As

filed with the United States Securities and Exchange Commission on September 28, 2023

Registration

No. 333-272652

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT NO.

1 TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

| |

SHARPLINK

GAMING LTD. |

|

| |

(Exact

name of registrant as specified in our charter) |

|

| Israel |

|

7999 |

|

98-1657258 |

(State

or other jurisdiction of

Incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S. Employer

I.D. N.) |

SharpLink

Gaming Ltd.

333

Washington Avenue North, Suite 104

Minneapolis,

Minnesota

(612)

293-0619

(Address,

including zip code and telephone number, including area code, of registrant’s principle executive offices)

Copies

to:

Mitchell

S. Nussbaum, Esq.

Tahra

Wright, Esq.

Loeb

& Loeb LLP

345

Park Avenue

New

York, New York 10154

Approximate

date of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large

Accelerated Filer |

☐ |

Accelerated

Filer |

☐ |

| Non-accelerated

Filer |

☒ |

Smaller

reporting company |

☒ |

| (Do

not check if a smaller reporting company) |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant will file a further amendment which specifically states that this Registration Statement will thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement will become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we

are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED SEPTEMBER 28, 2023

PRELIMINARY

PROSPECTUS

SHARPLINK

GAMING LTD.

266,667

Ordinary Shares

This

prospectus relates to the resale by the selling shareholder (the “Selling Shareholder”), identified on page 12 of this prospectus,

of up to 266,667 ordinary shares (the “Registrable Shares”), nominal value NIS 0.60 per share (the “Ordinary Shares”),

issuable upon exercise of 266,667 ordinary share purchase warrants which were issued to Alpha Capital Anstalt (“Alpha”) in

a private placement pursuant to a securities purchase agreement.

Unless

the context expressly dictates otherwise, the information set forth in this prospectus and the registration statement of which this prospectus

forms a part, reflects the 1-for-10 reverse stock split effected by the Company on April 25, 2023.

We

are registering the above described offer and sale of the Registrable Shares by the Selling Shareholder to satisfy certain registration

rights we have granted. We will not receive any proceeds from the sale of these shares by the Selling Shareholder. The Selling Shareholder

may offer all or part of the Registrable Shares for resale from time to time through public or private transactions, at either prevailing

market prices or at privately negotiated prices. These Registrable Shares are being registered to permit the Selling Shareholder to sell

shares from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Shareholder may sell these

Registrable Shares through ordinary brokerage transactions, directly to market makers of our shares or through any other means described

in the section titled “Plan of Distribution.” In connection with any sales of Registrable Shares offered hereunder, the Selling

Shareholder, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

We

will bear all costs, expenses and fees in connection with the registration of the Registrable Shares. The Selling Shareholder will bear

all commissions and discounts, if any, attributable to the sale or disposition of the Registrable Shares, or interests therein.

Investing

in our shares involves substantial risks. See “RISK FACTORS” on page 11 of this prospectus. You should carefully read this

prospectus and the documents incorporated herein before making any investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these Registrable Shares or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2023.

TABLE

OF CONTENTS

This

prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”)

pursuant to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the Registrable

Shares covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent

to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any

date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered, or Registrable Shares

are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus,

including the documents incorporated by reference therein, in making your investment decision. You should also read and consider the

information in the documents to which we have referred you under the caption “Where You Can Find Additional Information”

in this prospectus.

We

have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or

in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can

provide no assurance as to the reliability of, any other information that others may give to you. The information contained in this prospectus

is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our Registrable

Shares.

You

should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information

that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these shares in any

jurisdiction.

ABOUT

THIS PROSPECTUS

In

this prospectus, unless otherwise noted, references to “SharpLink,” the “Company,” “we,” “us,”

and “our” refer to SharpLink Gaming Ltd. and our subsidiaries.

Neither

we, nor any of our officers, directors, agents or representatives, make any representation to you about the legality of an investment

in our Ordinary Shares. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business,

investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax,

business, financial and other issues that you should consider before investing in our Ordinary Shares. You should rely only on the information

contained in this prospectus or in any amended prospectus that we may authorize to be delivered or made available to you. We and the

underwriter have not authorized anyone to provide you with different information. The information in this prospectus is accurate only

as of the date hereof, regardless of the time of its delivery or any sale of our Registrable Shares.

INDUSTRY

AND MARKET DATA

This

prospectus contains and incorporates by reference market data, industry statistics, and other data that have been obtained from, or compiled

from, information made available by third parties. Although we believe these third-party sources are reliable, we have not independently

verified the information. Except as may otherwise be noted, none of the sources cited in this prospectus has consented to the inclusion

of any data from its reports, nor have we sought their consent. In addition, some data are based on our good faith estimates. Such estimates

are derived from publicly available information released by independent industry analysts and third-party sources, as well as our own

management’s experience in the industry, and are based on assumptions made by us based on such data and our knowledge of such industry

and markets, which we believe to be reasonable. However, none of our estimates have been verified by any independent source. See “Special

Note Regarding Forward-Looking Statements” below.

MARKET

INFORMATION

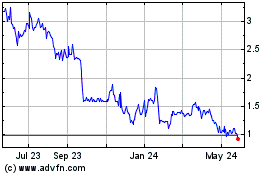

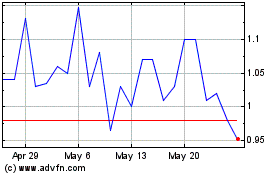

Our

Ordinary Shares are traded on The Nasdaq Capital Market under the symbol “SBET.” On September 27, 2023, the

last reported sale price of our Ordinary Shares was $2.12 per share. As of September 27, 2023, there were 93 holders of our Ordinary Shares. The actual number of stockholders of our Ordinary Shares is greater than the number of record

holders and includes holds of our Ordinary Shares which are held in street name by brokers and other nominees.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements within the meaning of the Securities Act, or the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking

statements are based on our management’s beliefs and assumptions and on information currently available to our management and involve

risks and uncertainties. Forward-looking statements include statements regarding our plans, strategies, objectives, expectations and

intentions, which are subject to change at any time at our discretion. Forward-looking statements include our assessment, from time to

time of our competitive position, the industry environment, potential growth opportunities, the effects of regulation and events outside

of our control, such as natural disasters, wars or health epidemics. Forward-looking statements include all statements that are not historical

facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would” or similar expressions.

Forward-looking

statements are merely predictions and therefore inherently subject to uncertainties and other factors which could cause the actual results

to differ materially from the forward-looking statement. These uncertainties and other factors include, among other things:

| |

● |

unexpected

technical and marketing difficulties inherent in major research and product development efforts; |

| |

|

|

| |

● |

our

ability to remain a market innovator, to create new market opportunities, and/or to expand into new markets; |

| |

|

|

| |

● |

the

potential need for changes in our long-term strategy in response to future developments; |

| |

|

|

| |

● |

our

ability to attract and retain skilled employees; |

| |

|

|

| |

● |

our

ability to raise sufficient capital to support our operations and fund our growth initiatives; |

| |

|

|

| |

● |

unexpected

changes in significant operating expenses; |

| |

|

|

| |

● |

changes

in the supply, demand and/or prices for our products and services; |

| |

|

|

| |

● |

increased

competition, including from companies which may have substantially greater resources than we have; |

| |

|

|

| |

● |

the

impact of potential security and cyber threats or the risk of unauthorized access to our, our customers’ and/or our business

partners’ information and systems; |

| |

|

|

| |

● |

changes

in the regulatory environment and the consequences to our financial position, business and reputation that could result from failing

to comply with such regulatory requirements; |

| |

|

|

| |

● |

our

ability to continue to successfully integrate acquired companies into our operations; |

| |

|

|

| |

● |

our

ability to respond and adapt to unexpected legal, regulatory and government budgetary changes, including those resulting from the

ongoing COVID-19 pandemic, such as vaccine mandates, the threat of future variants and resulting government-mandated shutdowns, quarantine

policies, travel restrictions and social distancing, curtailment of trade and other business restrictions affecting our ability to

market our products and services; |

| |

|

|

| |

● |

varying

attitudes towards sports and online casino games and poker (“iGaming”) data providers and betting by foreign governments; |

| |

|

|

| |

● |

failure

to develop or integrate new technology into current products and services; |

| |

|

|

| |

● |

unfavorable

results in legal proceedings to which we may be subject; |

| |

|

|

| |

● |

failure

to establish and maintain effective internal control over financial reporting; and |

| |

|

|

| |

● |

general

economic and business conditions in the United States and elsewhere in the world, including the impact of inflation. |

Any

forward-looking statement in this prospectus, in any related prospectus supplement and in any related free writing prospectus reflects

our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our

business, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus and any

related prospectus supplement and the documents that we reference herein and therein and have filed as exhibits hereto and thereto completely

and with the understanding that our actual future results may be materially different from any future results expressed or implied by

these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements

for any reason, even if new information becomes available in the future.

This

prospectus and any related prospectus supplement also contain or may contain estimates, projections and other information concerning

our industry, our business and the markets for our products, including data regarding the estimated size of those markets and their projected

growth rates. We obtained the industry and market data in this prospectus from our own research as well as from industry and general

publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations and contains

projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty,

including those discussed in “Risk Factors.” We caution you not to give undue weight to such projections, assumptions and

estimates. Further, industry and general publications, studies and surveys generally state that they have been obtained from sources

believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that these

publications, studies and surveys are reliable, we have not independently verified the data contained in them. In addition, while we

believe that the results and estimates from our internal research are reliable, such results and estimates have not been verified by

any independent source.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more

detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may

be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under

“Risk Factors” and the financial statements and related notes and other information that we incorporate by reference herein,

including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q.

Overview

Founded

in 2019 and headquartered in Minneapolis, Minnesota, SharpLink Gaming Ltd. is a leading business-to-business provider of performance

marketing and advanced technology-enabled fan engagement and conversion solutions for the fast emerging U.S. sports betting and iGaming

industries. Our base of marquis customers and trusted business partners includes many of the nation’s leading sports media publishers,

leagues, teams, sportsbook operators, casinos and sports technology companies, including Turner Sports, NASCAR, PGA TOUR, National Basketball

Association (“NBA”), National Collegiate Athletic Association (“NCAA”), NBC Sports, BetMGM, Party Poker, World

Poker Tour and Tipico, among numerous others.

We

continue to make deliberate and substantial investments in support of our long-term growth objectives. Our primary growth strategy is

centered on cost effectively monetizing our own and our customers’ respective online audiences of U.S. fantasy sports and casual

sports fans and casino gaming enthusiasts by converting them into loyal online sports and iGaming bettors. We are endeavoring to achieve

this through deployment of our proprietary conversion technologies, branded as our “C4” solutions, which are seamlessly integrated

with fun, highly engaging fan experiences. Purpose-built from the ground-up specifically for the U.S. market, SharpLink’s C4 innovations

are designed to help unlock the lifetime value of sports bettors and online casino players. More specifically, C4:

| |

● |

COLLECTS,

analyzes and leverages deep learning of behavioral data relating to individual fans; |

| |

● |

CONNECTS

and controls fan engagement with real-time, personalized betting offers sourced from U.S. sportsbooks and casinos in states where

online betting has been legalized; |

| |

● |

CONVERTS

passive fantasy sports and casual sports fans into sports bettors on a fully automated basis; and |

| |

● |

readily

enables gaming operators and publishers to CAPITALIZE on acquiring and scaling sports betting and iGaming depositors, resulting

in higher revenue generation and greatly enhanced user experiences. |

We

reach fans and cultivate audience growth and activation through our four primary operating segments: 1) Sports Gaming Client Services;

2) SportsHub Games Network/Fantasy Sports; 3) Affiliate Marketing Services – International; and 4) Affiliate Marketing Services

– United States.

The

Company previously owned and operated an enterprise telecom expense management business (“Enterprise TEM”) acquired in July

2021 in connection with SharpLink’s go-public merger with Mer Telemanagement Solutions Ltd. Beginning in 2022, we sought a buyer

for the business; and on December 31, 2022, we completed the sale of this business to Israel-based MTS Technology Ltd.

SharpLink

is guided by an accomplished, entrepreneurial leadership team of industry veterans and pioneers encompassing decades of experience in

delivering innovative sports solutions to partners that have included Turner Sports, Google, Facebook, the National Football League (“NFL”),

NCAA and NBA, among many other iconic organizations, with executive experience at companies which include ESPN, NBC, Sportradar, AOL,

Betfair and others.

As

of March 2023, the Company’s state regulatory initiatives have resulted in SharpLink being licensed and/or authorized to operate

in 26 U.S. states, the District of Columbia, Puerto Rico and Ontario, Canada, which represents nearly 100% of the legal online

betting market in North America.

By

leveraging our technology and building on our current client and industry relationships, SharpLink believes we are well positioned to

earn a leadership position in the rapidly evolving sports betting and iGaming markets by driving down customer acquisition costs, materially

increasing and enhancing player engagement and delivering users with high lifetime value to our proprietary web properties and to those

of our gaming partners.

During

the fiscal years ended December 31, 2022 and 2021, we generated revenues of $7,288,029 and $2,635,757, respectively, representing an

increase of 177% on a comparative year-over-year basis.

Our

Corporate Information

Go-Public

Merger with Mer Telemanagement Solutions Ltd.

Formerly

known as Mer Telemanagement Solutions Ltd. (“MTS”), the Company was incorporated as a public limited liability company under

the laws of the State of Israel in December 1995. The Company continues to operate under such laws and associated legislation of an Israeli

business. In July 2021, MTS completed a merger between New SL Acquisition Corp., its wholly owned subsidiary, and SharpLink, Inc. (“Old

SharpLink”) (the “MTS Merger”). In the MTS Merger, Old SharpLink was treated as the acquirer for accounting purposes

because, among other reasons, its pre-merger shareholders held a majority of the outstanding shares of the Company immediately following

the merger. After the merger, the Company changed its name from Mer Telemanagement Solutions Ltd. to SharpLink Gaming Ltd. and its NASDAQ

ticker symbol from MTSL to SBET.

FourCubed

Acquisition

On

December 31, 2021, in a combination of cash and stock transaction, we acquired certain assets of 6t4 Company, a Minnesota corporation

and FourCubed Management, LLC, a Delaware limited liability company (collectively “FourCubed”), including FourCubed’s

iGaming and affiliate marketing network, known as PAS.net. For more than 16 years, FourCubed provided its global iGaming operating partners

with affiliate marketing services. The strategic acquisition of FourCubed brought SharpLink an industry respected operating team with

decades of combined experience in conversion through affiliate marketing services and in securing highly profitable, recurring net gaming

revenue contracts with many of the world’s leading iGaming companies, including Party Poker, bwin, UNIBET, GG Poker, 888 poker,

betfair and others. Originally established in 2005, FourCubed’s international iGaming affiliate network, Poker Affiliate Solutions

(“PAS”) is currently comprised of over 12,000 sub-affiliates and has delivered nearly two million referred players since

it was launched in 2008 at www.pas.net.

Merger

with SportsHub Games Network Inc. (the “SportsHub Merger”)

SharpLink,

SHGN Acquisition Corp., a Delaware corporation and wholly owned subsidiary of SharpLink (“Merger Subsidiary”), SportsHub

Games Network Inc. (“SportsHub”) and Christian Peterson, an individual acting as the SportsHub stockholders’ representative

entered into a Merger Agreement on September 7, 2022. The Merger Agreement, as amended, contained the terms and conditions of the proposed

business combination of SharpLink and SportsHub. Pursuant to the Merger Agreement, as amended, on December 22, 2022, SportsHub merged

with and into Merger Subsidiary with Merger Subsidiary surviving as a wholly owned subsidiary of SharpLink. In association with the transaction,

SharpLink issued, in the aggregate, 431,926 Ordinary Shares to common and preferred stockholders of SportsHub, on a fully diluted basis.

An additional aggregate of 40,585 Ordinary Shares were reserved for future issuance.

Sale

of Legacy MTS Business

On

December 31, 2022, SharpLink closed on the sale of its legacy MTS business (“Legacy MTS”) to Israel-based MTS Technology

Ltd. (formerly Entrypoint South Ltd.), a subsidiary of Entrypoint Systems 2004 Ltd. In consideration of MTS Technology Ltd. acquiring

all rights, title, interests and benefits to Legacy MTS, including 100% of the shares of MTS Integratrak Inc., one of the Company’s

U.S. subsidiaries, MTS Technology Ltd. will pay SharpLink an earn-out payment (an “Earn-Out Payment”) equal to three times

Legacy MTS’ Earnings Before Interest, Taxes and Depreciation for the year ending December 31, 2023, up to a maximum earn-out payment

of $1 million (adjusted to reflect net working capital as of the closing date). Within ten (10) calendar days of the approval by the

board of directors of the Buyer of the audited annual financial statements of the Business as at December 31, 2023, and for the 12-month

period ending on such date, which shall occur no later than May 31, 2024, Buyer shall deliver to the Seller a schedule certified by its

Chief Executive Officer and Chief Financial Officer setting forth the computation of the Earn-Out Payment (as applicable), if any, together

with the calculation thereof in an agreed Excel table format (including, but not limiting to all relevant details of the EBITDA calculations

for the year 2023).

Change

from Foreign Private Issuer to Domestic Issuer

Prior

to January 1, 2023, SharpLink, an Israel corporation, qualified as a foreign private issuer. There are two tests to determine whether

a foreign company qualifies as a foreign private issuer: the U.S. shareholder test and U.S. business contacts test. Under the U.S. shareholder

test, a foreign company will qualify as a foreign private issuer if 50% or less of its outstanding voting securities are held by U.S.

residents. If a foreign company fails this shareholder test, it will still be considered a foreign private issuer unless it fails any

one part of the U.S. business contacts test. The U.S. business contacts test includes the following three parts: 1) the majority of the

company’s executive officers or directors are U.S. citizens or residents; 2) more than 50% of the issuer’s assets are located

in the United States; or 3) the issuer’s business is administered principally in the United States. Because we failed these tests,

we are no longer a foreign private issuer and effective January 1, 2023, we are required to comply with the reporting requirements under

the rules and regulations of the Exchange Act, applicable to U.S. domestic companies.

Reverse

Stock Split

On

January 20, 2023, the Company held an extraordinary general meeting of shareholders (the “Meeting”), at which the Company’s

shareholders approved amendments to the Company’s Memorandum of Association and Second Amended and Restated Articles of Association

(the “M&AA”) to effect a reverse stock split of the Company’s Ordinary Shares, nominal value NIS 0.06 per share

by a ratio of up to and including 20:1, to be effective at the ratio and on a date to be determined by the Company’s Board of Directors

(the “Board”). On April 17, 2023, the Board determined to effect the Reverse Stock Split at a ratio of 1-for-10 on May 3,

2023 or any other date determined by the Chairman of the Board, and approved the corresponding amendments to the M&AA. On April 24,

2023, the Chairman of the Board determined to effect the Reverse Stock Split on April 25, 2023. On April 25, 2023 (the “Effective

Date”), the Company effected a 1-for-10 reverse share split of all of the Company’s share capital, including its Ordinary

Shares, nominal value of NIS 0.06 per share (the “Reverse Stock Split”) and adopted amendments to its M&AA in connection

with the Reverse Stock Split.

The

Company undertook the Reverse Stock Split with the objective of meeting the minimum $1.00 per ordinary share bid requirement for maintaining

the listing of its Ordinary Shares on The Nasdaq Capital Market. As a result of the Reverse Stock Split, the number of Ordinary Shares

held by each shareholder of the Company automatically consolidated on a ten (old) Ordinary Share for one (new) Ordinary Share basis.

On the Effective Date, the Company’s 26,881,144 Ordinary Shares issued and outstanding were reduced to 2,688,451 Ordinary Shares

issued and outstanding, and the total number of the Company’s authorized Ordinary Shares under its M&AA was reduced from 92,900,000

Ordinary Shares, nominal value NIS 0.06 per share, to 9,290,000 Ordinary Shares, nominal value NIS 0.60 per share. No fractional shares

were issued in connection with the Reverse Stock Split, but fractions were rounded up or down to the nearest whole share (with half shares

rounded down). On May 10, 2023, Nasdaq notified the Company that since the bid price of the Company’s Ordinary Shares closed above

$1.00 for ten consecutive trading days from April 26, 2023 through May 9, 2023, the Company had cured the bid price deficiency, its ordinary

shares would not be suspended or delisted and the matter was considered closed. As a result, the Company is currently in compliance with

the Listing Rule 5550(a)(2).

The

Company’s Ordinary Shares began trading on a split-adjusted basis on The Nasdaq Capital Market on April 26, 2023, and continue

to trade under its existing symbol “SBET.” The new CUSIP number for the Ordinary Shares following the Reverse Stock Split

is M8273L110.

The

Company has retained its transfer agent, Equiniti/American Stock Transfer & Trust Company, to act as exchange agent for the

Reverse Stock Split. Shareholders of record as of the Effective Date in certificated form will receive a letter of transmittal providing

instructions for the surrender of their pre-reverse split share certificates. Shareholders owning uncertificated book-entry shares or

owning shares via a broker or other nominee will have their positions automatically adjusted to reflect the Reverse Stock Split and will

not be required to take any action in connection with the Reverse Stock Split.

NASDAQ

Notice

On May 23, 2023, SharpLink

received a notice (the “Notice”) from the staff of the Listing Qualifications Department at Nasdaq that it is no longer in

compliance with the equity standard for continued listing on Nasdaq. Nasdaq Listing Rule 5550(b)(1) requires listed companies to maintain

shareholders’ equity of at least $2,500,000 under the net equity standard (the “Nasdaq Rule”). SharpLink does not meet

the alternative standards for market value of listed securities or net income from continuing operations.

Nasdaq provided the Company

with 45 calendar days, or until July 7, 2023, to submit a plan to regain compliance with the Nasdaq Rule. The Company timely submitted

its plan and relevant materials to Nasdaq and requested an extension through November 20, 2023 to evidence compliance with the Nasdaq

Rule. On August 3, 2023, the Company received a determination letter from Nasdaq advising it that Nasdaq granted the Company an extension

to regain compliance with the Nasdaq Rule, and that on or before November 20, 2023 the Company must take the actions set forth in the

plan and opt for one of the two alternatives to evidence compliance with the Nasdaq Rule. The consummation of this offering is part of

the actions set forth in the plan to regain compliance with the Nasdaq Rule.

If

the Company fails to evidence compliance upon filing its periodic report for the year ended December 31, 2023, with the SEC, the Company

may receive a written notification from the Staff that its securities will be delisted. At that time, the Company may appeal the Staff’s

determination to a Hearings Panel.

Proposed

Offering

On

September 22, 2023, the Company filed a registration statement on Form S-1 in connection with a proposed public offering of the Company’s

Ordinary Shares, ordinary warrants and pre-funded warrants.

The

current conversion prices of our Series B Preferred Shares and Debenture are $7.00 and $4.1772 per share, respectively. The current

exercise price of our warrants issued to Alpha in February 2023 is $4.0704 per share. All of these securities include an

anti-dilution mechanism. If the proposed offering is consummated, and there is no guarantee that it will be, if the shares are

issued with a public offering price less than the conversion/exercise prices, these prices will be reduced accordingly, subject to

certain floor prices. As a result, we will receive less proceeds from the conversion/exercise of these securities.

Extraordinary

Meeting of Shareholders to be Held

On

September 26, 2023, SharpLink filed a definitive proxy notice and proxy statement in connection with its planned Extraordinary General

Meeting of Shareholders to be held in October. At the meeting, SharpLink’s shareholders will be asked to vote to adopt an amendment

to the Company’s amended and restated articles of association to increase the authorized share capital of the Company from 9,290,000

Ordinary Shares, nominal value NIS 0.60 per share, to 100,000,000 Ordinary Shares, nominal value NIS 0.60 per share, and to approve a

corresponding amendment to the Company’s Memorandum of Association.

The

primary purpose of this proposal is to provide sufficient authorized Ordinary Shares for SharpLink to consummate an offering, which is

part of the plan to regain compliance with the Nasdaq Rule. As disclosed in the Proxy Statement, in order to regain compliance with the

Nasdaq Rule, SharpLink will need to complete an equity offering prior to November 20, 2023. In addition, the increase in the authorized

shares is also necessary to ensure the availability of a sufficient number of authorized Ordinary Shares for possible future conversion

of convertible financial instruments into Ordinary Shares, or the restructuring of Company debt, and will allow the Company to issue

additional Ordinary Shares for various corporate purposes, including but not limited to, financings, potential strategic transactions,

including mergers, acquisitions, strategic partnerships, joint ventures, divestitures, and business combinations, as well as other general

corporate transactions, without the expense and delay of arranging another extraordinary meeting of shareholders.

ALPHA

PRIVATE PLACEMENT

On

November 16, 2021, the Company entered into a Securities Purchase Agreement (the “2021 Purchase Agreement”) with Alpha pursuant

to which the Company issued and sold, in a registered direct offering (the “Offering”), an aggregate of 141,307 of the Company’s

Ordinary Shares at an offering price of $37.5 per share. In addition, the Company sold to Alpha certain prefunded ordinary share purchase

warrants (the “Prefunded Warrants”) to purchase 125,359 Ordinary Shares. The Prefunded Warrants were sold at an offering

price of $37.4 per warrant share and are exercisable at a price of $0.10 per share. Subject to limited exceptions, a holder of a Prefunded

Warrant will not have the right to exercise any portion of such warrant if the holder, together with its affiliates, would beneficially

own in excess of 9.99% of the number of Ordinary Shares of the Company outstanding immediately after giving effect to such exercise (the

“Beneficial Ownership Limitation”); provided, however, that upon 61 days’ prior notice to the Company, the holder may

increase or decrease the Beneficial Ownership Limitation, provided that in no event shall the Beneficial Ownership Limitation exceed

9.99%.

The

aggregate net proceeds from the sale of the Shares and Prefunded Warrants, after deducting offering expenses, was $9.9 million. The Shares

and the Prefunded Warrants were offered by the Company pursuant to a registration statement on Form F-3 (File No. 333-237989), which

was initially filed with the SEC on May 4, 2020, and was declared effective by the SEC on May 12, 2020 (the “May 2020 Registration

Statement”). Alpha exercised the Prefunded Warrants in full on a cashless basis on June 6, 2023 and received 121,479 Ordinary

Shares.

In

a concurrent private placement (the “Private Placement”), the Company issued to Alpha, for each Share and Prefunded Warrant

purchased in the Offering, an additional ordinary share purchase warrant (the “Regular Warrant”), each to purchase one Ordinary

Share. The Regular Warrants are initially exercisable six months following issuance and terminate four years following issuance. The

Regular Warrants had an initial exercise price of $45.0 per share and are exercisable to purchase an aggregate of 266,667 Ordinary Shares.

As a result of a Securities Purchase Agreement (the “2023 Purchase Agreement”) entered into between the Company and Alpha

on February 14, 2023, the exercise price of the Regular Warrants was reduced to $0.60 per share. The Regular Warrants also provide for

an identical Beneficial Ownership Limitation as contained in the Prefunded Warrants.

The

Regular Warrants and the Ordinary Shares issuable upon the exercise of such warrants were not registered under the Securities Act, were

not offered pursuant to the May 2020 Registration Statement and were offered pursuant to the exemption provided in Section 4(a)(2) under

the Securities Act and Rule 506(b) promulgated thereunder. The 2021 Purchase Agreement provides the holder of the Regular Warrant with

certain “piggy-back” registration rights in the event the Company files other registration statements with the SEC under

the Securities Act. In the event that at the time of exercise there is not then a current registration statement covering the resale

of the Ordinary Shares issuable upon exercise of the Regular Warrants, the holder shall have the right to exercise such warrant on a

cashless (net exercise) basis.

We

are registering the offer and sale of the Registrable Shares by the Selling Shareholder to satisfy certain registration rights we have

granted.

Our

registration of the shares covered by this prospectus does not mean that the Selling Shareholder will offer or sell any of the Registrable

Shares if or when converted or exercised. The Selling Shareholder may offer, sell or distribute all or a portion of its Registrable Shares

publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the

Selling Shareholder may sell the Registrable Shares in the section titled “Plan of Distribution.”

THE

OFFERING

| Ordinary

Shares Beneficially Held by the Selling Shareholder: |

|

283,081* |

| |

|

|

| Ordinary

Shares Offered by the Selling Shareholder: |

|

266,667 |

| |

|

|

| Ordinary

Shares Outstanding Prior to the Exercise of the Regular Warrant by the Selling Shareholder: |

|

2,833,734 |

| |

|

|

| Ordinary

Shares Outstanding Assuming the Full Exercise of the Regular Warrant by the Selling Shareholder: |

|

3,100,401* |

| |

|

|

| Use

of Proceeds: |

|

We

will not receive any proceeds from the sale of shares by the Selling Shareholder. We will receive the proceeds of approximately

$160,000 from the full exercise of the Regular Warrant for cash, which we intend to use for general corporate and working capital

purposes. However, up until and if the Registrable Shares are registered pursuant to this prospectus, the Regular Warrant may be

exercised on a cashless basis; in which case we would not expect to receive any gross proceeds from the cashless exercise of the

Regular Warrant. |

| |

|

|

| Risk

Factors: |

|

You

should carefully read the “Risk Factors” on page 11 and other information included in this prospectus for a discussion

of factors you should consider carefully before deciding to invest in our Ordinary Shares. |

| |

|

|

| Nasdaq

Symbol for Our Ordinary Shares: |

|

SBET |

| * |

All

securities held by Alpha that are convertible or exercisable into our Ordinary Shares are subject to the Beneficial Ownership Limitation,

which limits Alpha from converting or exercising such securities in the event the conversion or exercise will result in Alpha beneficially

owning more than 9.99% of our issued and outstanding Ordinary Shares. Beneficial ownership is determined in accordance with Rule

13d-3 under the Exchange Act, and includes any shares as to which the security or shareholder has sole or shared voting power or

investment power and also any shares which the security or shareholder has the right to acquire within a forward-looking 60-day period,

whether through the exercise or conversion of any preferred share, option, convertible security, warrant or other right. |

RISK

FACTORS

Investment

in our Ordinary Shares involves a high degree of risk. Prior to making a decision about investing in our Ordinary Shares, you should

consider carefully the risk factors incorporated by reference in this prospectus, including the risk factors described in the section

titled “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with

the SEC on April 5, 2023, together with the other information set forth in this prospectus, and in the other documents that we include

or incorporate by reference into this prospectus, as updated by our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other

filings we make with the SEC, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement

and any risk factors set forth in our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act.

Those risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known

to us or that we currently deem immaterial also may impair our business operations. If any of these risks actually occur, our business,

results of operations and financial condition could suffer. In that event the trading price of our Ordinary Shares could decline, and

you may lose all or part of your investment.

For

more information about our SEC filings, please see “Where You Can Find Additional Information” and “Incorporation by

Reference.”

USE

OF PROCEEDS

All

of the Ordinary Shares covered by this prospectus are being sold by the Selling Shareholder. We will not receive any proceeds from the

sale of these Ordinary Shares. We will receive approximately $160,000 if the Regular Warrant is exercised in full for cash, and we intend

to use it for general corporate and working capital purposes.

The

Selling Shareholder will pay any underwriting discounts and commissions and expenses incurred by the Selling Shareholder for brokerage,

accounting, tax or legal services or any other expenses incurred by the Selling Shareholder in disposing of the shares. We will bear

all other costs, fees, and expenses incurred in effecting the registration of the shares covered by this prospectus, including, without

limitation, all registration and filing fees, and fees and expenses of our counsel and our accountants.

DETERMINATION

OF OFFERING PRICE

We

cannot currently determine the price or prices at which our Ordinary Shares may be sold by the Selling Shareholder under this prospectus.

DIVIDEND

POLICY

We

have never declared any cash dividends since inception and we do not anticipate paying any dividends in the foreseeable future. Instead,

we anticipate that all of our earnings will be used to provide working capital, to support our operations, and to finance the growth

and development of our business. The payment of dividends is within the discretion of the Board and will depend on our earnings, capital

requirements, financial condition, prospects, applicable Israeli law, which, among other requirements, provides that dividends are only

payable out of retained earnings, and other factors our Board might deem relevant. There are no restrictions that currently limit our

ability to pay dividends on our Ordinary Shares other than those generally imposed by applicable Israeli law and the restriction imposed

by the terms of the Series B Preferred Shares and the 8% interest rate, 10% original issue discount, senior convertible debenture

issued by SharpLink (the “Debenture”), which provide that as long as any portion of the Series B Preferred

Shares and Debenture remains outstanding, unless the holders of at least 50.1% of the Series B Preferred Shares and 67% in

principal amount of the then outstanding Debenture shall have otherwise given prior written consent, the Company shall not, and shall

not permit any of the subsidiaries to, directly or indirectly pay cash dividends or distributions on any equity securities of the Company.

SELLING

SHAREHOLDER

We

have prepared this prospectus to allow the Selling Shareholder or its successors, assignees or other permitted transferees to sell or

otherwise dispose of, from time to time, up to 266,667 Registrable Shares.

The

following table sets forth the number of our Ordinary Shares beneficially owned by the Selling Shareholder as of September 27,

2023:

| | |

Beneficial Ownership

Before Offering | | |

Number of Ordinary | | |

Beneficial Ownership

After Offering (2) | |

| Name | |

Number of Ordinary Shares (1) (3) (4) | | |

Percent | | |

Shares offered by Selling Shareholder | | |

Number of Ordinary Shares (1) (2) (3) (4) | | |

Percent | |

| Alpha Capital Anstalt (5) | |

| 283,081 | | |

| 9.9 | % | |

| 266,667 | | |

| 283,081 | | |

| 9.9 | % |

| (1) |

Beneficial

ownership is determined in accordance with Rule 13d-3 under the Exchange Act, and includes any shares as to which the security or

shareholder has sole or shared voting power or investment power and also any shares which the security or shareholder has the right

to acquire within 60 days of September 27, 2023, whether through the exercise or conversion of any preferred stock,

stock option, convertible security, warrant or other right. The indication herein that shares are beneficially owned is not an admission

on the part of the security or shareholder that he, she or it is a direct or indirect beneficial owner of those shares. Percentage

of shares beneficially owned after the resale of all the shares offered by this prospectus assumes there are 2,833,734 outstanding

Ordinary Shares prior to the issuance of any Ordinary Shares upon the exercise of the Regular Warrant. All securities held by Alpha

that are convertible or exercisable into our Ordinary Shares are subject to the Beneficial Ownership Limitation, which limits Alpha

from converting or exercising such securities in the event the conversion or exercise will result in Alpha owning more than 9.99%

of our issued and outstanding Ordinary Shares. Konrad Ackermann and Nicola Feuerstein share voting and dispositive power over the

securities held for the account of this selling shareholder. |

| |

|

| (2) |

Assumes

the sale of all registered shares in the offering. |

| |

|

| (3) |

Beneficial

ownership reflects the maximum number of Ordinary Shares that may be acquired by Alpha subject to the Beneficial Ownership Limitation.

Pursuant to the Company’s records, Alpha owns of record (i) 101,406 Ordinary Shares, (ii) 12,481 Preferred B Shares,

(iii) Regular Warrant to purchase 266,667 Ordinary Shares at an exercise price of $0.60 per share, (iv) the Debenture convertible

to up to 1,391,798 Ordinary Shares (consisting of 1,053,337 conversion shares to be issued at $4.1772 per share, the conversion price,

and 338,461 interest shares which may be issued at $3.90 per share, the closing price of our Ordinary Shares as of April 20, 2023,

assuming all permissible interest and principal payments are made in Ordinary Shares and the Debenture is held until maturity), and

(v) warrant to purchase up to 880,000 Ordinary Shares at an exercise price of $4.0704 per share, the average of the five Nasdaq Official

Closing Prices immediately preceding the Company’s filing of its preliminary proxy statement on April 14, 2023, subject to

adjustment. |

| |

|

| (4) |

As

of September 27, 2023, there were 7,202 Preferred A-1 Shares accrued as payment of quarterly dividends on the

Preferred B Shares held by Alpha, but not yet issued. |

| |

|

| (5) |

Alpha’s

address is Altenbach 8, 9490 Vaduz, Principality of Liechtenstein. |

Certain

Relationships with Selling Shareholder

2020

Old SharpLink-Alpha Securities Purchase Agreement

On

December 23, 2020, Old SharpLink entered into a securities purchase agreement with Alpha, which the parties amended on June 15, 2021

and July 26, 2021. We refer to this securities purchase agreement, as amended, as the 2020 Purchase Agreement. Pursuant to an initial

closing under the 2020 Purchase Agreement held on December 23, 2020, Old SharpLink issued and sold to Alpha shares of its Series A Preferred

Stock for an aggregate gross purchase price of $2 million. The 2020 Purchase Agreement also provided that Alpha would purchase from Old

SharpLink, and Old SharpLink would sell to Alpha, shares of Old SharpLink’s Series B Preferred Stock for an aggregate purchase

price of $6 million. The closing of the sale of the Old SharpLink’s Series B Preferred Stock occurred immediately prior to the

MTS Merger. The outstanding shares of Old SharpLink Series A Preferred Stock (including shares issued in satisfaction of dividends payable

thereon) and Series B Preferred Stock sold to Alpha pursuant to the 2020 Purchase Agreement were exchanged in the MTS Merger for shares

of the Company’s Preferred A-1 Shares and Preferred B Shares.

In

addition to the Old SharpLink preferred stock sold to Alpha pursuant to the 2020 Purchase Agreement, Old SharpLink also agreed to issue

to Alpha as a commitment fee for its obligation to purchase the Series B Preferred Stock. The commitment fee included a number of additional

shares of Old SharpLink (or its successor, which includes the Company) representing 3% of the fully-diluted shares of the Company following

the MTS Merger. In satisfaction of such commitment shares, Old SharpLink issued Alpha an additional number of its Series A-1 Preferred

Stock immediately prior to Closing of the MTS Merger, which were exchanged for 70,099 Preferred A-1 Shares of the Company in the MTS

Merger.

The

2020 Purchase Agreement also provided that until such time as Alpha has invested an additional $20 million in Old SharpLink, including,

subject to certain conditions, the Company following the effective time of the MTS Merger, or until July 26, 2022 (one year following

the effective time of the MTS Merger), Alpha will have a right to participate in future financings conducted by the Company by purchasing

up to 55% of the securities offered for sale in any such financing transactions. For as long as Alpha continues to hold Preferred A-1

Shares or Preferred B Shares, the Company is also, subject to customary exceptions and is prohibited from issuing any “variable

rate transactions,” which for purposes of the 2020 Purchase Agreement, means a transaction in which the Company issues debt or

equity securities that are convertible into Ordinary Shares at a conversion price that is based on or varies with the current trading

price of the Ordinary Shares.

2021

SharpLink-Alpha Securities Purchase Agreement

On

November 16, 2021, the Company entered into the 2021 Purchase Agreement with Alpha pursuant to which the Company issued and sold, in

a registered direct offering, an aggregate of 141,307 of the Company’s Ordinary Shares at an offering price of $37.5 per share.

In addition, the Company sold to Alpha certain Prefunded Warrants to purchase 125,359 Ordinary Shares. The Prefunded Warrants were sold

at an offering price of $37.40 per warrant share and are exercisable at a price of $0.10 per share. These shares and the Prefunded Warrants

were offered by the Company pursuant to a registration statement on Form F-3 (File No. 333-237989), which was initially filed with the

SEC on May 4, 2020, and was declared effective by the SEC on May 12, 2020 (the “May 2020 Registration Statement”). In a concurrent

private placement, the Company issued to Alpha, for each Ordinary Share and Prefunded Warrant purchased in the offering, an additional

Regular Warrant, each to purchase one Ordinary Share. The Regular Warrants are initially exercisable six months following issuance and

terminate four years following issuance. The Regular Warrants have an exercise price of $45.00 per share and are exercisable to purchase

an aggregate of 266,667 Ordinary Shares. The aggregate net proceeds from the sale of the Shares and Prefunded Warrants, after deducting

offering expenses, was $9,838,711. On June 6, 2023, Alpha exercised the Prefunded Warrants in full on a cashless basis and received

121,479 Ordinary Shares.

The

Regular Warrants and the Ordinary Shares issuable upon the exercise of such warrants were not registered under the Securities Act, were

not offered pursuant to the May 2020 Registration Statement and were offered pursuant to the exemption provided in Section 4(a)(2) under

the Securities Act and Rule 506(b) promulgated thereunder. The 2021 Purchase Agreement provides the holder of the Regular Warrant with

certain “piggy-back” registration rights in the event the Company files other registration statements with the SEC under

the Securities Act. In the event that at the time of exercise there is not then a current registration statement covering the resale

of the Ordinary Shares issuable upon exercise of the Regular Warrants, the holder shall have the right to exercise such warrant on a

cashless (net exercise) basis. We are registering the Ordinary Shares underlying the Regular Warrants to fulfill our obligation to maintain

an effective registration statement covering the Ordinary Shares underlying the Regular Warrant.

2023

SharpLink-Alpha Debenture and Warrant Financing

On

February 14, 2023, the Company entered into the 2023 Purchase Agreement with Alpha, pursuant to which the Company issued to Alpha, an

8% Interest Rate, 10% Original Issue Discount, Senior Convertible Debenture in the aggregate principal amount of $4,400,000 for a purchase

price of $4,000,000 on February 15, 2023. The Debenture is convertible, at any time, and from time to time, at Alpha’s option,

into conversion shares at an initial conversion price equal to $7.00 per share, subject to adjustment as described in the Debenture.

Pursuant to the terms of the Debenture, the conversion price of the Debenture has been reset upon filing of the initial registration

statement on Form S-1 on April 21, 2023 to $4.1772 per share, the lower of $7.00 and the average of the five Nasdaq Official Closing

Prices immediately preceding the filing of such registration statement. As part of the 2023 Purchase Agreement, the exercise price of

the Regular Warrants issued to Alpha in November 2021 and exercisable to purchase an aggregate of 266,667 Ordinary Shares (the Registrable

Securities) was reduced from $45.00 per share to $0.60 per share.

On

February 15, 2023, the Company also issued to Alpha a warrant to purchase 880,000 Ordinary Shares of the Company at an initial exercise

price of $8.75. The warrant is exercisable in whole or in part, at any time on or after February 15, 2023 and before February 15, 2028.

The exercise price of the warrant was subject to an initial reset immediately prior to the Company’s filing of a proxy statement

that includes a shareholder approval proposal approving the issuance of underlying shares in excess of 19.99% of the issued and outstanding

Ordinary Shares on the closing date (the “Shareholder Approval Proposal”) to the lower of $8.75 and the average of the five

Nasdaq Official Closing Prices immediately preceding such date. As a result, the exercise price has been reset to $4.0704, the average

of the five Nasdaq Official Closing Prices immediately preceding April 14, 2023, the date the Company filed its preliminary proxy statement

which includes the Shareholder Approval Proposal. The warrant includes a beneficial

ownership blocker of 9.99%. The warrant provides for adjustments to the exercise price, in connection with stock dividends and splits,

subsequent equity sales and rights offerings, pro rata distributions, and certain fundamental transactions. In the event the Company,

at any time while the warrant is still outstanding, issues or grants any right to re-price, Ordinary Shares or any type of securities

giving rights to obtain Ordinary Shares at a price below exercise price, Alpha shall be extended full-ratchet anti-dilution protection

on the warrant (reduction in price, only, no increase in number of warrant shares, and subject to customary exempt transaction issuances).

PLAN

OF DISTRIBUTION

The

Selling Shareholder and any of its pledgees, assignees and successors-in-interest, may, from time to time, sell any or all of their Ordinary

Shares covered by this prospectus hereby on the principal trading market or any other stock exchange, market or trading facility on which

our Ordinary Shares are traded or in private transactions.

These

sales may be at fixed or negotiated prices. The Selling Shareholder may use any one or more of the following methods when selling such

Ordinary Shares:

| |

● |

ordinary

brokerage transactions and transactions in which the broker dealer solicits purchasers; |

| |

● |

block

trades in which the broker dealer will attempt to sell the Ordinary Shares as agent but may position and resell a portion of the

block as principal to facilitate the transaction; |

| |

● |

purchases

by a broker dealer as principal and resale by the broker dealer for its account; |

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately

negotiated transactions; |

| |

● |

settlement

of short sales entered into after the effective date of the registration statement of which this prospectus is a part; |

| |

● |

in

transactions through broker dealers that agree with the Selling Shareholder to sell a specified number of such Ordinary Shares at

a stipulated price per share; |

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a

combination of any such methods of sale; or |

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Shareholder may also sell the Ordinary Shares covered by this prospectus under Rule 144 or any other exemption from registration

under the Securities Act, if available, rather than under this prospectus. Broker dealers engaged by the Selling Shareholder may arrange

for other brokers dealers to participate in sales. Broker dealers may receive commissions or discounts from the Selling Shareholder (or,

if any broker dealer acts as agent for the purchaser of Ordinary Shares, from the purchaser) in amounts to be negotiated, but, except

as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission

in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with the Supplementary

Material to FINRA Rule 2121.

In

connection with the sale of the Ordinary Shares offered hereby or interests therein, the Selling Shareholder may enter into hedging transactions

with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares in the course of hedging the

positions they assume. The Selling Shareholder may also sell the Ordinary Shares short and deliver these shares to close out their short

positions, or loan or pledge the Ordinary Shares to broker-dealers that in turn may sell these shares. The Selling Shareholder may also

enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities

which require the delivery to such broker-dealer or other financial institution of Ordinary Shares offered by this prospectus, which

shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect

such transaction).

The

Selling Shareholder and any broker-dealers or agents that are involved in selling the Ordinary Shares may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under

the Securities Act. Each selling shareholder has informed us that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the shares.

We

will pay certain fees and expenses incurred by us incident to the registration of the Ordinary Shares; provided, however, that the Selling

Shareholder will pay all underwriting discounts and selling commissions, if any.

Because

the Selling Shareholder may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject

to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any Ordinary Shares covered

by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under

this prospectus.

The

Ordinary Shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws.

In addition, in certain states, the Ordinary Shares covered hereby may not be sold unless they have been registered or qualified for

sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the Ordinary Shares may not simultaneously

engage in market making activities with respect to the Ordinary Shares for the applicable restricted period, as defined in Regulation

M, prior to the commencement of the distribution. In addition, the Selling Shareholder will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

Ordinary Shares by the Selling Shareholder or any other person. We will make copies of this prospectus available to the Selling Shareholder

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

The

Ordinary Shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws.

In addition, in certain states, the Ordinary Shares covered hereby may not be sold unless they have been registered or qualified for

sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

DESCRIPTION

OF SECURITIES

The

authorized capital stock of the Company consists of 9,290,000 Ordinary Shares, 80,000 Preferred A Shares, 260,000 Preferred A-1 Shares

and 370,000 Preferred B Shares, nominal value NIS 0.60 each. On September 26, 2023, we filed a definitive proxy notice and proxy statement

in connection with its planned Extraordinary General Meeting of Shareholders to adopt an amendment to the Company’s articles of

association to increase the authorized share capital of the Company from 9,290,000 Ordinary Shares, nominal value NIS 0.60 per share,

to 100,000,000 Ordinary Shares, nominal value NIS 0.60 per share. For further information, see “Prospectus Summary— Our Corporate

Information —Extraordinary Meeting of Shareholders to be Held”.

Ordinary

Shares

As

of September 27, 2023, we have issued and outstanding 2,833,734 Ordinary Shares. Our Ordinary Shares are listed on

the Nasdaq Capital Market under the symbol “SBET.” The transfer agent for our Ordinary Shares is Equiniti/American Stock

Transfer & Trust Company, and its address is 6201 15th Avenue Brooklyn, New York 11219.

The

rights attached to the Ordinary Shares are as follows:

| |

● |

equal

rights to receive an invitation to attend all of and vote at all of the general meetings of the Company. Each one of the Ordinary

Shares will confer upon the holder a single vote at every general meeting of the Company at which the holder participates and votes,

in person, by agent, or by proxy. |

| |

|

|

| |

● |

equal

rights to receive dividends, if and when distributed, whether in cash or any other manner, and to participate in a distribution of

bonus shares, if and when distributed, according to the ratio between the shareholders’ holdings in the Company’s issued

and outstanding share capital (Ordinary Shares and Preferred Shares on an as-converted basis, without regard to the Beneficial Ownership

Limitation) and the Company’s total issued and outstanding share capital (Ordinary Shares and Preferred Shares on an as-converted

basis, without regard to the Beneficial Ownership Limitation). |

| |

|

|

| |

● |

equal

right to participate in a distribution of the Company’s assets available for distribution, in the event of liquidation or winding-up

of the Company, following the distribution to the holders of the Series B Preferred Shares, if applicable, and pari-passu with the

Series A and Series A-1 Preferred Shares (on an as-converted basis). |

Liability

to capital calls by our Company.

Under

our Articles of Association, the liability of our shareholders is limited to the payment of the unpaid amount that they are required

to pay the Company for the shares held by them.

Limitations

on any existing or prospective major shareholder.

The

Israeli Companies Law, 1999, as amended (the “Israeli Companies Law”) requires that an office holder (a term that includes

also directors and executive officers) promptly, and no later than the first board meeting at which such transaction is considered, disclose

any personal interest that he or she may have and all related material information known to him or her and any material documents in

their possession, in connection with any existing or proposed transaction by us. The disclosure requirements that apply to an office

holder also apply to a transaction in which a controlling shareholder of the company has a personal interest. The Israeli Companies Law

provides that an extraordinary transaction (a transaction other than in the ordinary course of business, other than on market terms,

or that may have a material impact on the company’s profitability, assets or liabilities) with a controlling shareholder or an

extraordinary transaction with another person in which the controlling shareholder has a personal interest or a transaction with a controlling

shareholder or his relative regarding Terms of Service and Employment, must be approved by the audit committee or the compensation committee,

as the case may be, the board of directors and shareholders. The shareholders’ approval of such a transaction requires a simple

majority approval and the fulfillment of one of the following conditions: (i) at least a majority of the votes cast by shareholders who

have no personal interest in the transaction and who vote on the matter are voted in favor of the transaction, or (ii) the votes cast

by shareholders who have no personal interest in the transaction voted against the transaction do not represent more than two percent

of the voting rights in the company. In addition, any such transaction with a term that exceeds three years requires approval as described

above every three years, unless (with respect only to extraordinary transactions and not to other transactions that require the special

approval process) the audit committee approves that a longer term is reasonable under the circumstances.

Under

the Companies Regulations (Relief from Related Party Transactions), 5760-2000, promulgated under the Israeli Companies Law, as amended,

certain extraordinary transactions between a public company and its controlling shareholder(s) do not require shareholder approval. In

addition, under such regulations, directors’ compensation and employment arrangements in a public company do not require the approval

of the shareholders if both the compensation committee and the board of directors agree that such arrangements are solely for the benefit

of the company or if the directors’ compensation does not exceed the maximum amount of compensation for outside directors determined

by applicable regulations.

Preferred

A-1 Shares and Preferred B Shares

The

Company’s authorized shares capital includes Preferred Stock of the following classes, the rights, terms and preferences of which

are summarized below: Preferred A-1 Shares and Preferred B Shares. As of September 27, 2023, the Company had 12,481 Preferred

B Shares issued and outstanding.

Our

Articles provide that we shall not effect any conversion of the Preferred Shares to the extent that, after giving effect to the conversion,

the applicable shareholder would beneficially own in excess of the Beneficial Ownership Limitation. The “Beneficial Ownership Limitation”

is defined as 9.99% of the number of Ordinary Shares outstanding immediately after giving effect to the issuance of Ordinary Shares issuable

upon conversion of Preferred Shares held by the applicable shareholder. The applicable shareholder, upon notice to the Company, may increase

or decrease the Beneficial Ownership Limitation provisions applicable to its Preferred Shares, but not greater than 9.99%. Any such increase

or decrease in the Beneficial Ownership Limitation will not be effective until the 61st day after such notice is delivered to the Company

and shall only apply to such shareholder.

Preferred

A-1 Shares

As

of September 27, 2023, there were 7,202 Preferred A-1 Shares accrued as payment of quarterly dividends on the

Preferred B Shares held by Alpha, but not yet issued. Preferred A-1 Shares have equal rights to the Ordinary Shares and are

convertible into Ordinary Shares on a 1-for-1 basis (subject to customary adjustments); provided, however, that the Preferred A-1

Shares shall not be converted to the extent that, after giving effect to such conversion, the holder of the Preferred A-1 Shares

(together with such holder’s affiliates and any persons acting as a group together with such holder) would beneficially own in

excess of the beneficial ownership cap, which is initially set at 9.99%, of the number of the Ordinary Shares outstanding

immediately after giving effect to the issuance of Ordinary Shares issuable upon conversion of the Preferred A-1 Shares held by the

holder, or the Beneficial Ownership Limitation.

Prior

to conversion into Ordinary Shares, the Preferred A-1 Shares are entitled to the following rights:

| |

● |

equal

rights to receive dividends, if and when distributed to holders of Ordinary Shares, whether in cash or any other manner, and to participate

in a distribution of bonus shares, if and when distributed, according to the ratio between the shareholders’ holdings in the

Company’s issued and outstanding share capital (Ordinary Shares and Preferred Shares on an as-converted basis, without regard

to the Beneficial Ownership Limitation) and the Company’s total issued and outstanding share capital (Ordinary Shares and Preferred

Shares on an as-converted basis, without regard to the Beneficial Ownership Limitation); |

| |

|

|

| |

● |

equal

right to participate in a distribution of the Company’s assets available for distribution, in the event of liquidation or winding-up

of the Company, on an as-converted basis, following the distribution to the holders of the Series B Preferred Shares, if applicable,

and pari passu with the Ordinary Shares; and |

| |

|

|

| |

● |

equal

rights to vote on all matters submitted to a vote of the Ordinary Shares (on an as-converted basis, but only up to the number of

votes equal to the number of Ordinary Shares into which the Preferred Shares would be convertible subject to the Beneficial Ownership

Limitation). The rights attached to any class (other than modifications to the Beneficial Ownership Limitation, which may not be

modified) may be modified or abrogated by the affirmative consent of the respective Determining Majority of the shares of such class;

provided, however, that the creation of additional shares of a specific class, or the issuance of additional shares of a specific