Famous Dave's of America, Inc. (NASDAQ: DAVE) today reported

revenue of $33.3 million and net income of $1.2 million, or $0.13

per diluted share, for its fiscal third quarter ended September 27,

2009. Total revenue for the quarter decreased 5.1 percent from the

comparable period in 2008. For the nine months ended September 27,

2009, the company reported revenue of $103.4 million and net income

of $4.9 million, or $0.54 per diluted share.

Same store sales for company-owned restaurants open for 24

months or more declined 6.8 percent during the quarter, reflecting

declines in dine-in, To-Go and catering, while same store sales for

its franchise-operated restaurants declined 9.5 percent. Franchise

royalty revenue for the quarter totaled $4.2 million, a decrease of

2.8 percent from the comparable period in 2008. Same store sales

for company-owned restaurants declined 7.3 percent on a

year-to-date basis, while same store sales for franchise-operated

restaurants declined 8.8 percent. Franchise royalty revenue for the

year-to-date timeframe totaled $12.9 million.

“The sales environment for the entire casual dining sector

remains challenging, but I remain excited about the energy we’ve

created with our marketing efforts,” said Christopher O’Donnell,

chief executive officer of Famous Dave’s. “We’ve continued to make

progress in our efforts to control costs and have worked hard to

strengthen our balance sheet.”

Sales results for the third quarter for company-owned

restaurants reflect general declines in consumer spending slightly

offset by the impact of weighted average price increases of

approximately 2.0 percent, which were taken prior to 2009.

The company’s 2009 third quarter also reflected the

following:

During the third quarter of fiscal 2009, the company repaid $2.6

million in long-term high fixed-rate debt. As previously announced,

on October 1, 2009, the company has since repaid the last of five

outstanding term notes, bringing the amount of debt the company has

repaid to date in 2009 to approximately $10.0 million. The total

pay down of long-term debt in fiscal 2009 should result in

approximately $610,000 of scheduled interest savings for fiscal

2010. The company continues to maintain its revolving line of

credit, which had a balance of $14.0 million at the end of the

third quarter.

- Impairment and Lease

Termination Charges

During the quarter, asset impairment and lease termination

charges totaled $446,000. Included in this total are charges

related to a final agreement to buy out the lease of a previously

closed restaurant, a lease termination settlement for a restaurant

site where construction never commenced, and a software product

that was replaced with an alternative solution prior to

implementation.

Earnings results for the third quarter of 2009 included

approximately $236,000, or $0.02 per diluted share, in compensation

expense related to the company’s stock-based incentive programs, as

compared to approximately $100,000, or $0.01 per diluted share, for

the prior year comparable period. Stock-based compensation expense

for the nine months ended September 27, 2009 was approximately

$610,000, or $0.04 per diluted share, compared to approximately

$698,000 or $0.05 per diluted share for the prior year comparable

period.

Marketing and

Development

Marketing and Development highlights during the quarter included

a 15 year anniversary celebration featuring the return of the

“Buck-A-Bone” promotion, $1.15 draft beers and a special “Dave’s

Day” event. This fall, the company’s Limited Time Offer is a

“Smokin’ hot meatloaf and potatoes” entrée and a 12 ounce smoked

rib-eye steak with Dave’s special barbeque butter, roasted baby red

potatoes with baby bella mushrooms and a choice of side dish. This

promotion is available through November.

“We’ve responded to the current business climate with promotions

geared towards driving traffic through a balance of value-oriented

and premium items, as well as promotions that enhance our already

strong brand,” O’Donnell said. “Our 15-year anniversary celebration

was an example of this, which included our ‘Dave’s Day’

celebration, an event that we could ‘own’ and that drove traffic

and delivered sales that rivaled our largest day, Fathers Day.”

During the third quarter of fiscal 2009, two franchise-operated

restaurants opened in Thousand Oaks, California and Amarillo, Texas

and one franchise-operated restaurant closed in Omaha, Nebraska.

Famous Dave's ended the quarter with 177 restaurants, including 46

company-owned restaurants and 131 franchise-operated restaurants,

located in 38 states.

Outlook

Subsequent to quarter-end, three franchise-operated restaurants

opened in Lake Delton, Wisconsin, Ft. Collins, Colorado, and

Topeka, Kansas, bringing the total number of franchise-operated

restaurant openings in 2009 to 13. Additionally, the company closed

a company-owned restaurant in Naperville, Illinois at the end of

its lease term and a franchise-operated restaurant closed in

Augusta, Georgia. The company expects to open a minimum of 8

franchise-operated units in 2010. Company-owned unit growth for

2010 is still being evaluated.

The company has taken no price increases to date in 2009, but

expects to take a 1.0% price increase in December 2009.

Conference Call

The company will host a conference call tomorrow, October 29,

2009, at 10:00 a.m. Central Time to discuss its third quarter

financial results. There will be a live webcast of the discussion

through the Investor Relations section of Famous Dave's web site at

www.famousdaves.com.

About Famous

Dave’s

Famous Dave’s of America, Inc. develops, owns, operates and

franchises barbeque restaurants. As of today, the company owns 45

locations and franchises 133 additional units in 37 states. Its

menu features award-winning barbequed and grilled meats, an ample

selection of salads, side items and sandwiches, and unique

desserts.

FAMOUS DAVE’S OF AMERICA, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands,

except share and per share data) (unaudited)

Three Months Ended Nine Months Ended

September 27, September 28, September

27, September 28, 2009 2008

2009 2008 Revenue: Restaurant sales, net $

28,763 $ 30,407 $ 89,600 $ 93,219 Franchise royalty revenue 4,242

4,366 12,851 13,194 Franchise fee revenue 80 110 155 457 Licensing

and other revenue 220 205 811

707

Total revenue 33,305

35,088 103,417 107,577

Costs and expenses: Food and beverage costs 8,762

9,523 27,046 28,754 Labor and benefits costs 9,174 9,816 27,857

28,726 Operating expenses 7,760 7,497 23,492 24,162 Depreciation

and amortization 1,253 1,397 3,834 4,126 Asset impairment and

estimated lease termination and other closing costs 446 3,879 119

3,879

General and administrative

Expenses

3,701 3,337 11,976 12,370 Pre-opening expenses --- 333 --- 636 Net

loss on disposal of property 7 10

13 16

Total costs and expenses

31,103 35,792 94,337

102,669

Income (loss) from operations

2,202 (704 ) 9,080 4,908

Other expense: Loss on early extinguishment of

debt (40 ) --- (489 ) --- Interest expense (277 ) (504 ) (1,177 )

(1,478 ) Interest income 26 73 93 172 Other income (expense), net

7 (3 ) (1 ) (33 )

Total other

expense (284 ) (434 ) (1,574 )

(1,339 )

Income (loss) before income

taxes

1,918

(1,138

)

7,506

3,569

Income tax (expense) benefit (679 ) 375

(2,579 ) (1,225 )

Net income

(loss) $ 1,239 $ (763 ) $ 4,927 $ 2,344

Basic net income (loss) per

common share

$ 0.14 $ (0.08 ) $ 0.54 $ 0.25

Diluted net income (loss) per

common share

$ 0.13 $ (0.08 ) $ 0.54 $ 0.24

Weighted average common shares

outstanding – basic

9,124,000 9,304,000 9,104,000

9,516,000

Weighted average common shares

outstanding – diluted 9,254,000 9,304,000

9,184,000 9,671,000

FAMOUS DAVE’S OF AMERICA, INC. AND SUBSIDIARIES OPERATING

RESULTS (unaudited) Three Months

Ended Nine Months Ended September 27,

September 28, September 27, September

28, 2009 2008 2009 2008 Food and

beverage costs (1) 30.5 % 31.3 % 30.2 % 30.8 % Labor and benefits

costs (1) 31.9 % 32.3 % 31.1 % 30.8 % Operating expenses (1) 27.0 %

24.7 % 26.2 % 25.9 % Depreciation & amortization

(restaurant level) (1)

3.9 % 4.2 % 3.8 % 4.0 % Depreciation & amortization

(corporate level) (2)

0.4 % 0.4 % 0.4 % 0.3 % Asset impairment and lease termination

and other closing costs (1)

1.6 % 12.8 % 0.1 % 4.2 % General and administrative expenses (2)

11.1 % 9.5 % 11.6 % 11.5 % Pre-opening expenses and net

loss on disposal of property

(1)

0.0 % 1.1 % 0.0 % 0.7 % Total costs and expenses (2) 93.4 %

102.0 % 91.2 % 95.4 % Income (loss) from operations (2) 6.6 % (2.0

%) 8.8 % 4.6 %

(1) As a percentage of restaurant sales,

net(2) As a percentage of total revenue

FAMOUS DAVE’S OF AMERICA, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands)

(unaudited) September 27, December

28, 2009 2008 ASSETS Cash and cash

equivalents $ 1,629 $ 1,687 Other current assets 10,801 11,604

Property, equipment and leasehold improvements, net 55,047 58,129

Other assets 1,878 1,981

Total assets $ 69,355

$ 73,401

LIABILITIES AND SHAREHOLDERS’ EQUITY Line of

credit $ 13,000 $ 18,000 Other current liabilities 14,107 12,060

Long-term obligations 10,436 17,157 Shareholders’ equity

31,812 26,184

Total liabilities and shareholders’

equity $ 69,355 $ 73,401

FAMOUS DAVE’S OF AMERICA,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (unaudited) (in thousands)

Nine Months Ended September 27, September

28, 2009 2008 Cash flows provided by

operating activities $ 11,684 $ 10,352 Cash flows used for

investing activities (1,039 ) (8,046 ) Cash flows used for

financing activities (10,703 ) (2,353 ) Decrease in

cash and cash equivalents $ (58 ) $ (47 )

SUPPLEMENTAL

SALES INFORMATION (unaudited) Three

Months Ended Nine Months Ended September

27, September 28, September 27,

September 28, 2009 2008 2009

2008 Total weighted average weekly net sales (AWS):

Company-Owned $ 47,706 $ 49,429 $ 49,427 $ 52,368

Franchise-Operated $ 53,524 $ 58,276 $ 54,870 $ 58,449 AWS

2005 and Post 2005: (1) Company-Owned $ 55,340 $ 62,578 $ 58,909 $

67,918 Franchise-Operated $ 57,683 $ 64,600 $ 60,201 $ 65,691

AWS Pre 2005: (1) Company-Owned $ 45,011 $ 46,295 $ 46,112 $

48,608 Franchise-Operated $ 47,472 $ 50,355 $ 47,326 $ 49,834

Operating Weeks: Company-Owned 598 608 1,807 1,772

Franchise-Operated 1,684 1,597 4,934 4,723 Total number of

restaurants: Company-Owned 46 47 46 47 Franchise-Operated

131 123 131 123

Total 177 170 177 170 Comparable net sales (24 month):

Company-Owned (6.8 %) (4.7 %) (7.3 %) 0.1 % Franchise-Operated (9.5

%) (4.6 %) (8.8 %) (2.8 %) Total number of comparable

restaurants: Company-Owned 38 38 38 35 Franchise-Operated 100 86 92

75

(1) Provides further delineation of AWS for restaurants opened

during the pre-fiscal 2005, and restaurants opened during the

post-fiscal 2005, timeframes.

Statements in this press release that are not strictly

historical, including but not limited to statements regarding the

timing of our restaurant openings and the timing or success of our

expansion plans, are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements involve known and unknown risks, which

may cause the company’s actual results to differ materially from

expected results. Although Famous Dave's of America, Inc. believes

the expectations reflected in any forward-looking statements are

based on reasonable assumptions, it can give no assurance that its

expectation will be attained. Factors that could cause actual

results to differ materially from Famous Dave's expectation include

financial performance, restaurant industry conditions, execution of

restaurant development and construction programs, franchisee

performance, changes in local or national economic conditions,

availability of financing, governmental approvals and other risks

detailed from time to time in the company's SEC reports.

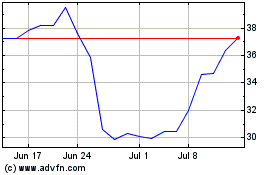

Dave (NASDAQ:DAVE)

Historical Stock Chart

From Apr 2024 to May 2024

Dave (NASDAQ:DAVE)

Historical Stock Chart

From May 2023 to May 2024