UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 4)1

Farmer Bros. Co.

(Name

of Issuer)

Common Stock, par value $1.00 per share

(Title of Class of Securities)

307675108

(CUSIP Number)

ARON R. ENGLISH

22NW, LP

590 1st Ave. S

Unit C1

Seattle, Washington 98104

(206) 227-3078

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

October 12, 2023

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☒.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW Fund, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.6%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

* Percentage based on 20,356,801 Shares outstanding

as of September 5, 2023, as disclosed in the Issuer’s Annual Report filed with the Securities and Exchange Commission on September

12, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.6%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

* Percentage based on 20,356,801 Shares outstanding

as of September 5, 2023, as disclosed in the Issuer’s Annual Report filed with the Securities and Exchange Commission on September

12, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW Fund GP, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.6%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

* Percentage based on 20,356,801 Shares outstanding

as of September 5, 2023, as disclosed in the Issuer’s Annual Report filed with the Securities and Exchange Commission on September

12, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW GP, Inc. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.6%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

* Percentage based on 20,356,801 Shares outstanding

as of September 5, 2023, as disclosed in the Issuer’s Annual Report filed with the Securities and Exchange Commission on September

12, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Aron R. English |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO, PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,964,536 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,964,536 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,964,536 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.7%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Percentage based on 20,356,801 Shares outstanding

as of September 5, 2023, as disclosed in the Issuer’s Annual Report filed with the Securities and Exchange Commission on September

12, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Bryson O. Hirai-Hadley |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,261 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,261 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,261 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Percentage based on 20,356,801 Shares outstanding

as of September 5, 2023, as disclosed in the Issuer’s Annual Report filed with the Securities and Exchange Commission on September

12, 2023.

The following constitutes Amendment

No. 4 to the Schedule 13D filed by the undersigned (“Amendment No. 4”). This Amendment No. 4 amends the Schedule 13D as specifically

set forth herein.

| Item 2. | Identity and Background. |

Item 2 is hereby amended to add

the following:

The Reporting Persons are parties

to that certain Group Agreement (as further described in Item 4) with JCP Investment Partnership, LP (“JCP Partnership”),

JCP Investment Partners, LP, JCP Investment Holdings, LLC, JCP Investment Management, LLC and James C. Pappas (collectively, “JCP”),

Troy A. Ellis, Emily K. Keeton and David R. Tresko (together with JCP, Mr. Ellis and Ms. Keeton, the “JCP Parties”). As a

result, the Reporting Persons may be deemed to be members of a “group,” within the meaning of Section 13(d)(3) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), comprised of the Reporting Persons and the JCP Parties. It is the understanding

of the Reporting Persons that the JCP Parties will file a separate Schedule 13D with respect to their ownership of Shares pursuant to

Rule 13d-1(k)(2) of the Exchange Act. Reference is made to such Schedule 13D for information concerning the JCP Parties and their investment

in the Issuer.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On October 12, 2023, the Reporting

Persons and the JCP Parties entered into a Group Agreement (the “Group Agreement”). Pursuant to the Group Agreement, the parties

agreed, among others things, (i) to form a group with respect to the securities of the Issuer, (ii) to solicit proxies for the election

of certain persons nominated for election to the board of directors of the Issuer (the “Board”) at the Issuer’s 2023

annual meeting of stockholders (the “Annual Meeting”) (including those nominated by JCP) and (iii) that expenses incurred

in connection with the group’s activities would be split evenly between JCP and the 22NW Group (as defined in the initial Schedule

13D) with each such party paying 50% of the expenses. A copy of the Group Agreement is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

On October 13, 2023, JCP

Partnership delivered a letter to the Issuer nominating Troy A. Ellis, Emily K. Keeton and David R. Tresko for election to the Board

at the Annual Meeting.

| Item 5. | Interest in Securities of the Issuer. |

Item 5(a) is hereby amended to add the following:

The JCP Parties have represented

to the Reporting Persons that they beneficially own an aggregate of 992,826

Shares. Collectively, the Reporting Persons and the JCP Parties beneficially own 2,958,623

Shares, which represents approximately 14.5% of the outstanding Shares. Each Reporting Person disclaims beneficial ownership of the Shares

that he or it does not directly own. Furthermore, the Reporting Persons expressly disclaim beneficial ownership of the 992,826

Shares beneficially owned in the aggregate by the JCP Parties.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

The description of the Group Agreement

contained in Item 4 above is incorporated herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibit:

| 99.1 | Group Agreement, dated October 12, 2023. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: October 16, 2023

| |

22NW FUND, LP |

| |

|

| |

By: |

22NW Fund GP, LLC

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW, LP |

| |

|

| |

By: |

22NW GP, Inc.

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

22NW FUND GP, LLC |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW GP, INC. |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

/s/ Aron R. English |

| |

ARON R. ENGLISH |

| |

/s/ Bryson O. Hirai-Hadley |

| |

BRYSON O. HIRAI-HADLEY |

Exhibit 99.1

GROUP AGREEMENT

This Group Agreement (this

“Agreement”) is made and entered into as of October 12, 2023 by and among (i) JCP Investment Partnership, LP, JCP Investment

Partners, LP, JCP Investment Holdings, LLC, JCP Investment Management, LLC and James C. Pappas (collectively, “JCP”),

(ii) 22NW Fund, LP, 22NW, LP, 22NW Fund GP, LLC, 22NW GP, Inc. and Aron R. English (collectively, “22NW”), (iii) Bryson

O. Hirai-Hadley (together with 22NW, the “22NW Parties”) and (iv) Troy Ellis, Emily Keeton and David Tresko (together

with JCP, the 22NW Parties, Troy Ellis and Emily Keeton, each a “Party” and collectively, the “Parties”

or the “Group”).

WHEREAS, certain of the

undersigned are stockholders, direct or beneficial, of Farmer Bros. Co., a Delaware corporation (the “Company”); and

WHEREAS, the Parties desire

to form the Group for the purpose of (i) seeking representation on the Board of Directors of the Company (the “Board”)

at the 2023 annual meeting of stockholders of the Company (including any other meeting of stockholders held in lieu thereof, and any adjournments,

postponements, reschedulings or continuations thereof, the “Annual Meeting”), (ii) soliciting proxies for the election

of certain persons nominated for election to the Board at the Annual Meeting (including those nominated by JCP), (iii) taking all other

action necessary to achieve the foregoing and (iv) taking any other actions the Group determines to undertake in connection with their

respective investment in the Company (the “Coordinated Activities”).

NOW, IT IS AGREED, this

12th day of October 2023 by the Parties:

1. Each

of the undersigned agrees to form a “group” (as such term is defined in Section 13(d)(3) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”)) with respect to the securities of the Company. In furtherance of the foregoing

and in accordance with Rule 13d-1(k) of the Exchange Act, the Parties shall file, separately or jointly, a Schedule(s) 13D and any amendments

thereto with respect to the securities of the Company to the extent required by applicable law. Each member of the Group shall be responsible

for the accuracy and completeness of its own disclosure therein, and is not responsible for the accuracy and completeness of the information

concerning the other members of the Group, unless such member knows or has reason to know that such information is inaccurate.

2. So

long as this Agreement is in effect, each of the undersigned shall provide written notice to Olshan Frome Wolosky LLP (“Olshan”),

such notice to be given no later than four (4) hours after each such transaction, of (i) any of their purchases or sales of securities

of the Company, or (ii) any securities of the Company over which they acquire or dispose of beneficial ownership; provided,

however, that each Party agrees not to purchase or sell securities of the Company or otherwise increase or decrease its

economic exposure to or beneficial ownership over the securities of the Company if it reasonably believes that, as a result of such action,

the Group or any member thereof would be likely to be required to make any regulatory filing (including, but not limited to, a Schedule

13D or amendment thereto, Form 3 or Form 4 with the Securities and Exchange Commission (the “SEC”)) without using its

reasonable efforts to give the other members of the Group at least twelve (12) hours prior written notice; provided, further,

that prior to the Annual Meeting, no Party shall sell, or dispose of any beneficial ownership over, any securities of the Company without

the prior consent of JCP and 22NW. For purposes of this Agreement, the term “beneficial ownership” shall have the meaning

of such term set forth in Rule 13d-3 under the Exchange Act.

3. Each

of the undersigned agrees to form the Group for the purpose of the Coordinated Activities.

4. JCP

and 22NW hereby agree to jointly pay all expenses and costs incurred in connection with the Group’s activities (collectively, the

“Expenses”) on a percentage basis as follows: (i) JCP 50% of the Expenses and (ii) 22NW 50% of the Expenses. Any

reimbursement from the Company regarding the Expenses paid pursuant to this Section 4 shall be split by the Parties in proportion to the

Expenses paid pursuant to this Section 4.

5. Each

Party agrees that any filing with the SEC, press release or other communication proposed to be made or issued by the Group or any member

of the Group in connection with the Group’s activities shall first be approved by a representative of JCP and 22NW. The Parties

agree to work in good faith to resolve any disagreement that may arise between or among any of the members of the Group concerning decisions

to be made, actions to be taken or statements to be made in connection with the Group’s activities.

6. The

relationship of the Parties shall be limited to carrying on the business of the Group in accordance with the terms of this Agreement.

Such relationship shall be construed and deemed to be for the sole and limited purpose of carrying on such business as described herein.

Nothing herein shall be construed to authorize any Party to act as an agent for any other Party, or to create a joint venture or partnership,

or to constitute an indemnification. Each Party agrees to use its reasonable efforts to avoid taking any action that may cause any other

person or entity to be deemed to be a member of the Group without the prior consent of each of JCP and 22NW. Except as provided in Section

2, nothing herein shall restrict any Party’s right to purchase or sell securities of the Company, as it deems appropriate, in its

sole discretion, provided that all such purchases and sales are made in compliance with all applicable securities laws and the provisions

of this Agreement.

7. This

Agreement may be executed in counterparts, each of which shall be deemed an original and all of which, taken together, shall constitute

but one and the same instrument, which may be sufficiently evidenced by one counterpart.

8. This

Agreement is governed by and will be construed in accordance with the laws of the State of New York. In the event of any dispute arising

out of the provisions of this Agreement or their investment in the Company, the Parties consent and submit to the exclusive jurisdiction

of the United States District Court for the Southern District of New York located in the Borough of Manhattan or the courts of the State

of New York located in the County of New York.

9. Each

Party hereby waives the application of any law, regulation, holding, or rule of construction providing that ambiguities in an agreement

or other document will be construed against the party drafting such agreement or document.

10. The

Parties’ rights and obligations under this Agreement (other than the rights and obligations set forth in Section 4 (solely with

respect to Expenses incurred prior to the termination of the Agreement) and Section 8, which shall survive any termination of this Agreement)

shall terminate immediately after the conclusion of the activities set forth in Section 3 or as otherwise agreed to by JCP and 22NW.

11. Each

Party acknowledges that Olshan shall act as counsel for both the Group and JCP relating to their investment in the Company.

12. Each

Party hereby agrees that this Agreement shall be filed as an exhibit to the Schedule(s) 13D required to be filed by them as contemplated

under Section 1 of this Agreement.

[Signature pages follow]

IN WITNESS WHEREOF, the

Parties hereto have caused this Agreement to be executed as of the day and year first above written.

| |

JCP INVESTMENT PARTNERSHIP, LP |

| |

|

| |

By: |

JCP Investment Management, LLC

Investment Manager |

| |

|

|

| |

By: |

/s/ James C. Pappas |

| |

|

Name: |

James C. Pappas |

| |

|

Title: |

Managing Member |

| |

JCP INVESTMENT PARTNERS, LP |

| |

|

| |

By: |

JCP Investment Holdings, LLC

General Partner |

| |

|

|

| |

By: |

/s/ James C. Pappas |

| |

|

Name: |

James C. Pappas |

| |

|

Title: |

Sole Member |

| |

JCP INVESTMENT HOLDINGS, LLC |

| |

|

| |

By: |

/s/ James C. Pappas |

| |

|

Name: |

James C. Pappas |

| |

|

Title: |

Sole Member |

| |

JCP INVESTMENT MANAGEMENT, LLC |

| |

|

| |

By: |

/s/ James C. Pappas |

| |

|

Name: |

James C. Pappas |

| |

|

Title: |

Managing Member |

| |

/s/ James C. Pappas |

| |

JAMES C. PAPPAS |

| |

22NW FUND, LP |

| |

|

| |

By: |

22NW Fund GP, LLC

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW, LP |

| |

|

| |

By: |

22NW GP, Inc.

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

22NW FUND GP, LLC |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW GP, INC. |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

/s/ Aron R. English |

| |

ARON R. ENGLISH |

| |

/s/ Bryson O. Hirai-Hadley |

| |

BRYSON O. HIRAI-HADLEY |

| |

/s/ Troy Ellis |

| |

TROY ELLIS |

| |

/s/ Emily Keeton |

| |

EMILY KEETON |

| |

/s/ David Tresko |

| |

DAVID TRESKO |

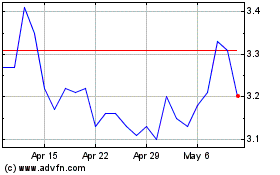

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Apr 2024 to May 2024

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From May 2023 to May 2024