Earnings Preview: Paychex Inc. - Analyst Blog

September 26 2011 - 9:15AM

Zacks

Paychex Inc.

(PAYX) is scheduled to announce its first quarter fiscal 2012

results on September 27, and we notice no movement in analyst

estimates at this point.

Fourth Quarter

Overview

Paychex delivered mediocre fourth

quarter 2011 results, with earnings of 33 cents per share just

matching the Zacks Consensus Estimate. The quarter’s results

indicated an improving client retention rate and higher checks per

client, but lower sale of new units remained an overhang.

Paychex’ fourth quarter revenues

grew 5.3% year over year backed by increases of 8.7% in Human

Resources Services revenue and 4.6% in the Payroll Service revenue.

But the reported revenue was below the Zacks Consensus

Estimate.

Total operating costs increased

5.4% year over year, reflecting higher acquisition and training

costs, partially offset by a higher utilization rate and lower

headcount. Operating margin remained flat year over year at

35.0%.

Guidance

For fiscal 2012, Paychex expects a

5–7% increase in Payroll Service revenues compared to the year-ago

quarter. Human Resource Services revenues are expected to increase

in the range of 12.0% to 15.0%.

Total service revenue is likely to

grow in the range of 7% to 9%. The company expects a 12–14% decline

in interest on funds held for clients and a roughly 2% increase in

net investment income.

Interest on funds held for clients

and investment income for fiscal 2012 are expected to be impacted

by the low interest rate environment. However, investment of cash

generated from operations is expected to continue, so investment

income will increase.

Net operating income is expected in

the range of 35–36% of total service revenue. The effective tax

rate is expected to be roughly 35% and net margin is projected at

between 5% and 7%.

The guidance for fiscal 2012

includes anticipated results from Paychex’s acquisition of

SurePayroll Inc. and its ePlan Services. The acquisition is

expected to have approximately a 2% positive impact on revenue,

nonetheless resulting in earnings dilution of around 1 cent per

share on a GAAP basis due to amortization on acquired intangible

assets and some one-time acquisition costs.

Agreement of

Analysts

Out of the 15 analysts providing

estimates for the first quarter, none made any revision in the last

thirty days. However, out of the 18 analysts providing estimates

for fiscal 2012, one raised the estimate in the last 7 days while

another reduced the estimate in the last 30 days.

The nominal change to first quarter

estimates point to the fact that there was no major catalyst during

the quarter that could drive results. Consequently, the analysts

are sticking to their estimates projected post fourth quarter

earnings.

But some analysts prefer to remain

cautious based on management’s commentary of not seeing a

significant sign of improvement in new small-business formation.

Moreover, a few analysts think that aggressive pricing from

Automated Data Processing Inc. (ADP) is stealing

away customers from Paychex.

The time difference between when

the company receives payroll from its clients and pays it out to

employees typically earns some interest for Paychex. Now, with the

government contemplating to keep interest rates low, this quick

income stream of the company will also be restricted.

Magnitude of Estimate

Revisions

There was no change to the Zacks

Consensus Estimate for the first quarter or fiscal 2012 over the

past 30 days. However, the Zacks Consensus Estimate for fiscal 2012

went down a penny to $1.50 in the past ninety days.

Recommendation

The market is losing confidence on

the growth of the small and medium business (SMB) group. The sector

is being hit hard by lackluster demand that comes on the heels of

high unemployment and inflation rates. Outsourcing companies like

Paychex are highly dependent on the performance of the SMB sector

and this is the reason that the company may be not see much revenue

growth.

However, we remain positive on

management’s positive commentary regarding continued investments in

product development and synergies from the recent acquisition. We

also believe that cost control will remain a catalyst for Paychex,

going forward.

On the other hand, we are slightly

concerned about the growing competition in the outsourcing space

from big players such as Automated Data Processing Inc. and

Administaff Inc., as well as limited margin expansion due to

continuous investments in diverse fields.

Paychex has a Zacks # 3 Rank,

implying a short-term Hold recommendation.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

Zacks Investment Research

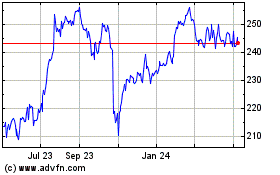

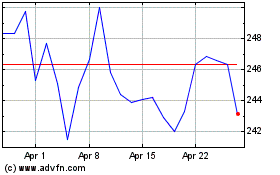

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jul 2024 to Aug 2024

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Aug 2023 to Aug 2024