Asure Software (NASDAQ: ASUR), a leading provider of workforce

management software, today announced financial results for the 2009

fiscal second quarter, ended January 31, 2009.

Highlights included:

-- Meeting Room Manager (MRM) Software-as-a-Service (SaaS) bookings

increased 119% over Q1 2009.

-- Overall gross margins increased to 81% in Q2 2009 from 80% in Q1 2009,

and from 78% in Q4 2008.

-- Overall operating expenses decreased by 5% in Q2 2009 versus Q1 2009.

-- Previously announced plans to privatize the company remain on track.

"Although revenue declined, strong growth in MRM SaaS business

in the second quarter convinces us of our continued revenue growth

potential," commented Richard Snyder, Chairman and Chief Executive

Officer of Asure Software. "In particular, new MRM SaaS bookings

were up 119% over the first quarter, and up 126% year over year. In

addition, during Q2 2009, we added nine Fortune 500 customers,

processed our ten-millionth paystub with our iEmployee business and

consummated our largest SaaS deal to date."

"Our plans for going private remain on track, with our

preliminary proxy filing currently under standard review by the

SEC. Completing this process is expected to contribute

approximately $1 million annually to the bottom line," Mr. Snyder

concluded.

Additional First-Quarter Highlights

On a sequential basis, Asure's total revenues declined

approximately 13% in Q2 2009, to $2.4 million, from the $2.8

million recorded in Q1 2009. Compared to Q2 2008 revenues of $2.7

million, the year-over-year decline in quarterly revenues totaled

approximately 11%.

Operating expenses declined in Q2 2009 versus Q1 2009 by 5% due

to reduced legal expenses relating to the company's building

assignment. By implementing a 10% salary reduction through the

balance of the fiscal year and other cost-cutting measures, Asure

management expects to reduce Q3 2009 quarterly operating expenses

by approximately $300,000.

As of January 31, 2009, the Company had working capital of $7.3

million, and cash, cash equivalents and short-term investments

totaling $12.1 million on its balance sheet.

Conference Call Details

Asure Software has scheduled a conference call for today,

Thursday, March 12, 2009 at 11:00 a.m. ET (10:00 a.m. CT) to

discuss its most recent financial results and outlook.

Participating in the call will be Richard Snyder, Chairman and

Chief Executive Officer; Jay Peterson, Chief Financial Officer; and

Nancy Harris, Chief Operating Officer.

To take part, please dial 866-700-7173 ten minutes before the

conference call begins, ask for the Asure Software event and use

passcode 16647848. International callers should dial 617-213-8838

and reference the same passcode, 16647848.

Investors, analysts, media and the general public will also have

the opportunity to listen to the conference call in listen-only

mode via the Internet by visiting the investor relations page of

Asure's web site at www.asuresoftware.com. To monitor the live

call, please visit the web site at least 15 minutes early to

register, download and install any necessary audio software. For

those who cannot listen to the live broadcast, an archived replay

will be available shortly after the call on the investor relations

page of the Company's web site at www.asuresoftware.com.

About Asure Software

Headquartered in Austin, Texas, Asure Software (ASUR), (a d/b/a

of Forgent Networks, Inc.), empowers small to mid-size

organizations and divisions of large enterprises to operate more

efficiently, increase worker productivity and reduce costs through

a comprehensive suite of on-demand workforce management software

and services. Asure's market-leading suite includes products that

optimize workforce time and attendance tracking, benefits

enrollment and tracking, pay stubs and W2 documentation, expense

management, and meeting and event management. With additional

offices in Warwick, Rhode Island, Vancouver, British Columbia, and

Mumbai, India, Asure serves 3,500 customers around the world. For

more information, please visit www.asuresoftware.com.

"Safe Harbor" Statement under the Private Securities Litigation

Reform Act of 1995:

Statements in this press release regarding Forgent's business

which are not historical facts are "forward-looking statements"

that involve risks and uncertainties. Such risks and uncertainties

could cause actual results to differ from those contained in the

forward-looking statements.

FORGENT NETWORKS, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except per share data)

JANUARY 31, JULY 31,

2009 2008

----------- -----------

(UNAUDITED)

ASSETS

Current Assets:

Cash and cash equivalents $ 9,056 $ 12,062

Short-term investments 3,074 2,627

Accounts receivable, net of allowance for

doubtful accounts of $56 and $41 at January

31, 2009 and July 31, 2008, respectively 1,528 1,718

Inventory 31 74

Prepaid expenses and other current assets 222 191

----------- -----------

Total Current Assets 13,911 16,672

Property and equipment, net 775 907

Intangible assets, net 4,338 4,729

----------- -----------

$ 19,024 $ 22,308

=========== ===========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable $ 3,779 $ 3,778

Accrued compensation and benefits 157 203

Lease impairment and advance 336 373

Other accrued liabilities 455 384

Deferred revenue 1,901 1,844

----------- -----------

Total Current Liabilities 6,628 6,582

Long-Term Liabilities:

Deferred revenue 53 25

Lease impairment and advance 375 564

Other long-term obligations 170 217

----------- -----------

Total Long-Term Liabilities 598 806

Stockholders' Equity:

Preferred stock, $.01 par value; 10,000 shares

authorized; none issued or outstanding -- --

Common stock, $.01 par value; 40,000 shares

authorized; 32,901 and 32,892 shares issued;

31,111 and 31,102 shares outstanding at

January 31, 2009 and July 31, 2008, respectively 329 329

Treasury stock at cost, 1,790 shares at

January 31, 2009 and July 31, 2008 (4,815) (4,815)

Additional paid-in capital 270,712 270,657

Accumulated deficit (254,292) (251,214)

Accumulated other comprehensive income (136) (37)

----------- -----------

Total Stockholders' Equity 11,798 14,920

----------- -----------

$ 19,024 $ 22,308

=========== ===========

FORGENT NETWORKS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

FOR THE FOR THE

THREE MONTHS ENDED SIX MONTHS ENDED

JANUARY 31, JANUARY 31,

2009 2008 2009 2008

-------- -------- -------- --------

(UNAUDITED) (UNAUDITED)

Revenues $ 2,421 $ 2,734 $ 5,213 $ 4,608

Cost of Sales (469) (629) (1,033) (958)

-------- -------- -------- --------

Gross Margin 1,952 2,105 4,180 3,650

OPERATING EXPENSES:

Selling, general and

administrative 3,034 2,962 6,231 5,402

Research and development 525 640 1,086 931

Amortization of intangible

assets 149 155 298 191

-------- -------- -------- --------

Total Operating Expenses 3,708 3,757 7,615 6,524

LOSS FROM OPERATIONS (1,756) (1,652) (3,435) (2,874)

OTHER INCOME AND (EXPENSES):

Interest income 35 195 89 533

Foreign currency translation (22) (4) 99 (11)

Gain on sale of assets 250 -- 250 --

Interest expense and other (23) (16) (33) (29)

-------- -------- -------- --------

Total Other Income 240 175 405 493

LOSS FROM OPERATIONS, BEFORE

INCOME TAXES (1,516) (1,477) (3,030) (2,381)

Provision for income taxes (23) (7) (48) (21)

-------- -------- -------- --------

NET LOSS $ (1,539) $ (1,484) $ (3,078) $ (2,402)

======== ======== ======== ========

BASIC AND DILUTED LOSS PER SHARE:

Net loss per share - basic and

diluted $ (0.05) $ (0.05) $ (0.10) $ (0.08)

======== ======== ======== ========

WEIGHTED AVERAGE SHARES OUTSTANDING:

Basic 31,110 30,940 31,107 29,017

Diluted 31,110 30,940 31,107 29,017

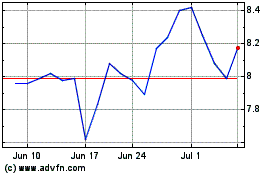

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From May 2024 to Jun 2024

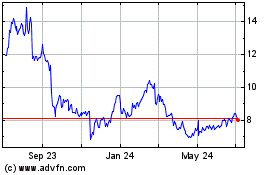

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024