GPRO000150043512/31Accelerated Filer10-Q3/31/20242024Q1FALSEClass A common stock, $0.0001 par valueNASDAQ Global Select MarketDelaware77-06294743025 Clearview WaySan Mateo,California94402(650)332-7600126,040,72026,258,546falseNo522,125P1YP2Y13. Subsequent events

In January 2024, the Company entered into an agreement to acquire a privately-held company that offers technology-enabled helmets. The transaction is expected to close in the first quarter of 2024, subject to the satisfaction of customary closing conditions.

8.17.01.17,8337,8331841847,6497,649——Schedule II

GoPro, Inc.

VALUATION AND QUALIFYING ACCOUNTS

For the year ended December 31, 2024, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Balance at Beginning of Year | | | | Charges to Revenue | | Charges (Benefits) to Expense | | Charges to Other Accounts - Equity | | Deductions/Write-offs | | Balance at End of Year |

Allowance for doubtful accounts receivable: | | | | | | | | | | | | | |

| Year ended March 31, 2024 | $ | 390 | | | | | $ | — | | | $ | 67 | | | $ | — | | | $ | (7) | | | $ | 450 | |

| Year ended March 31, 2023 | 700 | | | | | — | | | (294) | | | — | | | (16) | | | 390 | |

| Year ended December 31, 2021 | 492 | | | | | — | | | 393 | | | — | | | (185) | | | 700 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Valuation allowance for deferred tax assets: | | | | | | | | | | | | | |

| Year ended March 31, 2024 | $ | — | | | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Year ended March 31, 2023 | — | | | | | — | | | — | | | — | | | — | | | — | |

| Year ended December 31, 2021 | 287,276 | | | | | — | | | (284,551) | | | — | | | (2,725) | | | — | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission file number: 001-36514

GOPRO, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 77-0629474 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| | | |

| 3025 Clearview Way | | |

| San Mateo, | California | | 94402 |

| (Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value | GPRO | NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | þ |

| | | Smaller reporting company | ☐ |

| Non-accelerated filer | ☐ | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of May 6, 2024, 126,040,720 and 26,258,546 shares of Class A and Class B common stock were outstanding, respectively.

GoPro, Inc.

Index

| | | | | | | | |

| | Page |

PART I. FINANCIAL INFORMATION |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| PART II. OTHER INFORMATION |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 5. | | |

Item 6. | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

Special Note About Forward-Looking Statements

This Quarterly Report on Form 10-Q of GoPro, Inc. (GoPro or we or the Company) includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including statements regarding guidance, industry prospects, product and marketing plans, or future results of operations or financial position, made in this Quarterly Report on Form 10-Q are forward-looking. To identify forward-looking statements, we use words such as “expect,” “anticipate,” “believe,” “may,” “will,” “estimate,” “intend,” “target,” “goal,” “plan,” “likely,” “potentially,” or variations of such words and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their date. If any of management's assumptions prove incorrect or should unanticipated circumstances arise, the Company's actual results could materially differ from those anticipated by such forward-looking statements. The differences could be caused by a number of factors or combination of factors including, but not limited to, those factors identified and detailed in Risk Factors in Part II, Item 1A. of this Quarterly Report on Form 10-Q for the quarter ended March 31, 2024. Forward-looking statements include, but are not limited to, statements regarding our plans to expand and improve product offerings; projections of results of operations, research and development plans, marketing plans, plans to expand our global retail and distribution footprint, and revenue growth drivers; plans to manage our operating expenses effectively; plans to drive profitability, including our restructuring plans and the improved efficiencies in our operations that such plans may create; our ability to achieve profitability if there are delays in our product launches; the impact of negative macroeconomic factors including fluctuating interest rates and inflation, market volatility, economic recession concerns, and potential occurrence of a temporary federal government shutdown; the ability for us to grow camera sales to drive meaningful volume and subscription growth; our ability to acquire and retain subscribers; the impact of competition on our market share, revenue, and profitability; the effects of global conflicts and geopolitical issues such as the conflicts in the Middle East, Ukraine or China-Taiwan relations on our business; plans to settle the note conversion in cash; expectations regarding the volatility of the Company’s tax provision and resulting effective tax rate and projections of results of operations; the outcome of pending or future litigation and legal proceedings; the threat of a security breach or other disruption including cyberattacks; and any discussion of the trends and other factors that drive our business and future results, as discussed in Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and other sections of this Quarterly Report on Form 10-Q, including but not limited to Item 1A. Risk Factors. Readers are strongly encouraged to consider the foregoing when evaluating any forward-looking statements concerning the Company. The Company does not undertake any obligation to update any forward-looking statements in this Quarterly Report on Form 10-Q to reflect future events or developments.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

GoPro, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

| | | | | | | | | | | |

(in thousands, except par values) | March 31, 2024 | | December 31, 2023 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 133,658 | | | $ | 222,708 | |

| | | |

Marketable securities | — | | | 23,867 | |

Accounts receivable, net | 68,895 | | | 91,452 | |

Inventory | 131,252 | | | 106,266 | |

Prepaid expenses and other current assets | 35,704 | | | 38,298 | |

Total current assets | 369,509 | | | 482,591 | |

Property and equipment, net | 8,919 | | | 8,686 | |

Operating lease right-of-use assets | 17,647 | | | 18,729 | |

Goodwill | 152,351 | | | 146,459 | |

Other long-term assets | 27,329 | | | 311,486 | |

Total assets | $ | 575,755 | | | $ | 967,951 | |

| | | |

Liabilities and Stockholders’ Equity | | | |

Current liabilities: | | | |

Accounts payable | $ | 64,022 | | | $ | 102,612 | |

Accrued expenses and other current liabilities | 89,347 | | | 110,049 | |

Short-term operating lease liabilities | 10,525 | | | 10,520 | |

Deferred revenue | 55,808 | | | 55,913 | |

| | | |

Total current liabilities | 219,702 | | | 279,094 | |

Long-term taxes payable | 12,105 | | | 11,199 | |

Long-term debt | 92,743 | | | 92,615 | |

Long-term operating lease liabilities | 22,971 | | | 25,527 | |

Other long-term liabilities | 3,322 | | | 3,670 | |

Total liabilities | 350,843 | | | 412,105 | |

| | | |

| Commitments, contingencies and guarantees (Note 10) |

| |

|

| | | |

Stockholders’ equity: | | | |

Preferred stock, $0.0001 par value, 5,000 shares authorized; none issued | — | | | — | |

Common stock and additional paid-in capital, $0.0001 par value, 500,000 Class A shares authorized, 126,041 and 123,638 shares issued and outstanding, respectively; 150,000 Class B shares authorized, 26,259 and 26,259 shares issued and outstanding, respectively | 1,006,527 | | | 998,373 | |

Treasury stock, at cost, 26,608 and 26,608 shares, respectively | (193,231) | | | (193,231) | |

Accumulated deficit | (588,384) | | | (249,296) | |

Total stockholders’ equity | 224,912 | | | 555,846 | |

Total liabilities and stockholders’ equity | $ | 575,755 | | | $ | 967,951 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GoPro, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

(in thousands, except per share data) | 2024 | | 2023 | | | | | | |

Revenue | $ | 155,469 | | | $ | 174,720 | | | | | | | |

Cost of revenue | 102,431 | | | 122,218 | | | | | | | |

Gross profit | 53,038 | | | 52,502 | | | | | | | |

Operating expenses: | | | | | | | | | |

Research and development | 44,612 | | | 38,185 | | | | | | | |

Sales and marketing | 35,146 | | | 38,055 | | | | | | | |

General and administrative | 14,693 | | | 16,076 | | | | | | | |

Total operating expenses | 94,451 | | | 92,316 | | | | | | | |

| Operating loss | (41,413) | | | (39,814) | | | | | | | |

Other income (expense): | | | | | | | | | |

Interest expense | (674) | | | (1,153) | | | | | | | |

| Other income, net | 1,208 | | | 2,845 | | | | | | | |

| Total other income, net | 534 | | | 1,692 | | | | | | | |

| Loss before income taxes | (40,879) | | | (38,122) | | | | | | | |

| Income tax expense (benefit) | 298,209 | | | (8,253) | | | | | | | |

| Net loss | $ | (339,088) | | | $ | (29,869) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Basic and diluted net loss per share | $ | (2.24) | | | $ | (0.19) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Shares used to compute basic and diluted net loss per share | 151,091 | | | 155,402 | | | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GoPro, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

| | | | | | | | | | | | | | | | |

| Three months ended March 31, |

(in thousands) | 2024 | | | | | 2023 | | |

Operating activities: | | | | | | | | |

| Net loss | $ | (339,088) | | | | | | $ | (29,869) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Depreciation and amortization | 1,325 | | | | | | 1,809 | | | |

Non-cash operating lease cost | 1,082 | | | | | | 1,483 | | | |

Stock-based compensation | 8,770 | | | | | | 10,314 | | | |

Deferred income taxes | 296,775 | | | | | | (9,921) | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Other | 651 | | | | | | (1,326) | | | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable, net | 22,429 | | | | | | 19,947 | | | |

Inventory | (24,986) | | | | | | (27,673) | | | |

Prepaid expenses and other assets | (2,282) | | | | | | (3,251) | | | |

Accounts payable and other liabilities | (62,362) | | | | | | (27,627) | | | |

Deferred revenue | (717) | | | | | | (988) | | | |

| Net cash used in operating activities | (98,403) | | | | | | (67,102) | | | |

| | | | | | | | |

Investing activities: | | | | | | | | |

Purchases of property and equipment, net | (964) | | | | | | (483) | | | |

| Purchases of marketable securities | — | | | | | | (25,782) | | | |

Maturities of marketable securities | 24,000 | | | | | | 34,000 | | | |

| | | | | | | | |

| | | | | | | | |

| Acquisition, net of cash acquired | (12,308) | | | | | | — | | | |

| Net cash provided by investing activities | 10,728 | | | | | | 7,735 | | | |

| | | | | | | | |

Financing activities: | | | | | | | | |

| Proceeds from issuance of common stock | 1,379 | | | | | | 2,324 | | | |

| Taxes paid related to net share settlement of equity awards | (1,977) | | | | | | (4,251) | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Repurchase of outstanding common stock | — | | | | | | (5,000) | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in financing activities | (598) | | | | | | (6,927) | | | |

| | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | (777) | | | | | | 385 | | | |

| Net change in cash and cash equivalents | (89,050) | | | | | | (65,909) | | | |

| Cash and cash equivalents at beginning of period | 222,708 | | | | | | 223,735 | | | |

| Cash and cash equivalents at end of period | $ | 133,658 | | | | | | $ | 157,826 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GoPro, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock and additional paid-in capital | | Treasury stock | | Accumulated

deficit | | Stockholders’ equity |

| (in thousands) | Shares | Amount | | Amount | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Balances at December 31, 2022 | 154,888 | | $ | 960,903 | | | $ | (153,231) | | | $ | (196,113) | | | $ | 611,559 | |

| Common stock issued under employee benefit plans, net of shares withheld for tax | 1,960 | | 2,397 | | | — | | | — | | | 2,397 | |

| Taxes paid related to net share settlements | — | | (4,251) | | | — | | | — | | | (4,251) | |

| Stock-based compensation expense | — | | 10,314 | | | — | | | — | | | 10,314 | |

| Repurchase of outstanding common stock | (890) | | — | | | (5,000) | | | — | | | (5,000) | |

| Net loss | — | | — | | | — | | | (29,869) | | | (29,869) | |

| Balances at March 31, 2023 | 155,958 | | $ | 969,363 | | | $ | (158,231) | | | $ | (225,982) | | | $ | 585,150 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Balances at December 31, 2023 | 149,897 | | $ | 998,373 | | | $ | (193,231) | | | $ | (249,296) | | | $ | 555,846 | |

| Common stock issued under employee benefit plans, net of shares withheld for tax | 2,403 | | 1,361 | | | — | | | — | | | 1,361 | |

| Taxes paid related to net share settlements | — | | (1,977) | | | — | | | — | | | (1,977) | |

| Stock-based compensation expense (Note 7) | — | | 8,770 | | | — | | | — | | | 8,770 | |

| | | | | | | | |

| Net loss | — | | — | | | — | | | (339,088) | | | (339,088) | |

| Balances at March 31, 2024 | 152,300 | | $ | 1,006,527 | | | $ | (193,231) | | | $ | (588,384) | | | $ | 224,912 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

1. Summary of business and significant accounting policies

GoPro, Inc. and its subsidiaries (GoPro or the Company) make it easy for the world to capture and share itself in immersive and exciting ways, helping people get the most out of their photos and videos. The Company is committed to developing solutions that create an easy, seamless experience for consumers to capture, create, manage and share engaging personal content. To date, the Company’s cameras, mountable and wearable accessories, subscription and service, and implied post contract support have generated substantially all of its revenue. The Company sells its products globally on its website, and through retailers and wholesale distributors. The Company’s global corporate headquarters are located in San Mateo, California.

Basis of presentation. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (GAAP) for financial information set forth in the Accounting Standards Codification (ASC), as published by the Financial Accounting Standards Board (FASB), and with the applicable rules and regulations of the Securities and Exchange Commission (SEC). The Company’s fiscal year ends on December 31, and its fiscal quarters end on March 31, June 30, and September 30.

The condensed consolidated financial statements reflect all adjustments, which are normal and recurring in nature, that management believes are necessary for the fair statement of the Company's financial statements, but are not necessarily indicative of the results expected in future periods. The Condensed Consolidated Balance Sheet as of December 31, 2023 has been derived from the audited financial statements at that date, but does not include all the disclosures required by GAAP. This Quarterly Report on Form 10-Q should be read in conjunction with the Company's Annual Report on Form 10-K (2023 Annual Report) for the year ended December 31, 2023. There have been no material changes in the Company’s critical account policies and estimates from those disclosed in its Annual Report on Form 10-K.

Principles of consolidation. These condensed consolidated financial statements include all the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Use of estimates. The preparation of condensed consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the Company’s condensed consolidated financial statements and accompanying notes. Significant estimates and assumptions made by management include those related to revenue recognition and the allocation of the transaction price (including sales incentives, sales returns and implied post contract support), inventory valuation, product warranty liabilities, the valuation, impairment and useful lives of long-lived assets (property and equipment, operating lease right-of-use assets, intangible assets and goodwill), fair value of convertible senior notes, and income taxes. The Company bases its estimates and assumptions on historical experience and on various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results could differ materially from management’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations could be affected.

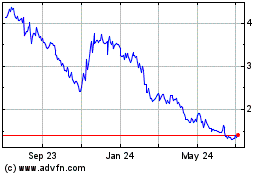

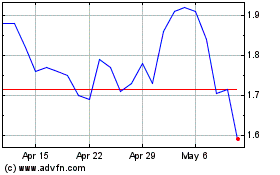

The Company performs an annual assessment of its goodwill during the fourth quarter of each calendar year or more frequently if indicators of potential impairment exist, such as an adverse change in business climate, declines in market capitalization or a decline in the overall industry demand, that would indicate it is more likely than not that the fair value of its single reporting unit is less than its’ carrying value. If the Company determines that it is more likely than not that the fair value of its single reporting unit is less than the carrying value, the Company measures the amount of impairment as the amount the carrying value of its single reporting unit exceeds the fair value, up to the carrying value of goodwill, by using a discounted cash flow method and market approach method.

Although the Company’s market capitalization further declined in the first quarter of 2024, the Company does not believe that it is more likely than not that the fair value of its single reporting unit is less than the carrying value. Using the market capitalization approach, which the Company expects would be similar to the discounted cash flow method, the fair value of the single reporting unit is estimated based on the trading price of the Company’s

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

stock at the test date, which is further adjusted by an acquisition control premium representing the synergies a market participant would obtain when obtaining control of the business. As of March 31, 2024, the market capitalization exceeded the carrying value of the single reporting unit by 34% which was not adjusted for an acquisition control premium. The acquisition control premium would further increase the percentage by which the estimated fair value of the Company’s single reporting unit would exceed the carrying value.

The estimated fair value of the Company’s single reporting unit is sensitive to the volatility in the Company’s stock price. For example, the Company’s stock price decreased from $2.23 on March 31, 2024, to a low of $1.69 on April 22, 2024, which would have resulted in the Company’s market capitalization exceeding the carrying value of the single reporting unit by 13% which was not adjusted for an acquisition control premium. If the Company's market capitalization continues to decline or future performance falls below the Company’s current expectations, assumptions, or estimates, including assumptions related to current macroeconomic uncertainties, this may trigger a future material non-cash goodwill impairment charge, which could have a material adverse effect on the Company’s business, financial condition, and results of operations in the reporting period in which a charge would be necessary. The Company will continue to monitor developments, including updates to the Company’s forecasts and market capitalization. An update of the Company’s assessment and related estimates may be required in the future.

Liquidity. As of March 31, 2024, the Company had $133.7 million in cash, cash equivalents and marketable securities. Based on the Company’s current cash balance, its cost reductions implemented to date, and working capital adjustments, the Company anticipates it will have sufficient funds to meet its strategic and working capital requirements, debt service requirements and lease payment obligations for at least twelve months from the issuance of these condensed consolidated financial statements. The Company also had $44.8 million available to draw from its 2021 Credit Agreement (as defined below) as of March 31, 2024 and as its 2025 Notes are due in November 2025, the Company has the ability to convert the balance due into stock. If the Company is unable to obtain adequate debt or equity financing when it is required or on terms acceptable to the Company, the Company’s ability to grow its business, repay debt and respond to business challenges could be significantly limited. Although management believes its current cash resources are sufficient to sustain operations for one year from issuance of these condensed consolidated financial statements, the success of the Company’s operations and the global economic outlook, among other factors, could impact its business and liquidity. The Company will continue to evaluate additional measures, including cost reduction initiatives, debt or equity refinancing, and other similar arrangements. The current cash flow projections used in the Company’s evaluation do not include the impact of these additional measures.

Comprehensive income (loss). For all periods presented, comprehensive income (loss) approximated net income (loss). Therefore, the Condensed Consolidated Statements of Comprehensive Income (Loss) have been omitted.

Prior period reclassifications. Reclassifications of certain prior period amounts in the condensed consolidated financial statements have been made to conform to the current period presentation.

Revenue recognition. The Company derives substantially all of its revenue from the sale of cameras, mounts, accessories, subscription and service, and implied post contract support to customers. The transaction price recognized as revenue represents the consideration the Company expects to be entitled to and is primarily comprised of product revenue, net of returns and variable consideration, which includes sales incentives provided to customers.

The Company’s camera sales contain multiple performance obligations that can include the following four separate obligations: (i) a camera hardware component (which may be bundled with hardware accessories) and the embedded firmware essential to the functionality of the camera component delivered at the time of sale, (ii) a subscription and service, (iii) the implied right for the customer to receive post contract support after the initial sale (PCS), and (iv) the implicit right to the Company’s downloadable free apps and software solutions. The Company’s PCS includes the right to receive, on a when and if available basis, future unspecified firmware upgrades and features as well as bug fixes, and email, chat, and telephone support.

The Company recognizes revenue from its sales arrangements when control of the promised goods or services are transferred to its customers, in an amount that reflects the amount of consideration expected to be received in

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

exchange for the transferred goods or services. For the sale of hardware products, including related firmware and free software solutions, revenue is recognized when transfer of control occurs at a point in time, which generally is at the time the hardware product is shipped and collection is considered probable. For customers who purchase products directly from GoPro.com, the Company retains a portion of the risk of loss on these sales during transit, which are accounted for as fulfillment costs. For PCS, revenue is recognized ratably over 24 months, which represents the estimated period PCS is expected to be provided based on historical experience.

The Company’s subscription and service revenue is recognized primarily from its Premium+, Premium, and Quik subscription offerings and is recognized ratably over the subscription term, with any payments received in advance of services rendered recorded as deferred revenue. The Company launched its Premium+ subscription in February 2024, which includes cloud storage up to 500 gigabytes (GB) of non-GoPro content, access to GoPro’s HyperSmooth Pro video stabilization software, and the features included in the Premium subscription. The Company’s Premium subscription offers a range of services, including unlimited cloud storage of GoPro content supporting source video and photo quality, damaged camera replacement, cloud storage up to 25 GB of non-GoPro content, Quik desktop editing tools, which was launched in February 2024, highlight videos automatically delivered via the Company’s mobile app when GoPro camera footage is uploaded to a GoPro cloud account using Auto Upload, access to a high-quality live streaming service on GoPro.com as well as discounts on GoPro cameras, gear, mounts, and accessories. The Company also offers the Quik subscription that provides access to a suite of simple single-clip and multi-clip editing tools. For the three months ended March 31, 2024, subscription and service revenue was $25.9 million, or 16.7% of total revenue. Subscription and service revenue as a percentage of 2023 annual revenue was not material.

For the Company’s camera sale arrangements with multiple performance obligations, revenue is allocated to each performance obligation based on its relative standalone selling price. Standalone selling prices are based on observable prices at which the Company separately sells its products, and subscription and service. If a standalone selling price is not directly observable, then the Company estimates the standalone selling prices considering market conditions and entity-specific factors. For example, the standalone selling price for PCS is determined based on a cost-plus approach, which incorporates the level of support provided to customers, estimated costs to provide such support, and the amount of time and costs that are allocated to efforts to develop the undelivered elements.

The Company’s standard terms and conditions of sale for non-web-based sales do not allow for product returns other than under warranty. However, the Company grants limited rights of return, primarily to certain large retailers. The Company reduces revenue and cost of sales for the estimated returns based on analyses of historical return trends by customer class and other factors. An estimated return liability along with a right to recover assets are recorded for future product returns. Return trends are influenced by product life cycles, new product introductions, market acceptance of products, product sell-through, the type of customer, seasonality, and other factors. Return rates may fluctuate over time but are sufficiently predictable to allow the Company to estimate expected future product returns.

The Company provides sales commissions to internal and external sales representatives which are earned in the period in which revenue is recognized. As a result, the Company expenses sales commissions as incurred.

Deferred revenue as of March 31, 2024 and December 31, 2023, includes amounts related to the Company’s subscriptions and PCS. The Company’s short-term and long-term deferred revenue balances totaled $58.4 million and $59.1 million as of March 31, 2024 and December 31, 2023, respectively. During the three months ended March 31, 2024 and 2023, the Company recognized $22.8 million and $16.5 million of revenue that was included in the deferred revenue balance as of December 31, 2023 and 2022, respectively.

Sales incentives. The Company offers sales incentives through various programs, including cooperative advertising, price protection, marketing development funds, and other incentives. Sales incentives are considered to be variable consideration, which the Company estimates and records as a reduction to revenue at the date of sale. The Company estimates sales incentives based on historical experience, product sell-through, and other factors.

Income taxes. The Company utilizes the asset and liability method for computing its income tax provision, under which, deferred tax assets and liabilities are recognized for the expected future consequences of temporary

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

differences between the financial reporting and tax bases of assets and liabilities using enacted tax rates. Management makes estimates, assumptions, and judgments to determine the Company’s provision for income taxes, deferred tax assets and liabilities, and any valuation allowance recorded against deferred tax assets. The Company assesses the likelihood that its deferred tax assets will be recovered from future taxable income in each tax jurisdiction and, to the extent the Company believes recovery is not likely, establishes a valuation allowance.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized from such positions are then measured based on the largest benefit that has a greater than 50% likelihood of being realized upon settlement. Interest and penalties related to unrecognized tax benefits are recognized within income tax expense.

Segment information. The Company operates as one operating segment as it only reports financial information on an aggregate and consolidated basis to its Chief Executive Officer, who is the Company’s chief operating decision maker.

Business Acquisitions. The Company accounts for acquired businesses using the acquisition method of accounting, which requires that once control of a business is obtained, 100% of the assets acquired and liabilities assumed be recorded at the date of acquisition at their respective fair values. Any excess of the purchase price over the estimated fair values of the net assets acquired is recorded as goodwill. Acquisition-related expenses including transaction and integration costs are expensed as incurred. The Company uses various models to determine the value of assets acquired such as the cost method. Determining the useful life of an intangible asset also requires judgment as different types of intangible assets will have different useful lives and certain assets may be considered to have indefinite useful lives.

Recent accounting standards.

| | | | | | | | | | | | | | | | | | | | |

| Standard | | Description | | Company’s date of adoption | | Effect on the condensed consolidated financial statements or other significant matters |

| Standards not yet adopted | | | | |

Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures ASU No. 2023-07

| | This standard is intended to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses on an interim and annual basis. Additionally, this standard would require that a public entity that has a single reportable segment provide all the disclosures required by the standard and all existing segment disclosures in Topic 280. This standard is effective for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The standard requires retrospective application. | | January 1, 2024 | | The Company is currently evaluating the impact of adopting this standard on its 2024 Form 10-K financial statements and related disclosures. |

Income Taxes (Topic 740): Improvements to Income Tax Disclosures ASU No. 2023-09 | | This standard requires reporting companies to break out income tax expense and a tax rate reconciliation in more detail. This standard is effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The standard requires prospective transition with the option to apply retrospectively. | | January 1, 2025 | | The Company is currently evaluating the impact of adopting this standard on its financial statements and related disclosures. |

Although there are several other new accounting standards issued or proposed by the FASB, which the Company has adopted or will adopt, as applicable, the Company does not believe any of these accounting pronouncements has had or will have a material impact on its condensed consolidated financial statements.

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

2. Business Acquisitions

On February 27, 2024, the Company completed an acquisition of Forcite Helmet Systems, a privately-held company that offers technology-enabled helmets, for total consideration of $14.0 million. The allocation of the purchase price primarily included $7.5 million in developed technology and $5.9 million of residual goodwill. Net tangible assets acquired were not material.

Goodwill is primarily attributable to expected synergies in the technologies that can be leveraged by the Company in future product offerings. Goodwill is not expected to be deductible for United States income tax purposes. The operating results of Forcite Helmet Systems have been included in the Company’s condensed consolidated financial statements from the date of acquisition. Actual and pro forma results of operations for this acquisition have not been presented because they did not have a material impact to the Company’s condensed consolidated results of operations.

3. Fair value measurements

The Company’s assets that are measured at fair value on a recurring basis within the fair value hierarchy are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (in thousands) | Level 1 | | Level 2 | | | | Total | | Level 1 | | Level 2 | | | | Total |

Cash equivalents (1): | | | | | | | | | | | | | | | |

| Money market funds | $ | 87,200 | | | $ | — | | | | | $ | 87,200 | | | $ | 152,760 | | | $ | — | | | | | $ | 152,760 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total cash equivalents | $ | 87,200 | | | $ | — | | | | | $ | 87,200 | | | $ | 152,760 | | | $ | — | | | | | $ | 152,760 | |

| Marketable securities: | | | | | | | | | | | | | | | |

| U.S. treasury securities | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | $ | 7,962 | | | | | $ | 7,962 | |

| Commercial paper | — | | | — | | | | | — | | | — | | | 7,942 | | | | | 7,942 | |

| Corporate debt securities | — | | | — | | | | | — | | | — | | | 3,978 | | | | | 3,978 | |

| Government securities | — | | | — | | | | | — | | | — | | | 3,985 | | | | | 3,985 | |

| Total marketable securities | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | $ | 23,867 | | | | | $ | 23,867 | |

(1) Included in cash and cash equivalents in the accompanying Condensed Consolidated Balance Sheets. Cash balances were $46.4 million and $69.9 million as of March 31, 2024 and December 31, 2023, respectively.

Cash equivalents are classified as Level 1 because the Company uses quoted market prices to determine their fair value. Marketable securities are classified as Level 2 because the Company uses alternative pricing sources and models utilizing market observable inputs to determine their fair value. The Company held no marketable securities as of March 31, 2024, and the contractual maturities of available-for-sale marketable securities as of December 31, 2023 were all less than one year in duration. As of March 31, 2024 and December 31, 2023, the Company had no financial assets or liabilities measured at fair value on a recurring basis that were classified as Level 3, which are valued based on inputs supported by little or no market activity.

As of March 31, 2024 and December 31, 2023, the amortized cost of the Company’s cash equivalents and marketable securities approximated their fair value and there were no material realized or unrealized gains or losses, either individually or in the aggregate.

In November 2020, the Company issued $143.8 million principal amount of Convertible Senior Notes due 2025 (2025 Notes) (see Note 5 Financing arrangements). In November 2023, the Company repurchased $50.0 million in aggregate principal amount of the 2025 Notes. The estimated fair value of the 2025 Notes is based on quoted market prices of the Company’s instruments in markets that are not active and are classified as Level 2 within the fair value hierarchy. The Company estimated the fair value of the 2025 Notes by evaluating quoted market prices and calculating the upfront cash payment a market participant would require to assume these obligations. The calculated fair value of the 2025 Notes was $85.6 million and $82.3 million as of March 31, 2024 and

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

December 31, 2023, respectively. The calculated fair value is highly correlated to the Company’s stock price and as a result, significant changes to the Company’s stock price will have a significant impact on the calculated fair value of the 2025 Notes.

For certain other financial assets and liabilities, including accounts receivable, accounts payable and other current assets and liabilities, the carrying amounts approximate their fair value primarily due to the relatively short maturity of these balances.

The Company also measures certain non-financial assets at fair value on a nonrecurring basis, primarily goodwill, intangible assets, and operating lease right-of-use assets, in connection with periodic evaluations for potential impairment.

4. Condensed consolidated financial statement details

The following section provides details of selected balance sheet items.

Inventory

| | | | | | | | | | | |

| | | |

(in thousands) | March 31, 2024 | | December 31, 2023 |

Components | $ | 20,510 | | | $ | 20,311 | |

Finished goods | 110,742 | | | 85,955 | |

Total inventory | $ | 131,252 | | | $ | 106,266 | |

Property and equipment, net

| | | | | | | | | | | | | |

| | | |

(in thousands) | | | March 31, 2024 | | December 31, 2023 |

| Leasehold improvements | | | $ | 23,904 | | | $ | 23,818 | |

| Production, engineering, and other equipment | | | 37,337 | | | 38,574 | |

| Tooling | | | 5,688 | | | 5,678 | |

| Computers and software | | | 14,085 | | | 13,896 | |

| Furniture and office equipment | | | 4,575 | | | 4,575 | |

| Tradeshow equipment and other | | | 1,503 | | | 1,502 | |

| Construction in progress | | | 231 | | | 83 | |

Gross property and equipment | | | 87,323 | | | 88,126 | |

| Less: Accumulated depreciation and amortization | | | (78,404) | | | (79,440) | |

Property and equipment, net | | | $ | 8,919 | | | $ | 8,686 | |

Other long-term assets

| | | | | | | | | | | |

(in thousands) | March 31, 2024 | | December 31, 2023 |

| | | |

Point of purchase (POP) displays | $ | 11,296 | | | $ | 6,254 | |

Deposits and other | 7,977 | | | 8,233 | |

| Intangible assets, net | 7,359 | | | 15 | |

Long-term deferred tax assets | 697 | | | 296,984 | |

| Other long-term assets | $ | 27,329 | | | $ | 311,486 | |

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

Intangible assets

| | | | | | | | | | | | | | | | | | | | | | | |

| Useful life

(in months) | | March 31, 2024 |

| (in thousands) | | | Gross carrying value | | Accumulated amortization | | Net carrying value |

| Purchased technology | 20-72 | | $ | 58,566 | | | $ | (51,222) | | | $ | 7,344 | |

| Domain name | | | 15 | | | — | | 15 | |

Total intangible assets | | | $ | 58,581 | | $ | (51,222) | | | $ | 7,359 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Useful life

(in months) | | December 31, 2023 |

| (in thousands) | | | Gross carrying value | | Accumulated amortization | | Net carrying value |

| Purchased technology | 20-72 | | $ | 51,066 | | | $ | (51,066) | | | $ | — | |

| Domain name | | | 15 | | | — | | 15 | |

Total intangible assets | | | $ | 51,081 | | $ | (51,066) | | | $ | 15 |

The gross carrying value of purchased technology increased $7.5 million from December 31, 2023 as result of the acquisition of Forcite Helmet Systems in February 2024 (see Note 2 Business Acquisitions). Amortization expense was $0.2 million and zero for the three months ended March 31, 2024 and 2023, respectively. At March 31, 2024, expected amortization expense of intangible assets with definite lives for future periods was as follows:

| | | | | |

(in thousands) | Total |

| Year ending December 31, | |

| 2024 (remaining 9 months) | $ | 1,406 | |

| 2025 | 1,875 | |

| 2026 | 1,875 | |

| 2027 | 1,875 | |

| 2028 | 313 | |

| $ | 7,344 | |

Accrued expenses and other current liabilities

| | | | | | | | | | | |

| |

(in thousands) | March 31, 2024 | | December 31, 2023 |

| Accrued sales incentives | $ | 33,727 | | | $ | 42,752 | |

| Accrued liabilities | 19,824 | | | 21,214 | |

Employee related liabilities (1) | 10,387 | | | 18,969 | |

| Warranty liabilities | 6,813 | | | 8,270 | |

| Return liability | 5,157 | | | 6,389 | |

Inventory received | 2,637 | | | 1,745 | |

Customer deposits | 2,527 | | | 1,933 | |

Purchase order commitments | 1,658 | | | 899 | |

Other | 6,617 | | | 7,878 | |

| Accrued expenses and other current liabilities | $ | 89,347 | | | $ | 110,049 | |

(1) See Note 12 Restructuring charges for amounts associated with restructuring liabilities.

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

Product warranty

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

(in thousands) | 2024 | | 2023 | | | | | | |

Beginning balance | $ | 8,759 | | | $ | 8,319 | | | | | | | |

Charged to cost of revenue | 1,811 | | | 3,755 | | | | | | | |

Settlement of warranty claims | (3,531) | | | (4,829) | | | | | | | |

Warranty liability | $ | 7,039 | | | $ | 7,245 | | | | | | | |

As of March 31, 2024 and December 31, 2023, $6.8 million and $8.3 million, respectively, of the warranty liability was recorded as a component of accrued expenses and other current liabilities, and $0.2 million and $0.5 million, respectively, was recorded as a component of other long-term liabilities.

5. Financing arrangements

2021 Credit Facility

In January 2021, the Company entered into a Credit Agreement which provides for a revolving credit facility (2021 Credit Facility) under which the Company may borrow up to an aggregate amount of $50.0 million. In March 2023, the Company amended the 2021 Credit Agreement (collectively, the 2021 Credit Agreement). The 2021 Credit Agreement will terminate and any outstanding borrowings become due and payable on the earlier of (i) January 2027 and (ii) unless the Company has cash in a specified deposit account in an amount equal to or greater than the amount required to repay the Company’s 1.25% Convertible Senior Notes due November 2025, 91 days prior to the maturity date of such convertible notes.

The amount that may be borrowed under the 2021 Credit Agreement may be based on a customary borrowing base calculation if the Company’s Asset Coverage Ratio is at any time less than 1.50. The Asset Coverage Ratio is defined as the ratio of (i) the sum of (a) the Company’s cash and cash equivalents in the United States plus specified percentages of other qualified debt investments (Qualified Cash) plus (b) specified percentages of the net book values of the Company’s accounts receivable and certain inventory to (ii) $50.0 million.

Borrowed funds accrue interest at the greater of (i) a per annum rate equal to the base rate plus a margin of from 0.50% to 1.00% depending on the Company’s Asset Coverage Ratio or (ii) a per annum rate equal to the Secured Overnight Financing Rate plus a 10 basis point premium and a margin of from 1.50% to 2.00% depending on the Company’s Asset Coverage Ratio. The Company is required to pay a commitment fee on the unused portion of the 2021 Credit Facility of 0.25% per annum. Amounts owed under the 2021 Credit Agreement are guaranteed by certain of the Company’s United States subsidiaries and secured by a first priority security interest in substantially all of the assets of the Company and certain of its subsidiaries (other than intellectual property, which is subject to a negative pledge restricting grants of security interests to third parties).

The 2021 Credit Agreement contains customary representations, warranties, and affirmative and negative covenants. The negative covenants include restrictions on the incurrence of liens and indebtedness, certain investments, dividends, stock repurchases, and other matters, all subject to certain exceptions. In addition, the Company is required to maintain Liquidity (the sum of unused availability under the credit facility and the Company’s Qualified Cash) of at least $55.0 million (of which at least $40.0 million shall be attributable to Qualified Cash), or, if the borrowing base is then in effect, minimum unused availability under the credit facility of at least $10.0 million. The 2021 Credit Agreement also includes customary events of default that include, among other things, non-payment of principal, interest or fees, inaccuracy of representations and warranties, violation of certain covenants, cross default to certain other indebtedness, bankruptcy and insolvency events, material judgments and change of control. Upon an event of default, the lender may, subject to customary cure rights, require the immediate payment of all amounts outstanding.

As of March 31, 2024, the Company was in compliance with all financial covenants contained in the 2021 Credit Agreement and has made no borrowings from the 2021 Credit Facility to date. As of March 31, 2024, the

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

Company could borrow up to $44.8 million under the 2021 Credit Agreement. However, there is an outstanding letter of credit under the 2021 Credit Agreement of $5.2 million for certain duty-related requirements. This was not collateralized by any cash on hand.

2025 Convertible Notes

In November 2020, the Company issued $125.0 million aggregate principal amount of 1.25% Convertible Senior Notes due 2025 (the 2025 Notes) and granted an option to the initial purchasers to purchase up to an additional $18.8 million aggregate principal amount of the 2025 Notes to cover over-allotments, of which $18.8 million was subsequently exercised during November 2020, resulting in a total issuance of $143.8 million aggregate principal amount of the 2025 Notes. The 2025 Notes are senior, unsecured obligations of the Company and mature on November 15, 2025, unless earlier repurchased or converted into shares of Class A common stock under certain circumstances. The 2025 Notes are convertible into cash, shares of the Company’s Class A common stock, or a combination thereof, at the Company’s election, at an initial conversion rate of 107.1984 shares of Class A common stock per $1,000 principal amount of the 2025 Notes, which is equivalent to an initial conversion price of approximately $9.3285 per share of common stock, subject to adjustment. The Company pays interest on the 2025 Notes semi-annually in arrears on May 15 and November 15 of each year.

The Company may redeem all or any portion of the 2025 Notes on or after November 20, 2023 for cash if the last reported sale price of the Company’s common stock has been at least 130% of the conversion price then in effect for least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which the Company provides the redemption notice, at a redemption price equal to 100% of the principal amount of the 2025 Notes to be redeemed, plus accrued interest and unpaid interest to, but excluding the redemption date. No sinking fund is provided for the 2025 Notes. The indenture includes customary terms and covenants, including certain events of default after which the 2025 Notes may be due and payable immediately.

Holders have the option to convert the 2025 Notes in multiples of $1,000 principal amount at any time prior to August 15, 2025, but only in the following circumstances:

•during any calendar quarter beginning after the calendar quarter ending on March 31, 2021, if the last reported sale price of Class A common stock for at least 20 trading days (whether or not consecutive) during the last 30 consecutive trading days of the immediately preceding fiscal quarter is greater than or equal to 130% of the conversion price of the 2025 Notes on each applicable trading day;

•during the five-business day period following any five consecutive trading day period in which the trading price for the 2025 Notes is less than 98% of the product of the last reported sale price of Class A common stock and the conversion rate for the 2025 Notes on each such trading day;

•if the Company calls any or all of the 2025 Notes for redemption, at any time prior to the close of business on the scheduled trading day immediately before the redemption date; or

•upon the occurrence of specified corporate events.

At any time on or after August 15, 2025 until the second scheduled trading day immediately preceding the maturity date of the 2025 Notes on November 15, 2025, a holder may convert its 2025 Notes, in multiples of $1,000 principal amount. Holders of the 2025 Notes who convert their 2025 Notes in connection with a make-whole fundamental change (as defined in the indenture) are, under certain circumstances, entitled to an increase in the conversion rate. In addition, in the event of a fundamental change prior to the maturity date, holders will, subject to certain conditions, have the right, at their option, to require the Company to repurchase for cash all or part of the 2025 Notes at a repurchase price equal to 100% of the principal amount of the 2025 Notes to be repurchased, plus accrued and unpaid interest up to, but excluding, the repurchase date. During the three months ended March 31, 2024, the conditions allowing holders of the 2025 Notes to convert were not met.

In connection with the offering of the 2025 Notes, the Company paid $10.2 million to enter into privately negotiated capped call transactions with certain financial institutions (Capped Calls). The Capped Calls have an initial strike price of $9.3285 per share, which corresponds to the initial conversion price of the 2025 Notes. The Capped Calls cover, subject to anti-dilution adjustments substantially similar to those applicable to the conversion rate of the 2025 Notes, the number of Class A common stock initially underlying the 2025 Notes. The Capped

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

Calls are generally expected to reduce potential dilution to the Company’s Class A common stock upon any conversion of the 2025 Notes and/or offset any cash payments the Company is required to make in excess of the principal amount of converted 2025 Notes, as the case may be, with such reduction and/or offset subject to a cap, initially equal to $12.0925, and is subject to certain adjustments under the terms of the Capped Call transactions. The Capped Calls will expire in November 2025, if not exercised earlier.

The Capped Calls are subject to adjustment upon the occurrence of specified extraordinary events affecting the Company, including merger events, tender offers, and announcement events. In addition, the Capped Calls are subject to certain specified additional disruption events that may give rise to a termination of the Capped Calls, including nationalization, insolvency or delisting, changes in law, failures to deliver, insolvency filings and hedging disruptions. For accounting purposes, the Capped Calls are separate transactions, and not part of the terms of the 2025 Notes. As these transactions meet certain accounting criteria, the Capped Calls are recorded in stockholders’ equity as a reduction to additional paid-in capital and will not be remeasured as long as they continue to meet certain accounting criteria.

In November 2023, the Company repurchased $50.0 million in aggregate principal amount of the 2025 Notes in exchange for $46.3 million cash through an individual, privately negotiated transaction. The repurchase was accounted for as a debt extinguishment. The carrying value of the portion of the 2025 Notes repurchased was $49.4 million, and the Company recognized a gain on the debt extinguishment of $3.1 million, which was recorded in the fourth quarter of 2023 within other income (expense), net, on the Company’s Condensed Consolidated Statements of Operations.

As of March 31, 2024 and December 31, 2023, the outstanding principal on the 2025 Notes was $93.8 million and $93.8 million, respectively, the unamortized debt issuance cost was $1.0 million and $1.2 million, respectively, and the net carrying amount of the liability was $92.7 million and $92.6 million, respectively, which was recorded as long-term debt within the Condensed Consolidated Balance Sheets. For the three months ended March 31, 2024 and 2023, the Company recorded interest expense of $0.3 million and $0.4 million, respectively, for contractual coupon interest, and $0.2 million and $0.2 million, respectively, for amortization of debt issuance costs. As of March 31, 2024, and December 31, 2023, the effective interest rate, which is calculated as the contractual interest rate adjusted for the debt issuance costs, was 0.5% and 2.8%, respectively.

6. Stockholders’ equity

Stock Repurchase Program. On January 27, 2022, the Company’s board of directors authorized the repurchase of up to $100 million of its Class A common stock, and on February 9, 2023, the Company’s board of directors authorized the repurchase of an additional $40 million of its Class A common stock. Stock repurchases under the program may be made periodically using a variety of methods, including without limitation, open market purchases, block trades or otherwise in compliance with all federal and state securities laws and state corporate law and in accordance with the single broker, timing, price, and volume guidelines set forth in Rule 10b-18 and Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, as such guidelines may be modified by the SEC from time to time. This stock repurchase program has no time limit and may be modified, suspended, or discontinued at any time. The Company currently intends to hold its repurchased shares as treasury stock.

As of March 31, 2024, the remaining amount of share repurchases under the program was $60.4 million. The following table summarizes share repurchases during the three months ended March 31, 2024 and 2023.

| | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| (in thousands, except per share data) | | | | | 2024 | | 2023 |

| Shares repurchased | | | | | — | | | 890 | |

| Average price per share | | | | | $ | — | | | $ | 5.62 | |

| Value of shares repurchased | | | | | $ | — | | | $ | 5,000 | |

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

7. Employee benefit plans

Equity incentive plans. The Company has outstanding equity grants from four of its five stock-based employee compensation plans: the 2024 Equity Incentive Plan (2024 Plan), the 2014 Equity Incentive Plan (2014 Plan), the 2010 Equity Incentive Plan (2010 Plan), and the 2024 Employee Stock Purchase Plan (2024 ESPP). The 2014 Plan serves as successor to the 2010 Plan and the 2024 Plan serves as a successor to the 2014 Plan. The effective date of both the 2024 Plan and the 2024 ESPP was February 15, 2024. The 2014 Plan and the 2014 Employee Stock Purchase Plan (2014 ESPP) each expired on February 15, 2024. The 2014 ESPP plan’s final purchase was on February 15, 2024, and no remaining purchase rights are accrued under this plan. Awards granted under the 2010 and 2014 Plans will continue to be subject to the terms and provisions of the 2010 and 2014 Plans.

The 2024 Plan provides for the granting of incentive and non-qualified stock options, restricted stock awards (RSAs), restricted stock units (RSUs), stock appreciation rights, stock bonus awards and performance awards to qualified employees, non-employee directors and consultants. Options granted under the 2024 Plan generally expire within ten years from the date of grant and generally vest over one to four years. Restricted stock units (RSUs) granted under the 2024 Plan generally vest over two to four years based upon continued service and are settled at vesting in shares of the Company’s Class A common stock. Performance stock units (PSUs) granted under the 2024 Plan generally vest over three years based upon continued service and the Company achieving certain financial and operating targets and are settled at vesting in shares of the Company’s Class A common stock. The Company accounts for forfeitures of stock-based payment awards in the period they occur. The 2024 ESPP allows eligible employees to purchase shares of the Company’s Class A common stock through payroll deductions at a price equal to 85% of the lesser of the fair market value of the stock as of the first date or the ending date of each six-month offering period. For additional information regarding the Company's equity incentive plans, refer to the 2023 Annual Report.

Stock options

A summary of the Company’s stock option activity for the three months ended March 31, 2024 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Shares (in thousands) | | Weighted-average exercise price | | Weighted-average remaining contractual term (in years) | | Aggregate intrinsic value (in thousands) |

| Outstanding at December 31, 2023 | 2,684 | | | $ | 8.43 | | | 5.08 | | $ | — | |

| Granted | — | | | — | | | | | |

| Exercised | — | | | — | | | | | |

| Forfeited/Cancelled | (98) | | | 16.39 | | | | | |

| Outstanding at March 31, 2024 | 2,586 | | | $ | 8.13 | | | 5.02 | | $ | — | |

| | | | | | | |

| Vested and expected to vest at March 31, 2024 | 2,586 | | | $ | 8.13 | | | 5.02 | | $ | — | |

| Exercisable at March 31, 2024 | 2,208 | | | $ | 8.52 | | | 4.40 | | $ | — | |

The aggregate intrinsic value of the stock options outstanding as of March 31, 2024 represents the value of the Company’s closing stock price on March 31, 2024 in excess of the exercise price multiplied by the number of options outstanding.

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

Restricted stock units

A summary of the Company’s RSU activity for the three months ended March 31, 2024 is as follows:

| | | | | | | | | | | |

| Shares (in thousands) | | Weighted-average grant date fair value |

| Non-vested shares at December 31, 2023 | 11,494 | | | $ | 5.94 | |

| Granted | 2,287 | | | 2.49 | |

| Vested | (2,248) | | | 6.75 | |

| Forfeited | (469) | | | 5.49 | |

| Non-vested shares at March 31, 2024 | 11,064 | | | $ | 5.08 | |

Performance stock units

A summary of the Company’s PSU activity for the three months ended March 31, 2024 is as follows:

| | | | | | | | | | | |

| Shares (in thousands) | | Weighted-average grant date fair value |

| Non-vested shares at December 31, 2023 | 829 | |

| $ | 6.40 | |

| Granted | — | | | — | |

| Vested | (297) | | | 6.46 | |

| Forfeited | (12) | | | 5.79 | |

| Non-vested shares at March 31, 2024 | 520 | | | $ | 6.38 | |

Employee stock purchase plan. For the three months ended March 31, 2024 and 2023, the Company issued 0.7 million and 0.5 million shares under its employee stock purchase plans, respectively, at weighted-average prices of $2.12 and $5.09, per share, respectively.

Stock-based compensation expense. The Company measures compensation expense for all stock-based payment awards based on the estimated fair values on the date of the grant. The fair value of stock options granted and ESPP issuances is estimated using the Black-Scholes option pricing model. The fair value of RSUs and PSUs are determined using the Company’s closing stock price on the date of grant. There have been no significant changes in the Company’s valuation assumptions from those disclosed in its 2023 Annual Report.

The following table summarizes stock-based compensation expense included in the Condensed Consolidated Statements of Operations:

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

(in thousands) | 2024 | | 2023 | | | | | | |

Cost of revenue | $ | 415 | | | $ | 466 | | | | | | | |

Research and development | 4,265 | | | 4,746 | | | | | | | |

Sales and marketing | 1,744 | | | 2,178 | | | | | | | |

General and administrative | 2,346 | | | 2,924 | | | | | | | |

| Total stock-based compensation expense | $ | 8,770 | | | $ | 10,314 | | | | | | | |

There was no income tax benefit related to stock-based compensation expense for the three months ended March 31, 2024 due to a full valuation allowance on the Company’s United States net deferred tax assets. The income tax benefit related to stock-based compensation expense for the three months ended March 31, 2023 was $2.3 million. See Note 9, Income taxes, for additional details.

As of March 31, 2024, total unearned stock-based compensation of $51.8 million related to stock options, RSUs, PSUs, and ESPP shares is expected to be recognized over a weighted-average period of 2.32 years.

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

8. Net loss per share

The following table presents the calculations of basic and diluted net loss per share for the three months ended March 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| (in thousands, except per share data) | 2024 | | 2023 | | | | | | |

Numerator: | | | | | | | | | |

| Net loss | $ | (339,088) | | | $ | (29,869) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Denominator: | | | | | | | | | |

| Weighted-average common shares—basic and diluted for Class A and Class B common stock | 151,091 | | | 155,402 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Basic and diluted net loss per share | $ | (2.24) | | | $ | (0.19) | | | | | | | |

| | | | | | | | | |

The following potentially dilutive shares were not included in the calculation of diluted shares outstanding as the effect would have been anti-dilutive:

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

(in thousands) | 2024 | | 2023 | | | | | | |

| Stock-based awards | 15,689 | | | 14,500 | | | | | | | |

| Shares related to convertible senior notes | 10,050 | | | 15,410 | | | | | | | |

| Total anti-dilutive securities | 25,739 | | | 29,910 | | | | | | | |

Basic net income (loss) per share is calculated by dividing net income (loss) by the weighted-average number of shares of common stock outstanding. Diluted net income per share adjusts the basic net income per share and the weighted-average number of shares of common stock outstanding for the potentially dilutive impact of the Company’s ESPP and stock awards, using the treasury stock method. The Company calculated the potential dilutive effect of its 2025 Notes under the if-converted method. Under the if-converted method, diluted net income per share was determined by assuming all of the 2025 Notes were converted into shares of the Company’s Class A common stock at the beginning of the reporting period. In addition, in periods of net income, interest charges on the 2025 Notes, which includes both coupon interest and amortization of debt issuance costs, were added back to net income on an after-tax effected basis.

The 2025 Notes will mature on November 15, 2025, unless earlier repurchased or converted into shares of Class A common stock under certain circumstances as described further in Note 5 Financing arrangements. The 2025 Notes are convertible into cash, shares of the Company’s Class A common stock, or a combination thereof, at the Company’s election.

The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share and each share of Class B common stock is entitled to ten votes per share. Each share of Class B common stock is convertible at any time at the option of the stockholder into one share of Class A common stock and has no expiration date. Each share of Class B common stock will convert automatically into one share of Class A common stock upon the date when the outstanding shares of Class B common stock represent less than 10% of the aggregate number of shares of common stock then outstanding. Class A common stock is not convertible into Class B common stock. The computation of the diluted net income per share of Class A common stock assumes the conversion of Class B common stock.

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

9. Income taxes

The following table provides the income tax expense (benefit) amount:

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| (dollars in thousands) | 2024 | | 2023 | | | | | | |

| Income tax expense (benefit) | $ | 298,209 | | | $ | (8,253) | | | | | | | |

| | | | | | | | | |

The Company recorded an income tax expense of $298.2 million for the three months ended March 31, 2024, on pre-tax net loss of $40.9 million. The Company’s income tax expense for the three months ended March 31, 2024 primarily resulted from a tax expense of $1.4 million on pre-tax book income in certain tax jurisdictions, and discrete items that included $294.9 million of net tax expense from the establishment of a valuation allowance on United States federal and state net deferred tax assets, and $2.5 million of nondeductible equity tax expense for employee stock-based compensation, partially offset by $0.4 million of restructuring charges.

Each quarter, the Company assesses the realizability of its existing deferred tax assets under ASC Topic 740. The Company assesses available positive and negative evidence to estimate whether sufficient future taxable income will be generated to realize its deferred tax assets. In the assessment for the period ended March 31, 2024, the Company concluded based on the introduction of negative evidence resulting from developments in the first quarter of 2024, such as increased and accelerated costs associated with the Company’s future product strategy and roadmap, an increasingly competitive environment, integration and product development costs related to the recent acquisition of Forcite Helmet Systems, restructuring costs and other negative factors, that it is more likely than not that its United States federal and state deferred tax assets will not be realized. Therefore, after consideration of the Company’s deferred tax liabilities and recent developments, the Company provided a valuation allowance of $294.9 million on United States federal and state deferred tax assets. That determination was also based, in part, on the Company’s revised expectation that its projections of pre-tax losses in 2024 and future years will cause the Company to be in a cumulative GAAP loss for ASC Topic 740 purposes in 2024 and forward. The Company will continue to monitor its future financial results, expected projections and their potential impact on the Company’s assessment regarding the recoverability of its deferred tax asset balances and in the event there is a need to release the valuation allowance, a tax benefit would be recorded.

For the three months ended March 31, 2023 the Company recorded an income tax benefit of $8.3 million on pre-tax net loss of $38.1 million. The Company’s income tax benefit for the three months ended March 31, 2023 was composed of $8.8 million of tax benefit incurred on pre-tax loss, and discrete items that primarily included $0.3 million of nondeductible equity tax expense for employee stock-based compensation, and $0.1 million of tax expense related to the foreign provision to income tax return adjustments.

At March 31, 2024 and December 31, 2023, the Company’s gross unrecognized tax benefits were $26.9 million and $25.8 million, respectively. If recognized, $12.0 million of these unrecognized tax benefits (net of United States federal benefit) at March 31, 2024 would reduce income tax expense. A material portion of the Company’s gross unrecognized tax benefits, if recognized, would increase the Company’s net operating loss carryforward, which would be offset by a full valuation allowance based on present circumstances.

The Company conducts business globally and as a result, files income tax returns in the United States and foreign jurisdictions. The Company’s unrecognized tax benefits relate primarily to unresolved matters with taxing authorities. While it is often difficult to predict the final outcome or the timing of resolution of any particular uncertain tax position, the Company believes that its reserves reflect the more likely outcome. The Company believes, due to statute of limitations expiration, that within the next 12 months, it is possible that up to $3.7 million of uncertain tax positions could be released. It is also reasonably possible that additional uncertain tax positions will be added. It is not reasonably possible at this time to quantify the net effect.

In 2021, the Organization for Economic Co-operation and Development (OECD) established an inclusive framework on base erosion and profit shifting and agreed on a two-pillar solution (Pillar Two) to global taxation, focusing on global profit allocation and a 15% global minimum effective tax rate. On December 15, 2022, the EU member states agreed to implement the OECD’s global minimum tax rate of 15%. The OECD issued Pillar Two model rules and continues to release guidance on these rules. The inclusive framework calls for tax law changes by participating countries to take effect in 2024 and 2025. Various countries have enacted or have announced

GoPro, Inc.

Notes to Condensed Consolidated Financial Statements

plans to enact new tax laws to implement the global minimum tax. The Company assessed the impact of Pillar Two and there is no material impact to the provision for income taxes for the three months ended March 31, 2024. The Company will continue to monitor future guidance issued and assess the potential impact to the Company’s condensed consolidated financial statements.

10. Commitments, contingencies, and guarantees

Facility leases. The Company leases its facilities under long-term operating leases, which expire at various dates through 2029.

The components of net lease cost, which were primarily recorded in operating expenses, were as follows:

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, | | |

| (in thousands) | 2024 | | 2023 | | | | | | |

Operating lease cost (1) | $ | 2,800 | | | $ | 3,358 | | | | | | | |

| Sublease income | (723) | | | (723) | | | | | | | |

| | | | | | | | | |

| Net lease cost | $ | 2,077 | | | $ | 2,635 | | | | | | | |

(1) Operating lease cost includes variable lease costs, which are immaterial.

Supplemental cash flow information related to leases was as follows:

| | | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, | |

| (in thousands) | | 2024 | | 2023 | | | | | |

| Cash paid for amounts included in the measurement of lease liabilities | | | | | | | | | |

| Operating cash flows from operating leases | | $ | 3,392 | | | $ | 3,791 | | | | | | |

| Right-of-use assets obtained in exchange for operating lease liabilities | | 513 | | | 186 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Supplemental balance sheet information related to leases was as follows: