UPDATE: ADP Nov Data Show Strong 206K Gain In Private-Sector Jobs

November 30 2011 - 9:55AM

Dow Jones News

Private-business hiring jumped in November, according to a

report released Wednesday. The data follow other news suggesting a

slightly better tone in a U.S. labor market that is still grappling

with high unemployment.

Private-sector jobs in the U.S. rose by 206,000, according to a

national employment report published by payroll giant Automatic

Data Processing Inc. (ADP) and consultancy Macroeconomic Advisers

(MEA.XX).

Economists surveyed by Dow Jones Newswires expected ADP would

report an increase of 130,000. The October data were revised to

show a rise of 130,000 versus 110,000 reported earlier.

"The increase in November was the largest monthly gain since

last December and nearly twice the average monthly gain since May

when employment decelerated sharply," the report said.

The ADP survey counts only private-sector jobs, while the Bureau

of Labor Statistics' nonfarm payroll data, to be released Friday,

include government workers.

Economists surveyed by Dow Jones Newswires expect total nonfarm

payrolls rose by 125,000 slots in November, better than the 80,000

jobs added in October.

The November unemployment rate is expected to remain at

9.0%.

Economists frequently note the wide variance between the ADP job

change and the private-payroll number reported by BLS. But the

extra-large jump in the ADP measure suggests an upside risk that

Friday's payrolls figures will be above expectations.

Wednesday's strong ADP number follows other signs of a gradually

improving labor market.

Joel Prakken, chairman of Macroeconomic Advisers that compiles

the data for ADP, points to the three positive trends in the labor

market.

First, jobless claims have been trending lower.

Second, a report released Tuesday showed consumers are slightly

more upbeat about the November labor markets. The Conference

Board's consumer confidence survey showed 41.1% of respondents

consider jobs "hard to get" this month, down from 46.9% thinking

that in October.

Lastly, BLS data show an increasing number of workers are

voluntarily quitting their old jobs, a suggestion workers see

better job opportunities.

Even so, Prakken said labor markets were not robust, and it

would still take time to bring down the unemployment rate.

The financial markets, which were digesting news of a

coordinated central bank liquidity move, reacted positively to the

ADP data.

The latest ADP report showed large businesses with 500 employees

or more added 12,000 employees to their staffs, while medium-size

businesses added 84,000 workers in November and small businesses

that employ fewer than 50 workers hired 110,000 new workers.

Service-sector jobs increased by 178,000 this month, and factory

jobs increased 7,000.

ADP, of Roseland, N.J., said it processes payments of one in six

U.S. workers. Macroeconomic Advisers, based in St. Louis, is an

economic-consulting firm.

Other job-related reports Wednesday weren't as upbeat about the

labor market.

TrimTabs estimated only 64,000 new jobs were created in

November. The report said, "It appears that hiring managers have

rolled up the welcome mat due to the raging debt crisis in

Europe."

In addition, layoff announcements this month were virtually

unchanged from October's level. Outplacement firm Challenger, Gray

& Christmas said the number of planned job cuts announced by

U.S.-based employers fell 0.7% to 42,474 in November.

Challenger Gray said, "With one month remaining in 2011, job

cuts for the year total 564,297, officially surpassing the 2010

year-end total of 529,973. The 11-month total is 13% higher than

the 497,969 job cuts announced over the same period a year

ago."

-By Kathleen Madigan, Dow Jones Newswires; 212-416-2466;

kathleen.madigan@dowjones.com

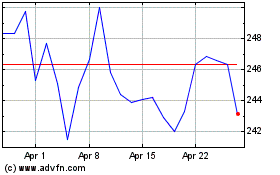

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Oct 2024 to Nov 2024

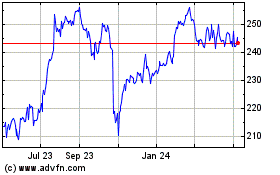

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Nov 2023 to Nov 2024