0001770121false00017701212024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2024

SANA BIOTECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39941 |

|

83-1381173 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

188 East Blaine Street, Suite 400

Seattle, Washington 98102

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (206) 701-7914

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.0001 par value per share |

|

SANA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, Sana Biotechnology, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and year ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02, including the attached Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

SANA BIOTECHNOLOGY, INC. |

|

|

Date: May 8, 2024 |

By: |

/s/ Nathan Hardy |

|

|

Nathan Hardy |

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Sana Biotechnology Reports First Quarter 2024 Financial Results and Business Updates

Goal to treat 40-60 patients in 2024 in four trials across seven indications in oncology, B-cell mediated autoimmune diseases, and type 1 diabetes

Ongoing ARDENT trial for SC291 continues in B-cell malignancies; expect to report additional data in 2024

Enrolling patients in the ongoing GLEAM trial for SC291 in B-cell mediated autoimmune diseases; expect to report initial clinical data in 2024

Enrolling patients in the ongoing VIVID trial for SC262 in relapsed/refractory B-cell malignancies; expect to report initial clinical data in 2024

Expect initial clinical data in 1H2024 for investigator-sponsored trial with hypoimmune-modified primary islet cells

Completed financing of $189.8 million in gross proceeds to support activities through multiple data readouts

Cash position of $311.1 million and expected 2024 operating cash burn below $200 million

SEATTLE — May 8, 2024 — Sana Biotechnology, Inc. (NASDAQ: SANA), a company focused on creating and delivering engineered cells as medicines, today reported financial results and business highlights for the first quarter 2024.

“We have four ongoing clinical trials in seven indications, and we remain on track to share initial data from each of these studies in 2024,” said Steve Harr, Sana’s President and Chief Executive Officer. “We strengthened our capital position with the financing in the first quarter, enabling us to share readouts from multiple clinical studies with our current balance sheet. 2024 is a year of execution at Sana with a goal of better understanding our hypoimmune platform, its potential to treat a number of prevalent diseases, and the impacts of clinical data on our longer-term plans.”

Recent Corporate Highlights

Advancing four clinical programs across seven indications, including an allogeneic CAR T program targeting CD19+ cancers, an allogeneic CAR T program for B-cell mediated autoimmune diseases, an allogeneic CAR T program targeting CD22+ cancers, and a primary islet cell therapy in type 1 diabetes:

•SC291 is a hypoimmune (HIP)-modified CD19-directed allogeneic CAR T for patients with B-cell malignancies and B-cell mediated autoimmune diseases.

•The ARDENT trial evaluates SC291 in patients with B-cell malignancies. Early SC291 data from the ongoing ARDENT trial suggest the ability to dose safely, the desired immune evasion profile, and early clinical efficacy. Enrollment in this study continues, and Sana expects to share more data in 2024.

•The GLEAM trial evaluates SC291 in patients with B-cell mediated autoimmune diseases including lupus nephritis, extrarenal lupus, and antineutrophil cytoplasmic antibody (ANCA)-associated vasculitis. The trial has begun enrollment, and Sana expects to share initial data in 2024.

•The VIVID trial evaluates SC262, a HIP-modified CD22-directed allogeneic CAR T, in patients with relapsed or refractory B-cell malignancies. The VIVID trial initially investigates SC262 in patients who have received prior CD19-directed CAR T therapy. The trial has begun enrollment, and Sana expects to share initial data in 2024.

•UP421 is a primary human HIP-modified islet cell therapy for patients with type 1 diabetes. The goal of this investigator-sponsored trial is to understand survival and immune evasion of allogeneic islet cells in patients with autoimmunity and without immunosuppression. The Clinical Trial Application (CTA) cleared in 4Q 2023, and Sana expects to share initial data in the first half of 2024.

Published preclinical data in Cell Stem Cell demonstrating that HIP-modified allogeneic islet cells provided lasting endocrine function in a fully immunocompetent non-human primate with type 1 diabetes, enabling the achievement of exogenous insulin independence without immunosuppression for six-month study duration:

•Sana developed HIP-modified allogeneic islet cells, which cluster into effective endocrine organoids termed “pseudo islet grafts” (p-islets). HIP p-islets engrafted and provided stable endocrine function, enabling insulin independence without immunosuppression.

•The allogeneic HIP p-islet graft survived for the six-month duration of the study with no indication of immune recognition of the HIP p-islet engraftment at any time.

•To demonstrate that there was no regeneration or recovery of an endogenous islet cell population in the diabetic NHP, HIP p-islets were eliminated using an anti-CD47 antibody, demonstrating proof of principle of CD47 overexpression and a potential safety switch.

Completed financing with gross proceeds of approximately $189.8 million to further support activities to enable multiple data readouts:

•Closed on an upsized public offering in February 2024 of 21.8 million shares of Sana’s common stock, which includes the full exercise of the underwriter’s option, and pre-funded warrants to purchase 12.7 million shares of Sana’s common stock. The gross proceeds from this offering were approximately $189.8 million before deducting underwriting discounts and commissions and estimated offering expenses.

First Quarter 2024 Financial Results

GAAP Results

•Cash Position: Cash, cash equivalents, and marketable securities as of March 31, 2024 were $311.1 million compared to $205.2 million as of December 31, 2023. The increase of $105.9 million was primarily driven by net proceeds from equity financings of $181.5 million during the three months ended March 31, 2024, partially offset by cash used in operations of $65.6 million and cash used for the purchase of property and equipment of $15.8 million.

•Research and Development Expenses: For the three months ended March 31, 2024, research and development expenses, inclusive of non-cash expenses, were $56.4 million compared to $67.2 million for the same period in 2023. The decrease of $10.8 million was primarily due to lower personnel-related costs, including non-cash stock-based compensation, and laboratory costs due to a decrease in headcount related to the strategic repositioning in the fourth quarter of 2023, decreased research costs, and lower costs for third-party manufacturing at contract development and manufacturing organizations. These decreases were partially offset by increased clinical development costs. Research and development expenses include non-cash stock-based compensation of $5.8 million and $6.0 million for the three months ended March 31, 2024 and 2023, respectively.

•Research and Development Related Success Payments and Contingent Consideration: For the three months ended March 31, 2024, Sana recognized a non-cash expense of $38.0 million compared to $0.1 million for the same period in 2023, in connection with the change in the estimated fair value of the success payment liabilities and contingent consideration in aggregate. The value of these potential liabilities fluctuate significantly with changes in Sana’s market capitalization and stock price.

•General and Administrative Expenses: General and administrative expenses for the three months ended March 31, 2024, inclusive of non-cash expenses, were $16.3 million compared to $16.8 million for the same period in 2023. The decrease of $0.5 million was primarily due to lower personnel-related costs due to a decrease in headcount related to the strategic repositioning in the fourth quarter of 2023, and a decrease in costs related to Sana’s previously planned manufacturing facility in Fremont, California. These decreases were partially offset by an increase in patent and other legal fees. General and administrative expenses include non-cash stock-based compensation of $3.2 million and $2.8 million for the three months ended March 31, 2024 and 2023, respectively.

•Net Loss: Net loss for the three months ended March 31, 2024 was $107.5 million, or $0.49 per share, compared to $82.1 million, or $0.43 per share for the same period in 2023.

Non-GAAP Measures

•Non-GAAP Operating Cash Burn: Non-GAAP operating cash burn for the three months ended March 31, 2024 was $58.7 million compared to $74.8 million for the same period in 2023. Non-GAAP operating cash burn is the decrease in cash, cash equivalents, and marketable securities, excluding cash inflows from financing activities, cash outflows from business development, non-recurring items, and the purchase of property and equipment.

•Non-GAAP Net Loss: Non-GAAP net loss for the three months ended March 31, 2024 was $69.5 million, or $0.32 per share, compared to $82.0 million, or $0.43 per share, for the same period in 2023. Non-GAAP net loss excludes non-cash expenses and gains related to the change in the estimated fair value of contingent consideration and success payment liabilities.

A discussion of non-GAAP measures, including a reconciliation of GAAP and non-GAAP measures, is presented below under “Non-GAAP Financial Measures.”

About Sana

Sana Biotechnology, Inc. is focused on creating and delivering engineered cells as medicines for patients. We share a vision of repairing and controlling genes, replacing missing or damaged cells, and making our therapies broadly available to patients. We are a passionate group of people working together to create an enduring company that changes how the world treats disease. Sana has operations in Seattle, Cambridge, South San Francisco, and Rochester.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements about Sana Biotechnology, Inc. (the “Company,” “we,” “us,” or “our”) within the meaning of the federal securities laws, including those related to the company’s vision, progress, and business plans; expectations for its development programs, product candidates and technology platforms, including its preclinical, clinical and regulatory development plans and timing expectations; expectations regarding the number of patients to be treated in its clinical trials in 2024 and the indications to be evaluated; expectations regarding the timing, substance, significance, and impact of data from clinical trials of the Company’s product candidates and an IST utilizing HIP-modified primary islet cells in patients with type 1 diabetes; the potential ability to dose safely, achieve the desired immune evasion profile, and achieve clinical efficacy with SC291 in patients with B-cell malignancies; the potential of SC379 as a potential therapy to deliver health GPCs to patients with certain central nervous system disorders; expectations regarding the Company’s 2024 operating cash burn; and expectations regarding the potential of the gross proceeds from the recent financing along with the Company’s existing cash position to support activities through multiple data readouts. All statements other than statements of historical facts contained in this press release, including, among others, statements regarding the Company’s strategy, expectations, cash runway and future financial condition, future operations, and prospects, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “positioned,” “potential,” “predict,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. The Company has based these forward-looking statements largely on its current expectations, estimates, forecasts and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. These statements are subject to risks and uncertainties that could cause the actual results to vary materially, including, among others, the risks inherent in drug development such as those associated with the initiation, cost, timing, progress and results of the Company’s current and future research and development programs, preclinical and clinical trials, as well as economic, market, and social disruptions. For a detailed discussion of the risk factors that could affect the Company’s actual results, please refer to the risk factors identified in the Company’s Securities and Exchange Commission (SEC) reports, including but not limited to its Quarterly Report on Form 10-Q dated May 8, 2024. Except as required by law, the Company undertakes no obligation to update publicly any forward-looking statements for any reason.

###

Investor Relations & Media:

Nicole Keith

investor.relations@sana.com

media@sana.com

Sana Biotechnology, Inc.

Unaudited Selected Consolidated Balance Sheet Data

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

(in thousands) |

|

Cash, cash equivalents, and marketable securities |

|

$ |

311,082 |

|

|

$ |

205,195 |

|

Total assets |

|

|

681,377 |

|

|

|

565,299 |

|

Contingent consideration |

|

|

114,990 |

|

|

|

109,606 |

|

Success payment liabilities |

|

|

45,422 |

|

|

|

12,799 |

|

Total liabilities |

|

|

306,235 |

|

|

|

277,793 |

|

Total stockholders' equity |

|

|

375,142 |

|

|

|

287,506 |

|

Sana Biotechnology, Inc.

Unaudited Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands, except per share data) |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

$ |

56,448 |

|

|

$ |

67,166 |

|

Research and development related success payments and contingent consideration |

|

|

38,007 |

|

|

|

120 |

|

General and administrative |

|

|

16,269 |

|

|

|

16,766 |

|

Total operating expenses |

|

|

110,724 |

|

|

|

84,052 |

|

Loss from operations |

|

|

(110,724 |

) |

|

|

(84,052 |

) |

Interest income, net |

|

|

3,034 |

|

|

|

1,976 |

|

Other income (expense), net |

|

|

215 |

|

|

|

(47 |

) |

Net loss |

|

$ |

(107,475 |

) |

|

$ |

(82,123 |

) |

Net loss per common share – basic and diluted |

|

$ |

(0.49 |

) |

|

$ |

(0.43 |

) |

Weighted-average number of common shares – basic and diluted |

|

|

217,290 |

|

|

|

191,228 |

|

Sana Biotechnology, Inc.

Changes in the Estimated Fair Value of Success Payments and Contingent Consideration

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Success Payment

Liability(1) |

|

|

Contingent

Consideration(2) |

|

|

Total Success Payment Liability and Contingent Consideration |

|

|

|

(in thousands) |

|

Liability balance as of December 31, 2023 |

|

$ |

12,799 |

|

|

$ |

109,606 |

|

|

$ |

122,405 |

|

Changes in fair value – expense |

|

|

32,623 |

|

|

|

5,384 |

|

|

|

38,007 |

|

Liability balance as of March 31, 2024 |

|

$ |

45,422 |

|

|

$ |

114,990 |

|

|

$ |

160,412 |

|

Total change in fair value for the three months ended March 31, 2024 |

|

$ |

32,623 |

|

|

$ |

5,384 |

|

|

$ |

38,007 |

|

(1)Cobalt Biomedicine, Inc. (Cobalt) and the Presidents of Harvard College (Harvard) are entitled to success payments pursuant to the terms and conditions of their respective agreements. The success payments are recorded at fair value and remeasured at each reporting period with changes in the estimated fair value recorded in research and development related success payments and contingent consideration on the statement of operations.

(2)Cobalt is entitled to contingent consideration upon the achievement of certain milestones pursuant to the terms and conditions of the agreement. Contingent consideration is recorded at fair value and remeasured at each reporting period with changes in the estimated fair value recorded in research and development related success payments and contingent consideration on the statement of operations.

Non-GAAP Financial Measures

To supplement the financial results presented in accordance with generally accepted accounting principles in the United States (GAAP), Sana uses certain non-GAAP financial measures to evaluate its business. Sana’s management believes that these non-GAAP financial measures are helpful in understanding Sana’s financial performance and potential future results, as well as providing comparability to peer companies and period over period. In particular, Sana’s management utilizes non-GAAP operating cash burn, non-GAAP research and development expense and non-GAAP net loss and net loss per share. Sana believes the presentation of these non-GAAP measures provides management and investors greater visibility into the company’s actual ongoing costs to operate its business, including actual research and development costs unaffected by non-cash valuation changes and certain one-time expenses for acquiring technology, as well as facilitating a more meaningful comparison of period-to-period activity. Sana excludes these items because they are highly variable from period to period and, in respect of the non-cash expenses, provides investors with insight into the actual cash investment in the development of its therapeutic programs and platform technologies.

These are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read in conjunction with Sana’s financial statements prepared in accordance with GAAP. These non-GAAP measures differ from GAAP measures with the same captions, may be different from non-GAAP financial measures with the same or similar captions that are used by other companies, and do not reflect a comprehensive system of accounting. Sana’s management uses these supplemental non-GAAP financial measures internally to understand, manage, and evaluate Sana’s business and make operating decisions. In addition, Sana’s management believes that the presentation of these non-GAAP financial measures is useful to investors because they enhance the ability of investors to compare Sana’s results from period to period and allows for greater transparency with respect to key financial metrics Sana uses in making operating decisions. The following are reconciliations of GAAP to non-GAAP financial measures:

Sana Biotechnology, Inc.

Unaudited Reconciliation of Change in Cash, Cash Equivalents, and Marketable Securities to

Non-GAAP Operating Cash Burn

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Beginning cash, cash equivalents, and marketable securities |

|

$ |

205,195 |

|

|

$ |

434,014 |

|

Ending cash, cash equivalents, and marketable securities |

|

|

311,082 |

|

|

|

355,131 |

|

Change in cash, cash equivalents, and marketable securities |

|

|

105,887 |

|

|

|

(78,883 |

) |

Cash paid to purchase property and equipment |

|

|

15,845 |

|

|

|

2,176 |

|

Change in cash, cash equivalents, and marketable securities, excluding capital expenditures |

|

|

121,732 |

|

|

|

(76,707 |

) |

Adjustments: |

|

|

|

|

|

|

Net proceeds from issuance of common stock |

|

|

(181,468 |

) |

|

|

- |

|

Cash paid for personnel-related costs related to portfolio prioritizations |

|

|

1,019 |

|

|

|

1,881 |

|

Operating cash burn – Non-GAAP |

|

$ |

(58,717 |

) |

|

$ |

(74,826 |

) |

Sana Biotechnology, Inc.

Unaudited Reconciliation of GAAP to Non-GAAP Net Loss and Net Loss Per Share

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands, except per share data) |

|

Net loss – GAAP |

|

$ |

(107,475 |

) |

|

$ |

(82,123 |

) |

Adjustments: |

|

|

|

|

|

|

Change in the estimated fair value of the success payment liabilities(1) |

|

|

32,623 |

|

|

|

(5,340 |

) |

Change in the estimated fair value of contingent consideration(2) |

|

|

5,384 |

|

|

|

5,460 |

|

Net loss – Non-GAAP |

|

$ |

(69,468 |

) |

|

$ |

(82,003 |

) |

Net loss per share – GAAP |

|

$ |

(0.49 |

) |

|

$ |

(0.43 |

) |

Adjustments: |

|

|

|

|

|

|

Change in the estimated fair value of the success payment liabilities(1) |

|

|

0.15 |

|

|

|

(0.03 |

) |

Change in the estimated fair value of contingent consideration(2) |

|

|

0.02 |

|

|

|

0.03 |

|

Net loss per share – Non-GAAP |

|

$ |

(0.32 |

) |

|

$ |

(0.43 |

) |

Weighted-average shares outstanding – basic and diluted |

|

|

217,290 |

|

|

|

191,228 |

|

(1)For the three months ended March 31, 2024, the expense related to the Cobalt success payment liability was $27.9 million compared to a gain of $4.8 million for the same period in 2023. For the three months ended March 31, 2024, the expense related to the Harvard success payment liability was $4.7 million compared to a gain of $0.6 million for the same period in 2023.

(2)The contingent consideration is in connection with the acquisition of Cobalt.

v3.24.1.u1

Document and Entity Information

|

May 08, 2024 |

| Cover [Abstract] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001770121

|

| Document Type |

8-K

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

SANA BIOTECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39941

|

| Entity Tax Identification Number |

83-1381173

|

| Entity Address, Address Line One |

188 East Blaine Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98102

|

| City Area Code |

(206)

|

| Local Phone Number |

701-7914

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

SANA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

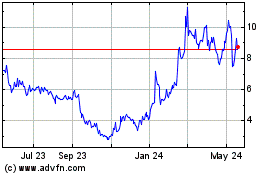

Sana Biotechnology (NASDAQ:SANA)

Historical Stock Chart

From Apr 2024 to May 2024

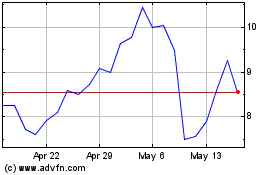

Sana Biotechnology (NASDAQ:SANA)

Historical Stock Chart

From May 2023 to May 2024