FISCAL 2021 SECOND QUARTER KEY

FINANCIAL HIGHLIGHTS

- Revenues were $2.41 billion, a 3% decline compared to $2.48

billion in the prior year – Adjusted Revenues increased 2% compared

to the prior year

- Net income of $261 million compared to $103 million in the

prior year

- Total Segment EBITDA was $497 million compared to $355

million in the prior year

- Reported diluted EPS were $0.39 compared to $0.14 in the

prior year – Adjusted EPS were $0.34 compared to $0.18 in the prior

year

- Book Publishing Segment EBITDA increased 65% compared to the

prior year, driven by strong revenue growth across every

category

- Move, operator of realtor.com®, reported 28% revenue growth

and was a key driver of Segment EBITDA growth at the Digital Real

Estate Services segment

- Dow Jones reported 43% Segment EBITDA growth, driven

by record digital advertising revenues and continued growth in

digital subscriptions

- Subscription Video Services Segment EBITDA grew 77% as

Foxtel benefited from lower costs while reaching a record of more

than 1.3 million paying OTT subscribers as of the quarter

end

News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS,

NWSA; ASX: NWS, NWSLV) today reported financial results for the

three months ended December 31, 2020. Commenting on the results,

Chief Executive Robert Thomson said:

“The second quarter of fiscal 2021 was the most profitable

quarter since the new News Corp was launched more than seven years

ago, reflecting the ongoing digital transformation of the business.

We reported the largest profits for Dow Jones since the acquisition

of the company in 2007, with Segment EBITDA increasing 43 percent

and traffic across the Dow Jones digital network surging 48

percent.

There was also a 77 percent rise in Segment EBITDA at the

Subscription Video Services segment, where the exponential

evolution at Foxtel continued apace, with streaming customers

increasing over 90 percent, rights costs reset and audiences for

summer sports at unprecedented levels.

Rapid expansion continued at Move, which accounted for about 80

percent of Segment EBITDA growth in the Digital Real Estate

Services segment, while revenue grew 28 percent compared to a year

earlier. Realtor.com®’s traffic growth has now outpaced that of

Zillow for the last 11 months in a row, according to Comscore, and

monthly average unique users were 37 percent higher during the

quarter compared to the prior year.

In the Book Publishing segment, HarperCollins’ revenues rose 23

percent, with double digit growth across every category, and a 65

percent burgeoning of Segment EBITDA. And history was also made at

the New York Post, which reported its first profit in modern times

– a notable feat for what had been a chronic loss-making masthead

founded in 1801 by Alexander Hamilton.”

SECOND QUARTER RESULTS

The Company reported fiscal 2021 second quarter total revenues

of $2.41 billion, 3% lower compared to $2.48 billion in the prior

year period. The decline was mainly due to lower revenues at the

News Media segment, primarily driven by a $191 million, or 8%,

negative impact from the divestiture of News America Marketing,

weakness in the print advertising market, and a $34 million, or 1%,

negative impact from the closure or transition to digital of

certain regional and community newspapers in Australia. The decline

was partially offset by growth in the Book Publishing, Digital Real

Estate Services and Dow Jones segments, as well as a $75 million,

or 3%, positive impact from foreign currency fluctuations. Adjusted

Revenues (which exclude the foreign currency impact, acquisitions

and divestitures as defined in Note 2) increased 2%.

Net income for the quarter was $261 million compared to $103

million in the prior year, reflecting higher Total Segment EBITDA,

as discussed below, and higher Other, net, partially offset by

higher tax expense.

The Company reported second quarter Total Segment EBITDA of $497

million, a 40% increase compared to $355 million in the prior year.

The increase was primarily due to the strong performance at key

segments, driven by a combination of improved operating trends and

cost reductions, as well as an $18 million, or 6%, positive impact

from foreign currency fluctuations. Adjusted Total Segment EBITDA

(as defined in Note 2) increased 39%.

Diluted net income per share attributable to News Corporation

stockholders was $0.39 as compared to $0.14 in the prior year.

Adjusted EPS (as defined in Note 3) were $0.34 compared to $0.18

in the prior year.

SEGMENT REVIEW

For the three months ended

December 31,

For the six months ended December

31,

2020

2019

% Change

2020

2019

% Change

(in millions)

Better/ (Worse)

(in millions)

Better/ (Worse)

Revenues:

Digital Real Estate Services

$

339

$

294

15

%

$

629

$

566

11

%

Subscription Video Services

511

501

2

%

1,007

1,015

(1

)

%

Dow Jones(a)

446

430

4

%

832

812

2

%

Book Publishing

544

442

23

%

1,002

847

18

%

News Media(a)

573

811

(29

)

%

1,060

1,578

(33

)

%

Other

1

1

—

%

1

1

—

%

Total Revenues

$

2,414

$

2,479

(3

)

%

$

4,531

$

4,819

(6

)

%

Segment EBITDA:

Digital Real Estate Services

$

142

$

118

20

%

$

261

$

200

31

%

Subscription Video Services

124

70

77

%

202

151

34

%

Dow Jones

109

76

43

%

181

125

45

%

Book Publishing

104

63

65

%

175

112

56

%

News Media

66

66

—

%

44

73

(40

)

%

Other

(48

)

(38

)

(26

)

%

(98

)

(85

)

(15

)

%

Total Segment EBITDA

$

497

$

355

40

%

$

765

$

576

33

%

(a)

In the fourth quarter of fiscal 2020, the

Company revised the composition of its reportable segments to

present the Dow Jones business as a separate segment. Previously,

the financial information for this segment was aggregated with the

businesses within the News Media segment and, together, formed the

News and Information Services segment. All prior periods have been

revised to reflect the new segment presentation.

Digital Real Estate Services

Revenues in the quarter increased $45 million, or 15%, compared

to the prior year, including a $12 million, or 4%, positive impact

from foreign currency fluctuations. Segment EBITDA in the quarter

increased $24 million, or 20%, compared to the prior year,

primarily due to $19 million of higher contribution from Move and a

positive impact of $7 million, or 6%, from foreign currency

fluctuations. Adjusted Revenues and Adjusted Segment EBITDA (as

defined in Note 2) increased 11% and 19%, respectively.

Move’s revenues in the quarter increased $34 million, or 28%, to

$155 million, primarily as a result of higher real estate revenues.

Real estate revenues, which represented 83% of total Move revenues,

grew $30 million, or 30%, due to the continued strength in the

referral model and the recovery in the traditional lead generation

product, both benefiting from an over 30% increase in average

monthly lead volume and higher transaction volume. The referral

model also benefited from higher average home values and generated

approximately 30% of total Move revenues. The traditional lead

generation product saw continued strong demand from agents, driving

increased sell-through and yield. Based on Move’s internal data,

average monthly unique users of realtor.com®’s web and mobile sites

for the fiscal second quarter grew 37% year-over-year to 80

million.

In the quarter, revenues at REA Group increased $11 million, or

6%, to $184 million, primarily driven by a $12 million, or 7%,

positive impact from foreign currency fluctuations. The modest

revenue declines in the commercial and Asia businesses were offset

by growth in Australian residential depth revenues. Australian

national residential listing volumes in the quarter increased 10%

compared to the prior year as more markets recovered with the

relaxation of government restrictions, with listings in Melbourne

and Sydney up 25% and 13%, respectively.

Subscription Video Services

Revenues in the quarter increased $10 million, or 2%, compared

with the prior year, reflecting a $33 million, or 7%, positive

impact from foreign currency fluctuations and higher revenues from

OTT products. The revenue increase was partially offset by the

impact from fewer residential broadcast subscribers and an $11

million, or 2%, negative impact from lower commercial subscription

revenues resulting from the ongoing restrictions on pubs, clubs and

other commercial venues due to COVID-19. Adjusted Revenues

decreased 5% compared to the prior year.

As of December 31, 2020, Foxtel’s total closing paid subscribers

were 3.314 million, a 12% increase compared to the prior year,

primarily due to the launch of Binge and the growth in Kayo

subscribers, partially offset by lower residential and commercial

broadcast subscribers. 2.001 million of the total closing

subscribers were residential and commercial broadcast subscribers,

and the remaining 1.313 million consisted of Kayo, Binge and Foxtel

Now subscribers. As of December 31, 2020, there were 648,000 Kayo

subscribers (624,000 paying), compared to 372,000 subscribers

(350,000 paying) in the prior year. Binge, which launched in May

2020, had 468,000 subscribers (431,000 paying) as of December 31,

2020. As of December 31, 2020, there were 265,000 Foxtel Now

subscribers (258,000 paying), compared to 343,000 subscribers

(334,000 paying) in the prior year.

Broadcast subscriber churn in the quarter increased to 17.5%

from 16.0% in the prior year, due to fewer promotions and the

roll-off of lower value subscribers. Broadcast ARPU for the quarter

increased 3% to A$80 (US$58).

Segment EBITDA in the quarter increased $54 million, or 77%,

compared with the prior year. The improvement reflects $35 million

of lower sports programming rights and production costs, which was

primarily driven by the savings from renegotiated sports rights,

partially offset by the $20 million negative impact related to the

deferral of costs from the fourth quarter of fiscal 2020. The

Segment EBITDA improvement was also due to lower entertainment

programming costs, lower overhead expenses resulting from cost

reduction efforts and an $8 million positive impact from foreign

currency fluctuations. Adjusted Segment EBITDA increased 66%.

Dow Jones

Revenues in the quarter increased $16 million, or 4%, compared

to the prior year, primarily due to growth in circulation and

subscription and digital advertising revenues, partially offset by

lower print advertising revenues. Digital revenues at Dow Jones in

the quarter represented 70% of total revenues compared to 64% in

the prior year.

Circulation and subscription revenues increased $23 million, or

8%, including a $3 million, or 1%, positive impact from foreign

currency fluctuations. Circulation revenue grew 8%, reflecting the

continued strong growth in digital-only subscriptions, partially

offset by lower single-copy and amenity sales related to COVID-19.

Professional information business revenues grew 4%, driven by 21%

growth in Risk & Compliance products, partially offset by the

decline in revenues from other professional information business

products. Digital circulation revenues accounted for 63% of

circulation revenues for the quarter, compared to 57% in the prior

year.

During the second quarter, Dow Jones saw the highest

year-over-year growth in total subscriptions and digital-only

subscriptions for both The Wall Street Journal and total Dow Jones’

consumer products in its history. Total subscriptions to Dow Jones’

consumer products reached a record 4.03 million average

subscriptions for the quarter, an 18% increase compared to the

prior year, of which digital-only subscriptions grew 29%. Total

subscriptions to The Wall Street Journal grew 19% compared to the

prior year, to a record 3.22 million average subscriptions in the

quarter. Digital-only subscriptions to The Wall Street Journal grew

28% to more than 2.46 million average subscriptions in the quarter,

and represented 76% of total Wall Street Journal subscriptions.

Advertising revenues decreased $5 million, or 4%, primarily due

to a 29% decline in print advertising revenues, driven by general

market weakness and lower print volume across The Wall Street

Journal and Barron’s due to COVID-19. The decline was partially

offset by record quarterly digital advertising revenues, driven by

custom revenue and a rebound in direct display sales. Digital

advertising revenues grew 29% compared to the prior year, which was

the highest growth rate in 10 years. Digital advertising accounted

for 58% of total advertising revenues in the quarter, compared to

43% in the prior year.

Segment EBITDA for the quarter increased $33 million, or 43%,

primarily due to higher revenues, as discussed above, and lower

costs related to lower print volume and other discretionary cost

savings, partially offset by higher compensation costs.

Book Publishing

Revenues in the quarter increased $102 million, or 23%, compared

to the prior year, including a $5 million, or 1%, positive impact

from foreign currency fluctuations. The revenue growth was

primarily due to higher sales in every category with the success of

titles such as Didn’t See That Coming by Rachel Hollis, The Happy

in a Hurry Cookbook by Steve Doocy, The Greatest Secret by Rhonda

Byrne and Code Name Bananas by David Walliams. Adjusted Revenues

increased 19%. Digital sales increased 15% compared to the prior

year, driven by growth in both e-book and downloadable audiobook

sales. Digital sales represented 18% of Consumer revenues for the

quarter. Segment EBITDA for the quarter increased $41 million, or

65%, compared to the prior year, primarily due to the higher

revenues discussed above and the mix of titles. Adjusted Segment

EBITDA increased 60%.

News Media

Revenues in the quarter decreased $238 million, or 29%, as

compared to the prior year, including a $22 million, or 3%,

positive impact from foreign currency fluctuations. The decline was

primarily driven by a $191 million, or 24%, impact from the

divestiture of News America Marketing in May 2020. The decline also

reflects weakness in the print advertising market and the $34

million, or 4%, impact from the closure or transition to digital of

certain regional and community newspapers in Australia. Within the

segment, revenues at News Corp Australia and News UK declined 11%

and 5%, respectively. Adjusted Revenues for the segment decreased

9% compared to the prior year.

Circulation and subscription revenues increased $12 million, or

5%, compared to the prior year, primarily due to digital subscriber

growth, a $9 million, or 4%, positive impact from foreign currency

fluctuations and price increases, partially offset by lower

single-copy sales revenue, primarily at News UK and the New York

Post.

Advertising revenues decreased $231 million, or 48%, compared to

the prior year, reflecting a $191 million, or 40%, negative impact

from the divestiture of News America Marketing. The remainder of

the decline was driven by continued weakness in the print

advertising market, exacerbated by COVID-19, and a $28 million, or

6%, negative impact related to the closure or transition to digital

of certain regional and community newspapers in Australia,

partially offset by a $10 million, or 2%, positive impact from

foreign currency fluctuations and growth in digital advertising at

the New York Post and News UK.

In the quarter, Segment EBITDA was flat compared to the prior

year, as higher cost savings at News UK and News Corp Australia, as

well as a positive contribution from the New York Post, were offset

by lower revenues, as discussed above, and the absence of a $22

million one-time benefit in the prior year from the settlement of

certain warranty related claims in the U.K. Adjusted Segment EBITDA

increased 5%.

Digital revenues represented 31% of News Media segment revenues

in the quarter, compared to 22% in the prior year, and represented

29% of the combined revenues of the newspaper mastheads. Digital

subscribers and users across key properties within the News Media

segment are summarized below:

- Closing digital subscribers at News Corp Australia’s mastheads

as of December 31, 2020 were 738,300, compared to 566,600 in the

prior year (Source: Internal data)

- The Times and Sunday Times closing digital subscribers as of

December 31, 2020 were 335,000, compared to 320,000 in the prior

year (Source: Internal data)

- The Sun’s digital offering reached 130 million global monthly

unique users in December 2020, compared to 140 million in the prior

year (Source: Google Analytics)

- New York Post’s digital network reached 141 million unique

users in December 2020, compared to 95 million in the prior year

(Source: Google Analytics)

CASH FLOW

The following table presents a reconciliation of net cash

provided by operating activities to free cash flow available to

News Corporation:

For the six months ended December

31,

2020

2019

(in millions)

Net cash provided by operating

activities

$

483

$

192

Less: Capital expenditures

(173

)

(237

)

310

(45)

Less: REA Group free cash flow

(65

)

(86

)

Plus: Cash dividends received from REA

Group

32

35

Free cash flow available to News

Corporation

$

277

$

(96

)

Net cash provided by operating activities of $483 million for

the six months ended December 31, 2020 was $291 million higher than

$192 million in the prior year, primarily due to higher Total

Segment EBITDA as noted above and lower working capital.

Free cash flow available to News Corporation in the six months

ended December 31, 2020 was $277 million compared to $(96) million

in the prior year period. The improvement was primarily due to

higher cash provided by operating activities, as mentioned above,

and lower capital expenditures. Foxtel’s capital expenditures for

the six months ended December 31, 2020 were $79 million, compared

to $129 million in the prior year.

Free cash flow available to News Corporation is a non-GAAP

financial measure defined as net cash provided by operating

activities, less capital expenditures (“free cash flow”), less REA

Group free cash flow, plus cash dividends received from REA

Group.

The Company considers free cash flow available to News

Corporation to provide useful information to management and

investors about the amount of cash that is available to be used to

strengthen the Company’s balance sheet and for strategic

opportunities including, among others, investing in the Company’s

business, strategic acquisitions, dividend payouts and repurchasing

stock. The Company believes excluding REA Group’s free cash flow

and including dividends received from REA Group provides users of

its consolidated financial statements with a measure of the amount

of cash flow that is readily available to the Company, as REA Group

is a separately listed public company in Australia and must declare

a dividend in order for the Company to have access to its share of

REA Group’s cash balance. The Company believes free cash flow

available to News Corporation provides a more conservative view of

the Company’s free cash flow because this presentation includes

only that amount of cash the Company actually receives from REA

Group, which has generally been lower than the Company’s unadjusted

free cash flow. A limitation of free cash flow available to News

Corporation is that it does not represent the total increase or

decrease in the cash balance for the period. Management compensates

for the limitation of free cash flow available to News Corporation

by also relying on the net change in cash and cash equivalents as

presented in the Company’s consolidated statements of cash flows

prepared in accordance with GAAP which incorporates all cash

movements during the period.

OTHER ITEMS

COVID-19 Impact and Outlook

The ongoing impact of the COVID-19 pandemic and measures to

prevent its spread continue to create significant economic

volatility, uncertainty and disruption, affecting the Company’s

businesses in a number of ways. The discussion below summarizes the

effects on the Company’s businesses during the six months ended

December 31, 2020 and through the date of this filing, as well as

expected trends for the second half of fiscal 2021:

Digital Real Estate Services: The real estate markets in

Australia, Asia and the U.S. have been, and may continue to be,

impacted as a result of social distancing measures, business

closures and economic uncertainty resulting from COVID-19. In

January, national residential listings in Australia were flat

compared to the prior year with a 12% increase in Melbourne and a

1% decline in Sydney. Consumer confidence is improving as COVID-19

cases remain extremely low in Australia. Based on the current

market outlook and excluding the impact of acquisitions, REA Group

expects core operating costs for fiscal 2021 to be broadly in-line

with the prior year. Second half results will be impacted by the

consolidation of Elara. In the U.S., Move is benefiting from strong

consumer demand, with unique users and leads at all-time highs,

despite active listings across the industry remaining at

historically low levels. Unique users at realtor.com® in January

grew 37% year-over-year to a record 94 million. Higher expected

revenues driven by growth in traffic and lead volumes will fund

reinvestment in the second half of fiscal 2021. The Company expects

to invest an additional $40 million in brand marketing and product

development compared to the prior year to drive further market

share and expand into adjacent verticals.

Subscription Video Services: Foxtel’s revenue trends have been

better than anticipated in the first half of fiscal 2021, with

higher ARPU offsetting higher churn, resulting in lower

year-over-year revenue declines in residential broadcast. Broadcast

churn is expected to remain elevated due to the suspension of

government stimulus payments and Foxtel’s ongoing emphasis on ARPU.

In addition, higher average OTT subscribers through January should

result in higher than expected OTT revenue for the full year. The

ongoing disruption in operations at pubs and clubs from government

imposed occupancy restrictions and lower occupancy at hotels

throughout Australia due to the domestic travel restrictions are

expected to continue to adversely impact commercial subscription

revenue. Given Foxtel’s continued investment in its OTT products as

well as higher costs from the higher revenue, the Company now

expects the full year overall net cost reductions to be less than

$73 million (A$100 million), compared to the previous estimate of

net A$160 million ($117 million), inclusive of approximately $58

million (A$80 million) of higher sports costs in the second half of

fiscal 2021, particularly in the fourth quarter, compared to the

prior year. U.S. dollar amounts are converted by using the fiscal

2021 second quarter average exchange rate (See Note 2).

Dow Jones and News Media: COVID-19 continues to exacerbate print

advertising weakness and negatively impact weekday print volumes

due to increased economic uncertainty and lower demand for single

copy and amenity newspapers driven by decreased foot traffic

resulting from remote working, social distancing measures and other

government restrictions. The latest national lockdown in the U.K.,

the continuation of remote working in the U.S. and, to a lesser

extent, the current domestic travel restrictions in Australia are

expected to continue to negatively impact these revenue streams in

the second half of the fiscal year. However, the Company has seen

increases in digital paid subscriptions and digital audience gains

at online versions of many of its news properties. Additionally,

the Company implemented strict and immediate discretionary cost

controls towards the end of fiscal 2020 in response to COVID-19 and

related uncertainty. At the News Media segment, cost declines in

the second half are expected to moderate from the rate of decline

in the first half as the Company laps these COVID-19 related cost

savings as well as the sale of News America Marketing. At Dow

Jones, given the performance in the first half of fiscal 2021, the

Company expects expenses to increase modestly in the second half

compared to the prior year period as the Company reinvests in its

digital assets to drive longer-term growth.

Book Publishing: While the Company has benefited from changing

consumer behavior as a consequence of COVID-19, such as the

increase in free time for consumers to read and the increase in the

average number of books purchased, the Company continues to monitor

the sustainability of these recent consumer patterns. Currently the

Company is expecting performance to moderate in the second half of

fiscal 2021, particularly in the fourth quarter, in part due to the

strong performance in the prior year, which benefited from

increased consumer demand at the onset of COVID-19 lockdowns and

restrictions.

Other: The Company expects costs to increase by at least $50

million in the second half of fiscal 2021, primarily due to higher

employee costs related to stock price performance, the absence of

the bonus reductions for certain employees, including the senior

executive team, implemented in the prior year in response to

COVID-19, as well as initial investment spending as the Company

ramps up the global shared services initiative.

Dividends

The Company today declared a semi-annual cash dividend of $0.10

per share for Class A Common Stock and Class B Common Stock. This

dividend is payable on April 14, 2021 to stockholders of record as

of March 17, 2021.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment

EBITDA, Adjusted Segment EBITDA, adjusted net income attributable

to News Corporation stockholders, Adjusted EPS and free cash flow

available to News Corporation are non-GAAP financial measures

contained in this earnings release. The Company believes these

measures are important tools for investors and analysts to use in

assessing the Company’s underlying business performance and to

provide for more meaningful comparisons of the Company’s operating

performance between periods. These measures also allow investors

and analysts to view the Company’s business from the same

perspective as Company management. These non-GAAP measures may be

different than similar measures used by other companies and should

be considered in addition to, not as a substitute for, measures of

financial performance calculated in accordance with GAAP.

Reconciliations for the differences between non-GAAP measures used

in this earnings release and comparable financial measures

calculated in accordance with U.S. GAAP are included in Notes 1, 2

and 3 and the reconciliation of net cash provided by operating

activities to free cash flow available to News Corporation is

included above.

Conference call

News Corporation’s earnings conference call can be heard live at

4:30pm EST on February 4, 2021. To listen to the call, please visit

http://investors.newscorp.com.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements include, but are not

limited to, statements regarding trends and uncertainties affecting

the Company’s business, results of operations and financial

condition, including expected impacts from the ongoing COVID-19

pandemic and related public health measures, the Company’s strategy

and strategic initiatives, including potential acquisitions,

investments and dispositions, and the outcome of contingencies such

as litigation and investigations. These statements are based on

management’s views and assumptions regarding future events and

business performance as of the time the statements are made. Actual

results may differ materially from these expectations due to the

risks and uncertainties related to COVID-19 and the risks,

uncertainties and other factors described in the Company’s filings

with the Securities and Exchange Commission (many of which may be

amplified by COVID-19). The ultimate impact of the COVID-19

pandemic, including the extent of adverse impacts on the Company’s

business, results of operations, cash flows and financial

condition, will depend on, among other things, the severity,

duration, spread and any reoccurrence of the pandemic, the impact

of governmental actions and business and consumer behavior in

response to the pandemic, the effectiveness of actions taken to

contain or mitigate the outbreak and prevent or limit any

reoccurrence, including the development, availability and public

acceptance of effective treatments and vaccines, the resulting

global economic conditions and how quickly and to what extent

normal economic and operating conditions can resume, all of which

are highly uncertain and cannot be predicted. More detailed

information about this and other factors that could affect future

results is contained in our filings with the Securities and

Exchange Commission. The “forward-looking statements” included in

this document are made only as of the date of this document and we

do not have and do not undertake any obligation to publicly update

any “forward-looking statements” to reflect subsequent events or

circumstances, and we expressly disclaim any such obligation,

except as required by law or regulation.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: digital real estate services,

subscription video services in Australia, news and information

services and book publishing. Headquartered in New York, News Corp

operates primarily in the United States, Australia, and the United

Kingdom, and its content and other products and services are

distributed and consumed worldwide. More information is available

at: www.newscorp.com.

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited; in millions,

except per share amounts)

For the three months ended

December 31,

For the six months ended December

31,

2020

2019

2020

2019

Revenues:

Circulation and subscription

$

1,030

$

990

$

2,032

$

1,985

Advertising

448

677

780

1,285

Consumer

523

421

964

808

Real estate

281

242

516

460

Other

132

149

239

281

Total Revenues

2,414

2,479

4,531

4,819

Operating expenses

(1,198

)

(1,351

)

(2,362

)

(2,689

)

Selling, general and administrative

(719

)

(773

)

(1,404

)

(1,554

)

Depreciation and amortization

(167

)

(162

)

(331

)

(324

)

Impairment and restructuring charges

(23

)

(29

)

(63

)

(326

)

Equity losses of affiliates

(3

)

(3

)

(4

)

(5

)

Interest expense, net

(12

)

(8

)

(20

)

(4

)

Other, net

54

2

71

6

Income (loss) before income tax

expense

346

155

418

(77

)

Income tax expense

(85

)

(52

)

(110

)

(31

)

Net income (loss)

261

103

308

(108

)

Less: Net income attributable to

noncontrolling interests

(30

)

(18

)

(43

)

(34

)

Net income (loss) attributable to News

Corporation stockholders

$

231

$

85

$

265

$

(142

)

Weighted average shares outstanding:

Basic

591

588

590

587

Diluted

593

590

592

587

Net income (loss) attributable to News

Corporation stockholders per share:

Basic

$

0.39

$

0.15

$

0.45

$

(0.24

)

Diluted

$

0.39

$

0.14

$

0.45

$

(0.24

)

NEWS CORPORATION

CONSOLIDATED BALANCE

SHEETS

(Unaudited; in

millions)

As of December 31, 2020

As of June 30, 2020

ASSETS

Current assets:

Cash and cash equivalents

$

1,562

$

1,517

Receivables, net

1,444

1,203

Inventory, net

203

348

Other current assets

387

393

Total current assets

3,596

3,461

Non-current assets:

Investments

353

297

Property, plant and equipment, net

2,315

2,256

Operating lease right-of-use assets

1,074

1,061

Intangible assets, net

1,934

1,864

Goodwill

4,292

3,951

Deferred income tax assets

337

332

Other non-current assets

1,193

1,039

Total assets

$

15,094

$

14,261

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

291

$

351

Accrued expenses

1,094

1,019

Deferred revenue

400

398

Current borrowings

212

76

Other current liabilities

864

838

Total current liabilities

2,861

2,682

Non-current liabilities:

Borrowings

1,044

1,183

Retirement benefit obligations

254

277

Deferred income tax liabilities

339

258

Operating lease liabilities

1,160

1,146

Other non-current liabilities

362

326

Commitments and contingencies

Equity:

Class A common stock

4

4

Class B common stock

2

2

Additional paid-in capital

12,091

12,148

Accumulated deficit

(2,976

)

(3,241

)

Accumulated other comprehensive loss

(990

)

(1,331

)

Total News Corporation stockholders'

equity

8,131

7,582

Noncontrolling interests

943

807

Total equity

9,074

8,389

Total liabilities and equity

$

15,094

$

14,261

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited; in

millions)

For the six months ended December

31,

2020

2019

Operating activities:

Net income (loss)

$

308

$

(108

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

331

324

Operating lease expense

64

86

Equity losses of affiliates

4

5

Cash distributions received from

affiliates

7

5

Impairment charges

—

292

Other, net

(71

)

(6

)

Deferred income taxes and taxes

payable

21

(35

)

Change in operating assets and

liabilities, net of acquisitions:

Receivables and other assets

(172

)

(1,661

)

Inventories, net

27

3

Accounts payable and other liabilities

(36

)

1,287

Net cash provided by operating

activities

483

192

Investing activities:

Capital expenditures

(173

)

(237

)

Acquisitions, net of cash acquired

(90

)

(2

)

Investments in equity affiliates and

other

(11

)

(8

)

Proceeds from property, plant and

equipment and other asset dispositions

3

10

Other, net

(5

)

3

Net cash used in investing activities

(276

)

(234

)

Financing activities:

Borrowings

146

917

Repayment of borrowings

(248

)

(1,161

)

Dividends paid

(80

)

(81

)

Other, net

(37

)

(3

)

Net cash used in financing activities

(219

)

(328

)

Net change in cash and cash

equivalents

(12

)

(370

)

Cash and cash equivalents, beginning of

period

1,517

1,643

Exchange movement on opening cash

balance

57

(1

)

Cash and cash equivalents, end of

period

$

1,562

$

1,272

NOTE 1 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: depreciation and amortization, impairment and

restructuring charges, equity losses of affiliates, interest

(expense) income, net, other, net and income tax (expense) benefit.

Management believes that Segment EBITDA is an appropriate measure

for evaluating the operating performance of the Company’s business

segments because it is the primary measure used by the Company’s

chief operating decision maker to evaluate the performance of and

allocate resources within the Company’s businesses. Segment EBITDA

provides management, investors and equity analysts with a measure

to analyze the operating performance of each of the Company’s

business segments and its enterprise value against historical data

and competitors’ data, although historical results may not be

indicative of future results (as operating performance is highly

contingent on many factors, including customer tastes and

preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income

(loss), cash flow and other measures of financial performance

reported in accordance with GAAP. In addition, this measure does

not reflect cash available to fund requirements and excludes items,

such as depreciation and amortization and impairment and

restructuring charges, which are significant components in

assessing the Company’s financial performance. The Company believes

that the presentation of Total Segment EBITDA provides useful

information regarding the Company’s operations and other factors

that affect the Company’s reported results. Specifically, the

Company believes that by excluding certain one-time or non-cash

items such as impairment and restructuring charges and depreciation

and amortization, as well as potential distortions between periods

caused by factors such as financing and capital structures and

changes in tax positions or regimes, the Company provides users of

its consolidated financial statements with insight into both its

core operations as well as the factors that affect reported results

between periods but which the Company believes are not

representative of its core business. As a result, users of the

Company’s consolidated financial statements are better able to

evaluate changes in the core operating results of the Company

across different periods. The following tables reconcile net income

(loss) to Total Segment EBITDA for the three and six months ended

December 31, 2020 and 2019:

For the three months ended

December 31,

2020

2019

Change

% Change

(in millions)

Net income

$

261

$

103

$

158

**

Add:

Income tax expense

85

52

33

63%

Other, net

(54

)

(2

)

(52

)

**

Interest expense, net

12

8

4

50%

Equity losses of affiliates

3

3

—

—%

Impairment and restructuring charges

23

29

(6

)

(21)%

Depreciation and amortization

167

162

5

3%

Total Segment EBITDA

$

497

$

355

$

142

40%

** - Not meaningful

For the six months ended December

31,

2020

2019

Change

% Change

(in millions)

Net income (loss)

$

308

$

(108

)

$

416

**

Add:

Income tax expense

110

31

79

**

Other, net

(71

)

(6

)

(65

)

**

Interest expense, net

20

4

16

**

Equity losses of affiliates

4

5

(1

)

(20)%

Impairment and restructuring charges

63

326

(263

)

(81)%

Depreciation and amortization

331

324

7

2%

Total Segment EBITDA

$

765

$

576

$

189

33%

** - Not meaningful

NOTE 2 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, fees and

costs, net of indemnification, related to the claims and

investigations arising out of certain conduct at The News of the

World (the “U.K. Newspaper Matters”) and foreign currency

fluctuations (“Adjusted Revenues,” “Adjusted Total Segment EBITDA”

and “Adjusted Segment EBITDA,” respectively) to evaluate the

performance of the Company’s core business operations exclusive of

certain items that impact the comparability of results from period

to period such as the unpredictability and volatility of currency

fluctuations. The Company calculates the impact of foreign currency

fluctuations for businesses reporting in currencies other than the

U.S. dollar by multiplying the results for each quarter in the

current period by the difference between the average exchange rate

for that quarter and the average exchange rate in effect during the

corresponding quarter of the prior year and totaling the impact for

all quarters in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events

warrant adjustment. Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA are not measures of performance

under generally accepted accounting principles and should not be

construed as substitutes for amounts determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three and six months ended December 31, 2020

and 2019:

Revenues

Total Segment EBITDA

For the three months ended

December 31,

For the three months ended

December 31,

2020

2019

Difference

2020

2019

Difference

(in millions)

(in millions)

As reported

$

2,414

$

2,479

$

(65

)

$

497

$

355

$

142

Impact of acquisitions

(14

)

—

(14

)

3

—

3

Impact of divestitures

(1

)

(210

)

209

1

(4

)

5

Impact of foreign currency

fluctuations

(75

)

—

(75

)

(18

)

—

(18

)

Net impact of U.K. Newspaper Matters

—

—

—

3

(1

)

4

As adjusted

$

2,324

$

2,269

$

55

$

486

$

350

$

136

Revenues

Total Segment EBITDA

For the six months ended December

31,

For the six months ended December

31,

2020

2019

Difference

2020

2019

Difference

(in millions)

(in millions)

As reported

$

4,531

$

4,819

$

(288

)

$

765

$

576

$

189

Impact of acquisitions

(24

)

—

(24

)

2

—

2

Impact of divestitures

(1

)

(420

)

419

1

(15

)

16

Impact of foreign currency

fluctuations

(125

)

—

(125

)

(26

)

—

(26

)

Net impact of U.K. Newspaper Matters

—

—

—

5

1

4

As adjusted

$

4,381

$

4,399

$

(18

)

$

747

$

562

$

185

Foreign Exchange Rates

Average foreign exchange rates used in the calculation of the

impact of foreign currency fluctuations for each of the three month

periods in the six months ended December 31, 2020 and 2019 are as

follows:

Fiscal Year 2021

Q1

Q2

U.S. Dollar per Australian Dollar

$0.71

$0.73

U.S. Dollar per British Pound Sterling

$1.29

$1.32

Fiscal Year 2020

Q1

Q2

U.S. Dollar per Australian Dollar

$0.69

$0.68

U.S. Dollar per British Pound Sterling

$1.23

$1.29

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three and six months ended December 31, 2020 and 2019 are as

follows:

For the three months ended

December 31,

2020

2019

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

Digital Real Estate Services

$

327

$

294

11

%

Subscription Video Services

478

501

(5

)

%

Dow Jones

443

429

3

%

Book Publishing

526

441

19

%

News Media

550

604

(9

)

%

Other

—

—

—

%

Adjusted Total Revenues

$

2,324

$

2,269

2

%

Adjusted Segment EBITDA:

Digital Real Estate Services

$

141

$

118

19

%

Subscription Video Services

116

70

66

%

Dow Jones

108

76

42

%

Book Publishing

101

63

60

%

News Media

64

61

5

%

Other

(44

)

(38

)

(16

)

%

Adjusted Total Segment EBITDA

$

486

$

350

39

%

For the six months ended December

31,

2020

2019

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

Digital Real Estate Services

$

611

$

566

8

%

Subscription Video Services

954

1,015

(6

)

%

Dow Jones

828

811

2

%

Book Publishing

971

846

15

%

News Media

1,017

1,161

(12

)

%

Other

—

—

—

%

Adjusted Total Revenues

$

4,381

$

4,399

—

%

Adjusted Segment EBITDA:

Digital Real Estate Services

$

257

$

201

28

%

Subscription Video Services

190

151

26

%

Dow Jones

180

125

44

%

Book Publishing

170

112

52

%

News Media

42

56

(25

)

%

Other

(92

)

(83

)

(11

)

%

Adjusted Total Segment EBITDA

$

747

$

562

33

%

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three and six months ended December 31, 2020 and

2019:

For the three months ended

December 31, 2020

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Digital Real Estate Services

$

339

$

—

$

—

$

(12

)

$

—

$

327

Subscription Video Services

511

—

—

(33

)

—

478

Dow Jones

446

—

—

(3

)

—

443

Book Publishing

544

(13

)

—

(5

)

—

526

News Media

573

(1

)

—

(22

)

—

550

Other

1

—

(1

)

—

—

—

Total Revenues

$

2,414

$

(14

)

$

(1

)

$

(75

)

$

—

$

2,324

Segment EBITDA:

Digital Real Estate Services

$

142

$

6

$

—

$

(7

)

$

—

$

141

Subscription Video Services

124

—

—

(8

)

—

116

Dow Jones

109

—

—

(1

)

—

108

Book Publishing

104

(3

)

—

—

—

101

News Media

66

—

—

(2

)

—

64

Other

(48

)

—

1

—

3

(44

)

Total Segment EBITDA

$

497

$

3

$

1

$

(18

)

$

3

$

486

For the three months ended

December 31, 2019

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Digital Real Estate Services

$

294

$

—

$

—

$

—

$

—

$

294

Subscription Video Services

501

—

—

—

—

501

Dow Jones

430

—

(1

)

—

—

429

Book Publishing

442

—

(1

)

—

—

441

News Media

811

—

(207

)

—

—

604

Other

1

—

(1

)

—

—

—

Total Revenues

$

2,479

$

—

$

(210

)

$

—

$

—

$

2,269

Segment EBITDA:

Digital Real Estate Services

$

118

$

—

$

—

$

—

$

—

$

118

Subscription Video Services

70

—

—

—

—

70

Dow Jones

76

—

—

—

—

76

Book Publishing

63

—

—

—

—

63

News Media

66

—

(5

)

—

—

61

Other

(38

)

—

1

—

(1

)

(38

)

Total Segment EBITDA

$

355

$

—

$

(4

)

$

—

$

(1

)

$

350

For the six months ended December

31, 2020

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Digital Real Estate Services

$

629

$

—

$

—

$

(18

)

$

—

$

611

Subscription Video Services

1,007

—

—

(53

)

—

954

Dow Jones

832

—

—

(4

)

—

828

Book Publishing

1,002

(22

)

—

(9

)

—

971

News Media

1,060

(2

)

—

(41

)

—

1,017

Other

1

—

(1

)

—

—

—

Total Revenues

$

4,531

$

(24

)

$

(1

)

$

(125

)

$

—

$

4,381

Segment EBITDA:

Digital Real Estate Services

$

261

$

6

$

—

$

(10

)

$

—

$

257

Subscription Video Services

202

—

—

(12

)

—

190

Dow Jones

181

—

—

(1

)

—

180

Book Publishing

175

(4

)

—

(1

)

—

170

News Media

44

—

—

(2

)

—

42

Other

(98

)

—

1

—

5

(92

)

Total Segment EBITDA

$

765

$

2

$

1

$

(26

)

$

5

$

747

For the six months ended December

31, 2019

As Reported

Impact of Acquisitions

Impact of Divestitures

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Digital Real Estate Services

$

566

$

—

$

—

$

—

$

—

$

566

Subscription Video Services

1,015

—

—

—

—

1,015

Dow Jones

812

—

(1

)

—

—

811

Book Publishing

847

—

(1

)

—

—

846

News Media

1,578

—

(417

)

—

—

1,161

Other

1

—

(1

)

—

—

—

Total Revenues

$

4,819

$

—

$

(420

)

$

—

$

—

$

4,399

Segment EBITDA:

Digital Real Estate Services

$

200

$

—

$

1

$

—

$

—

$

201

Subscription Video Services

151

—

—

—

—

151

Dow Jones

125

—

—

—

—

125

Book Publishing

112

—

—

—

—

112

News Media

73

—

(17

)

—

—

56

Other

(85

)

—

1

—

1

(83

)

Total Segment EBITDA

$

576

$

—

$

(15

)

$

—

$

1

$

562

NOTE 3 – ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO NEWS

CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) attributable to News

Corporation stockholders and diluted earnings per share (“EPS”)

excluding expenses related to U.K. Newspaper Matters, impairment

and restructuring charges and “Other, net”, net of tax, recognized

by the Company or its equity method investees, as well as the

settlement of certain pre-Separation tax matters (“adjusted net

income (loss) attributable to News Corporation stockholders” and

“adjusted EPS,” respectively), to evaluate the performance of the

Company’s operations exclusive of certain items that impact the

comparability of results from period to period, as well as certain

non-operational items. The calculation of adjusted net income

(loss) attributable to News Corporation stockholders and adjusted

EPS may not be comparable to similarly titled measures reported by

other companies, since companies and investors may differ as to

what type of events warrant adjustment. Adjusted net income (loss)

attributable to News Corporation stockholders and adjusted EPS are

not measures of performance under generally accepted accounting

principles and should not be construed as substitutes for

consolidated net income (loss) attributable to News Corporation

stockholders and net income (loss) per share as determined under

GAAP as a measure of performance. However, management uses these

measures in comparing the Company’s historical performance and

believes that they provide meaningful and comparable information to

investors to assist in their analysis of our performance relative

to prior periods and our competitors.

The following tables reconcile reported net income (loss)

attributable to News Corporation stockholders and reported diluted

EPS to adjusted net income attributable to News Corporation

stockholders and adjusted EPS for the three and six months ended

December 31, 2020 and 2019:

For the three months ended

December 31, 2020

For the three months ended

December 31, 2019

(in millions, except per share data)

Net income attributable to

stockholders

EPS

Net income attributable to

stockholders

EPS

Net income

$

261

$

103

Less: Net income attributable to

noncontrolling interests

(30

)

(18

)

Net income attributable to News

Corporation stockholders

$

231

$

0.39

$

85

$

0.14

U.K. Newspaper Matters

3

0.01

(1

)

—

Impairment and restructuring charges

23

0.04

29

0.05

Other, net

(54

)

(0.10

)

(2

)

—

Tax impact on items above

(2

)

—

(5

)

(0.01

)

Impact of noncontrolling interest on items

above

(1

)

—

(1

)

—

As adjusted

$

200

$

0.34

$

105

$

0.18

For the six months ended December

31, 2020

For the six months ended December

31, 2019

(in millions, except per share data)

Net income attributable to

stockholders

EPS

Net (loss) income attributable to

stockholders

EPS

Net income (loss)

$

308

$

(108

)

Less: Net income attributable to

noncontrolling interests

(43

)

(34

)

Net income (loss) attributable to News

Corporation stockholders

$

265

$

0.45

$

(142

)

$

(0.24

)

U.K. Newspaper Matters

5

0.01

1

—

Impairment and restructuring

charges(a)

63

0.10

326

0.55

Other, net

(71

)

(0.12

)

(6

)

(0.01

)

Tax impact on items above

(12

)

(0.02

)

(46

)

(0.08

)

Impact of noncontrolling interest on items

above

(2

)

—

(2

)

—

As adjusted

$

248

$

0.42

$

131

$

0.22

(a)

During the six months ended December 31,

2019, the Company recognized $292 million of non-cash impairment

charges, primarily at News America Marketing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210204006066/en/

Investor Relations Michael Florin

212-416-3363 mflorin@newscorp.com Leslie Kim 212-416-4529

lkim@newscorp.com Corporate

Communications Jim Kennedy 212-416-4064

jkennedy@newscorp.com

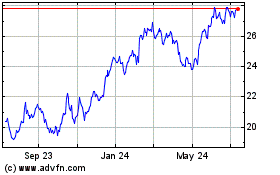

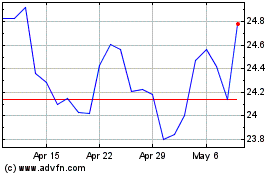

News (NASDAQ:NWSA)

Historical Stock Chart

From Nov 2024 to Dec 2024

News (NASDAQ:NWSA)

Historical Stock Chart

From Dec 2023 to Dec 2024