HUNSTVILLE, Texas, June 2 /PRNewswire-FirstCall/ -- Mitcham

Industries, Inc. (NASDAQ:MIND) (the "Company") today announced

financial results for its fiscal 2010 first quarter ended April 30,

2009. The Company reported total revenues of $10.6 million for the

first quarter of fiscal 2010 compared to $18.5 million in the first

quarter of fiscal 2009. The Company reported a net loss of $80,000,

or $0.01 loss per share, for the first quarter of fiscal 2010

compared to net income of $4.3 million, or $0.41 per diluted share,

for the first quarter of fiscal 2009. EBITDA (earnings before

interest, taxes, depreciation and amortization), a non-GAAP

measure, amounted to $4.5 million for the first quarter of fiscal

2010 compared to $10.4 million in the same period last year. Bill

Mitcham, the Company's President and CEO, stated, "Our first fiscal

quarter is typically our strongest of the year. However, the

pick-up in activity that usually occurs during the winter months in

Canada and Russia did not materialize this year, negatively

affecting our first quarter as it did the fourth quarter. "Despite

the difficult economic environment, there are some encouraging

signs. In regions such as South America and parts of Asia, oil and

gas exploration activity is still fairly healthy. Bidding activity

outside of North America and Russia, particularly in South America,

is relatively steady, and we believe that there are prospects for

some rather large jobs later in the year. Demand for VSP, or

vertical seismic profiling, tools remains encouraging. The marine

environment is reasonably stable, and we expect to begin deliveries

of our Polarcus contract during the second quarter. Seamap, as

previously announced, is providing Polarcus with its GunLink 4000

fully distributed digital gun controller systems and BuoyLink RGPS

tail buoy positioning systems. "We believe that we are well

positioned to manage through this downturn and capitalize on

opportunities as they arise. The one factor that makes this current

downturn different from previous cycles is the tight credit market;

and when credit is tight, we know that our customers tend to lease

equipment before making capital commitments for purchases. From a

liquidity standpoint, we continue to generate good cash flow; have

a strong balance sheet with modest debt; and have access to

additional credit and liquidity, should the need arise. The

long-term fundamentals of our industry remain intact, and when the

seismic acquisition process returns to some state of normalcy, we

expect that even more equipment will be required on each new

prospect to better define the reservoir and reduce drilling costs.

Fossil fuel will provide the world's energy needs for many years to

come, and we will provide the additional equipment needed to find

those hidden deposits. We are very optimistic about the future of

our industry and our company." FIRST QUARTER FISCAL 2010 RESULTS

Total revenues for the first quarter of fiscal 2010 were $10.6

million compared to $18.5 million for the first quarter of fiscal

2009, a decline of approximately 43%. The decline was primarily

attributable to a decrease in equipment leasing revenues and lower

sales from Seamap. A significant portion of the Company's revenues

are generated from sources outside the United States, with revenues

from international customers totaling approximately 79% of total

revenues during the first quarter of fiscal 2010 compared to 86% of

total revenues in the same period last year. Core revenues from

equipment leasing, excluding equipment sales, were $6.3 million

compared to $12.4 million in the same period a year ago, a 49%

decline. Leasing revenues were impacted by the dramatic decline in

demand for seismic equipment and services, including the lack of

seasonal demand in Canada and Russia, areas where a great deal of

seismic exploration activity usually occurs during the winter

months. Oil and gas exploration activities have fallen

significantly in these regions, as well as in many other areas

worldwide, due to the global economic situation. Sales of new

seismic, hydrographic and oceanographic equipment were $1.6 million

compared to $318,000 in the comparable period a year ago, primarily

reflecting deliveries to the Royal Australian Navy, along with

services and other equipment sold in Australia and throughout the

Pacific Rim. In May 2008, the Company entered into a contract with

the Royal Australian Navy that contributed approximately $900,000

to first quarter revenues. Sales of lease pool equipment were

$69,000 compared to $561,000 in the first quarter of fiscal 2009,

reflecting the decline in seismic exploration activity. Seamap

equipment sales in the first quarter declined 51% to $2.6 million

from $5.3 million in the comparable period a year ago, reflecting

the fact that there were no large GunLink or BuoyLink systems

shipped during the first quarter of fiscal 2010. Seamap sales can

vary significantly on a quarter-to-quarter basis due to varying

customer delivery requirements. Shipments related to Seamap's

orders from Polarcus are scheduled to begin in the second quarter

of fiscal 2010. Total gross profit in the fiscal 2010 first quarter

was $3.8 million compared to $11.6 million in the first quarter of

fiscal 2009, a 68% decline. The fiscal 2010 gross profit was

impacted by the decline in leasing revenues and higher depreciation

expense related to new lease pool equipment that the Company

acquired during fiscal 2009. Gross profit margin for the first

quarter of fiscal 2010 was 36% compared to 63% in the same period a

year ago. General and administrative costs for the first quarter of

fiscal 2010 were $3.5 million compared to $4.9 million in the first

quarter of fiscal 2009, primarily due to lower stock-based and

incentive compensation expenses and reductions in other general

administrative costs, such as travel costs. Operating income for

the first quarter of fiscal 2010 was $16,000 compared to $6.4

million in the comparable period a year ago, primarily due to lower

leasing revenues and higher lease pool depreciation expense. Income

before income taxes was $46,000 compared to $6.5 million in the

first quarter of fiscal 2009. Provision for income taxes was

$126,000 in the fiscal 2010 first quarter compared to $2.2 million

in the first quarter of fiscal 2009. Income tax expense for the

first quarter of fiscal 2010 included $109,000 of estimated

penalties and interest that could arise from uncertain tax

provisions. Income tax expense for the last year's first quarter

included $399,000 of estimated potential penalties and interest

from uncertain tax positions. The estimated penalties and interest

are recorded pursuant to the accounting standard dealing with

uncertain tax positions, which the Company adopted in the first

quarter of fiscal 2008. EBITDA (earnings before interest, taxes,

depreciation and amortization) for the first quarter was $4.5

million, or 42% of total revenues, compared to $10.4 million, or

56% of total revenues, in the same period last year. Adjusted

EBITDA, which excludes stock-based compensation expense, was $4.9

million, or 46% of total revenues, in the first quarter compared to

$11.1 million, or 60% of total revenues, in the first quarter of

last year. EBITDA and Adjusted EBITDA, which are not measures

determined in accordance with generally accepted accounting

principles ("GAAP"), are defined and reconciled to reported net

(loss) income, the most comparable GAAP measure, in Note A under

the accompanying financial tables. CONFERENCE CALL The Company has

scheduled a conference call for Wednesday, June 3, 2009 at 9:00

a.m. Eastern time to discuss its fiscal 2010 first quarter results.

To access the call, please dial (480) 629-9692 and ask for the

Mitcham Industries call at least 10 minutes prior to the start

time. Investors may also listen to the conference live on the

Mitcham Industries corporate website,

http://www.mitchamindustries.com/, by logging on that site and

clicking "Investors." A telephonic replay of the conference call

will be available through June 10, 2009 and may be accessed by

calling (303) 590-3030, and using the passcode 4084489#. A web cast

archive will also be available at http://www.mitchamindustries.com/

shortly after the call and will be accessible for approximately 90

days. For more information, please contact Donna Washburn at

DRG&E at (713) 529-6600 or email . Mitcham Industries, Inc., a

geophysical equipment supplier, offers for lease or sale, new and

"experienced" seismic equipment to the oil and gas industry,

seismic contractors, environmental agencies, government agencies

and universities. Headquartered in Texas, with sales and services

offices in Calgary, Canada; Brisbane, Australia; Singapore; Ufa,

Bashkortostan, Russia; and the United Kingdom and with associates

throughout Europe, South America and Asia, Mitcham conducts

operations on a global scale and is the largest independent

exploration equipment lessor in the industry. This press release

includes forward-looking statements within the meaning of Section

21E of the Securities Exchange Act of 1934 and Section 27A of the

Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical facts included herein,

including statements regarding the Company's future financial

position and results of operations, planned capital expenditures,

the Company's business strategy and other plans for future

expansion, the future mix of revenues and business, future demand

for the Company's services and general conditions in the energy

industry in general and seismic service industry, are

forward-looking statements. While management believes that these

forward-looking statements are reasonable when and as made, actual

results may differ materially from such forward-looking statements.

Important factors that could cause or contribute to such

differences include possible decline in demand for seismic data and

our services; the effect of recent declines in oil and natural gas

prices on exploration activity; the effect of uncertainty in

financial markets on our customers' and our ability to obtain

financing; loss of significant customers; defaults by customers on

amounts due us; possible impairment of long-lived assets; risks

associated with our manufacturing operations; foreign currency

exchange risk; and other factors that are disclosed in the

Company's filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K and available from the Company

without charge. Readers are cautioned to not place undue reliance

on forward-looking statements which speak only as of the date of

this release and the Company undertakes no duty to update or revise

any forward-looking statement whether as a result of new

information, future events or otherwise. Contacts: Billy F.

Mitcham, Jr., President & CEO Mitcham Industries, Inc.

936-291-2277 Jack Lascar / Karen Roan Dennard Rupp Gray &

Easterly (DRG&E) 713-529-6600 - Tables to follow - MITCHAM

INDUSTRIES, INC. CONSOLIDATED BALANCE SHEETS (In thousands, except

per share data) April 30, January 31, 2009 2009 ASSETS Current

assets: Cash and cash equivalents $4,756 $5,063 Restricted cash

1,112 969 Accounts receivable, net 12,730 12,415 Current portion of

contracts receivable 562 836 Inventories, net 6,057 3,772 Costs

incurred and estimated profit in excess of billings on uncompleted

contract 1,001 1,787 Income taxes receivable - 1,000 Deferred tax

asset 1,339 1,682 Prepaid expenses and other current assets 1,051

1,535 Total current assets 28,608 29,059 Seismic equipment lease

pool and property and equipment, net 61,165 64,251 Intangible

assets, net 2,719 2,744 Goodwill 4,320 4,320 Deferred tax asset 671

- Long-term portion of contracts receivable 3,806 3,806 Other

assets 50 47 Total assets $101,339 $104,227 LIABILITIES AND

SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $8,197

$13,561 Income taxes payable 455 - Deferred revenue 553 424 Accrued

expenses and other current liabilities 3,281 3,877 Total current

liabilities 12,486 17,862 Non-current income taxes payable 3,448

3,260 Deferred tax liability - 32 Long-term debt 6,450 5,950 Total

liabilities 22,384 27,104 Shareholders' equity: Preferred stock,

$1.00 par value; 1,000 shares authorized; none issued and

outstanding - - Common stock, $.01 par value; 20,000 shares

authorized; 10,725 shares issued at April 30, 2009 and January 31,

2009 107 107 Additional paid-in capital 74,819 74,396 Treasury

stock, at cost (923 and 922 shares at April 30, 2009 and January

31, 2009, respectively) (4,832) (4,826) Retained earnings 9,647

9,727 Accumulated other comprehensive income (786) (2,281) Total

shareholders' equity 78,955 77,123 Total liabilities and

shareholders' equity $101,339 $104,227 MITCHAM INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per

share data) For the Three Months Ended April 30, 2009 2008

Revenues: Equipment leasing $6,326 $12,373 Lease pool equipment

sales 69 561 Seamap equipment sales 2,598 5,282 Other equipment

sales 1,612 318 Total revenues 10,605 18,534 Cost of sales: Direct

costs - equipment leasing 528 442 Direct costs - lease pool

depreciation 4,101 3,640 Cost of lease pool equipment sales 10 125

Cost of Seamap and other equipment sales 2,194 2,699 Total cost of

sales 6,833 6,906 Gross profit 3,772 11,628 Operating expenses:

General and administrative 3,502 4,875 Depreciation and

amortization 254 395 Total operating expenses 3,756 6,906 Operating

income 16 11,628 Other income (expense) Interest income, net (89)

150 Other, net 119 5 Total other income (expense) 30 155 Income

before income taxes 46 6,513 Provision for income taxes (126)

(2,235) Net (loss) income $(80) $4,278 Net (loss) income per common

share: Basic $(0.01) $0.44 Diluted $(0.01) $0.41 Shares used in

computing net (loss) income per common share: Basic 9,784 9,751

Diluted 9,784 10,337 MITCHAM INDUSTRIES, INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands) For the Three months Ended

April 30, 2009 2008 Cash flows from operating activities: Net

(loss) income $(80) $4,278 Adjustments to reconcile net (loss)

income to net cash provided by operating activities: Depreciation

and amortization 4,385 4,076 Stock-based compensation 416 636

Provision for doubtful accounts - 116 Provision for inventory

obsolescence (81) 6 Gross profit from sale of lease pool equipment

(59) (438) Excess tax benefit from exercise of non-qualified stock

options (7) (53) Deferred tax (benefit) provision (176) 548 Changes

in non-current income taxes payable 188 205 Changes in working

capital items: Accounts receivable 555 (2,814) Contracts receivable

- 424 Inventories (2,029) 825 Income taxes payable and receivable

1,402 30 Accounts payable, accrued expenses and other current

liabilities (239) (7,310) Contract revenues in excess of billings

1,066 - Prepaids and other, net 261 431 Net cash provided by

operating activities 5,602 960 Cash flows from investing

activities: Sales of used lease pool equipment 69 561 Purchases of

seismic equipment held for lease (6,485) (11,338) Purchases of

property and equipment (95) (269) Net cash used in investing

activities (6,511) (11,046) Cash flows from financing activities:

Net proceeds from revolving line of credit 500 4,000 Payments on

borrowings - (637) Proceeds from issuance of common stock upon

exercise of stock options (6) 49 Excess tax benefits from exercise

of non-qualified stock options 7 53 Net cash provided by financing

activities 501 3,465 Effect of changes in foreign exchange rates on

cash and cash equivalents 101 (330) Net decrease in cash and cash

equivalents (307) (6,951) Cash and cash equivalents, beginning of

period 5,063 13,884 Cash and cash equivalents, end of period $4,756

$6,933 Note A MITCHAM INDUSTRIES, INC. Reconciliation of Net (Loss)

Income to EBITDA (In thousands) (Unaudited) For the Three Months

Ended April 30, 2009 2008 Net (loss) income $(80) $4,278 Interest

expense (income), net 89 (150) Depreciation, amortization and

impairment 4,385 4,076 Provision for income taxes 126 2,235 EBITDA

(1) 4,520 10,439 Stock-based compensation 416 636 Adjusted

EBITDA(1) $4,936 $11,075 (1) EBITDA is defined as net income (loss)

before (a) interest income, net of interest expense, (b) provision

for (or benefit from) income taxes and (c) depreciation,

amortization and impairment. Adjusted EBITDA excludes stock-based

compensation. We consider EBITDA and Adjusted EBITDA to be

important indicators for the performance of our business, but not

measures of performance calculated in accordance with accounting

principles generally accepted in the United States of America

("GAAP"). We have included these non-GAAP financial measures

because management utilizes this information for assessing our

performance and as indicators of our ability to make capital

expenditures, service debt and finance working capital

requirements. The covenants of our revolving credit agreement

require us to maintain a minimum level of EBITDA. Management

believes that EBITDA and Adjusted EBITDA are measurements that are

commonly used by analysts and some investors in evaluating the

performance of companies such as us. In particular, we believe that

it is useful to our analysts and investors to understand this

relationship because it excludes transactions not related to our

core cash operating activities. We believe that excluding these

transactions allows investors to meaningfully trend and analyze the

performance of our core cash operations. EBITDA and Adjusted EBITDA

are not measures of financial performance under GAAP and should not

be considered in isolation or as alternatives to cash flow from

operating activities or as alternatives to net income as indicators

of operating performance or any other measures of performance

derived in accordance with GAAP. In evaluating our performance as

measured by EBITDA, management recognizes and considers the

limitations of this measurement. EBITDA and Adjusted EBITDA do not

reflect our obligations for the payment of income taxes, interest

expense or other obligations such as capital expenditures.

Accordingly, EBITDA and Adjusted EBITDA are only two of the

measurements that management utilizes. Other companies in our

industry may calculate EBITDA or Adjusted EBITDA differently than

we do and EBITDA and Adjusted EBITDA may not be comparable with

similarly titled measures reported by other companies. Mitcham

Industries, Inc. Segment Operating Results (In thousands)

(Unaudited) For the Three Months Ended April 30, 2009 2008 Revenues

Equipment Leasing $8,007 $13,252 Seamap 2,683 5,305 Less

inter-segment sales (85) (23) Total revenues 10,605 18,534 Cost of

Sales Equipment Leasing 5,862 4,488 Seamap 1,109 2,469 Less

inter-segment costs (138) (51) Total cost of sales 6,833 6,906

Gross Profit Equipment Leasing $2,145 $8,764 Seamap 1,574 2,836

Plus inter-segment amounts 53 28 Total gross profit 3,772 11,628

DATASOURCE: Mitcham Industries, Inc. CONTACT: Billy F. Mitcham,

Jr., President & CEO of Mitcham Industries, Inc.,

+1-936-291-2277; or Jack Lascar, or Karen Roan, both of Dennard

Rupp Gray & Easterly (DRG&E), +1-713-529-6600, for Mitcham

Industries, Inc. Web Site: http://www.mitchamindustries.com/

Copyright

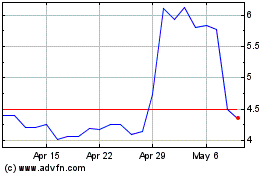

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From May 2024 to Jun 2024

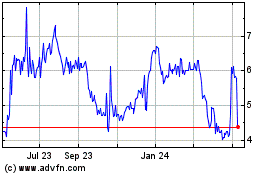

MIND Technology (NASDAQ:MIND)

Historical Stock Chart

From Jun 2023 to Jun 2024