UPDATE -- Plug Power Announces Results of Annual Meeting

July 01 2013 - 9:52PM

The following is a revised version of a press release that was

issued earlier today by Plug Power Inc. (Nasdaq:PLUG) with the same

headline:

Plug Power Inc. (Nasdaq:PLUG) (the "Company") today announced the

results of its 2013 Annual Meeting of Stockholders (the "Annual

Meeting"), which was originally convened on June 28, 2013 and

adjourned until July 1, 2013. Based on the voting results from the

Annual Meeting, stockholders re-elected incumbent directors George

C. McNamee and Johannes M. Roth, approved an Amendment to the

Company's Amended and Restated Certificate of Incorporation to

allow, but not require, the Board of Directors of the Company to

effect a reverse stock split of the Company's Common Stock at a

ratio within a range of 1:10 to 1:25 should they determine that a

reverse stock split be in the best interest of the Company and the

stockholders, and ratified the selection of KPMG LLP as the

Company's independent auditors for 2013. Plug Power will report the

specific voting results on a Current Report on Form 8-K.

Plug Power Inc. Safe Harbor Statement

This communication contains statements that are not historical

facts and are considered forward-looking within the meaning of

Section 27A of the Securities Act and Section 21E of the Exchange

Act. These forward-looking statements contain projections of our

future results of operations or of our financial position or state

other forward-looking information. We believe that it is important

to communicate our future expectations to our investors. However,

there may be events in the future that we are not able to

accurately predict or control and that may cause our actual results

to differ materially from the expectations we describe in our

forward-looking statements. Investors are cautioned not to unduly

rely on forward-looking statements because they involve risks and

uncertainties, and actual results may differ materially from those

discussed as a result of various factors, including, but not

limited to: the risk that we continue to incur losses and might

never achieve or maintain profitability, the risk that we expect we

will need to raise additional capital to fund our operations and

such capital may not be available to us; the risk that we do not

have enough cash to fund our operations to profitability and if we

are unable to secure additional capital, we may need to reduce

and/or cease our operations; the risk that a "going concern"

opinion from our auditors, KPMG LLP, could impair our ability to

finance its operations through the sale of equity, incurring debt,

or other financing alternatives; the recent restructuring plan we

adopted may adversely impact management's ability to meet financial

reporting requirements; our lack of extensive experience in

manufacturing and marketing products may impact our ability to

manufacture and market products on a profitable and large-scale

commercial basis; the risk that unit orders will not ship, be

installed and/or converted to revenue; the risk that pending orders

may not convert to purchase orders; the risk that our continued

failure to comply with NASDAQ's listing standards may result in our

common stock being delisted from the NASDAQ stock market, which may

severely limit our ability to raise additional capital; the cost

and timing of developing, marketing and selling our products and

our ability to raise the necessary capital to fund such costs; the

ability to achieve the forecasted gross margin on the sale of our

products; the actual net cash used for operating expenses may

exceed the projected net cash for operating expenses; the cost and

availability of fuel and fueling infrastructures for our products;

market acceptance of our GenDrive systems; our ability to establish

and maintain relationships with third parties with respect to

product development, manufacturing, distribution and servicing and

the supply of key product components; the cost and availability of

components and parts for our products; our ability to develop

commercially viable products; our ability to reduce product and

manufacturing costs; our ability to successfully expand our product

lines; our ability to improve system reliability for our GenDrive

systems; competitive factors, such as price competition and

competition from other traditional and alternative energy

companies; our ability to protect our intellectual property; the

cost of complying with current and future federal, state and

international governmental regulations; and other risks and

uncertainties discussed under "Item IA—Risk Factors" in Plug

Power's annual report on Form 10-K for the fiscal year ended

December 31, 2012, filed with the Securities and Exchange

Commission ("SEC") on April 1, 2013 and as amended on April 30,

2013 and the reports Plug Power filed from time to time with the

SEC. These forward-looking statements speak only as of the date on

which the statements were made and are not guarantees of future

performance. Except as may be required by applicable law, we do not

undertake or intend to update any forward-looking statements after

the date of this communication.

CONTACT: David Rodewald / Karen Freedman

+1 805-494-9508

The David James Agency | Plug Power

plugpower@davidjamesagency.com

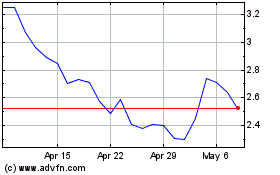

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Feb 2025 to Mar 2025

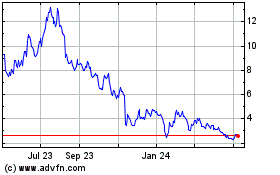

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Mar 2025