in the first quarter of

2009, and no interest reversals in the first quarter of 2008; most

of the growth in average interest-earning assets during the past

year has been in investments, which tend to be lower-yielding than

loans; average non-performing assets, including non-accruing loans

and OREO, were $38 million higher in the first quarter of 2009 than

the first quarter of 2008; average non-interest bearing demand

deposits were $6 million lower; and, since many of our non-maturity

interest-bearing deposits, such as NOW, savings and money market

accounts, had relatively low rates already, deposits did not

re-price to the same extent as loans during the rapidly declining

rate environment of the past year. Some of the $1.3 million

increase in the loan loss provision can be explained by the

increase in net charge-offs, although many of the charged-off loan

balances had specific reserves allocated to them as of the

beginning of the quarter and charging them off did not necessarily

create the need for reserve replenishment. Our first quarter net

charge-offs include commercial loans (primarily unsecured business

lines of credit) and the non-guaranteed portion of SBA loans

totaling $1.4 million, real estate loan balances (including equity

lines) of $1.3 million, unsecured personal lines of credit of

$325,000, and other consumer loans and overdrafts adding up to

$457,000. In addition to the increase in reserves related to

charge-offs, we provided specific reserves as necessary for loans

placed on non-accrual status during the quarter and adjusted

general reserves for changes in historical loss rates and

forward-looking risk factors. Our detailed analysis indicates that

as of March 31, 2009, our allowance for loan and lease losses

should be sufficient to cover potential credit losses inherent in

loan and lease balances outstanding as of that date. However, no

assurance can be given that the Company will not experience

substantial future losses relative to the size of the allowance.

Our allowance for loan and lease losses was 1.60% of total loans at

March 31, 2009. Service charges on deposits increased by $161,000,

or 7%, in the first quarter of 2009 relative to the first quarter

of 2008. Service charges show improvement due primarily to returned

item and overdraft fees generated by new consumer checking

accounts, and a fee increase that became effective mid-2008. The

$66,000 gain on investments in 2009 consists entirely of a recovery

on a previously charged-off investment in a title insurance holding

company, and the $45,000 in 2008 represents gains received on

called securities. Other non-interest income declined by $910,000,

or 56%, due in part to non-recurring events that added $446,000 to

income in 2008, including a $289,000 one-time gain resulting from

the mandatory redemption of a portion of our Visa shares pursuant

to Visa's initial public offering in March 2008. The drop also

reflects the elimination of dividends on our FHLB equity

investment, which contributed $127,000 to income in the first

quarter of 2008 but none in the first quarter of 2009, and includes

a $295,000 increase in pass-through operating costs associated with

our investment in low-income housing tax credit funds. Tax credit

investment costs are netted against non-interest income. With

regard to non-interest expense, salaries and benefits increased by

$562,000, or 12%, due to a $364,000 drop in the deferral of

current-period salaries associated with successful loan

originations, the addition of staff for our two newest branches

(opened in July and November of 2008), and normal annual increases.

A decline of $43,000 in deferred compensation expense stemming from

higher participant losses on deferred compensation investments

helped offset some of the increase in salaries. Occupancy expense

went up by $169,000, or 11%, due primarily to costs associated with

our new branches. Other non-interest expenses increased by

$939,000, or 37%, due in part to a $242,000 non-recurring offset

against deposit services costs in the first quarter of 2008

representing payments received for the Company's EFT

processing/debit card conversions. The increase also includes the

following: An increase of $146,000 in FDIC insurance assessments;

OREO write-downs totaling $225,000 in the first quarter of 2009; an

$83,000 increase in OREO operating expenses; a $61,000 increase in

appraisal, inspection, and foreclosure costs; a $92,000 increase in

collection-related legal costs; and an increase of $114,000 in

telecommunications costs related to network upgrades. These

increases were partially offset by a $35,000 increase in

participant losses in the directors' deferred fee plan, reflected

as an expense accrual reduction, and an insurance recovery of

$70,000 in the first quarter of 2009 related to a prior-period

legal settlement. As noted above, balance sheet changes during the

first quarter of 2009 include a sizeable jump up in deposits. Total

deposits increased by $34 million, or 3%, during the first quarter,

although after a $24 million drop in wholesale-sourced brokered

deposits is factored out, the growth in branch deposits is

calculated at $58 million, or 6%. Most of the increase in branch

deposits was in time deposits, including a $17 million increase in

CDARS deposits and a $39 million increase in other time deposits

over $100,000. Combined NOW/savings balances were up by $9 million,

or 6%, and money market deposits increased by $3 million, or 2%,

but those increases were largely offset by an $11 million decline

in non-interest bearing demand deposit balances. Because of the

increase in deposits and the drop in cash and due from banks, we

were able to let $55 million in Federal Home Loan Bank borrowings

roll off. The $17 million drop in cash and due from banks was due

mainly to timing differences on cash items (checks) in process of

collection. Interest-earning assets were virtually unchanged for

the quarter, since a slight increase in loan balances was offset by

a slight decrease in investment balances. Non-performing assets

increased by $15 million, or 41%, during the first three months of

2009, ending the quarter at over $52 million. That balance includes

$45 million in non-accruing loans and $7 million in foreclosed

assets (primarily OREO). The biggest change in non-performing

assets during the first quarter of 2009 came from the downgrade of

an $11 million acquisition and development loan to non-accrual

status, because of the borrower's inability to make scheduled

payments due to cash flow problems. Based on recent appraisals, the

loan is very well secured and does not currently require a specific

loss reserve. There were three additional relatively large

land/construction loan relationships totaling close to $2 million

that were placed on non-accrual status during the quarter, as well

as a loan on a mini-storage facility with a balance of about $1.5

million. All non-performing assets at March 31, 2009 have either

been written down to current appraised values, less expected costs

of disposition, or are well-reserved based on loss expectations.

About Sierra Bancorp Sierra Bancorp is the holding company for Bank

of the Sierra (http://www.bankofthesierra.com/), which is in its

32nd year of operations and is the largest independent bank

headquartered in the South San Joaquin Valley. The Company has $1.3

billion in total assets with 23 branch offices, an agricultural

credit center, an SBA center, an online "virtual" branch, and over

400 employees. The statements contained in this release that are

not historical facts are forward-looking statements based on

management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward looking statements.

Actual results may differ from those projected. These

forward-looking statements involve risks and uncertainties

including but not limited to the health of the national and

California economies, the Company's ability to attract and retain

skilled employees, customers' service expectations, the Company's

ability to successfully deploy new technology, the success of

branch expansion, changes in interest rates, loan portfolio

performance, the Company's ability to secure buyers for foreclosed

properties, and other factors detailed in the Company's SEC

filings. CONSOLIDATED INCOME STATEMENT 3-Month Period Ended: (in

$000's, unaudited) 3/31/2009 3/31/2008 % Change Interest Income

$17,701 $20,479 -13.6% Interest Expense 3,900 6,536 -40.3% -----

----- Net Interest Income 13,801 13,943 -1.0% Provision for Loan

& Lease Losses 3,601 2,270 58.6% ----- ----- Net Int after

Provision 10,200 11,673 -12.6% Service Charges 2,629 2,468 6.5%

Loan Sale & Servicing Income 17 16 6.3% Other Non-Interest

Income 728 1,638 -55.6% Gain (Loss) on Investments 66 45 46.7% --

-- Total Non-Interest Income 3,440 4,167 -17.4% Salaries &

Benefits 5,060 4,498 12.5% Occupancy Expense 1,655 1,486 11.4%

Other Non-Interest Expenses 3,498 2,559 36.7% ----- ----- Total

Non-Interest Expense 10,213 8,543 19.5% Income Before Taxes 3,427

7,297 -53.0% Provision for Income Taxes 732 2,338 -68.7% --- -----

Net Income $2,695 $4,959 -45.7% ====== ====== TAX DATA Tax-Exempt

Muni Income $588 $578 1.7% Tax-Exempt BOLI Income $106 $160 -33.8%

Interest Income - Fully Tax Equiv $18,018 $20,790 -13.3% NET

CHARGE-OFFS $3,513 $2,069 69.8% PER SHARE DATA 3-Month Period

Ended: (unaudited) 3/31/2009 3/31/2008 % Change Basic Earnings per

Share $0.28 $0.52 -46.2% Diluted Earnings per Share $0.28 $0.51

-45.1% Common Dividends $0.10 $0.17 -41.2% Wtd. Avg. Shares

Outstanding 9,675,846 9,558,161 Wtd. Avg. Diluted Shares 9,752,425

9,801,531 Book Value per Basic Share (EOP) $11.29 $10.65 6.0%

Tangible Book Value per Share (EOP) $10.72 $10.06 6.6% Common

Shares Outstndg. (EOP) 9,678,791 9,521,273 KEY FINANCIAL RATIOS

3-Month Period Ended: (unaudited) 3/31/2009 3/31/2008 Return on

Average Equity 10.03% 19.82% Return on Average Assets 0.83% 1.62%

Net Interest Margin (Tax-Equiv.) 4.80% 5.15% Efficiency Ratio

(Tax-Equiv.) 58.09% 47.16% Net C/O's to Avg Loans (not annualized)

0.37% 0.23% AVERAGE BALANCES 3-Month Period Ended: (in $000's,

3/31/2009 3/31/2008 % Change unaudited) Average Assets $1,312,422

$1,232,798 6.5% Average Interest-Earning Assets $1,193,894

$1,113,727 7.2% Average Gross Loans & Leases $939,934 $916,027

2.6% Average Deposits $1,081,891 $866,419 24.9% Average Equity

$109,008 $100,644 8.3% STATEMENT OF CONDITION End of Period: (in

$000's, unaudited) 3/31/2009 12/31/2008 3/31/2008 Annual Chg ASSETS

Cash and Due from Banks $29,261 $46,010 $43,150 -32.2% Securities

and Fed Funds Sold 247,979 248,913 236,664 4.8% Agricultural 11,316

13,542 9,864 14.7% Commercial & Industrial 147,037 142,739

138,398 6.2% Real Estate 705,012 705,141 697,437 1.1% SBA Loans

19,629 19,463 20,817 -5.7% Consumer Loans 64,104 65,755 54,528

17.6% ------ ------ ------ Gross Loans & Leases 947,098 946,640

921,044 2.8% Deferred Loan & Lease Fees (1,151) (1,365) (2,818)

-59.2% ------- ------- ------- Loans & Leases Net of Deferred

Fees 945,947 945,275 918,226 3.0% Allowance for Loan & Lease

Losses (15,181) (15,094) (12,478) 21.7% -------- -------- --------

Net Loans & Leases 930,766 930,181 905,748 2.8% Bank Premises

& Equipment 18,993 19,280 18,240 4.1% Other Assets 82,080

81,908 77,960 5.3% ------ ------ ------ Total Assets $1,309,079

$1,326,292 $1,281,762 2.1% ========== ========== ==========

LIABILITIES & CAPITAL Demand Deposits $221,150 $232,168

$225,318 -1.8% NOW / Savings Deposits 165,656 156,322 149,853 10.5%

Money Market Deposits 149,769 146,896 135,911 10.2% Time

Certificates of Deposit 558,434 526,112 412,466 35.4% -------

------- ------- Total Deposits 1,095,009 1,061,498 923,548 18.6%

Junior Subordinated Debentures 30,928 30,928 30,928 0.0% Other

Interest-Bearing Liabilities 59,799 113,919 207,894 -71.2% ------

------- ------- Total Deposits & Int.-Bearing Liab. 1,185,736

1,206,345 1,162,370 2.0% Other Liabilities 14,054 13,147 18,031

-22.1% Total Capital 109,289 106,800 101,361 7.8% ------- -------

------- Total Liabilities & Capital $1,309,079 $1,326,292

$1,281,762 2.1% ========== ========== =========== CREDIT QUALITY

DATA End of Period: (in $000's, unaudited) 3/31/2009 12/31/2008

3/31/2008 Annual Chg Non-Accruing Loans $44,691 $29,786 $7,021

536.5% Over 90 Days PD and Still Accruing - 71 - 0.0% Foreclosed

Assets 7,440 7,127 1,875 296.8% ----- ----- ----- Total

Non-Performing Assets $52,131 $36,984 $8,896 486.0% ===========

=========== ============= Non-Perf Loans to Total Loans 4.72% 3.15%

0.76% Non-Perf Assets to Total Assets 3.98% 2.79% 0.69% Allowance

for Ln Losses to Loans 1.60% 1.59% 1.35% OTHER PERIOD-END

STATISTICS End of Period: (unaudited) 3/31/2009 12/31/2008

3/31/2008 Shareholders Equity / Total Assets 8.3% 8.1% 7.9% Loans /

Deposits 86.5% 89.2% 99.7% Non-Int. Bearing Dep. /Total Dep. 20.2%

21.9% 24.4% DATASOURCE: Sierra Bancorp CONTACT: Ken Taylor,

EVP/CFO, or Kevin McPhaill, EVP/Chief Banking Officer, both of

Sierra Bancorp, +1-559-782-4900, or 1-888-454-BANK Web Site:

http://www.bankofthesierra.com/

Copyright

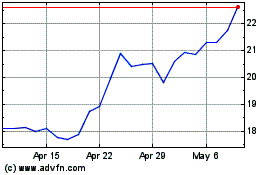

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From May 2024 to Jun 2024

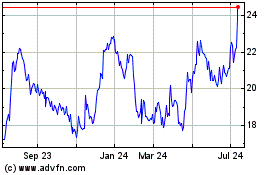

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2023 to Jun 2024