0001019034

BIO KEY INTERNATIONAL INC

false

--12-31

Q3

2023

170,000,000

170,000,000

9,501,669

9,501,669

9,190,504

9,190,504

0.0001

0.0001

729,905

-

371,956

918,260

83,333

9,895

1,373,549

34,145

63,973

2,200,000

3

0

0

0

0

0

0

0

0

2,200,000

18

30

50

1

1

3

1

0

0

0

0.175

5

EMESA – Europe, Middle East, South America

00010190342023-01-012023-09-30

xbrli:shares

00010190342023-11-17

thunderdome:item

iso4217:USD

00010190342023-09-30

00010190342022-12-31

iso4217:USDxbrli:shares

0001019034us-gaap:ServiceMember2023-07-012023-09-30

0001019034us-gaap:ServiceMember2022-07-012022-09-30

0001019034us-gaap:ServiceMember2023-01-012023-09-30

0001019034us-gaap:ServiceMember2022-01-012022-09-30

0001019034us-gaap:LicenseMember2023-07-012023-09-30

0001019034us-gaap:LicenseMember2022-07-012022-09-30

0001019034us-gaap:LicenseMember2023-01-012023-09-30

0001019034us-gaap:LicenseMember2022-01-012022-09-30

0001019034bkyi:HardwareMember2023-07-012023-09-30

0001019034bkyi:HardwareMember2022-07-012022-09-30

0001019034bkyi:HardwareMember2023-01-012023-09-30

0001019034bkyi:HardwareMember2022-01-012022-09-30

00010190342023-07-012023-09-30

00010190342022-07-012022-09-30

00010190342022-01-012022-09-30

0001019034us-gaap:CommonStockMember2022-12-31

0001019034us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0001019034us-gaap:RetainedEarningsMember2022-12-31

0001019034us-gaap:CommonStockMember2023-01-012023-03-31

0001019034us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0001019034us-gaap:RetainedEarningsMember2023-01-012023-03-31

00010190342023-01-012023-03-31

0001019034us-gaap:CommonStockMember2023-03-31

0001019034us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0001019034us-gaap:RetainedEarningsMember2023-03-31

00010190342023-03-31

0001019034us-gaap:CommonStockMember2023-04-012023-06-30

0001019034us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0001019034us-gaap:RetainedEarningsMember2023-04-012023-06-30

00010190342023-04-012023-06-30

0001019034us-gaap:CommonStockMember2023-06-30

0001019034us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0001019034us-gaap:RetainedEarningsMember2023-06-30

00010190342023-06-30

0001019034us-gaap:CommonStockMember2023-07-012023-09-30

0001019034us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0001019034us-gaap:RetainedEarningsMember2023-07-012023-09-30

0001019034us-gaap:CommonStockMember2023-09-30

0001019034us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0001019034us-gaap:RetainedEarningsMember2023-09-30

0001019034us-gaap:CommonStockMember2021-12-31

0001019034us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

0001019034us-gaap:RetainedEarningsMember2021-12-31

00010190342021-12-31

0001019034us-gaap:CommonStockMember2022-01-012022-03-31

0001019034us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-31

0001019034us-gaap:RetainedEarningsMember2022-01-012022-03-31

00010190342022-01-012022-03-31

0001019034us-gaap:CommonStockMember2022-03-31

0001019034us-gaap:AdditionalPaidInCapitalMember2022-03-31

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-31

0001019034us-gaap:RetainedEarningsMember2022-03-31

00010190342022-03-31

0001019034us-gaap:CommonStockMember2022-04-012022-06-30

0001019034us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-30

0001019034us-gaap:RetainedEarningsMember2022-04-012022-06-30

00010190342022-04-012022-06-30

0001019034us-gaap:CommonStockMember2022-06-30

0001019034us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

0001019034us-gaap:RetainedEarningsMember2022-06-30

00010190342022-06-30

0001019034us-gaap:CommonStockMember2022-07-012022-09-30

0001019034us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-30

0001019034us-gaap:RetainedEarningsMember2022-07-012022-09-30

0001019034us-gaap:CommonStockMember2022-09-30

0001019034us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001019034us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

0001019034us-gaap:RetainedEarningsMember2022-09-30

00010190342022-09-30

0001019034bkyi:SwivelSecureEuropeMember2023-01-012023-09-30

0001019034bkyi:SwivelSecureEuropeMember2022-01-012022-09-30

0001019034us-gaap:ServiceMembersrt:NorthAmericaMember2023-07-012023-09-30

0001019034us-gaap:ServiceMembersrt:SouthAmericaMember2023-07-012023-09-30

0001019034us-gaap:ServiceMemberbkyi:EMESAMember2023-07-012023-09-30

0001019034us-gaap:ServiceMembersrt:AsiaMember2023-07-012023-09-30

0001019034us-gaap:LicenseMembersrt:NorthAmericaMember2023-07-012023-09-30

0001019034us-gaap:LicenseMembersrt:SouthAmericaMember2023-07-012023-09-30

0001019034us-gaap:LicenseMemberbkyi:EMESAMember2023-07-012023-09-30

0001019034us-gaap:LicenseMembersrt:AsiaMember2023-07-012023-09-30

0001019034bkyi:HardwareMembersrt:NorthAmericaMember2023-07-012023-09-30

0001019034bkyi:HardwareMembersrt:SouthAmericaMember2023-07-012023-09-30

0001019034bkyi:HardwareMemberbkyi:EMESAMember2023-07-012023-09-30

0001019034bkyi:HardwareMembersrt:AsiaMember2023-07-012023-09-30

0001019034srt:NorthAmericaMember2023-07-012023-09-30

0001019034srt:SouthAmericaMember2023-07-012023-09-30

0001019034bkyi:EMESAMember2023-07-012023-09-30

0001019034srt:AsiaMember2023-07-012023-09-30

0001019034us-gaap:ServiceMembersrt:NorthAmericaMember2022-07-012022-09-30

0001019034us-gaap:ServiceMembersrt:SouthAmericaMember2022-07-012022-09-30

0001019034us-gaap:ServiceMemberbkyi:EMESAMember2022-07-012022-09-30

0001019034us-gaap:ServiceMembersrt:AsiaMember2022-07-012022-09-30

0001019034us-gaap:LicenseMembersrt:NorthAmericaMember2022-07-012022-09-30

0001019034us-gaap:LicenseMembersrt:SouthAmericaMember2022-07-012022-09-30

0001019034us-gaap:LicenseMemberbkyi:EMESAMember2022-07-012022-09-30

0001019034us-gaap:LicenseMembersrt:AsiaMember2022-07-012022-09-30

0001019034bkyi:HardwareMembersrt:NorthAmericaMember2022-07-012022-09-30

0001019034bkyi:HardwareMembersrt:SouthAmericaMember2022-07-012022-09-30

0001019034bkyi:HardwareMemberbkyi:EMESAMember2022-07-012022-09-30

0001019034bkyi:HardwareMembersrt:AsiaMember2022-07-012022-09-30

0001019034srt:NorthAmericaMember2022-07-012022-09-30

0001019034srt:SouthAmericaMember2022-07-012022-09-30

0001019034bkyi:EMESAMember2022-07-012022-09-30

0001019034srt:AsiaMember2022-07-012022-09-30

0001019034us-gaap:ServiceMembersrt:NorthAmericaMember2023-01-012023-09-30

0001019034us-gaap:ServiceMembersrt:SouthAmericaMember2023-01-012023-09-30

0001019034us-gaap:ServiceMemberbkyi:EMESAMember2023-01-012023-09-30

0001019034us-gaap:ServiceMembersrt:AsiaMember2023-01-012023-09-30

0001019034us-gaap:LicenseMembersrt:NorthAmericaMember2023-01-012023-09-30

0001019034us-gaap:LicenseMembersrt:SouthAmericaMember2023-01-012023-09-30

0001019034us-gaap:LicenseMemberbkyi:EMESAMember2023-01-012023-09-30

0001019034us-gaap:LicenseMembersrt:AsiaMember2023-01-012023-09-30

0001019034bkyi:HardwareMembersrt:NorthAmericaMember2023-01-012023-09-30

0001019034bkyi:HardwareMembersrt:SouthAmericaMember2023-01-012023-09-30

0001019034bkyi:HardwareMemberbkyi:EMESAMember2023-01-012023-09-30

0001019034bkyi:HardwareMembersrt:AsiaMember2023-01-012023-09-30

0001019034srt:NorthAmericaMember2023-01-012023-09-30

0001019034srt:SouthAmericaMember2023-01-012023-09-30

0001019034bkyi:EMESAMember2023-01-012023-09-30

0001019034srt:AsiaMember2023-01-012023-09-30

0001019034us-gaap:ServiceMembersrt:NorthAmericaMember2022-01-012022-09-30

0001019034us-gaap:ServiceMembersrt:SouthAmericaMember2022-01-012022-09-30

0001019034us-gaap:ServiceMemberbkyi:EMESAMember2022-01-012022-09-30

0001019034us-gaap:ServiceMembersrt:AsiaMember2022-01-012022-09-30

0001019034us-gaap:LicenseMembersrt:NorthAmericaMember2022-01-012022-09-30

0001019034us-gaap:LicenseMembersrt:SouthAmericaMember2022-01-012022-09-30

0001019034us-gaap:LicenseMemberbkyi:EMESAMember2022-01-012022-09-30

0001019034us-gaap:LicenseMembersrt:AsiaMember2022-01-012022-09-30

0001019034bkyi:HardwareMembersrt:NorthAmericaMember2022-01-012022-09-30

0001019034bkyi:HardwareMembersrt:SouthAmericaMember2022-01-012022-09-30

0001019034bkyi:HardwareMemberbkyi:EMESAMember2022-01-012022-09-30

0001019034bkyi:HardwareMembersrt:AsiaMember2022-01-012022-09-30

0001019034srt:NorthAmericaMember2022-01-012022-09-30

0001019034srt:SouthAmericaMember2022-01-012022-09-30

0001019034bkyi:EMESAMember2022-01-012022-09-30

0001019034srt:AsiaMember2022-01-012022-09-30

utr:M

0001019034srt:MinimumMember2023-09-30

0001019034srt:MaximumMember2023-09-30

0001019034us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-07-012023-09-30

0001019034us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-07-012022-09-30

0001019034us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-30

0001019034us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012022-09-30

0001019034us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-09-30

0001019034us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-09-30

0001019034us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-30

0001019034us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-09-30

0001019034country:NG2023-09-30

0001019034bkyi:ApproximationMember2023-09-30

0001019034bkyi:ApproximationMember2022-09-30

utr:Y

xbrli:pure

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2022-12-22

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2022-12-222022-12-22

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2023-09-30

0001019034bkyi:WarrantsIssuedInConnectionWithNoteMember2022-12-222022-12-22

0001019034bkyi:WarrantsIssuedInConnectionWithNoteMember2022-12-22

0001019034bkyi:TheNoteMember2023-09-30

0001019034bkyi:TheNoteMember2022-12-31

0001019034us-gaap:EmployeeStockOptionMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2023-07-012023-09-30

0001019034us-gaap:EmployeeStockOptionMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2022-07-012022-09-30

0001019034us-gaap:EmployeeStockOptionMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2023-01-012023-09-30

0001019034us-gaap:EmployeeStockOptionMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2022-01-012022-09-30

0001019034us-gaap:WarrantMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2023-07-012023-09-30

0001019034us-gaap:WarrantMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2022-07-012022-09-30

0001019034us-gaap:WarrantMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2023-01-012023-09-30

0001019034us-gaap:WarrantMemberbkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2022-01-012022-09-30

0001019034bkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2023-07-012023-09-30

0001019034bkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2022-07-012022-09-30

0001019034bkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2023-01-012023-09-30

0001019034bkyi:ExercisePriceGreaterThanAverageMarketPriceOfCommonSharesMember2022-01-012022-09-30

0001019034bkyi:EmployeeStockPurchasePlanMember2021-06-18

0001019034bkyi:EmployeeStockPurchasePlanMember2021-06-182021-06-18

0001019034bkyi:EmployeeStockPurchasePlanMember2023-01-302023-09-30

0001019034bkyi:EmployeeStockPurchasePlanMember2022-01-302022-09-30

0001019034bkyi:SwivelSecureEuropeMember2022-03-082022-03-08

0001019034bkyi:SwivelSecureEuropeMember2022-03-08

0001019034us-gaap:RestrictedStockMember2022-01-012022-09-30

0001019034us-gaap:RestrictedStockMember2023-01-012023-09-30

0001019034us-gaap:RestrictedStockMember2023-07-012023-09-30

0001019034us-gaap:RestrictedStockMember2022-07-012022-09-30

0001019034us-gaap:CommonStockMembersrt:DirectorMember2023-07-012023-09-30

0001019034us-gaap:CommonStockMembersrt:DirectorMember2022-07-012022-09-30

0001019034us-gaap:CommonStockMembersrt:DirectorMember2023-01-012023-09-30

0001019034us-gaap:CommonStockMembersrt:DirectorMember2022-01-012022-09-30

0001019034bkyi:TheNoteMemberus-gaap:FairValueInputsLevel1Memberbkyi:SeniorSecuredPromissoryNoteMember2023-09-30

0001019034bkyi:TheNoteMemberus-gaap:FairValueInputsLevel2Memberbkyi:SeniorSecuredPromissoryNoteMember2023-09-30

0001019034bkyi:TheNoteMemberus-gaap:FairValueInputsLevel3Memberbkyi:SeniorSecuredPromissoryNoteMember2023-09-30

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2022-12-31

0001019034bkyi:TheNoteMemberus-gaap:FairValueInputsLevel1Memberbkyi:SeniorSecuredPromissoryNoteMember2022-12-31

0001019034bkyi:TheNoteMemberus-gaap:FairValueInputsLevel2Memberbkyi:SeniorSecuredPromissoryNoteMember2022-12-31

0001019034bkyi:TheNoteMemberus-gaap:FairValueInputsLevel3Memberbkyi:SeniorSecuredPromissoryNoteMember2022-12-31

0001019034bkyi:TheNoteMembersrt:WeightedAverageMemberbkyi:SeniorSecuredPromissoryNoteMember2023-09-30

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2023-01-012023-09-30

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2022-01-012022-12-31

0001019034bkyi:TheNoteMemberus-gaap:MeasurementInputDiscountRateMemberbkyi:SeniorSecuredPromissoryNoteMember2023-09-30

0001019034bkyi:TheNoteMemberus-gaap:MeasurementInputDiscountRateMemberbkyi:SeniorSecuredPromissoryNoteMember2022-12-31

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2023-01-012023-03-31

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2023-03-31

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2023-04-012023-06-30

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2023-06-30

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMember2023-07-012023-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-07-012023-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbkyi:TwoCustomersMember2023-07-012023-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-07-012022-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbkyi:OneCustomerMember2022-07-012022-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbkyi:TwoCustomersMember2023-01-012023-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbkyi:OneCustomerMember2022-01-012022-09-30

0001019034us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberbkyi:OneCustomerMember2023-01-012023-09-30

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbkyi:ThreeCustomersMember2023-01-012023-09-30

0001019034us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberbkyi:OneCustomerMember2022-01-012022-12-31

0001019034us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbkyi:OneCustomerMember2022-01-012022-12-31

0001019034bkyi:UnitedStatesHongKongAndNigeriaMember2023-07-012023-09-30

0001019034bkyi:UnitedStatesHongKongAndNigeriaMember2023-01-012023-09-30

0001019034bkyi:UnitedStatesHongKongAndNigeriaMember2022-07-012022-09-30

0001019034bkyi:UnitedStatesHongKongAndNigeriaMember2022-01-012022-09-30

0001019034country:ES2023-01-012023-09-30

0001019034us-gaap:SubsequentEventMemberbkyi:PublicOfferingMember2023-10-302023-10-30

0001019034us-gaap:SubsequentEventMemberbkyi:PublicOfferingMember2023-10-30

0001019034bkyi:PrefundedWarrantsMemberus-gaap:SubsequentEventMember2023-10-302023-10-30

0001019034bkyi:CommonWarrantsMemberus-gaap:SubsequentEventMember2023-10-302023-10-30

0001019034bkyi:CommonWarrantsMemberus-gaap:SubsequentEventMember2023-10-30

0001019034bkyi:PrefundedWarrantsMemberus-gaap:SubsequentEventMember2023-10-30

0001019034bkyi:TheNoteMemberbkyi:SeniorSecuredPromissoryNoteMemberus-gaap:SubsequentEventMember2023-10-302023-10-30

Table of Contents

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | ☒ | QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

or

| | ☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE EXCHANGE ACT |

For the Transition Period from to

Commission file number 1-13463

BIO-KEY INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 41-1741861 |

| (State or Other Jurisdiction of Incorporation of Organization) | (IRS Employer Identification Number) |

101 CRAWFORDS CORNER ROAD, SUITE 4116, HOLMDEL, NJ 07733

(Address of Principal Executive Offices)

(732) 359-1100

(Registrant’s telephone number, including area code)

Securities registered pursuance to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| | | |

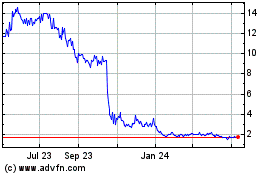

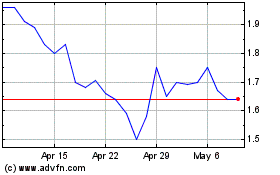

| Common Stock, par value $0.0001 per share | BKYI | Nasdaq Capital Market |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ |

| | |

| Non-accelerated filer ☒ | | Smaller Reporting Company ☒ |

| | |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by rule 12b-2 of the Exchange Act) Yes ☐ No ☒

Number of shares of Common Stock, $.0001 par value per share, outstanding as of November 17, 2023, is 13,731,669

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

INDEX

PART I -- FINANCIAL INFORMATION

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| | | (Unaudited) | | | | | |

| ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 307,086 | | | $ | 2,635,522 | |

| Accounts receivable, net | | | 2,799,218 | | | | 1,522,784 | |

| Due from factor | | | 62,572 | | | | 49,500 | |

| Inventory | | | 4,289,213 | | | | 4,434,369 | |

| Prepaid expenses and other | | | 362,250 | | | | 342,706 | |

| Total current assets | | | 7,820,339 | | | | 8,984,881 | |

| Equipment and leasehold improvements, net | | | 69,202 | | | | 107,413 | |

| Capitalized contract costs, net | | | 264,348 | | | | 283,069 | |

| Deposits and other assets | | | - | | | | 8,712 | |

| Deferred offering costs | | | 25,434 | | | | - | |

| Operating lease right-of-use assets | | | 50,465 | | | | 197,355 | |

| Intangible assets, net | | | 1,519,592 | | | | 1,762,825 | |

| Total non-current assets | | | 1,929,041 | | | | 2,359,374 | |

| TOTAL ASSETS | | $ | 9,749,380 | | | $ | 11,344,255 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 1,656,107 | | | $ | 1,108,279 | |

| Accrued liabilities | | | 1,080,032 | | | | 1,009,123 | |

| Income taxes payable | | | 162,811 | | | | - | |

| Convertible note payable | | | 2,331,497 | | | | 2,596,203 | |

| Government loan – BBVA Bank, current portion | | | 135,308 | | | | 120,000 | |

| Deferred revenue, current | | | 610,451 | | | | 462,418 | |

| Operating lease liabilities, current portion | | | 51,746 | | | | 159,665 | |

| Total current liabilities | | | 6,027,952 | | | | 5,455,688 | |

| Deferred revenue, long term | | | 32,354 | | | | 52,134 | |

| Deferred tax liability | | | 152,998 | | | | 170,281 | |

| Government loan – BBVA Bank – net of current portion | | | 221,625 | | | | 326,767 | |

| Operating lease liabilities, net of current portion | | | - | | | | 37,829 | |

| Total non-current liabilities | | | 406,977 | | | | 587,011 | |

| TOTAL LIABILITIES | | | 6,434,929 | | | | 6,042,699 | |

| | | | | | | | | |

| Commitments and Contingencies | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY | | | | | | | | |

| | | | | | | | | |

| Common stock — authorized, 170,000,000 shares; issued and outstanding; 9,501,669 and 9,190,504 of $.0001 par value at September 30, 2023 and December 31, 2022, respectively | | | 950 | | | | 919 | |

| Additional paid-in capital | | | 122,263,106 | | | | 122,028,612 | |

| Accumulated other comprehensive loss | | | (115,208 | ) | | | (242,602 | ) |

| Accumulated deficit | | | (118,834,397 | ) | | | (116,485,373 | ) |

| TOTAL STOCKHOLDERS’ EQUITY | | | 3,314,451 | | | | 5,301,556 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 9,749,380 | | | $ | 11,344,255 | |

See accompanying notes to the condensed consolidated financial statements.

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Services |

|

$ |

587,893 |

|

|

$ |

371,956 |

|

|

$ |

1,740,880 |

|

|

$ |

1,202,866 |

|

| License fees |

|

|

950,015 |

|

|

|

918,260 |

|

|

|

4,664,341 |

|

|

|

3,540,592 |

|

| Hardware |

|

|

279,200 |

|

|

|

83,333 |

|

|

|

424,583 |

|

|

|

518,377 |

|

| Total revenues |

|

|

1,817,108 |

|

|

|

1,373,549 |

|

|

|

6,829,804 |

|

|

|

5,261,835 |

|

| Costs and other expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of services |

|

|

125,039 |

|

|

|

162,632 |

|

|

|

639,996 |

|

|

|

554,222 |

|

| Cost of license fees |

|

|

203,891 |

|

|

|

173,310 |

|

|

|

1,022,919 |

|

|

|

604,677 |

|

| Cost of hardware |

|

|

147,674 |

|

|

|

57,841 |

|

|

|

240,074 |

|

|

|

296,278 |

|

| Total costs and other expenses |

|

|

476,604 |

|

|

|

393,783 |

|

|

|

1,902,989 |

|

|

|

1,455,177 |

|

| Gross profit |

|

|

1,340,504 |

|

|

|

979,766 |

|

|

|

4,926,815 |

|

|

|

3,806,658 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

1,547,376 |

|

|

|

2,510,706 |

|

|

|

5,422,272 |

|

|

|

6,315,277 |

|

| Research, development and engineering |

|

|

558,686 |

|

|

|

829,506 |

|

|

|

1,807,026 |

|

|

|

2,418,855 |

|

| Total Operating Expenses |

|

|

2,106,062 |

|

|

|

3,340,212 |

|

|

|

7,229,298 |

|

|

|

8,734,132 |

|

| Operating loss |

|

|

(765,558 |

) |

|

|

(2,360,446 |

) |

|

|

(2,302,483 |

) |

|

|

(4,927,474 |

) |

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

5,917 |

|

|

|

8 |

|

|

|

5,944 |

|

|

|

216 |

|

| Loss on foreign currency transactions |

|

|

- |

|

|

|

- |

|

|

|

(15,000 |

) |

|

|

- |

|

| Investment-debt security reserve |

|

|

- |

|

|

|

(40,000 |

) |

|

|

- |

|

|

|

(190,000 |

) |

| Change in fair value of convertible note |

|

|

167,283 |

|

|

|

- |

|

|

|

264,706 |

|

|

|

- |

|

| Interest expense |

|

|

(45,655 |

) |

|

|

(2,071 |

) |

|

|

(159,379 |

) |

|

|

(3,611 |

) |

| Total other income (expense), net |

|

|

127,545 |

|

|

|

(42,063 |

) |

|

|

96,271 |

|

|

|

(193,395 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before provision for income tax |

|

|

(638,013 |

) |

|

|

(2,402,509 |

) |

|

|

(2,206,212 |

) |

|

|

(5,120,869 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for (income tax) tax benefit |

|

|

189 |

|

|

|

- |

|

|

|

(142,811 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(637,824 |

) |

|

$ |

(2,402,509 |

) |

|

$ |

(2,349,023 |

) |

|

$ |

(5,120,869 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(637,824 |

) |

|

$ |

(2,402,509 |

) |

|

$ |

(2,349,023 |

) |

|

$ |

(5,120,869 |

) |

| Other comprehensive income (loss) – Foreign currency translation adjustment |

|

|

35,364 |

|

|

|

(119,269 |

) |

|

|

127,394 |

|

|

|

(229,350 |

) |

| Comprehensive loss |

|

$ |

(602,460 |

) |

|

$ |

(2,521,778 |

) |

|

$ |

(2,221,629 |

) |

|

$ |

(5,350,219 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Loss per Common Share |

|

$ |

(0.07 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.64 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

9,081,873 |

|

|

|

8,148,848 |

|

|

|

9,042,319 |

|

|

|

8,054,207 |

|

See accompanying notes to the condensed consolidated financial statements.

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Additional |

|

|

Other |

|

|

|

|

|

|

|

|

|

| |

|

Common Stock |

|

|

Paid-in |

|

|

Comprehensive |

|

|

Accumulated |

|

|

|

|

|

| |

|

|

|

|

Amount |

|

|

|

|

|

|

|

|

Deficit |

|

|

Total |

|

| Balance as of January 1, 2023 |

|

|

9,190,504 |

|

|

$ |

919 |

|

|

$ |

122,028,612 |

|

|

$ |

(242,602 |

) |

|

$ |

(116,485,373 |

) |

|

$ |

5,301,556 |

|

| Issuance of common stock for directors’ fees |

|

|

15,388 |

|

|

|

1 |

|

|

|

12,001 |

|

|

|

- |

|

|

|

- |

|

|

|

12,002 |

|

| Issuance of common stock to employees |

|

|

40,000 |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

| Restricted stock forfeited |

|

|

(19,834 |

) |

|

|

(2 |

) |

|

|

(3,103 |

) |

|

|

- |

|

|

|

- |

|

|

|

(3,105 |

) |

| Foreign currency translation adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

72,146 |

|

|

|

- |

|

|

|

72,146 |

|

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

62,474 |

|

|

|

- |

|

|

|

- |

|

|

|

62,474 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(288,322 |

) |

|

|

(288,322 |

) |

| Balance as of March 31, 2023 |

|

|

9,226,058 |

|

|

$ |

922 |

|

|

$ |

122,099,984 |

|

|

$ |

(170,456 |

) |

|

$ |

(116,773,695 |

) |

|

$ |

5,156,755 |

|

| Issuance of common stock for directors’ fees |

|

|

23,150 |

|

|

|

2 |

|

|

|

16,000 |

|

|

|

- |

|

|

|

- |

|

|

|

16,002 |

|

| Issuance of restricted common stock to employees |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Restricted stock forfeited |

|

|

(14,375 |

) |

|

|

(1 |

) |

|

|

1 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Issuance of common stock for Employee stock purchase plan |

|

|

28,020 |

|

|

|

3 |

|

|

|

13,931 |

|

|

|

- |

|

|

|

- |

|

|

|

13,934 |

|

| Share based compensation for employee stock plan |

|

|

- |

|

|

|

- |

|

|

|

3,563 |

|

|

|

- |

|

|

|

- |

|

|

|

3,563 |

|

| Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

19,884 |

|

|

|

- |

|

|

|

19,884 |

|

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

57,831 |

|

|

|

- |

|

|

|

- |

|

|

|

57,831 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,422,878 |

) |

|

|

(1,422,878 |

) |

| Balance as of June 30, 2023 |

|

|

9,262,853 |

|

|

$ |

926 |

|

|

$ |

122,191,310 |

|

|

$ |

(150,572 |

) |

|

$ |

(118,196,573 |

) |

|

$ |

3,845,091 |

|

| Issuance of common stock for directors’ fees |

|

|

16,874 |

|

|

|

2 |

|

|

|

11,000 |

|

|

|

- |

|

|

|

- |

|

|

|

11,002 |

|

| Restricted stock forfeited |

|

|

(33,333 |

) |

|

|

(3 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3 |

) |

| Issuance of restricted common stock to employees and directors |

|

|

255,275 |

|

|

|

25 |

|

|

|

(25 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Share based compensation for employee stock plan |

|

|

- |

|

|

|

- |

|

|

|

10,398 |

|

|

|

- |

|

|

|

- |

|

|

|

10,398 |

|

| Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

35,364 |

|

|

|

- |

|

|

|

35,364 |

|

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

50,423 |

|

|

|

- |

|

|

|

- |

|

|

|

50,423 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(637,824 |

) |

|

|

(637,824 |

) |

| Balance as of September 30, 2023 |

|

|

9,501,669 |

|

|

$ |

950 |

|

|

$ |

122,263,106 |

|

|

$ |

(115,208 |

) |

|

$ |

(118,834,397 |

) |

|

$ |

3,314,451 |

|

See accompanying notes to the condensed consolidated financial statements.

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Additional |

|

|

Other |

|

|

|

|

|

|

|

|

|

| |

|

Common Stock |

|

|

Paid-in |

|

|

Comprehensive |

|

|

Accumulated |

|

|

|

|

|

| |

|

|

|

|

Amount |

|

|

|

|

|

|

|

|

Deficit |

|

|

Total |

|

| Balance as of January 1, 2022 |

|

|

7,853,759 |

|

|

$ |

786 |

|

|

$ |

120,190,139 |

|

|

$ |

- |

|

|

$ |

(104,575,470 |

) |

|

$ |

15,615,455 |

|

| Issuance of common stock for directors’ fees |

|

|

9,382 |

|

|

|

1 |

|

|

|

22,019 |

|

|

|

- |

|

|

|

- |

|

|

|

22,020 |

|

| Issuance of common stock pursuant to Swivel purchase agreement |

|

|

269,060 |

|

|

|

27 |

|

|

|

599,977 |

|

|

|

- |

|

|

|

- |

|

|

|

600,004 |

|

| Issuance of restricted common stock to employees and directors |

|

|

274,250 |

|

|

|

27 |

|

|

|

(27 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

55,802 |

|

|

|

- |

|

|

|

55,802 |

|

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

87,677 |

|

|

|

- |

|

|

|

- |

|

|

|

87,677 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(999,403 |

) |

|

|

(999,403 |

) |

| Balance as of March 31, 2022 |

|

|

8,406,451 |

|

|

$ |

841 |

|

|

$ |

120,899,785 |

|

|

$ |

55,802 |

|

|

$ |

(105,574,873 |

) |

|

$ |

15,381,555 |

|

| Issuance of common stock for directors’ fees |

|

|

9,117 |

|

|

|

1 |

|

|

|

18,005 |

|

|

|

- |

|

|

|

- |

|

|

|

18,006 |

|

| Issuance of restricted common stock to employees |

|

|

1,250 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Restricted stock forfeited |

|

|

(1,250 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Issuance of common stock for Employee stock purchase plan |

|

|

26,006 |

|

|

|

2 |

|

|

|

39,123 |

|

|

|

- |

|

|

|

- |

|

|

|

39,125 |

|

| Share based compensation for employee stock plan |

|

|

- |

|

|

|

- |

|

|

|

8,314 |

|

|

|

- |

|

|

|

- |

|

|

|

8,314 |

|

| Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(165,883 |

) |

|

|

- |

|

|

|

(165,883 |

) |

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

57,379 |

|

|

|

- |

|

|

|

- |

|

|

|

57,379 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,718,957 |

) |

|

|

(1,718,957 |

) |

| Balance as of June 30, 2022 |

|

|

8,441,574 |

|

|

$ |

844 |

|

|

$ |

121,022,606 |

|

|

$ |

(110,081 |

) |

|

$ |

(107,293,830 |

) |

|

$ |

13,619,539 |

|

| Issuance of common stock for directors’ fees |

|

|

8,547 |

|

|

|

1 |

|

|

|

18,008 |

|

|

|

- |

|

|

|

- |

|

|

|

18,009 |

|

| Issuance of restricted common stock to employees |

|

|

2,500 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(119,269 |

) |

|

|

- |

|

|

|

(119,269 |

) |

| Share-based compensation |

|

|

- |

|

|

|

- |

|

|

|

82,738 |

|

|

|

- |

|

|

|

- |

|

|

|

82,738 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2,402,509 |

) |

|

|

(2,402,509 |

) |

| Balance as of September 30, 2022 |

|

|

8,452,621 |

|

|

$ |

845 |

|

|

$ |

121,123,352 |

|

|

$ |

(229,350 |

) |

|

$ |

(109,696,339 |

) |

|

$ |

11,198,508 |

|

See accompanying notes to the condensed consolidated financial statements.

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | Nine Months Ended September 30, | |

| | | 2023 | | | 2022 | |

| | | | | | | | | |

| CASH FLOW FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net loss | | $ | (2,349,023 | ) | | $ | (5,120,869 | ) |

| Adjustments to reconcile net loss to net cash used for operating activities: | | | | | | | | |

| Depreciation | | | 38,213 | | | | 33,813 | |

| Amortization of intangible assets | | | 217,978 | | | | 216,806 | |

| Amortization of capitalized contract costs | | | 126,057 | | | | 80,019 | |

| Operating leases right-of-use assets | | | 146,890 | | | | 87,903 | |

| Reserve for Investment – debt security | | | - | | | | 190,000 | |

| Allowance for note receivable | | | | | | | 40,000 | |

| Share and warrant-based compensation for employees and consultants | | | 163,584 | | | | 236,108 | |

| Stock based directors’ fees | | | 39,006 | | | | 58,035 | |

| Change in fair value of convertible note | | | (264,706 | ) | | | - | |

| Deferred income tax benefit | | | (20,000 | ) | | | - | |

| Bad debts | | | 150,000 | | | | 130,111 | |

| Change in assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (1,334,989 | ) | | | (264,635 | ) |

| Due from factor | | | (13,072 | ) | | | - | |

| Capitalized contract costs | | | (107,336 | ) | | | (120,968 | ) |

| Inventory | | | 145,156 | | | | 47,993 | |

| Resalable software license rights | | | - | | | | 7,466 | |

| Prepaid expenses and other | | | (51,831 | ) | | | (120,977 | ) |

| Accounts payable | | | 488,416 | | | | 239,227 | |

| Accrued liabilities | | | 327,131 | | | | (6,882 | ) |

| Income taxes payable | | | 62,811 | | | | - | |

| Deferred revenue | | | 128,253 | | | | 43,351 | |

| Operating lease liabilities | | | (154,460 | ) | | | (104,904 | ) |

| Net cash used for operating activities | | | (2,261,922 | ) | | | (4,328,403 | ) |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Purchase of Swivel Secure, net of cash acquired of $729,905 | | | - | | | | (543,578 | ) |

| Receipt of cash from note receivable | | | - | | | | 9,000 | |

| Capital expenditures | | | - | | | | (31,066 | ) |

| Net cash used for investing activities | | | - | | | | (565,644 | ) |

| CASH FLOW FROM FINANCING ACTIVITIES: | | | | | | | | |

| Deferred offering costs | | | (25,434 | ) | | | - | |

| Receipt of cash from Employee stock purchase plan | | | 13,934 | | | | 39,125 | |

| Repayment of government loan | | | (113,885 | ) | | | - | |

| Net cash provided by (used in) financing activities | | | (125,385 | ) | | | 39,125 | |

| | | | | | | | | |

| Effect of exchange rate changes | | | 58,871 | | | | (124,507 | ) |

| | | | | | | | | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | | | (2,328,436 | ) | | | (4,979,429 | ) |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | | | 2,635,522 | | | | 7,754,046 | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | | $ | 307,086 | | | $ | 2,774,617 | |

See accompanying notes to the condensed consolidated financial statements.

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

SUPPLEMENTARY DISCLOSURES OF CASH FLOW INFORMATION

| |

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Cash paid for: |

|

|

|

|

|

|

|

|

| Interest |

|

$ |

159,379 |

|

|

$ |

3,661 |

|

| |

|

|

|

|

|

|

|

|

| Noncash investing and financing activities |

|

|

|

|

|

|

|

|

| Accounts receivable acquired from Swivel Secure |

|

$ |

- |

|

|

$ |

702,886 |

|

| Equipment acquired from Swivel Secure |

|

$ |

- |

|

|

$ |

65,640 |

|

| Other assets acquired from Swivel Secure |

|

$ |

- |

|

|

$ |

20,708 |

|

| Intangible assets acquired from Swivel Secure |

|

$ |

- |

|

|

$ |

762,860 |

|

| Goodwill resulting from the acquisition from Swivel Secure |

|

$ |

- |

|

|

$ |

1,067,372 |

|

| Accounts payable and accrued expenses acquired from Swivel Secure |

|

$ |

- |

|

|

$ |

431,884 |

|

| Government loan acquired from Swivel Secure |

|

$ |

- |

|

|

$ |

544,000 |

|

| Common stock issued for acquisition of Swivel Secure |

|

$ |

- |

|

|

$ |

600,004 |

|

| Operating lease right-of-use asset and liability for new lease |

|

$ |

- |

|

|

$ |

105,893 |

|

See accompanying notes to the condensed consolidated financial statements.

BIO-KEY INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 (Unaudited)

| 1. | NATURE OF BUSINESS AND BASIS OF PRESENTATION |

Nature of Business

The Company, founded in 1993, develops and markets proprietary fingerprint identification biometric technology and software solutions enterprise-ready identity access management solutions to commercial, government and education customers throughout the United States and internationally. The Company was a pioneer in developing automated, finger identification technology that supplements or compliments other methods of identification and verification, such as personal inspection identification, passwords, tokens, smart cards, ID cards, PKI, credit cards, passports, driver’s licenses, OTP or other form of possession or knowledge-based credentialing. Additionally, advanced BIO-key® technology has been, and is, used to improve both the accuracy and speed of competing finger-based biometrics.

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements include the accounts of BIO-key International, Inc. and its wholly-owned subsidiaries (collectively, the “Company” or “BIO-key”) and are stated in conformity with accounting principles generally accepted in the United States of America (“GAAP”), pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). The operating results for interim periods are not necessarily indicative of results that may be expected for any other interim period or for the full year. Pursuant to such rules and regulations, certain financial information and footnote disclosures normally included in the financial statements have been condensed or omitted. Intercompany accounts and transactions have been eliminated in consolidation.

In the opinion of management, the accompanying unaudited interim consolidated financial statements contain all necessary adjustments, consisting only of those of a recurring nature, and disclosures to present fairly the Company’s financial position and the results of its operations and cash flows for the periods presented. The balance sheet at December 31, 2022 was derived from the audited financial statements, but does not include all of the disclosures required by GAAP. These unaudited interim condensed consolidated financial statements should be read in conjunction with the financial statements and the related notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on June 1, 2023.

Foreign Currencies

The Company accounts for foreign currency transactions pursuant to ASC 830, Foreign Currency Matters ("ASC 830”). The functional currency of the Company is the U.S. dollar, which is the currency of the primary economic environment in which it operates. In accordance with ASC 830, all assets and liabilities are translated into U. S. dollars using the current exchange rate at the end of each fiscal period. Revenues and expenses are translated using the average exchange rates prevailing throughout the respective periods. All transaction gains and losses from the measurement of monetary balance sheet items denominated in Euros are reflected in the statement of operations as appropriate. Translation adjustments are included in accumulated other comprehensive income (loss).

Recently Issued Accounting Pronouncements

Effective January 1, 2023, the Company adopted ASU 2016-13, Financial Instruments-Credit Losses (Topic 326), referred to herein as ASU 2016-13, which significantly changes how entities will account for credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. ASU 2016-13 replaces the existing incurred loss model with an expected credit loss model that requires entities to estimate an expected lifetime credit loss on most financial assets and certain other instruments. Under ASU 2016-13 credit impairment is recognized as an allowance for credit losses, rather than as a direct write-down of the amortized cost basis of a financial asset. The impairment allowance is a valuation account deducted from the amortized cost basis of financial assets to present the net amount expected to be collected on the financial asset. Once the new pronouncement is adopted by the Company, the allowance for credit losses must be adjusted for management’s current estimate at each reporting date. The new guidance provides no threshold for recognition of impairment allowance. Therefore, entities must also measure expected credit losses on assets that have a low risk of loss. For instance, trade receivables that are either current or not yet due may not require an allowance reserve under currently generally accepted accounting principles, but under the new standard, the Company will have to estimate an allowance for expected credit losses on trade receivables under ASU 2016-13. The adoption of ASU 2016-13 did not have a material effect on the consolidated financial statements of the Company.

In August 2020, the Financial Accounting Standards Board issued ASU 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815-40) (“ASU 2020-06”) to simplify accounting for certain financial instruments. ASU 2020-06 eliminates the current models that require separation of beneficial conversion and cash conversion features from convertible instruments and simplifies the derivative scope exception guidance pertaining to equity classification of contracts in an entity’s own equity. The new standard also introduces additional disclosures for convertible debt and freestanding instruments that are indexed to and settled in an entity’s own equity. ASU 2020-06 amends the diluted earnings per share guidance, including the requirement to use the if-converted method for all convertible instruments. ASU 2020-06 is effective for the Company on January 1, 2024 and should be applied on a full or modified retrospective basis. The Company is currently assessing the impact ASU 2020-06 will have on its consolidated financial statements.

Management does not believe that any other recently issued, but not yet effective, accounting standard, if currently adopted, would have a material effect on the accompanying consolidated financial statements.

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America ("GAAP"), which contemplate continuation of the Company as a going concern, and assumes continuity of operations, realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The Company has suffered substantial net losses and negative cash flows from operations in recent years and is dependent on debt and equity financing to fund its operations all of which raise substantial doubt about the Company’s ability to continue as a going concern. Recoverability of a major portion of the recorded asset amounts shown in the accompanying balance sheet is dependent upon the Company’s ability to increase its revenue and meet its financing requirements on a continuing basis and become profitable in its future operations. The accompanying consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence.

As of the date of this report, the Company does not have enough cash for twelve months of operations. The history of significant losses, the negative cash flow from operations, the limited cash resources on hand and the dependence by the Company on its ability to obtain additional financing to fund its operations after the current cash resources are exhausted raises substantial doubt about the Company's ability to continue as a going concern. In recent periods, the Company has reduced its marketing, research and development, and rent expenses. In addition, the Company has purchased inventory for projects in Nigeria, which have been delayed in deployment, and is currently exploring other markets and opportunities to sell or return the product to generate additional cash.

| 3. | REVENUE FROM CONTRACTS WITH CUSTOMERS |

Disaggregation of Revenue

The following table summarizes revenue from contracts with customers for the three month periods ended September 30, 2023 and September 30, 2022:

| | | North | | | | | | | | | | | | | | | September 30, | |

| | | America | | | Africa | | | EMESA* | | | Asia | | | 2023 | |

| | | | | | | | | | | | | | | | | | | | | |

| Services | | $ | 294,581 | | | $ | 26,009 | | | $ | 267,303 | | | $ | - | | | $ | 587,893 | |

| License fees | | | 426,059 | | | | - | | | | 523,956 | | | | - | | | | 950,015 | |

| Hardware | | | 48,057 | | | | - | | | | 231,143 | | | | - | | | | 279,200 | |

| Total Revenues | | $ | 768,697 | | | $ | 26,009 | | | $ | 1,022,402 | | | $ | - | | | $ | 1,817,108 | |

| | | North | | | | | | | | | | | | | | | September 30, | |

| | | America | | | Africa | | | EMESA* | | | Asia | | | 2022 | |

| | | | | | | | | | | | | | | | | | | | | |

| Services | | $ | 280,192 | | | $ | 22,677 | | | $ | 69,087 | | | $ | - | | | $ | 371,956 | |

| License fees | | | 468,090 | | | | - | | | | 450,170 | | | | - | | | | 918,260 | |

| Hardware | | | 48,226 | | | | 13,800 | | | | 11,412 | | | | 9,895 | | | | 83,333 | |

| Total Revenues | | $ | 796,508 | | | $ | 36,477 | | | $ | 530,669 | | | $ | 9,895 | | | $ | 1,373,549 | |

The following table summarizes revenue from contracts with customers for the nine month periods ended September 30, 2023 and September 30, 2022:

| | | North | | | | | | | | | | | | | | | September 30, | |

| | | America | | | Africa | | | EMESA* | | | Asia | | | 2023 | |

| | | | | | | | | | | | | | | | | | | | | |

| Services | | $ | 840,045 | | | $ | 75,806 | | | $ | 812,654 | | | $ | 12,375 | | | $ | 1,740,880 | |

| License fees | | | 1,614,971 | | | | 552,630 | | | | 2,426,090 | | | | 70,650 | | | | 4,664,341 | |

| Hardware | | | 134,390 | | | | - | | | | 278,293 | | | | 11,900 | | | | 424,583 | |

| Total Revenues | | $ | 2,589,406 | | | $ | 628,436 | | | $ | 3,517,037 | | | $ | 94,925 | | | $ | 6,829,804 | |

| | | North | | | | | | | | | | | | | | | September 30, | |

| | | America | | | Africa | | | EMESA* | | | Asia | | | 2022 | |

| | | | | | | | | | | | | | | | | | | | | |

| Services | | $ | 936,910 | | | $ | 60,629 | | | $ | 205,274 | | | $ | 53 | | | $ | 1,202,866 | |

| License fees | | | 1,436,704 | | | | 517,161 | | | | 1,507,051 | | | | 79,676 | | | | 3,540,592 | |

| Hardware | | | 323,338 | | | | 25,833 | | | | 18,342 | | | | 150,864 | | | | 518,377 | |

| Total Revenues | | $ | 2,696,952 | | | $ | 603,623 | | | $ | 1,730,667 | | | $ | 230,593 | | | $ | 5,261,835 | |

*EMESA – Europe, Middle East, South America

Deferred Revenue

Deferred revenue includes customer advances and amounts that have been paid by customer for which the contractual maintenance terms have not yet occurred. The majority of these amounts are related to maintenance contracts for which the revenue is recognized ratably over the applicable term, which generally is 12-60 months. Contracts greater than 12 months are segregated as long term deferred revenue. Maintenance contracts include provisions for unspecified when-and-if available product updates and customer telephone support services. At September 30, 2023 and December 31, 2022, amounts in deferred revenue were approximately $642,000 and $515,000, respectively. Revenue recognized during the three and nine-months ended September 30, 2023 from amounts included in deferred revenue at the beginning of the period was approximately $67,000 and $402,000, respectively. Revenue recognized during the three and nine-months ended September 30, 2022 from amounts included in deferred revenue at the beginning of the period was approximately $62,000 and $448,000, respectively. The Company did not recognize any revenue from performance obligations satisfied in prior periods.

Accounts receivable are carried at original amount less an estimate made for credit losses based on a review of all outstanding amounts on a monthly basis. Management determines the allowance for credit losses by regularly evaluating individual customer receivables and considering a customer’s financial condition, credit history, current economic conditions and other relevant factors, including specific reserves for certain accounts. Accounts receivable are written off when deemed uncollectible.

Accounts receivable at September 30, 2023 and December 31, 2022 consisted of the following:

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| | | | | | | | | |

| Accounts receivable | | $ | 3,423,003 | | | $ | 2,096,569 | |

| Allowance for credit losses | | | (623,785 | ) | | | (573,785 | ) |

| Accounts receivable, net of allowances for credit losses | | $ | 2,799,218 | | | $ | 1,522,784 | |

Bad debt expenses are recorded in selling, general, and administrative expense.

| 5. | SHARE BASED COMPENSATION |

The following table presents share-based compensation expenses included in the Company’s unaudited condensed interim consolidated statements of operations:

| | | Three Months Ended September 30, | |

| | | 2023 | | | 2022 | |

| | | | | | | | | |

| Selling, general and administrative | | $ | 56,414 | | | $ | 66,152 | |

| Research, development and engineering | | | 15,406 | | | | 17,547 | |

| | | $ | 71,820 | | | $ | 83,699 | |

| | | Nine Months Ended September 30, | |

| | | 2023 | | | 2022 | |

| | | | | | | | | |

| Selling, general and administrative | | $ | 171,833 | | | $ | 158,578 | |

| Research, development and engineering | | | 48,758 | | | | 34,818 | |

| | | $ | 220,591 | | | $ | 193,396 | |

Inventory is stated at the lower of cost, determined on a first in, first out basis, or realizable value. The Company periodically evaluates inventory items and establishes reserves for obsolescence accordingly. The Company also reserves for excess quantities, slow moving goods, and for other impairment of value based upon assumptions of future demand and market conditions. The $400,000 reserve on inventory is due to slow moving inventory purchased for projects in Nigeria. The Company is exploring other markets and opportunities to sell or return the product. Inventory is comprised of the following as of:

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

| | | | | | | | | |

| Finished goods | | $ | 4,619,487 | | | $ | 4,764,643 | |

| Fabricated assemblies | | | 69,726 | | | | 69,726 | |

| Reserve on finished goods | | | (400,000 | ) | | | (400,000 | ) |

| Total inventory | | $ | 4,289,213 | | | $ | 4,434,369 | |

| 7. | COMMITMENTS AND CONTINGENCIES |

Distribution Agreement

Swivel Secure has a distribution agreement with Swivel Secure Limited (“SSL”). Terms of the agreement include the following:

| 1. | The initial term of the agreement ends on January 31, 2027 and will be automatically extended for additional one-year terms thereafter unless either party provides written notice to the other party not later than 30 days before the end of the term that it does not wish to extend the term. |

| 2. | SSL appoints Swivel Secure as the exclusive distributor of SSL’s products, to market, sell and distribute in the EMEA (Europe, Middle East and Africa), excluding the United Kingdom and Republic of Ireland, for a defined discount on the sale price. |

| 3. | Swivel Secure is expected to generate a certain minimum level of orders of SSL products each year during the term of the agreement. If Swivel Secure fails to meet such minimum level of orders in any year, the exclusive distribution rights will terminate and Swivel Secure will serve as a non-exclusive distributer of SSL Products. |

The Company expects the revenue targets to continue to be met based on historical performance and increasing distribution by Swivel Secure.

Litigation

From time to time, the Company may be involved in litigation relating to claims arising out of our operations in the normal course of business. As of September 30, 2023, the Company was not a party to any pending lawsuits.

The Company’s leases office space in New Jersey, Minnesota, New Hampshire, Madrid and Hong-Kong with lease termination dates in 2023 and 2024. On August 11, 2023, the Company signed a new one-year lease starting September 1, 2023 for office space in New Jersey. The property leased in China is paid monthly as used, without a formal agreement. The following tables present the components of lease expense and supplemental balance sheet information related to the operating leases were:

| | | 3 Months ended | | | 3 Months ended | |

| | | September 30, | | | September 30, | |

| | | 2023 | | | 2022 | |

| | | | | | | | | |

| Lease cost | | | | | | | | |

| Total lease cost | | | $ 34,145 | | | | $ 63,973 | |

| | | 9 Months ended | | | 9 Months ended | |

| | | September 30, | | | September 30, | |

| | | 2023 | | | 2022 | |

| | | | | | | | | |

| Lease cost | | | | | | | | |

| Total lease cost | | $ | 145,828 | | | $ | 163,401 | |

| | | September 30, | | | December 31, | |

| Balance sheet information | | 2023 | | | 2022 | |

| Operating right-of-use assets | | $ | 50,465 | | | $ | 197,355 | |

| | | | | | | | | |

| Operating lease liabilities, current portion | | $ | 51,746 | | | $ | 159,665 | |

| Operating lease liabilities, non-current portion | | | - | | | | 37,829 | |

| Total operating lease liabilities | | $ | 51,746 | | | $ | 197,494 | |

| | | | | | | | | |

| Weighted average remaining lease term (in years) – operating leases | | | 0.93 | | | | 0.96 | |

| Weighted average discount rate – operating leases | | | 5.50 | % | | | 5.50 | % |

| | | | | | | | | |

| | | | | | | | | |

| Cash paid for amounts included in the measurement of operating lease liabilities for the nine months ended September 30, 2023 and 2022: | | $ | 197,946 | | | $ | 144,985 | |

Maturities of operating lease liabilities were as follows as of September 30, 2023:

| 2023 (3 months remaining) | | $ | 14,553 | |

| 2024 | | | 38,808 | |

| Total future lease payments | | $ | 53,361 | |

| Less: imputed interest | | | (1,615 | ) |

| Total | | $ | 51,746 | |

| 9. | CONVERTIBLE NOTE PAYABLE |

Securities Purchase Agreement dated December 22, 2022

On December 22, 2022, the Company entered into and closed a securities purchase agreement (the “Purchase Agreement”) and issued a $2,200,000 principal amount senior secured promissory note (the “Note”). At closing, a total of $2,002,000 was funded, with the proceeds to be used for general working capital.

The principal amount of the Note was due six months following the date of issuance, subject to one six-month extension by the Company. The Company elected to extend the due date to December 22, 2023. Interest under the Note accrued at a rate of 10% per annum through month six and accrues at a rate of 12% per annum in months seven through twelve, payable monthly. The Note is secured by a lien on substantially all of the Company’s assets and properties can be prepaid in whole or in part without penalty at any time.

In connection with the issuance of the Note, the Company issued to the investor 700,000 shares of Common Stock (the “Commitment Shares”) valued at $1.00 per share and a warrant (the “Warrant”) to purchase 200,000 shares of common stock (the “Warrant Shares”) at an exercise price of $3.00 per share, exercisable commencing on the date of issuance with a term of five years.

Upon issuance, the Note was not convertible into common stock or any other securities of the Company. Only after a date that is six (6) months following the issuance date of the Note and upon the occurrence of any events of default (as defined) and expiration of any applicable cure periods, all amounts due under the Note will immediately and automatically become due and payable in full, interest will accrue at the higher of 18% per annum or the maximum amount permitted by applicable law, the outstanding principal amount due under the Note will be increased by 30%, and the Investor will have the right to convert all amounts due under the Note into shares of common stock (the “Conversion Shares”) at a conversion price equal to the 10 day volume weighted average sales price of the Company’s common stock on the date of conversion, subject to the Share Cap described in the paragraph below.

The aggregate number of shares of common stock issuable in the forgoing transaction consisting of the Commitment Shares, the Warrant Shares, and the Conversion Shares are capped at 1,684,576 which is 19.9% of the Company’s issued and outstanding shares of common stock on December 22, 2022, the date the definitive transaction documents were executed (the “Share Cap”).

The Company elected the fair value measurement option for the Note as the Note had embedded derivatives that required bifurcation and recorded the entire hybrid financing instrument at fair value under the guidance of ASC 825, Financial Instruments. As a result, the Note was recorded at fair value upon issuance and is subsequently remeasured at each reporting date until settled or converted. The Company reports interest expense, including accrued interest, related to the Note under the fair value option, separately from within the change in fair value of the Note in the accompanying consolidated statement of operations. See Note 13.

As of September 30, 2023 and December 31, 2022, the Note with principal balance of $2,200,000, at fair value, was recorded at $2,331,497 and $2,596,203, respectively. See note 16.

| 10. | EARNINGS (LOSS) PER SHARE - COMMON STOCK (“EPS”) |

The Company’s basic EPS is calculated using net income (loss) available to common shareholders and the weighted-average number of shares outstanding during the reporting period. Diluted EPS includes the effect from potential issuance of common stock, such as stock issuable pursuant to the exercise of stock options and warrants and the assumed conversion of preferred stock.

The following table sets forth options and warrants which were excluded from the diluted per share calculation because the exercise price was greater than the average market price of the common shares:

| | | Three Months ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | | | | | | |

| Stock options | | | 166,234 | | | | 203,257 | | | | 166,234 | | | | 203,257 | |

| Warrants | | | 4,864,150 | | | | 4,672,025 | | | | 4,872,025 | | | | 4,672,025 | |

| Total | | | 5,030,384 | | | | 4,875,282 | | | | 5,038,259 | | | | 4,875,282 | |

Issuances of Common Stock

During the nine-month periods ended September 30, 2023, there have not been any shares of common stock issued to anyone outside the Company.

On June 18, 2021, the stockholders approved the Employee Stock Purchase Plan. Under the terms of this plan, 789,000 shares of common stock are reserved for issuance to employees and officers of the Company at a purchase price equal to 85% of the lower of the closing price of the common stock on the first day or the last day of the offering period as reported on the Nasdaq Capital Market. Eligible employees are granted an option to purchase shares under the plan funded by payroll deductions. The Board may suspend or terminate the plan at any time, otherwise the plan expires June 17, 2031. On September 30, 2023, 28,020 shares were issued to employees which resulted in a $3,563 non-cash compensation expense for the Company. On September 30, 2022, 26,006 shares were issued to employees which resulted in a $8,314 non-cash compensation expense for the Company.

On March 8, 2022, the Company issued 269,060 shares of common stock of which 89,687 shares were held back by the Company to secure certain indemnification obligations under the Swivel Secure stock purchase agreement. The shares of Company common stock were issued at a total cost of $600,004, priced at $2.23, based on the contractual 20 day volume-weighted average price of the Company’s common stock immediately prior to the payment date as reported on the Nasdaq Capital Market

Issuances of Restricted Stock