Q2 2016 OVERVIEW

- Revenue totaled $12.4 million, compared

to $13.7 million in Q2 2015.

- Gross profit rose 24% to $3.6 million,

or 29% of revenue, from $2.9 million, or 21% of revenue, in Q2

2015.

- Selling, general & administrative

decreased 27% to $2.9 million, or 23% of revenue, from $4.0

million, or 29% of revenue, in Q2 2015.

- EBITDA totaled $0.4 million, up from an

EBITDA loss of $1.2 million in Q2 2015.

- Adjusted EBITDA increased to $1.1

million from an adjusted EBITDA loss of $0.5 million in Q2

2015.

- Net income equaled $0.1 million, or

$0.01 per diluted share, compared to a net loss of $1.5 million, or

$(0.08) per diluted share, in Q2 2015.

- Adjusted net income, excluding the

impact of restructuring charges, loss from the change in fair value

of contingent consideration and stock-based compensation expense,

increased to $0.9 million, or $0.05 per basic and diluted share,

from an adjusted net loss of $0.8 million, or $(0.05) per basic and

diluted share, in Q2 2015.

At June 30, 2016

- Cash and equivalents of $14.3 million,

or $0.78 per diluted share, including $3.4 million of restricted

cash.

- Working capital of $10.7 million and

current ratio of 1.5x.

- $0 long-term debt.

- Backlog totaled $71.1 million, up 48%

compared to year-end 2015 backlog of $47.9 million.

Subsequent Events

- Hired Emmett Pepe as GSE’s new Chief

Financial Officer in July 2016.

- Appointed Jim Stanker to the Company’s

Board of Directors and Audit Committee in August 2016.

- Chris Sorrells assumed the Chief

Operating Officer role, on a permanent basis, in August 2016.

GSE Systems, Inc. (“GSE” or “the Company”) (NYSE MKT:

GVP), the world leader in real-time high-fidelity simulation

systems and training solutions to the power and process industries,

today announced financial results for the second quarter (“Q2”)

ended June 30, 2016.

Kyle J. Loudermilk, GSE’s President and Chief Executive Officer,

said, “We are pleased to report GSE’s fourth consecutive quarter of

positive adjusted EBITDA. In Q2 2016, GSE recorded significantly

higher gross margins and lower operating expenses, reflecting our

continuing efforts to reduce costs and focus on project

profitability. We have reduced annualized operating expenses by

more than $4 million since I joined GSE approximately one year ago.

We also have continued to invest in resources for growth, hiring

key leadership positions in the areas of technology, finance and

operations. On that note, we are pleased to announce that Chris

Sorrells, who has played an instrumental role in GSE’s operational

turnaround, has agreed to assume the COO role on a permanent basis.

Furthermore, we strengthened our financial and accounting

leadership with the appointment of Emmett Pepe as our new CFO and

Jim Stanker as a new member of our Board or Directors and Audit

Committee. With the benefit of an enhanced leadership team and

streamlined operations, we are now firmly focused on implementing

our strategy to revitalize GSE’s growth.”

Q2 2016 RESULTS

Q2 2016 revenue decreased 9% to $12.4 million from $13.7 million

in Q2 2015, reflecting a 1% increase in Performance Improvement

Solutions revenue and a 25% decrease in Nuclear Industry Training

and Consulting revenue due to a strategic shift in sales focus to

higher margin assignments.

(in thousands)

Three Months ended

June 30,

Six Months ended

June 30,

Revenue: 2016 2015 2016

2015 (unaudited) (unaudited) (unaudited)

(unaudited) Performance Improvement Solutions $ 8,323 $ 8,213 $

17,166 $ 17,046 Nuclear Industry Training and Consulting

4,092 5,441 8,225 10,621 Total Revenue $

12,415 $ 13,654 $ 25,391 $ 27,667

Performance Improvement Solutions orders totaled $5.8 million in

Q2 2016 compared to $12.7 million in Q2 2015. Nuclear Industry

Training and Consulting orders totaled $3.4 million in Q2 2016

compared to $6.1 million in Q2 2015.

Q2 2016 gross profit grew by 24% to $3.6 million, or 29% of

revenue, from $2.9 million, or 21% of revenue, in Q2 2015.

(in thousands)

Three Months ended

June 30,

Six Months ended

June 30,

Gross Profit: 2016 %

2015 % 2016

% 2015 %

(unaudited) (unaudited) (unaudited)

(unaudited) Performance Improvement Solutions $ 2,911 35.0 %

$ 2,297 28.0 % $ 6,056 35.3 % $ 5,074 29.8 % Nuclear Industry

Training and Consulting 649 15.9 % 590

10.8

% 1,128 13.7 % 1,107 10.4 % Total Gross Profit $

3,560

28.6

% $ 2,887 21.1 % $ 7,184 28.3 % $ 6,181 22.3 %

Performance Improvement Solutions gross profit for Q2 2016

increased 27% to $2.9 million, or 35% gross margin, from $2.3

million, or 28% gross margin, in Q2 2015. Nuclear Industry Training

and Consulting gross profit for Q2 2016 increased 10% to

approximately $649,000, or 16% gross margin, from approximately

$590,000, or 11% gross margin, in Q2 2015.

Selling, general & administrative expenses in Q2 2016

decreased 27% to $2.9 million, or 23% of revenue, from $4.0

million, or 29% of revenue, in Q2 2015.

Operating income for Q2 2016 was $0.2 million compared to an

operating loss of $1.4 million in Q2 2015.

Net income for Q2 2016 was $0.1 million, or $0.01 per basic and

diluted share, compared to a net loss of $1.5 million, or $(0.08)

per basic and diluted share, in Q2 2015.

Q2 2016 adjusted net income, excluding the impact of

restructuring charges, loss from the change in fair value of

contingent consideration and stock-based compensation expense,

increased to $0.9 million, or $0.05 per basic and diluted share,

from an adjusted net loss of $0.8 million, or $(0.05) per basic and

diluted share, in Q2 2015.

EBITDA (Earnings before interest, taxes, depreciation and

amortization) for Q2 2016 was $0.4 million compared to an EBITDA

loss of $1.2 million in Q2 2015.

Adjusted EBITDA, which excludes the impact of restructuring

charges, loss from the change in fair value of contingent

consideration and stock-based compensation expense, increased to

$1.1 million in Q2 2016 from an adjusted EBITDA loss of

approximately $0.5 million in Q2 2015.

Backlog at June 30, 2016, increased 48% to $71.1 million from

$47.9 million at December 31, 2015. Backlog at June 30, 2016,

included $64.7 million of Performance Improvement Solutions backlog

and $6.4 million of Nuclear Industry Training and Consulting

backlog.

GSE’s cash position at June 30, 2016, was $14.3 million,

including $3.4 million of restricted cash, as compared to $14.6

million, including $3.6 million of restricted cash, at December 31,

2015.

CONFERENCE CALL

Management will host a conference call today at 4:30 pm Eastern

Time to discuss Q2 results and other matters.

Interested parties may participate in the call by dialing:

- (877) 407-9753 (Domestic) or

- (201) 493-6739 (International)

The conference call will also be accessible via the following

link:http://www.investorcalendar.com/IC/CEPage.asp?ID=175198

For those who cannot listen to the live broadcast, an online

webcast replay will be available through November 15, 2016 at

www.gses.com or via the following

link:http://www.investorcalendar.com/IC/CEPage.asp?ID=175198

ABOUT GSE SYSTEMS,

INC.

GSE Systems, Inc. is a world leader in real-time high-fidelity

simulation, providing a wide range of simulation, training and

engineering solutions to the power and process industries. Its

comprehensive and modular solutions help customers achieve

performance excellence in design, training and operations. GSE’s

products and services are tailored to meet specific client

requirements such as scope, budget and timeline. The Company has

over four decades of experience, more than 1,100 installations, and

hundreds of customers in over 50 countries spanning the globe. GSE

Systems is headquartered in Sykesville (Baltimore), Maryland, with

offices in St. Marys, Georgia; Huntsville, Alabama; Chennai, India;

Nyk�ping, Sweden; Stockton-on-Tees, UK; and Beijing, China.

Information about GSE Systems is available at www.gses.com.

FORWARD LOOKING

STATEMENTS

We make statements in this press release that are considered

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. These statements reflect our

current expectations concerning future events and results. We use

words such as “expect,” “intend,” “believe,” “may,” “will,”

“should,” “could,” “anticipates,” and similar expressions to

identify forward-looking statements, but their absence does not

mean a statement is not forward-looking. These statements are not

guarantees of our future performance and are subject to risks,

uncertainties, and other important factors that could cause our

actual performance or achievements to be materially different from

those we project. For a full discussion of these risks,

uncertainties, and factors, we encourage you to read our documents

on file with the Securities and Exchange Commission, including

those set forth in our periodic reports under the forward-looking

statements and risk factors sections. We do not intend to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

GSE SYSTEMS, INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Operations

(in thousands, except share and per share

data)

Three Months ended

Six Months ended June 30, June 30,

2016 2015

2016 2015

(unaudited) (unaudited) (unaudited) (unaudited) Revenue $ 12,415 $

13,654 $ 25,391 $

27,667

Cost of revenue 8,855 10,767

18,207

21,486

Gross profit 3,560 2,887 7,184 6,181 Selling,

general and administrative 2,881 3,951 5,992 7,220 Restructuring

charges 277 48 402 145 Depreciation 102 135 202 264 Amortization of

definite-lived intangible assets 73 124

146 247 Operating expenses 3,333

4,258 6,742 7,876

Operating income (loss) 227 (1,371 ) 442 (1,695 )

Interest income, net 13 21 40 48 Loss on derivative instruments,

net (17 ) (31 ) (135 ) (79 ) Other income (expense), net (4

) (41 ) 98 (80 ) Income (loss)

before income taxes 219 (1,422 ) 445 (1,806 ) Provision for

income taxes 108 73 196

161 Net income (loss) $ 111 $ (1,495 )

$ 249 $ (1,967 ) Basic earnings (loss) per common

share $ 0.01 $ (0.08 ) $ 0.01 $ (0.11 ) Diluted

earnings (loss) per common share $ 0.01 $ (0.08 ) $ 0.01

$ (0.11 ) Weighted average shares outstanding - Basic

18,010,949 17,887,859 17,956,622

17,887,859 Weighted average shares outstanding

- Diluted 18,262,413 17,887,859

18,194,039 17,887,859

GSE SYSTEMS, INC AND

SUBSIDIARIES

Selected Balance Sheet Data (in

thousands)

(unaudited) (audited)

June 30, 2016 December 31, 2015 Cash and cash

equivalents $ 10,903 $ 11,084 Restricted cash – current 1,658 1,771

Current assets 30,108 28,414 Long-term restricted cash 1,735 1,779

Total assets 40,684 39,371 Current liabilities $ 19,439 $

19,708 Long-term liabilities 1,945 1,295 Stockholders' equity

19,300 18,368

EBITDA and Adjusted EBITDA

Reconciliation (in thousands)

EBITDA and Adjusted EBITDA are not measures of financial

performance under generally accepted accounting principles

(“GAAP”). Management believes EBITDA and Adjusted EBITDA, in

addition to operating profit, net income and other GAAP measures,

are useful to investors to evaluate the Company’s results because

it excludes certain items that are not directly related to the

Company’s core operating performance that may, or could, have a

disproportionate positive or negative impact on our results for any

particular period. Investors should recognize that EBITDA and

Adjusted EBITDA might not be comparable to similarly-titled

measures of other companies. This measure should be considered in

addition to, and not as a substitute for or superior to, any

measure of performance prepared in accordance with GAAP. A

reconciliation of non-GAAP EBITDA and Adjusted EBITDA to the most

directly comparable GAAP measure in accordance with SEC Regulation

G follows:

Three

Months ended Six Months ended June 30, June

30, 2016 2015

2016 2015

Net income (loss) $ 111 $ (1,495 ) $ 249 $ (1,967 )

Interest income, net (13 ) (21 ) (40 ) (48 ) Provision for income

taxes 108 73 196 161 Depreciation and amortization 175

259 348 511 EBITDA

381 (1,184 ) 753 (1,343 )

Loss from the change in fair value of

contingent

consideration

223 513 154 433 Restructuring charges 277 48 402 145 Stock-based

compensation expense 242

137

489

271

Consulting support for revenue recognition analysis -

- 78 - Adjusted EBITDA $

1,123 $ (499 ) $ 1,876 $

(494

)

Adjusted Net Income and Adjusted EPS

Reconciliation (in thousands, except per share amounts)

Adjusted Net Income and adjusted earnings (loss) per share

(“adjusted EPS”) are not measures of financial performance under

generally accepted accounting principles (“GAAP”). Management

believes adjusted net income and adjusted EPS, in addition to other

GAAP measures, are useful to investors to evaluate the Company’s

results because they exclude certain items that are not directly

related to the Company’s core operating performance that may, or

could, have a disproportionate positive or negative impact on our

results for any particular period. These measures should be

considered in addition to, and not as a substitute for or superior

to, any measure of performance prepared in accordance with GAAP. A

reconciliation of non-GAAP adjusted net income and adjusted EPS to

GAAP net income, the most directly comparable GAAP financial

measure, is as follows:

Three Months ended Six Months

ended June 30, June 30, 2016

2015 2016 2015 Net

income (loss) $ 111 $ (1,495)

$ 249 $ (1,967)

Loss from the change in fair value of

contingent

consideration

223 513 154 433 Restructuring charges 277 48 402 145 Stock-based

compensation expense 242

137

489

271

Consulting support for revenue recognition analysis -

- 78 -

Adjusted net income $ 853

$

(797)

$ 1,372 $

(1,118)

Earnings (loss) per share - diluted $

0.01 $ (0.08) $ 0.01 $

(0.11) Adjusted earnings (loss) per share -

diluted $ 0.05 $ (0.05) $

0.08 $ (0.06) Weighted average shares

outstanding - Diluted 18,262,413 17,887,859 18,194,039 17,887,859

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160815006109/en/

GSE Systems, Inc.Chris Sorrells, 410-970-7802Chief

Operating OfficerorThe Equity Group Inc.Devin Sullivan,

212-836-9608Senior Vice Presidentdsullivan@equityny.comorKalle Ahl,

CFA, 212-836-9614Senior Associatekahl@equityny.com

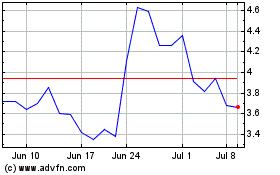

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Apr 2024 to May 2024

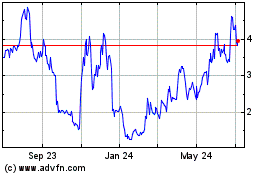

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From May 2023 to May 2024