Submitted Final PMA Supplement to FDA for

New U.S. Manufacturing Site

Sientra, Inc. (NASDAQ:SIEN) (“Sientra” or the “Company”), a medical

aesthetics company, today announced its financial results for the

fourth quarter and full year ended December 31, 2016.

Jeffrey M. Nugent, Chairman and Chief Executive

Officer of Sientra, said, “As promised, we have made significant

progress on a number of strategic and operational initiatives over

the last several months and met an important milestone today with

the submission of our final PMA Supplement to the FDA for our new

U.S. based manufacturing facility. I want to acknowledge our

entire organization and especially our regulatory and R&D teams

that have worked diligently to get us to this significant milestone

and keep us on track for FDA approval of our new manufacturing site

by the end of the year. 2017 is a pivotal year for us as we

prepare to move into 2018 and beyond with our breast implant supply

chain back and intact. We also put in place financing to

access up to $20 million in additional capital to go along with our

current solid cash position to ensure we have the flexibility to

support our working capital and inventory needs as we ramp up

toward re-supply along with supporting any strategic

initiatives.”

Mr. Nugent concluded, “As we move through 2017,

we remain laser focused on meeting our previously stated

manufacturing timelines to achieve FDA approval and resupply by the

end of 2017. I am also committed to maintaining our elite

sales force and board certified plastic surgeon customers, and also

to continue building our strong corporate culture, which has been a

key priority since I started just over a year ago. And

finally, we remain confident in our ability to re-establish our

earlier market share position and growth strategy. We have made

several additions to our team that will add to our ability to

expedite our return to the competitive position we had previously

achieved.”

Fourth Quarter and Full Year 2016

Financial Review

Total net sales for the fourth quarter 2016 were

$6.5 million, compared to total net sales of $1.5 million for the

same period in 2015. Total sales for the year ended December 31,

2016 were $20.7 million, compared to total sales of $38.1 million

for the full year 2015. This decrease was driven by our controlled

market re-entry designed to optimize the availability of our Breast

Product inventory as we established our supply options following

the voluntary hold on the sale and implanting of all Sientra

devices manufactured by our former manufacturing contractor between

October 9, 2015 and March 1, 2016.

Breast Products accounted for 82% of our total

net sales for the fourth quarter 2016 and 79% for the full year

2016 and bioCorneum®, or our Scar Management Products, accounted

for 17% of our total net sales for fourth quarter 2016 and 18% for

the full year 2016.

Gross profit for the fourth quarter of 2016 was

$3.9 million, or 61% of sales, compared to gross profit of $1.0

million, or 64% of sales, for the same period in 2015. The

decrease in gross margin was driven primarily by an incremental

reserve for obsolete inventory, offset by lower fixed overhead as a

percentage of total sales.

Gross profit for the year ended December 31,

2016 was $13.9 million, or 67% of sales, compared to gross profit

of $27.5 million, or 72% of sales, for the full year 2015. The

decrease in gross margin for full year 2016 was primarily due to an

incremental reserve for obsolete inventory.

Operating expenses for the fourth quarter of

2016 were $12.0 million, a decrease of $17.2 million, compared to

operating expenses of $29.2 million for the same period in

2015. The fourth quarter of 2015 included a non-cash

impairment charge of $14.3 million related to the write down of

goodwill as a result of the significant decline in our stock

price. Excluding the goodwill impairment, operating expense

for the fourth quarter 2016 were $2.9 million lower than fourth

quarter of 2015, primarily due to transition costs for certain

former executives incurred during 2015.

Operating expenses for the full year 2016

totaled $53.9 million, a decrease of $12.1 million, compared to

operating expenses of $66.0 million for full year 2015. The

decrease is primarily due to the goodwill impairment charge of

$14.3 million recorded in 2015, offset by an increase in legal

expenses.

Net loss for the fourth quarter of 2016 was $8.1

million, compared to $28.3 million for the same period in 2015. Net

loss for the full year ended December 31, 2016 was $40.2 million,

compared to $41.2 million for the same period in 2015.

Net cash and cash equivalents were $67.2 million

as of December 31, 2016.

Additionally, the Company announced that it has

added a $15 million secured line of credit and a $5 million

available secured credit facility with Silicon Valley Bank which

will be used for general corporate purposes, working capital needs

related to inventory as the Company prepares for final

manufacturing site approval, as well as strategic initiatives.

Conference Call

Sientra will hold a conference call on Tuesday,

March 14, 2017 at 1:30 p.m. PT/4:30 p.m. ET to discuss the

results.

The dial-in numbers are (844) 464-3933 for

domestic callers and (765) 507-2612 for international callers. The

conference ID is 77604092. A live webcast of the conference

call will be available on the Investor Relations section of the

Company's website at www.sientra.com.

About Sientra

Headquartered in Santa Barbara, California,

Sientra is a medical aesthetics company committed to making a

difference in patients’ lives by enhancing their body image,

growing their self-esteem and restoring their confidence. The

Company was founded to provide greater choice to board-certified

plastic surgeons and patients in need of medical aesthetics

products. The Company has developed a broad portfolio of products

with technologically differentiated characteristics, supported by

independent laboratory testing and strong clinical trial outcomes.

The Company sells its breast implants and breast tissue expanders

exclusively to board-certified and board-admissible plastic

surgeons and tailors its customer service offerings to their

specific needs. The Company also offers a range of other

aesthetic and specialty products including bioCorneum®, the

professional choice in scar management.

Forward-looking statementsThis press release

contains “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, based on

management’s current assumptions and expectations of future events

and trends, which affect or may affect the Company’s business,

strategy, operations or financial performance, and actual results

may differ materially from those expressed or implied in such

statements due to numerous risks and uncertainties.

Forward-looking statements include, but are not limited to,

statements regarding the success of the Company’s market re-entry,

its ability to transition the business back to historical revenue

and growth levels and create a world class, diversified aesthetics

organization, the Company’s development of a long-term

manufacturing solution, including the timing and ability to qualify

a manufacturing facility for the manufacture of product for the

Company’s customers, and the integration of and expected

contributions from new additions to the Company’s management

team. Such statements are subject to risks and uncertainties,

including the dependence on positive reaction from plastic surgeons

and their patients in order to successfully re-enter the market,

future profitability depending on the success of the Company’s

breast products, and risks associated with contracting with Vesta

or any third-party manufacturer and supplier, including

uncertainties that the development and validation of Vesta’s

manufacturing facility will be timely completed, that a PMA

Supplement or other regulatory requirements will be timely approved

by the FDA or other applicable regulatory authorities, and that the

integration of recently acquired product lines will not achieve the

anticipated benefits or will divert attention of management from

the operation of the existing business. Additional factors

that could cause actual results to differ materially from those

contemplated in this press release can be found in the Risk Factors

section of Sientra’s most recently filed Quarterly Report on Form

10-Q and and its Annual Report on Form 10-K for the year ended

December 31, 2016 which Sientra expects to file with the Securities

and Exchange Commission on March 14, 2017. All statements

other than statements of historical fact are forward-looking

statements. The words ‘‘believe,’’ ‘‘may,’’ ‘‘might,’’ ‘‘could,’’

‘‘will,’’ ‘‘aim,’’ ‘‘estimate,’’ ‘‘continue,’’ ‘‘anticipate,’’

‘‘intend,’’ ‘‘expect,’’ ‘‘plan,’’ or the negative of those terms,

and similar expressions that convey uncertainty of future events or

outcomes are intended to identify estimates, projections and other

forward-looking statements. Estimates, projections and other

forward-looking statements speak only as of the date they were

made, and, except to the extent required by law, the Company

undertakes no obligation to update or review any estimate,

projection or forward-looking statement.

| |

| SIENTRA, INC. |

| Condensed Statements of Operations |

| (In thousands, except per share and share

amounts) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

|

|

|

|

|

|

December

31, |

|

|

December

31, |

|

| |

|

|

|

|

|

|

|

2016 |

|

|

2015 |

|

|

|

2016 |

|

|

2015 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

|

|

$ |

6,488 |

|

$ |

1,537 |

|

|

$ |

20,734 |

|

$ |

38,106 |

|

|

| Cost of

goods sold |

|

2,561 |

|

|

547 |

|

|

|

6,880 |

|

|

10,654 |

|

|

| |

|

|

|

|

Gross

profit |

|

3,927 |

|

|

990 |

|

|

|

13,854 |

|

|

27,452 |

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

| |

Sales and

marketing |

|

4,074 |

|

|

5,675 |

|

|

|

20,607 |

|

|

25,762 |

|

|

| |

Research

and development |

|

2,334 |

|

|

2,304 |

|

|

|

9,704 |

|

|

7,199 |

|

|

| |

General and

administrative |

|

5,633 |

|

|

6,933 |

|

|

|

23,577 |

|

|

18,738 |

|

|

| |

Goodwill

Impairment |

|

— |

|

|

14,278 |

|

|

|

— |

|

|

14,278 |

|

|

| |

|

|

|

|

Total

operating expenses |

|

12,041 |

|

|

29,190 |

|

|

|

53,888 |

|

|

65,977 |

|

|

| |

|

|

|

|

Loss from

operations |

|

(8,114 |

) |

|

(28,200 |

) |

|

|

(40,034 |

) |

|

(38,525 |

) |

|

| Other

income (expense), net |

|

|

|

|

|

|

|

|

|

|

| |

Interest

income |

|

16 |

|

|

13 |

|

|

|

63 |

|

|

32 |

|

|

| |

Interest

expense |

|

20 |

|

|

(149 |

) |

|

|

(98 |

) |

|

(3,097 |

) |

|

| |

Other

(expense) income, net |

|

18 |

|

|

86 |

|

|

|

(36 |

) |

|

360 |

|

|

| |

|

|

|

|

Total other

income (expense), net |

|

54 |

|

|

(50 |

) |

|

|

(71 |

) |

|

(2,705 |

) |

|

| |

|

|

|

|

Loss before

income taxes |

|

(8,060 |

) |

|

(28,250 |

) |

|

|

(40,105 |

) |

|

(41,230 |

) |

|

| Income

taxes |

|

|

13 |

|

|

— |

|

|

|

61 |

|

|

— |

|

|

| |

|

|

|

|

Net

loss |

$ |

(8,073 |

) |

$ |

(28,250 |

) |

|

$ |

(40,166 |

) |

$ |

(41,230 |

) |

|

| Basic and

diluted net loss per share attributable to common stockholders |

$ |

(0.43 |

) |

$ |

(1.57 |

) |

|

$ |

(2.20 |

) |

$ |

(2.61 |

) |

|

| Weighted

average outstanding common shares used for net loss per |

|

|

|

|

|

|

|

|

|

|

| |

share

attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

| |

|

Basic and

diluted |

|

18,595,286 |

|

|

17,993,400 |

|

|

|

18,233,177 |

|

|

15,770,972 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| SIENTRA, INC. |

| Condensed Balance Sheets |

| (In thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

| |

|

2016 |

|

2015 |

|

| Assets |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

| |

Cash and

cash equivalents |

$ |

67,212 |

$ |

112,801 |

|

| |

Accounts

receivable, net |

|

3,082 |

|

4,249 |

|

| |

Inventories, net |

|

18,484 |

|

20,602 |

|

| |

Insurance

recovery receivable |

|

9,375 |

|

— |

|

| |

Prepaid

expenses and other current assets |

|

1,852 |

|

1,473 |

|

| |

|

Total

current assets |

|

100,005 |

|

139,125 |

|

| Property

and equipment, net |

|

2,986 |

|

1,404 |

|

|

Goodwill |

|

|

|

|

4,878 |

|

— |

|

| Other

intangible assets, net |

|

6,186 |

|

53 |

|

| Other

assets |

|

|

|

228 |

|

223 |

|

| |

|

Total

assets |

$ |

114,283 |

$ |

140,805 |

|

| Liabilities and Stockholders' Equity |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| |

Accounts

payable |

$ |

3,555 |

$ |

4,069 |

|

| |

Accrued and

other current liabilities |

|

6,507 |

|

6,959 |

|

| |

Legal

settlement payable |

|

10,900 |

|

— |

|

| |

Customer

deposits |

|

6,559 |

|

9,488 |

|

| |

|

Total

current liabilities |

|

27,521 |

|

20,516 |

|

| Warranty

reserve and other long-term liabilities |

|

3,145 |

|

1,418 |

|

| |

|

Total

liabilities |

|

30,666 |

|

21,934 |

|

|

Stockholders’ equity: |

|

|

|

|

|

| |

|

Total

stockholders’ equity |

|

83,617 |

|

118,871 |

|

| |

|

Total

liabilities and stockholders’ equity |

$ |

114,283 |

$ |

140,805 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Investor Contacts:

Patrick F. Williams

Sientra, Chief Financial Officer

(619) 675-1047

patrick.williams@sientra.com

Nick Laudico / Brian Johnston

The Ruth Group

(646) 536-7030 / (646) 536-7028

IR@Sientra.com

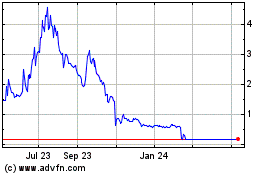

Sientra (NASDAQ:SIEN)

Historical Stock Chart

From Apr 2024 to May 2024

Sientra (NASDAQ:SIEN)

Historical Stock Chart

From May 2023 to May 2024