By Katie Deighton

Venmo, the payments app owned by PayPal Holdings Inc., has

introduced its first physical credit card, stamped with a prominent

QR code on the front.

Venmo is gradually rolling out the ability to apply for the

card, which is issued by Synchrony Financial, to its app users in

the U.S. starting this week, the company said.

Cardholders can choose from five color schemes -- from

"Nightlife black" to "Cotton Candy pink" -- and must scan the

card's unique QR code with the Venmo app to activate it.

The main purpose of the code on the card is to bring the digital

experience of splitting checks and purchases via Venmo -- a big

part of Venmo's pitch to new users -- into the physical world, said

Darrell Esch, senior vice president and general manager of

Venmo.

"When you're out for dinner and everyone throws their card into

the folio, the waiter has to split the check between four or five

cards," Mr. Esch said. "Whereas here, I can throw my card into the

center, and everybody else can quickly scan my code, link to my

Venmo and push the funds to settle."

That can minimize the amount of touching while out dining, a

potentially appealing feature during the coronavirus pandemic, but

Venmo designed the QR code feature well before Covid-19 upended

life, Mr. Esch said.

The move comes as parent company PayPal pushes touchless

payments in its enterprise division. In a company first, the

financial firm in July said PayPal and Venmo QR code technology

would be installed across more than 8,000 CVS stores, allowing

shoppers to pay for goods by scanning their smartphones at the

register.

PayPal Chief Executive Daniel Schulman said in the same month

that QR code technology would accelerate Venmo's effort to turn a

profit. Still, Venmo has long looked to physical cards as a way to

diversify its revenue stream away from low-stakes digital

transactions among friends. Executives at the firm began meeting

with banks to discuss a credit card in 2018, the same year the

company introduced a debit card -- a simple Mastercard Inc. design

without a QR code print.

While the credit card's code design is a neat addition, Venmo's

attempts to jazz up the in-app experience will be more critical to

the product's success, said Ana Milicevic, co-founder and principal

of digital consulting firm Sparrow Advisers, who wasn't involved

with the project.

"Venmo's not the first entrant targeting mobile-first consumers

and won't be the last, so the user experience here is critical,"

she said. "But if they nail that they stand a good chance to be the

default finance app for many mobile-first consumers."

"Knowing how expensive it is to acquire customers in financial

services, and how Venmo can continue to layer on other services on

top of the card, this bodes well long-term for retention and

customer lifetime value expansion," Ms. Milicevic said.

Venmo offers credit card holders an "intelligent reward system,"

whereby they will earn 3% cash back on purchases made in their top

spending category, 2% cash back on their second highest and 1% back

on all other transactions. Rewards can be earned across eight

categories, and a user's top categories can switch from month to

month.

Other credit card providers are making efforts to adapt their

rewards programs as the pandemic halts spending in categories like

travel. But Venmo's ability to adjust each user's cashback

categories every month is somewhat unique, said Sara Rathner, a

credit card expert at NerdWallet.

"It makes it easier for a customer to become what I call a 'lazy

optimizer': Instead of having to decide which card to use in a

restaurant, or which card to book a plane ticket with, they could

really put everything on the same card," she said. "For somebody

who really just wants one really easy to use card that will reward

them when they shop, this could be it."

A moving pie-chart display in the Venmo app lets users track

which categories will earn them the most cash back, said Dennis

Bauer, senior vice president and general manager at Synchrony,

which issues the credit card.

"It's a fun, lively experience," he said. "The way you watch

your spending trends move up and down from category to category,

and the way in which information is revealed really makes you want

to check the app more frequently."

That attempt to deliver digital dopamine hits, coupled with a

rewards system that encourages spending on categories including

dining-and-nightlife and health-and-beauty, will make it easier for

millennials and Generation Z to spend money during an economic

downturn, said Wendy Johansson, global vice president of experience

at digital agency Publicis Sapient.

"Which is smart, but it's ethically dubious for Venmo to be

offering a credit card to younger generations at this time," Ms.

Johansson said, referencing statistics that showed elevated youth

unemployment this summer. "Venmo should employ their user

experience design expertise for good," building more financial

education into the mobile app so users can better understand the

impact of their spending patterns.

Mr. Bauer said financial education is part of the experience,

citing the ability to view spending patterns by category.

"More transparency gives customers more opportunities to manage

their finances," he said.

Write to Katie Deighton at katie.deighton@wsj.com

(END) Dow Jones Newswires

October 07, 2020 06:14 ET (10:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

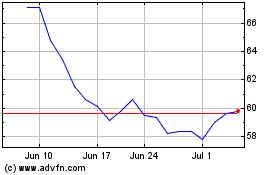

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2024 to May 2024

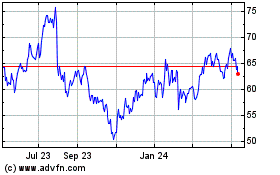

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From May 2023 to May 2024