Ethereum Suffers 3rd Straight Weekly Outflows, Becomes 2024’s Worst Performer

July 02 2024 - 5:45AM

NEWSBTC

The digital asset market is experiencing a wave of investor

caution, with Ethereum leading the charge. CoinShares reports show

a third consecutive week of outflows, with Ether sustaining the

biggest damage. This negative sentiment in the top altcoin, coupled

with sluggish trading volumes and regional outflows across the

market, paints a picture of a market searching for direction.

Related Reading: Dogwifhat (WIF) Jumps 21% As Analysts See $4.5

Price Tag Ethereum Faces Headwinds Despite Upcoming Milestone

Ethereum, the world’s second-largest cryptocurrency, has seen the

worst outflows of any digital asset this year, reaching a

staggering $61 million last week. The dismal figure could be

attributed to the delay in approving a spot Ethereum ETF, a highly

anticipated event that has been in the works for nearly three

years. According to CoinShares, digital asset investment products

saw $30 million in outflows last week, the third consecutive week

of outflows. Ethereum saw its largest outflow since August 2022,

totaling $61 million, making it the worst performing digital asset

investment product so… — Wu Blockchain (@WuBlockchain) July 1, 2024

The long wait for regulatory greenlight might be causing investors

to hold off on commitments, creating uncertainty in the Ethereum

market. However, the upcoming launch on July 4th remains a pivotal

moment. Analysts are closely watching to see if this long-awaited

development triggers a surge in Ethereum adoption or if it simply

cannibalizes existing Bitcoin ETF investments. Mixed Signals:

Regional Divergence And Altcoin Interest While the overall trend

points towards caution, there are regional variations in investor

sentiment. The United States, for example, defied the global trend

and witnessed inflows of $43 million, suggesting continued American

interest in the digital asset space. Similarly, inflows into

multi-asset and Bitcoin Exchange-Traded Products (ETPs) indicate a

preference for diversification and established players. This

highlights the ongoing appeal of a broader exposure to the digital

asset landscape, rather than a singular focus on any one

cryptocurrency. Interestingly, amidst the Ethereum outflow woes,

some altcoins are experiencing a resurgence. Solana and Litecoin,

for instance, saw inflows, suggesting that investors are seeking

opportunities beyond the top two cryptocurrencies. This

diversification could be a sign of a maturing market where

investors are conducting a more thorough risk assessment and

exploring undervalued gems within the vast digital asset ecosystem.

Related Reading: Ethereum Goes Budget-Friendly: Transaction Fees

Drop To Lowest Since 2016 Navigating Uncertain Waters The current

state of the digital asset market is one of cautious optimism.

While outflows and Ethereum’s struggles are undeniable concerns,

positive inflows in specific regions and products offer a

counterpoint. The upcoming Ethereum ETF launch is a wild card,

potentially acting as a catalyst for further adoption or simply

reshuffling existing investments. Investors are likely to

remain watchful in the near future, carefully weighing risk and

reward before making significant commitments. Featured image from

Parents, chart from TradingView

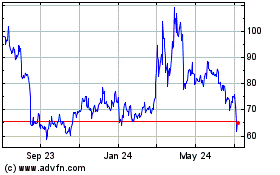

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

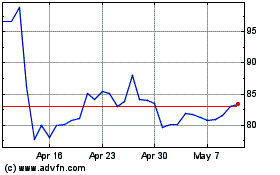

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024