false00017528280001752828celu:WarrantsEachExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShareMember2024-01-032024-01-0300017528282024-01-032024-01-030001752828celu:ClassACommonStock00001ParValuePerShareMember2024-01-032024-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 3, 2024 |

Celularity Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

001-38914 |

83-1702591 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

170 Park Ave |

|

Florham Park, New Jersey |

|

07932 |

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: (908) 768-2170 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class

|

Trading

Symbol(s) |

Name of each exchange on which registered

|

Class A Common Stock, $0.0001 par value per share |

CELU |

The Nasdaq Stock Market LLC |

Warrants, each exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

CELUW |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02 |

Results of Operations and Financial Condition. |

On January 3, 2024, Celularity Inc. issued a press release announcing its expected net sales and total revenues for the fourth quarter and full year ended December 31, 2023. A copy of the press release is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and in Exhibit 99.1 to this current report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CELULARITY INC. |

|

|

|

|

Date: |

January 9, 2024 |

By: |

/s/ Robert J. Hariri |

|

|

|

Robert J. Hariri, M.D., Ph.D.

Chairman and Chief Executive Officer |

Exhibit 99.1

Celularity Announces Net Sales and Total Revenue Expectations

for Fourth Quarter 2023 and Full Year 2023

Celularity expects net sales of its biomaterial products and biobanking businesses to be in the range of $11.4 million to $12.1 million for the fourth quarter 2023 and $22.06 million to $22.76 million for the full year 2023 reflecting triple-digit increases compared to the fourth quarter 2022 and full year 2022, respectively. These numbers do not include revenue from other sources, including research contracts such as the Company’s previously announced multi-year research collaboration services agreement with Regeneron.

FLORHAM PARK, N.J., January 3, 2024, (GLOBE NEWSWIRE) — Celularity Inc. (Nasdaq: CELU) (the “Company), a biotechnology company developing allogeneic cell therapies and biomaterial products, today announced expected net sales of its advance biomaterial products and biobanking businesses for the fourth quarter 2023 and the full year 2023 and expected total revenue for the fourth quarter 2023 and the full year 2023.

For the fourth quarter 2023, the Company expects net sales of its biomaterial products and biobanking businesses to be in the range of $11.4 million to $12.1 million and the net sales percentage growth to be in the range of 176.1% to 193.0% compared to the fourth quarter 2022.

For the full year 2023, the Company expects net sales of its biomaterial products and biobanking businesses to be in the range of $22.06 million to $22.76 million and the net sales percentage growth to be in the range of 22.7% to 26.6% compared to the full year 2022.

The Company anticipates that it will announce actual net sales and actual total revenue for the fourth quarter of 2023 and the full year of 2023 later this year.

“We are particularly encouraged by the growth in net revenues from our commercial-stage products and services as a testament to our unique business model, which produces both cellular and regenerative tools for several clinical indications such as wound healing and orthopedics. Considering the financial challenges experienced in the cellular medicine sector in 2023, the Company is working to maximize access to capital through cash flow from our manufactured biomaterial products, technical operations expertise, and cell banking activities. Based on the growth of this part of our business, we anticipate being able to provide revenue guidance across our entire business for 2024 in the very near future,” said Robert J. Hariri, M.D., Ph.D., Chairman, Chief Executive Officer, and founder.

# # #

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995, as well as within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are “forward-looking statements,” including those relating to future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “can,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intends,” “may,” “might,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “strive,” “target,” “will,” “would” and the negative of terms like these or other comparable terminology, and other

words or terms of similar meaning. The forward-looking statements in this press release include statements regarding The Company’s ability to sufficiently capitalize itself through cash flow from its manufactured biomaterial products, technical operations expertise and cell banking activities, among others. Many factors could cause actual results to differ materially from those described in these forward-looking statements, including but not limited to: the regulatory status of its biomaterial products; the Company’s ability to develop and maintain sales and marketing capabilities, whether alone or with potential future collaborators; the risks associated with the Company’s current liquidity as well as developments relating to the Company’s competitors and industry, along with those risk factors set forth under the caption “Risk Factors” in The Company’s annual report on Form 10-K filed with the Securities and Exchange Commission (SEC) on March 31, 2023, and other filings with the SEC. If any of these risks materialize or underlying assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that The Company does not presently know, or that The Company currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, these forward-looking statements reflect The Company’s current expectations, plans, or forecasts of future events and views as of the date of this communication. Subsequent events and developments could cause assessments to change. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Celularity Investor Contacts:

Carlos Ramirez SVP, Investor Relations

Celularity Inc.

carlos.ramirez@celularity.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=celu_ClassACommonStock00001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=celu_WarrantsEachExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

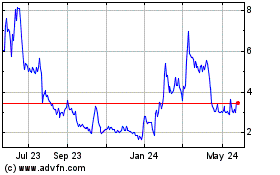

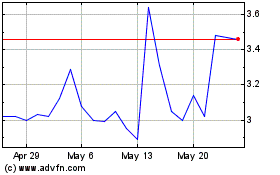

Celularity (NASDAQ:CELU)

Historical Stock Chart

From Apr 2024 to May 2024

Celularity (NASDAQ:CELU)

Historical Stock Chart

From May 2023 to May 2024