Praxair Posts In Line Q1 Earnings, Rev Lags Ests - Analyst Blog

April 23 2014 - 3:00PM

Zacks

Industrial gas producer and

supplier, Praxair Inc. (PX) reported adjusted

earnings per share of $1.51 for first-quarter 2014. The bottom-line

result was an improvement over $1.38 recorded in the year-ago

quarter and in line with the Zacks Consensus Estimate.

Revenue

Praxair generated total sales of

$3,026.0 million in first-quarter 2014, an increase of 4.8% year

over year. The improvement was attributable to a 6% contribution

from volume growth and 2% from acquisitions, partially offset by a

4% negative impact from foreign currency translation.

However, the top-line result was below the Zacks Consensus Estimate

of $3,060 million.

In first-quarter 2014, revenues generated from North America were

up 8.4%, while revenues in Europe grew 7.3% year over year. Weak

South American operations resulted in a revenue decline of 8.1%. In

Asia, revenues increased 6.8% while revenues from the Surface

Technologies business were up 3.7%.

Margins

Cost of sales grew 5.4% year over year and represented 57.0% of

total revenues in first-quarter 2014. Selling, general and

administrative expenses were $326 million, down 3.3% year over

year. Research and development expenses were $23 million versus $24

million in the year-ago quarter.

Adjusted operating profit in the quarter was $675 million, up 8.3%

year over year while adjusted margin grew 70 basis points to

22.3%.

Balance Sheet

Exiting first-quarter 2014, Praxair’s cash and cash equivalent

balance was $144 million versus $138 million in the previous

quarter. Long-term debt increased 6.7% sequentially to $8,564

million.

Cash Flow

Praxair’s net cash flow from operating activities was $536 million

in first-quarter 2014, an increase of 13.6% year over year. Capital

spent on purchase of property, plant and equipment was $393

million, lower than $466 million invested in the year-ago

quarter.

Share Repurchases/Dividends

Pursuant to the policy of rewarding shareholders handsomely,

Praxair paid dividends of $191 million in first-quarter 2014.

Shares worth $286 million were repurchased in the quarter.

Concurrent with the earnings release, Praxair announced that its

board of directors has approved a quarterly dividend payment for

second-quarter 2014. The dividend of 65 cents per share will be

paid on Jun 16, 2014 to shareholders of record as on Jun 6,

2014.

Outlook

For second-quarter 2014, Praxair

anticipates adjusted earnings per share to be in the $1.55−$1.60

range.

For 2014, adjusted earnings per share are expected in the band of

$6.30−$6.50 versus the prior forecast of $6.25–$6.55. The new

guidance reflects an increase of 6−10% year over year.

Sales are anticipated to be within the $12.4−$12.8 billion range as

against $12.3−$12.8 billion expected earlier. Capital spending is

expected to be roughly $1.8 billion versus the prior expectation of

$1.8−$2.0 billion and the adjusted effective tax rate is projected

at 28%.

Praxair currently has a market capitalization of $38.8 billion and

carries a Zacks Rank #4 (Sell). However, better-ranked stocks in

the industry include L'Air Liquide SA (AIQUY),

Huntsman Corporation (HUN) and Methanex

Corporation (MEOH), all of which hold a Zacks Rank #2

(Buy).

AIR LIQUIDE-ADR (AIQUY): Get Free Report

HUNTSMAN CORP (HUN): Free Stock Analysis Report

METHANEX CORP (MEOH): Free Stock Analysis Report

PRAXAIR INC (PX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

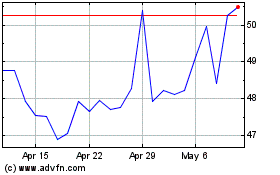

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Oct 2024 to Nov 2024

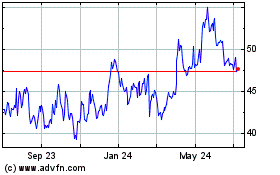

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Nov 2023 to Nov 2024