TIDMWINV

RNS Number : 7232S

Worsley Investors Limited

18 July 2022

18 July 2022

Worsley Investors Limited

(the "Company")

Annual Report for the period ended 31 March 2022

The Company is pleased to announce the release of its annual

report and audited consolidated financial statements for the period

ended 31 March 2022 (the "Annual Report"). A copy of the Annual

Report will be posted to shareholders and will be available to view

on the Company's website shortly at: www.worsleyinvestors.com

For further information, please contact:

Worsley Associates LLP (Investment Advisor)

Blake Nixon

Tel: +44 (0) 203 873 2288

Shore Capital (Financial Adviser and Broker)

Robert Finlay / Anita Ghanekar

Tel: +44 (0) 20 74080 4090

Sanne Fund Services (Guernsey) Limited (Administrator and

Secretary)

Chris Bougourd / Katrina Rowe

Tel: +44 (0) 1481 737600

LEI: 213800AF85VEZMDMF931

Performance Summary

31 March

2022 31 March 2021 % change

-----------------------------

Net Asset Value ("NAV") per

share 39.91p 41.55p -3.95%

---------- -------------- ---------

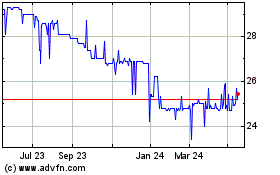

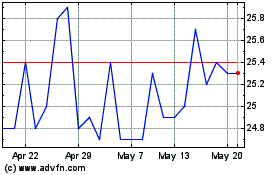

Share price(1) 27.70p 28.00p -1.07%

---------- -------------- ---------

Share price discount to NAV 30.59% 32.6%

---------- --------------

year ended 9 month period

31 March 2022 ended

31 March 2021

(Loss)/earnings per share(2) -1.50p 4.91p

--------------- ---------------

NAV Total Return(3) -3.95% 8.77%

--------------- ---------------

Share price Total Return(4)

--------------- ---------------

- Worsley Investors Limited -1.07% 15.25%

--------------- ---------------

- FTSE All Share Index 13.03% 26.71%

--------------- ---------------

- FTSE Real Estate Investment

Trust Index 22.54% 19.93%

--------------- ---------------

Worsley Associates LLP ("Worsley Associates") was appointed on

31 May 2019 as Investment Advisor (the "Investment Advisor") to

Worsley Investors Limited (the "Company"). At an EGM held on 28

June 2019, an ordinary resolution was passed to adopt the new

Investment Objective and Policy. The Investment Objective and

Policy are set out below.

These financial statements are made up to the year ended 31

March 2022. The annual results, therefore, cover a twelve-month

period up to 31 March 2022 and are not entirely comparable to the

previous results, which covered a period of nine months to 31 March

2021.

Past performance is not a guide to future performance.

(1) Mid-market share price (source: Shore Capital and Corporate

Limited).

(2) Loss per share based on the net loss for the year of

GBP0.505 million (nine month period to 31 March 2021: net profit of

GBP1.657 million) and the weighted average number of Ordinary

Shares in issue during the year of 33,740,929 (nine month period to

31 March 2021: 33,740,929).

(3) On a pro forma basis which includes adjustments to add back

any prior NAV reductions from share redemptions. NAV Total Return

is a measure showing how the NAV per share has performed over a

period of time, taking into account both capital returns and any

dividends paid to shareholders.

(4) A measure showing how the share price has performed over a

period of time, taking into account both capital returns and any

dividends paid to shareholders.

Source : Worsley Associates LLP and Shore Capital and Corporate

Limited.

Chairman's Statement

After a positive NAV total return of +3.11% in the first half

year (i.e. to 30 September 2021), the second half of the year saw

that progress more than reversed with our result dipping for the

full 12 months to 31 March 2022 to a -3.95% return.

On a share price basis, shareholder returns were somewhat

better, in that the mid-market share price fell by just over 1% in

the year from 28.0p to 27.7p per share. The discount which the

share price represents in relation to NAV improved from 32.6% to

30.6% as the decline of the market price of shares was less than

the fall in NAV. As at 11 July, the latest practicable date for

which independent data was available before going to print, the

performance of Worsley Investors Limited shares was ranked 1st and

3rd in the UK smaller companies sector (in each case out of 24 in

the sector) over the past 3 and 12 months respectively.

The biggest contributor to this NAV return outcome was a

reduction in the independent valuer's appraisal of the Curno cinema

value. Over the full year, this more than outweighed the rest of

the Group's profit contribution. A fuller description of the

effects of this valuation downgrade is given in the Investment

Adviser's Report ("IAR"), but a very high-level summary is that the

valuer has chosen to increase the already very conservative

discount rate it applied to the rental stream from Curno and this

has more than offset the effect of the significant increase in

passing rental.

I would like to remind shareholders that the rent benefits from

an annual upwards-only indexation clause in relation to Italian

consumer price inflation. If this measure of inflation exceeds

5.29% p.a. for the year to 31 December 2022, the contractual base

rental for 2023 will exceed EUR1 million to give a passing rental

yield of more than 11.5% on the 31 March 2022 valuation.

We are in the fortunate position of having no borrowings and

consequently no banking covenants within which to operate. We can

therefore be judicious in an orderly sale process to optimise the

value of the asset as and when confidence returns to the pool of

potential buyers. We note that the last remaining restrictions on

the sale of food and beverages by cinema operators in this region

of Italy came to an end on 15 June 2022. This should improve the

in-theatre experience for customers and, as it is generally a major

contributor to operator returns in the cinema sector, the

profitability for our tenant, UCI.

The second major contributor to the negative NAV returns was the

corporate costs of Worsley Investors Limited. At GBP530,000, this

represented a welcome reduction in the annualised run-rate of just

under 10% and was broadly in line with expectations.

We also had a foreign exchange mark-to-market translation loss

of GBP48,000 on the Sterling value of mainly euro-based assets,

predominantly Curno. This was a modest figure over the whole year,

although it represented a GBP161,000 adverse turnaround from the

position at the halfway point in the year.

Notwithstanding the impact on equity markets of the Ukrainian

conflict, returns on our core equity portfolio held up well with a

total annualised return of 1.9% on the capital deployed in the

portfolio over the year . Worsley Associates gives more detail in

its IAR.

Strategic Priorities

It remains our key priority to release the capital tied up in

the Curno asset for redeployment in our core equity strategy. In

that regard, external events of the past two years have not been

helpful. Firstly, Covid restrictions and secondly, the acceleration

of rises in interest rates and medium-term bond yields which, with

the general availability of credit are key to the ability of buyers

to finance the purchase of property assets, have made this a slower

process than we hoped. The current yield and the inflation

protection built into the lease terms mean that the cinema is an

increasingly attractive asset in its own right, generating a high

and stable return. It is a truism that sometimes portfolio managers

have to sell good investments (such as the cinema) to buy even

better ones such as those in our core equity strategy. While the

board cannot control the external factors which determine

investment demand for a cinema in northern Italy, we are not forced

sellers at the prey of opportunistic buyers and can temper our

response to retain the cinema until a disposal can be achieved at a

price which properly reflects its medium-term prospects. In the

meantime, we have the prospect of an inflation-hedged return in

excess of 10% p.a.

As we compound returns on our core equity strategy over time and

have available for additional re-investment the net cash flow from

the cinema sub-group, the proportion of our total NAV represented

by the cinema can be expected to continue to fall. As at 31 March

2022, it had declined to 54% of NAV, down from 55% at 30 September

2021 and 58% at 31 March 2021. Two years ago, at 30 June 2020,

Curno represented 66% of NAV.

Our other key priority will be to grow the Company, thereby

spreading our largely fixed costs over an enlarged asset base and

benefiting from keener rates on tiered fee structures. Current

market circumstances are not likely to be receptive to an immediate

raise and so this remains more aspirational in the immediate short

term than something on which we have a particular timetable.

Outlook

When I last wrote to you in mid-December, we were looking

forward to an economy growing at a brisk pace as it recovered from

the COVID-19 lock-downs albeit there was then some uncertainty and

concern from the emergence of the then-new "Omicron" variant. As it

has turned out, Omicron was not the disaster which some had feared

and by being relatively mild, may arguably have had some benefit in

the achievement of so-called "herd immunity" and bringing to a

close the public health emergency phase of the pandemic. We

expected interest rates, which had been cut as the pandemic

started, to increase again in response to rising activity and

prices. After more than a decade of ultra-low rates in the wake of

the Global Financial Crisis of 2008, normalisation was at some

point inevitable. What we did not foresee was the Russian invasion

of Ukraine in February. Although both countries, especially Russia,

are geographically large, their proportion of global GDP is

relatively small. In 2019 (the last full year before the Covid

pandemic), according to the World bank and IMF, Russia's GDP was

ranked at number 12 in the World (smaller than South Korea) and

Ukraine, at number 57, was much smaller than New Zealand. That

said, Russia is a significant supplier of energy and minerals and

Ukraine of food for both the human and animal population across the

world and of fertiliser used in the agricultural industries of many

countries. The supply disruption caused by sanctions and by Russian

military action has caused dislocation and sharp price rises in

basic elements of our own, apparently domestic, economy.

The immediate consequence is that interest rates are rising (as

we expected) but at a much faster rate than we had anticipated.

Whilst the stock market has weakened in immediate consequence, in

due course this should further enrich the opportunity set for a

value-based equity strategy such as is our core strategy.

On behalf of the Board, I would like to thank our Investment

Advisor, Worsley Associates LLP, for the encouraging progress they

continue to make in developing our portfolio and to thank you, our

shareholders, for your continuing support.

W. Scott

Chairman

15 July 2022

Investment Advisor's Report

Investment Advisor

The Investment Advisor, Worsley Associates LLP, is regulated by

the FCA and is authorised to provide investment management and

advisory services.

In the year under review, the equities portfolio continued to be

almost fully invested, and the Investment Advisor has concentrated

on its development and fostering investor interest in the Curno

cinema, which was impacted operationally by the tail end of the

COVID-19 pandemic.

Curno Cinema Complex

The Group's Italian multiplex cinema complex, located in Curno,

on the outskirts of Bergamo, is let in its entirety to UCI Italia

S.p.A. ("UCI").

The cinema lease documentation remains as amended in June

2020.

The key rental terms of the lease, which has a final termination

date of 31 December 2042, are:

Base Rent

1 April 2022 to 31 December 2022 - EUR949,770 per annum.

From 1 January 2022, at which point it increased by 3.8%, base

rental is indexed annually to 100% of the Italian ISTAT Consumer

Index on an upwards-only basis. The ISTAT Consumer Index in the six

months to 30 June has already risen 5.5%.

Variable Rent

Incremental rent is payable at the rate of EUR1.50 per ticket

sold above a minimum threshold of 350,000 tickets per year up to

450,000 tickets per year, rising in 50,000 ticket stages above this

level up to EUR2.50 per extra ticket.

Tenant Guarantee

The lease benefits from a rental guarantee of an initial EUR13

million, reducing over 15 years to EUR4.5 million, given by a U.K.

domiciled European holding company for the UCI group, United

Cinemas International Acquisitions Limited, which has latest

published shareholders' funds of GBP312.2 million.

Tenant break option

UCI has the right to terminate the lease on 30 June 2035.

Trading

The cinema, having been closed at the beginning of the period

because of Lombardy COVID-19 related regulations, reopened on 20

May 2021, and has remained open since. Notwithstanding the wearing

of masks being compulsory throughout the period, trading built

steadily, bolstered in the third quarter by a strong slate of new

movie releases. From 25 December 2021 to 9 March 2022 Italian

cinemas were prohibited from selling food and beverages, a

significant revenue generator and major profit source. During most

of the period COVID-19 passes were mandatory, which also impacted

demand, but it is pleasing to note that this restriction was lifted

on 30 April 2022 and masks have no longer been required since 15

June.

Rentals have remained current throughout the period.

Valuation

As at 31 March 2022, the Group's independent asset valuer,

Knight Frank LLP, fair valued the Curno cinema at EUR8.7 million

(30 September 2021: EUR9.6 million), and this figure has been

adopted in these Financial Statements.

Since the June 2020 lease amendment, the Board's expectation has

been that the valuation of the Curno cinema would increase once the

enhanced rental began to be generated by the property from 1 March

2021 onwards. The current rental is some 14% higher than the pre

amendment level.

In spite of this, the valuer as at 31 March 2022 has chosen to

increase the yield at which it capitalised the rental stream from

9.10% to 10.53%, which was had the effect of reducing the valuation

by nearly 10%. This extremely conservative approach reflects the

significant impact on investor demand of COVID-19 trading

restrictions in Italian cinemas.

Following the resumption of regular rental arrangements, we have

received enquiries from a number of investors. However, it quickly

became apparent that appetite would remain very subdued until the

cinema was fully free from all COVID-19 constraints. The Group will

retain the Curno cinema until a disposal can be effected at a price

which the board believes properly reflects its medium term

prospects.

Investment Strategy

The Investment Advisor's strategy allies the taking of holdings

in British quoted securities priced at a deep discount to their

intrinsic value, as determined by a comprehensive and robust

research process. Most of these companies will have smaller to

mid-sized equity market capitalisations, which will in general not

exceed GBP600 million. It is intended to secure influential

positions in such British quoted securities, with the employment of

activism as necessary to drive highly favourable outcomes.

In the first six weeks of 2022, dovish signals from the US

Federal Reserve and easing of fears regarding the Omicron COVID-19

variant saw the British stock market drifting upwards, peaking on

10 February. Fourteen days later, sentiment altered very

dramatically with the Russian invasion of Eastern Ukraine, and the

Ukrainian conflict has joined inflation concerns and the expected

impact on monetary policy as the largest influences on the U.K.

market.

The fortnight immediately following the invasion saw a sharp

downturn in global equity markets, but over the next month these

rallied on hopes that economic sanctions and subsequent peace talks

would be successful. However, those proved unfruitful and in early

April continued high US inflation and signals from the US Federal

Reserve that it would tackle that with higher interest rates,

allied to weak US retail sales, then sent equities into

reverse.

In the first week of May the Bank of England announced a 0.25%

increase in the base rate to 1%, the highest level for 13 years,

and a warned that a very sharp U.K. slowdown was imminent. Trading

for the rest of May was choppy, as mid-month U.K. inflation was

revealed to have hit 9%, and since the beginning of June the

British market has slewed downwards as concerns regarding runaway

inflation have reasserted themselves. Such concerns drove the US

Federal Reserve on 15 June to hike US interest rates by 0.75%, the

largest increase in 28 years. This was followed the next day by the

Bank of England raising U.K. rates a further 0.25%.

The prognosis is for rates in the U.K. and US to continue to be

lifted to a level of 3% or more and, in response, the U.K. stock

market has retreated, falling 5.9% over the June quarter. Within

the Company's target universe of British smaller companies, share

prices have fared significantly worse than the market as a whole,

being on the slide from almost the beginning of the June quarter

and ending it down 10.3%.

The Company's portfolio has remained quite fully invested during

the reporting period. This includes a previously undisclosed

holding of some 3.7% of Net Assets in Amedeo Air Four Plus Limited

('AA4'). AA4 is a Guernsey company, whose shares are listed on the

Specialist Fund Segment of the London Stock Exchange's Main Market.

AA4 has a market capitalisation of GBP109.4 million and owns via

its subsidiaries an aircraft fleet of six A380s and two B777-300ERs

leased to Emirates Airlines ('Emirates') and four A350-900s leased

to Thai Airways ('Thai Air'). As at 30 September 2021, the AA4

group held cash, net of provisions for maintenance, of slightly

less than GBP84 million, which has subsequently been reduced by a

GBP30 million pro rata capital redemption. In addition,

unencumbered gross lease payments contracted to be paid to AA4 by

Emirates as at 31 March 2022 were some GBP194 million. Once Thai

Air trading has normalised, there is scope to return by way of

capital return the GBP15 million held by AA4 as a capital buffer,

and to increase very substantially the annual dividend of five

pence per share, which is presently constrained by the AA4 board's

prudent approach to Thai Air's current trading.

The holding in Hurricane Energy plc July 2022 US$ 7.5% bonds,

which we disclosed had been purchased in the first half at 63.6% of

par, was disposed of shortly after year end at slightly more than

100% of par.

The largest portfolio position continues to be the shareholding

of just over 4% in Smiths News plc, England's major distributor of

newspapers and magazines. In early May, Smiths News published its

2022 interim results, which disclosed flat profitability with

magazine sales recovering well owing to the end of COVID-19

restrictions, reorganisation costs continuing to be relatively

modest, and good debt reduction from some significant one-off

non-trading receipts. Nevertheless, the shares have underperformed

over the past year, with the prospect of significant special

dividends now severely diminished by unduly restrictive banking

facilities entered into at the end of 2021.

The Northamber plc shareholding was increased modestly in the

second half, but that in Shepherd Neame Limited is unchanged since

the Interim Report. Preliminary (less than 2% of Net Assets)

holdings are also held in 9 other companies. During the second half

we exited two positions, crystallising substantial gains over their

cost. Other than AA4, one new position was initiated.

As at 30 June 2022 the Company's portfolio, which had a total

cost of GBP3.92 million and a combined market value of some GBP5.75

million, comprised 13 stocks. The surplus on the portfolio was a

little under 50% of cost, and the annualised return on capital

invested since the current strategy was adopted remains very

acceptable at more than 31%.

Results for the period

Cash revenue from Curno for the period to 31 March 2022 was

EUR923,700 (GBP790,000) ( 31 March 2021 nine months : EUR284,000

(GBP254,000)). As previously reported, the rental received in the

comparative period reflected the five-month holiday granted under

the 2020 lease amendment.

General and administrative expenses (including transaction

charges) of GBP530,000 ( 31 March 2021 nine months : GBP440,000)

were significantly lower than the 2021 run rate, an outturn which

was in line with expectations. Accounting and taxation-related

expenses at the Italian subsidiary, Multiplex 1 S.r.l. ('

Multiplex'), were significantly higher in 2022 because of one-off

projects, but Group legal and professional costs were considerably

lower. The Company audit fee was broadly similar to 2021's, the fee

for a nine-month period being no lower than that required for a

full year. As previously foreshadowed, t he growth in the value of

the portfolio during calendar year 2021 led to an increase in

AUM-based costs in the current period.

Transaction charges incurred on equity acquisitions were

GBP4,000 ( 31 March 2021 nine months : GBP17,000). The initial

buildup of the portfolio in the previous period had incurred much

greater charges, reflecting an abnormally elevated level of

transactions.

The Group's ongoing operating costs in the current year are

expected to be similar to the 2022 level. Prior to the ultimate

sale of Curno there remains limited scope for significant reduction

in the overall cost base.

The equities portfolio was steady in the third quarter before a

downturn in the fourth, culminating for the year as a whole in a

small (GBP0.161 million) net investment mark-to-market reduction (

31 March 2021 nine months : GBP2.082 million gain). Investment

Income for the year, predominantly dividends, was GBP217,000 and

net investment gains realised added GBP46,000. As a result, the

total annualised return on capital invested in the portfolio over

the year came out at 1.9%.

Taxation is payable on an ongoing basis on Italian income and in

Luxembourg. The bulk of the small legacy exposure in Germany was

settled in the second half. For the year, an operating tax charge

of GBP51,000 ( 31 March 2021 nine months : GBP10,000 operating

credit) was incurred. In addition, net VAT, predominantly in

Luxembourg, of some GBP5,000 was paid. The Group took the

opportunity in late 2021 to recapitalise Multiplex, and this

generated a one-off tax credit of EUR108,000 (GBP92,000).

Owing to the inflation linked increase in the Curno rental,

operating cash flow (that is prior to allowance for equity income)

is now expected to be modestly positive in the current year.

Net Assets at 31 March 2022 were GBP13.466 million, which

compares with the GBP14.453 million contained in the 30 September

2021 Interim Report. The decrease arose from the combined impact of

the loss in the second half of GBP0.826 million, of which

GBP770,000 (EUR900,000) related to the reduction in the Euro

valuation of the Curno property, and a GBP161,000 decrease in the

pound sterling fair value of Euro-denominated assets, principally

the property.

Financial Position

The Group's Statement of Financial Position improved slightly in

the period, with GBP576,000 in cash held at 31 March 2022 and no

debt. Augmented by the ample secondary liquidity of the equity

portfolio and positive ongoing cash flows, the financial position

remains strong.

In due course, the sale of the Curno cinema will provide

considerable additional resources for equity investment.

Euro

As at 31 March 2022, some 58% of Total Assets were denominated

in Euros, of which the Curno property was some 55% of Total Assets,

down from 58% as at 31 March 2021. The pound sterling Euro cross

rate moved slightly during the period from 1.175 as at 31 March

2021 to 1.187 as at 31 March 2022. This cross rate will remain a

potentially significant influence on the level of Group Net Assets

until Curno's disposal.

Outlook

U.K. stock market prices, whilst volatile, finished the first

five months of this year at close to their opening level, in part

reflecting a view that the economic effects of the COVID-19

pandemic were behind us.

Against that, in the Interim Report we had expressed the view

that the economic distortions caused thereby would take some time

to dissipate, and that we anticipated the unwinding across the

globe of the exceptional quantitative easing during the pandemic

would expose areas of business vulnerability.

In the event, the extent of the outbreak of rampant

pandemic-fueled inflation became clear in May, spurring a

tightening in monetary conditions which was the fastest since the

Global Financial Crisis, and more abrupt than we had anticipated.

Global equities markets have reflected the unexpected level of

tightening, experiencing sharp downturns since.

We have previously commented that COVID-19 has had little direct

impact in the period on the Group.

C inemas in Italy have been reopened for over a year, and our

rentals have remained current. Nevertheless, the continued

operating restrictions imposed on the cinema by the Lombardy

authorities ruled out any prospect of a disposal. The final

restrictions have now been lifted which will be positive for future

investor appetite.

The Worsley investment strategy, which is focussed on the

medium-term prospects of specific companies, is relatively

insensitive to shorter term economic conditions.

We continue to believe that the British stock market is yet

fully to discount the impact of extreme inflation on U.K. company

earnings and the permanent changes in the structure of certain

industries in reaction to the vulnerabilities exposed by the

pandemic, and more recently the Ukrainian conflict.

In consequence, we expect the upcoming trading outlooks to be

announced by many British companies to be materially worse than

market expectations. Whilst the share prices of many have already

tumbled, this is likely to result in further falls.

Such downturns inexorably lead to a significant level of stock

mispricing, from which strategies such as ours have previously

benefitted well.

The equity portfolio is soundly based, and against the above

background the Company can look forward to the future with

confidence.

Worsley Associates LLP

15 July 2022

Board of Directors

William Scott (Chairman) , a Guernsey resident, was appointed to

the board of the Company as an independent Director on 28 March

2019. Mr Scott also currently serves as an independent

non-executive director of a number of investment companies and

funds, of which Axiom European Financial Debt Fund Limited and RTW

Venture Fund Limited are listed on the Premium Segment of the LSE.

He is also a director of The Flight and Partners Recovery Fund

Limited and a number of funds sponsored by Man and Abrdn (formerly

Standard Life Aberdeen). From 2003 to 2004, Mr Scott worked as

senior vice president with FRM Investment Management Limited, which

is now part of Man Group plc. Previously, Mr Scott was a director

at Rea Brothers (which became part of the Close Brothers group in

1999) from 1989 to 2002 and assistant investment manager with the

London Residuary Body Superannuation Scheme from 1987 to 1989. Mr

Scott graduated from the University of Edinburgh in 1982 and is a

chartered accountant having qualified with Arthur Young (now Ernst

& Young LLP) in 1987. Mr Scott also holds the Securities

Institute Diploma and is a chartered fellow of the Chartered

Institute for Securities & Investment. He is also a chartered

wealth manager.

Robert Burke , a resident of Ireland, was appointed to the board

of the Company as an independent Director on 28 March 2019. He also

serves as an independent non-executive director of a number of

investment companies and investment management companies which are

domiciled in Ireland as well as a number of companies engaged in

retail activities, aircraft leasing, pharmaceuticals, corporate

service provision and group treasury activities. He is a graduate

of University College Dublin with degrees of Bachelor of Civil Law

(1968) and Master of Laws (1970). He was called to the Irish Bar in

1969 and later undertook training for Chartered Accountancy with

Price Waterhouse (now PricewaterhouseCoopers) in London, passing

the final examination in 1973. He later was admitted as a Solicitor

of the Irish Courts and was a tax partner in the practice of McCann

FitzGerald in Dublin from 1981 to 2005 at which point he retired

from the partnership to concentrate on directorship roles in which

he was involved. He continues to hold a practice certificate as a

solicitor and is a member of the Irish Tax Institute.

Blake Nixon was one of the pioneers of activism in the UK and

has wide corporate experience in the UK and overseas. Following

three years at Jordan Sandman Smythe (now part of Goldman Sachs), a

New Zealand stockbroker, Mr Nixon emigrated to Australia, where he

spent three years as an investment analyst at Industrial Equity

Limited ("IEL"), then Australia's fourth largest listed company. In

1989 he transferred to IEL's UK operation and early in 1990 led the

takeover of failing LSE listed financial conglomerate, Guinness

Peat Group plc ("GPG"). The group was then relaunched as an

investment company, applying an owner orientated approach to listed

investee companies. Mr Nixon was UK Executive Director, responsible

for GPG's UK operations and corporate function, for the following

20 years, finally retiring as a non-executive director in December

2015. He is a founding partner of Worsley Associates LLP, an

activist fund manager, and has served as a non-executive director

of a number of other UK listed companies, as well as numerous

unlisted companies. He is a British resident and was appointed to

the Board on 23 January 2019.

Report of Directors

The Directors of the Company present their Annual Report

together with the Group's Audited Consolidated Financial Statements

(the "Financial Statements") for the year ended 31 March 2022. The

Directors' Report together with the Financial Statements give a

true and fair view of the financial position of the Group. They

have been prepared properly, in conformity with International

Financial Reporting Standards ("IFRS") as issued by the

International Accounting Standards Board and are in accordance with

any relevant enactment for the time being in force; and are in

agreement with the accounting records.

Principal Activity and Status

The Company is an Authorised closed-ended investment company

domiciled in Guernsey, registered under the provision of The

Companies (Guernsey) Law, 2008 and has a premium listing on the

Official List and trades on the Main Market of the London Stock

Exchange. Trading in the Company's ordinary shares commenced on 18

April 2005. The Company and the entities listed in note 3(f) to the

Financial Statements together comprise the "Group".

Investment Objective and Investment Policy .

The investment objective and investment policy of the Company

are described in greater detail below.

Going Concern

These Financial Statements have been prepared on a going concern

basis. The Directors, at the time of approving the Financial

Statements, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for a

period of at least twelve months from the date of approval of these

Financial Statements. The Group maintains a significant cash

balance and an extensive portfolio of realisable securities, and

the property lease generates sufficient cash flows to pay on-going

expenses and other obligations. The Directors have considered the

cash position and performance of the current capital invested by

the Group, the potential impact on markets and supply chains of

geo-political risks such as the current crisis in Ukraine, the risk

of further COVID-19 uncertainty and continuing macro-economic

factors and inflation and concluded that it is appropriate to adopt

the going concern basis in the preparation of these Consolidated

Financial Statements.

Going concern is assessed over the period until 12 months from

the approval of these Consolidated Financial Statements. Owing to

the fact that the Group currently has no borrowing, has a

significant cash holding and that the Company's equity investments

predominantly comprise readily realisable securities, the Board

considers there to be no material uncertainty. Matters relating to

the going concern status of the Group are also discussed in the

long-term viability statement below.

Viability Statement

The Board has evaluated the long-term prospects of the Group,

beyond the 12 month time horizon assumption within the going

concern framework. The Directors have conducted a review of the

viability of the Company taking account of the Company's current

position and considering the potential impact of risks likely to

threaten the Company's business model, future performance, solvency

or liquidity. For the purposes of this statement the Board has

adopted a three year viability period.

The Directors consider that a 20% fall in the value in the

Company's equity portfolio would not have a fundamental impact on

the Company's ability to continue in operation over the next three

years. In reaching this conclusion, the Directors considered the

Company's expenditure projections, the fact that the Group

currently has no borrowing, has a significant cash holding and that

the Company's equity investments predominantly comprise readily

realisable securities, which in extremis could be expected to be

sold to meet funding requirements if necessary, assuming usual

market liquidity.

The Directors in forming this view also considered the long

operational history and track record of the Group's investment

property, Curno.

In addition, the Board has assumed that the regulatory and

fiscal regimes under which the Group operates will continue in

broadly the same form during the viability period. The Board

consults with its broker and legal advisers to the extent required

to understand issues impacting on the Company's regulatory and

fiscal environment. The Administrator also monitors changes to

regulations and advises the Board as necessary.

Based on the Company's processes for monitoring operating costs,

internal controls, the Investment Advisor's performance in relation

to the investment objective, the portfolio risk profile and

liquidity risk, the Board has concluded that there is a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the three year

period.

Results and Dividends

These Financial Statements are made up for the year ended 31

March 2022. The annual results, therefore, cover a twelve-month

period up to 31 March 2022 and are not entirely comparable to the

previous results, which cover a period of a nine months to 31 March

2021.

The results for the year are set out in the Consolidated

Statement of Comprehensive Income.

No dividend payments were paid in the year (nine months to 31

March 2021: none).

Directors

The Directors who held office during the year and up to the date

of this report and their interests in the shares of the Company

(all of which are beneficial) were:

31 March 2022 31 March 2021

--------------------- --------------------

W. Scott (Chairman) 400,000 1.19% 400,000 1.19%

B. A. Nixon 10,083,126 29.88% 10,083,126 29.88%

R. H. Burke n/a n/a n/a n/a

At the date of this report, Mr Nixon holds 10,083,126 shares,

being an interest of 29.88% in the shares of the Company and Mr

Scott holds 453,500 shares, being an interest of 1.34% in the

shares of the Company.

Mr Nixon, a Director of the Company, is also Founding Partner of

the Investment Advisor.

Management

With effect from 31 May 2019 the Board appointed Worsley

Associates LLP as its Investment Advisor. A summary of the contract

between the Company and the Investment Advisor in respect of the

advisory services provided is given in note 4 to the Financial

Statements.

Listing Requirements

Throughout the year the Company's shares were admitted to the

Official List of the London Stock Exchange maintained by the

Financial Conduct Authority ("FCA") and it has complied with the

Listing Rules.

Investee Engagement

The Company is a closed-ended investment company which has no

employees. The Company operates by outsourcing significant elements

of its operations to reputable professional companies, which are

required to comply with all relevant laws and regulations.

The nature of the Company's investments is such that it often

seeks to acquire substantial shareholdings which provide a direct

route via which to influence investee companies. The Company's

focus is on investees' medium-term financial performance, and, if

necessary, it will press them to adopt governance practices which

ensure that they are properly accountable to their shareholders for

the delivery of sustainable shareholder value. This active

involvement is outside the scope of many traditional institutional

shareholders. In matters which may affect the success of the

Company's investments the Board and the Investment Advisor work

together to ensure that all relevant factors are carefully

considered and reflected in investment decisions.

In carrying out its investment activities and in relationship

with suppliers, the Company aims to conduct itself responsibly,

ethically and fairly.

International Tax Reporting

For purposes of the US Foreign Accounts Tax Compliance Act, the

Company is registered with the US Internal Revenue Service ("IRS")

as a Guernsey reporting Foreign Financial Institution ("FFI"), has

received a Global Intermediary Identification Number

(G0W47U.99999.SL.831), and can be found on the IRS FFI list.

The Common Reporting Standard ("CRS"), which came into effect on

1 January 2016, is a global standard for the automatic exchange of

financial account information, developed by the Organisation for

Economic Co-operation and Development ("OECD"), and has been

adopted by Guernsey. The Board has taken the necessary action to

ensure that the Company is compliant with Guernsey regulations and

guidance in this regard.

Significant Shareholdings

As at 8 July 2022, shareholders with 3% or more of the voting

rights are as follows:

Shares held % of issued

share capital

B.A. Nixon 10,083,126 29.88%

------------ ---------------

Transact Nominees Limited 3,679,409 10.90%

------------ ---------------

Pershing Nominees Limited 3,000,000 8.89%

------------ ---------------

Chase Nominees Limited 2,522,420 7.48%

------------ ---------------

State Street Nominees Limited 2,075,804 6.15%

------------ ---------------

Lion Nominees Limited 1,815,734 5.38%

------------ ---------------

BBHISL Nominees Limited 1,800,000 5.33%

------------ ---------------

Winterflood Client Nominees

Limited 1,060.235 3.14%

------------ ---------------

Guernsey Financial Services Commission Code of Corporate

Governance

The Board of Directors confirms that, throughout the year

covered by the Financial Statements, the Company complied with the

Code of Corporate Governance issued by the Guernsey Financial

Services Commission, to the extent it was applicable based upon its

legal and operating structure and its nature, scale and

complexity.

Anti-Bribery and Corruption

The Company adheres to the requirements of the Prevention of

Corruption (Bailiwick of Guernsey) Law, 2003. In consideration of

the UK Bribery Act 2010, the Board abhors bribery and corruption of

any form and expects all the Company's business activities, whether

undertaken directly by the Directors themselves or by third parties

on the Company's behalf, to be transparent, ethical and beyond

reproach.

Criminal Finances Act

The Directors of the Company have a zero-tolerance commitment to

preventing persons associated with it from engaging in criminal

facilitation of tax evasion. The Board has satisfied itself in

relation to its key service providers that they have reasonable

provisions in place to prevent the criminal facilitation of tax

evasion by their own associated persons and will not work with

service providers who do not demonstrate the same zero-tolerance

commitment to preventing persons associated with them from engaging

in criminal facilitation of tax evasion.

Independent Auditor

BDO Limited served as the Company's Independent Auditor

throughout the year and has indicated its willingness to continue

in office.

Annual General Meeting

The next AGM of the Company is scheduled to be held on 22

September 2022.

Directors' Responsibilities

The Directors of the Company are responsible for preparing for

each financial year an annual report and the Financial Statements

which give a true and fair view of the state of affairs of the

Group and of the respective results for the period then ended, in

accordance with applicable Guernsey law and International

Accounting Standards Board ("IASB") adopted International Financial

Reporting Standards ("IFRS"). In preparing these Financial

Statements, the Directors are required to:

- select suitable accounting policies and apply them

consistently;

- make judgements and estimates which are reasonable and

prudent;

- prepare the Financial Statements on a going concern basis

unless it is inappropriate to presume that the Group will continue

in business; and

- state whether or not applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the Financial Statements.

The Directors confirm that they have complied with the above

requirements in preparing the Financial Statements.

The Directors are responsible for keeping proper accounting

records which are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the Group and enable them to ensure that its

financial statements comply with the Companies (Guernsey) Law,

2008. They are responsible for such internal control as they

determine is necessary to enable the preparation of financial

statements which are free from material misstatement, whether owing

to fraud or error, and have general responsibility for taking such

steps as are reasonably open to them to safeguard the assets of the

Company and to prevent and detect fraud and other

irregularities.

Disclosure of Information to Auditors

So far as each Director is aware, all relevant information has

been disclosed to the Company's Auditor; and each Director has

taken all the steps which he ought to have taken as a director to

make himself aware of any relevant audit information and to

establish that the Company's Auditor is aware of that

information.

Responsibility Statement

Each of the Directors, confirms to the best of that person's

knowledge and belief:

-- the Financial Statements, prepared in accordance with the

IFRS as endorsed by the IASB, give a true and fair view of the

assets, liabilities, financial position and profit of the Group, as

required by DTR 4.1.12R of the Disclosure and Transparency Rules,

and are in compliance with the requirements set out in the

Companies (Guernsey) Law, 2008;

-- the Financial Statements, taken as a whole, are fair,

balanced and understandable and provide the information necessary

for the shareholders to assess the Group's position, performance,

business model and strategy; and

-- the Financial Statements including information detailed in

the Chairman's Statement, the Report of the Directors, the

Investment Advisor's report and the notes to the Financial

Statements, include a fair review of the development and

performance of the business and the position of the Group together

with a description of the principal risks and uncertainties that it

faces, as required by:

- DTR 4.1.8 and DTR 4.1.9 of the Disclosure and Transparency

Rules, being a fair review of the Group's business and a

description of the principal risks and uncertainties facing the

Group; and

- DTR 4.1.11 of the Disclosure and Transparency Rules, being an

indication of important events which have occurred since the end of

the financial period and the likely future development of the

Group.

Signed on behalf of the Board by:

W. Scott

Director

15 July 2022

Corporate Governance Report

On 18 December 2019, the Company became a member of the

Association of Investment Companies ("AIC") and except as noted

herein complies with the 2019 AIC Code of Corporate Governance

issued in February 2019 ("the AIC Code"), effective for accounting

periods commencing on or after 1 January 2019. By complying with

the AIC Code, the Company is deemed to comply with both the UK

Corporate Governance Code (July 2018) (the "UK Code") issued by the

Financial Reporting Council ("FRC") and the Code of Corporate

Governance issued by the Guernsey Financial Services Commission

(the "GFSC Code").

The Board considers that reporting against the principles and

recommendations of the AIC Code provides appropriate information to

shareholders and during the period the Board has reviewed its

policies and procedures against the AIC Code.

The GFSC Code provides a governance framework for GFSC licensed

entities, authorised and registered collective investment schemes.

Companies reporting against the UK Code or the AIC Code are deemed

to comply with the GFSC Code. The AIC Code is available on the

AIC's website, www.theaic.co.uk.

For the year ended 31 March 2022, the Company has complied with

the recommendations of the AIC Code and the relevant provisions of

the UK Code, except for the following provisions relating to:

-- Senior Independent Director;

-- the need for an internal audit function;

-- the whistle blowing policy;

-- Remuneration Committee; and

-- Nomination Committee

The Board considers these provisions are not relevant given the

nature, scale and lack of complexity of the Company and its legal

and operating structure as a self-managed investment company. The

Company has therefore not reported further in respect of these

provisions. Details of compliance are noted below. The absence of

an Internal Audit function is discussed in the Audit Committee

Report.

The Directors are non-executive and the Company does not have

any employees, hence no Chief Executive, Executive Directors'

remuneration nor whistle-blowing policy is required. The Board is

satisfied that any relevant issues can be properly considered by

the Board. Moreover, the Directors have satisfied themselves that

the Company's service providers have appropriate whistle-blowing

policies and procedures and have received confirmation from the

service providers that nothing has arisen under those policies and

procedures which should be brought to the attention of the

Board.

Composition, Independence and Role of the Board

The Board currently comprises three non-executive Directors.

Both Mr Scott and Mr Burke are considered by the Board to be

independent of the Company's Investment Advisor. Mr Nixon is

Founding Partner of the Investment Advisor and is therefore not

independent.

Whilst Mr Nixon is not an independent director, the presence of

two other directors who are independent and non-executive mitigates

the risk of Mr Nixon acting against the Company's interest.

Mr Scott was appointed Chairman on 28 March 2019. The Chairman

of the Board must be independent for the purposes of Chapter 15 of

the Listing Rules. Mr Scott is considered independent because

he:

-- has no current or historical employment with the Investment Advisor; and

-- has no current directorships in any other investment funds managed by the Investment Advisor.

The Board has overall responsibility for maximising the

Company's success by directing and supervising the affairs of the

business and meeting the appropriate interests of shareholders and

relevant stakeholders, while enhancing the value of the Company and

also ensuring protection of investors. A summary of the Board's

responsibilities is as follows:

-- statutory obligations and public disclosure;

-- strategic direction and financial reporting;

-- risk assessment and management including reporting

compliance, governance, monitoring and control; and

-- other matters having a material effect on the Company.

The Board is responsible to shareholders for the overall

management of the Company.

The Board needs to ensure that the Annual Report and Financial

Statements, taken as a whole, are fair, balanced and understandable

and provide the information necessary for shareholders to assess

the Company's performance, business model and strategy. In seeking

to achieve this, the Directors have set out the Company's

investment objective and policy and have explained how the Board

and its delegated Committees operate and how the Directors review

the risk environment within which the Company operates and set

appropriate risk controls. Furthermore, throughout the Annual

Report and Financial Statements the Board has sought to provide

further information to enable shareholders better to understand the

Company's business and financial performance.

The Board's responsibilities for the Annual Report are set out

in the Directors' Responsibility Statement.

The Board is also responsible for issuing half yearly reports,

NAV updates and other price sensitive public reports.

The Board does not consider it appropriate to appoint a Senior

Independent Director. The Board believes it has a good balance of

skills and experience to ensure it operates effectively. The

Chairman is responsible for leadership of the Board and ensuring

its effectiveness.

The Board has engaged external businesses to undertake the

investment advisory and administrative activities of the Company.

Documented contractual arrangements are in place with these

businesses and these define the areas where the Board has delegated

responsibility to them. The Board has adopted a schedule of matters

specifically reserved for its decision-making and distinguished

these from matters it has delegated to the Company's key service

providers.

The Company holds regular board meetings to discuss general

management, structure, finance, corporate governance, marketing,

risk management, compliance, asset allocation and gearing,

contracts and performance. The quarterly Board meetings are the

principal source of regular information for the Board enabling it

to determine policy and to monitor performance, compliance and

controls which are supplemented by communication and discussions

throughout the year.

A representative of each of the Investment Advisor and

Administrator attends each Board meeting either in person or by

telephone, thus enabling the Board fully to discuss and review the

Company's operation and performance. Each Director has direct

access to the Investment Advisor and Company Secretary and may at

the expense of the Company seek independent professional advice on

any matter. The Company maintains appropriate Directors' and

Officers' liability insurance.

Conflicts of interest

Directors are required to disclose all actual and potential

conflicts of interest as they arise for approval by the Board, who

may impose restrictions or refuse to authorise conflicts. The

process of consideration and, if appropriate, approval will be

conducted only by those Directors with no material interest in the

matter being considered. The Board maintains a Conflicts of

Interest policy which is reviewed periodically and a Business

Interests and Potential Conflicts of Interest register which is

reviewed by the Board at each quarterly Board meeting.

Re-election

There are provisions in the Company's Articles of Incorporation

which require Directors to seek re-election on a periodic basis.

There is no limit on length of service, nor is there any upper age

restriction on Directors. The Board considers that there is

significant benefit to the Company arising from continuity and

experience among directors, and accordingly does not intend to

introduce restrictions based on age or tenure. It does, however,

believe that shareholders should be given the opportunity to review

membership of the Board on a regular basis.

The Board believes that, while regular rotation is in keeping

with good governance, the unquestionable benefits of ensuring that

there is some continuity mean that it is in the best interests of

the Company that not all Directors offer themselves for re-election

each year. The Company may terminate the appointment of a Director

immediately on serving written notice and no compensation is

payable upon termination of office as a director of the Company

becoming effective.

In accordance with the Company's Articles of Incorporation, at

each AGM all Directors who held office at the two previous AGM's

and did not retire shall retire from office and shall be available

for re-election. Messrs Scott and Nixon will stand for re-election

at this year's AGM. Mr Nixon as Founding Partner and a Designated

Member of Worsley Associates LLP stands annually. Further details

regarding the experience of each of the Directors are set out

within the Board of Directors section.

Board Diversity

The Board has also given careful consideration to the

recommendation of the Davies Report on "Women on Boards" and notes

the recommendations of the Parker review into ethnic diversity and

the Hampton-Alexander review on gender balance in FTSE leadership.

As recommended in the Davies Report, the Board has reviewed its

composition. However, it believes that the current appointments

provide an appropriate range of skills and experience and are in

the interests of shareholders.

Board Evaluation and Succession Planning

The Board conducts an annual self-evaluation of its performance

and that of the Company's individual Directors, which is led by the

Chairman and, as regards the Chairman's performance evaluation, by

the other Directors. The annual self-evaluation considers how the

Board functions as a whole taking balance of skills, experience and

length of service into consideration and also reviews the

individual performance of its members.

To facilitate this annual self-evaluation, the Company Secretary

circulates a detailed questionnaire to each Director and a separate

questionnaire for the evaluation of the Chairman. The

questionnaires, once completed, are returned to the Company

Secretary who collates responses, prepares a summary and discusses

the Board evaluation with the Chairman prior to circulation to the

remaining Board members. The performance of the Chairman is

evaluated by the other Directors. On occasions, the Board may seek

to employ an independent third party to conduct a review of the

Board.

The Board considers it has a breadth of experience relevant to

the Company, and the Directors believe that any changes to the

Board's composition can be managed without undue disruption. An

induction programme has been prepared for any future Director

appointments and all Directors receive other relevant training as

necessary .

Board and Committee Meetings

The table below sets out the number of scheduled Board, Audit

Committee and Management Engagement Committee meetings held during

the year ended 31 March 2022 and, where appropriate, the number of

such meetings attended by each Director who held office during the

same period.

Risk Committee Management Engagement

Board of Directors Audit Committee Committee

------------ ------------------------ ------------------------ ------------------------- -------------------------

Scheduled Attended Scheduled Attended Scheduled Attended Scheduled Attended

------------ ----------- ----------- ----------- ----------- ------------ ----------- ------------ -----------

W. Scott

(Chairman) 4 4 2 2 3 3 1 1

R. H. Burke 4 4 2 2 3 3 1 1

B. A. Nixon 4 4 2* 2* 3 3 1* 1*

------------ ----------- ----------- ----------- ----------- ------------ ----------- ------------ -----------

*In attendance by

invitation

In normal circumstances the Board intends to meet not less than

four times per year on a quarterly basis in addition to such ad hoc

meetings as may be necessary.

Audit Committee

The Company has established an Audit Committee with formal

duties and responsibilities. The Audit Committee meets formally at

least twice a year and each meeting is attended by the independent

external auditor and Administrator. The Company's Audit Committee

is comprised of Mr Burke and Mr Scott. At the invitation of the

Audit Committee, Mr. Nixon may attend meetings of the Committee.

The Audit Committee is chaired by Mr Burke. The Company does not

maintain an internal audit function, and, given that there are only

three Directors, the Chair of the Board is a member of the

Committee.

The Audit Committee monitors the performance of the auditor, and

also examines the remuneration and engagement of the auditor, as

well as its independence and any non-audit services provided by it.

A report of the Audit Committee detailing its responsibilities and

its key activities.

Risk Committee

The Company established a Risk Committee on 26 February 2020

with formal duties and responsibilities. The Risk Committee meets

formally at least twice a year. The Risk Committee is comprised of

the entire Board and is chaired by Mr Scott. The principal function

of the Risk Committee is to identify, assess, monitor and, where

possible, oversee the management of risks to which the Company's

investments are exposed, with regular reporting to the Board. The

Directors have appointed the Risk Committee to manage the

additional risks faced by the Company as well as the disclosures to

be made to investors and the relevant regulators.

The Risk Committee reviews the robustness of the Company's risk

management processes, the integrity of the Company's system of

internal controls and risk management systems, and the

identification and management of risks through the use of the

Company's risk matrix. The Risk Committee reviews the principal,

emerging, and other risks relevant to the Company.

The Risk Committee reports on the internal controls and risk

management systems to the Board of Directors. The Board of

Directors is responsible for establishing the system of internal

controls relevant to the Company and for reviewing the

effectiveness of those systems. The review of internal controls is

an on-going process for identifying and evaluating the risks faced

by the Company, designed to manage effectively rather than attempt

to eliminate business risks, to ensure the Board's ability to

achieve the Company's business objectives.

It is the responsibility of the Board to undertake the risk

assessment and review of the internal controls in the context of

the Company's objectives in relation to business strategy, and the

operational, compliance and financial risks facing the Company.

These controls are operated in the Company's main service

providers: the Investment Advisor and Administrator. The Board

receives regular updates and undertakes an annual review of each

service provider.

The Board of Directors considers the arrangements for the

provision of Investment Advisor and Administration services to the

Company and as part of the annual review the Board considered the

quality of the personnel assigned to handle the Company's affairs,

the investment process and the results achieved to date.

The Board is satisfied that each service provider has effective

controls in place to control the risks associated with the services

which they are contracted to provide to the Company and therefore

the Board is satisfied with the internal controls of the

Company.

Management Engagement Committee

The Company has established a Management Engagement Committee

with formal duties and responsibilities. The Management Engagement

Committee meets formally at least once a year. The Management

Engagement Committee is comprised of Mr Burke and Mr Scott. The

principal function of the Management Engagement Committee is to

ensure that the Company's investment advisory arrangements are

competitive and reasonable for the shareholders, along with the

Company's agreements with all other third party service providers

(other than the external auditor).

During the period the Management Engagement Committee has

reviewed the services provided by the Investment Advisor and other

service providers, and recommended that the continuing appointments

of the Company's service providers was in the best interests of the

Company. The Management Engagement Committee is chaired by Mr

Scott.

Nomination Committee

The Board does not have a separate Nomination Committee. The

Board as a whole fulfils the function of a Nomination Committee.

Any proposal for a new Director will be discussed and approved by

the Board, giving full consideration to succession planning and the

leadership needs of the Company.

Remuneration Committee

In view of its non-executive nature, the Board considers that it

is not appropriate for there to be a separate Remuneration

Committee, as anticipated by the AIC Code, because this function is

carried out as part of the regular Board business. A Remuneration

Report prepared by the Board is contained in the Financial

Statements within the Directors' Remuneration Report.

Terms of Reference

All Terms of Reference for Committees are available from the

Administrator upon request.

Internal Controls

The Board is ultimately responsible for establishing and

maintaining the Company's system of internal controls and for

maintaining and reviewing its effectiveness. The system of internal

controls is designed to manage rather than to eliminate the risk of

failure to achieve business objectives and by its nature can only

provide reasonable and not absolute assurance against misstatement

and loss. These controls aim to ensure that assets of the Company

are safeguarded, proper accounting records are maintained and the

financial information for publication is reliable.

The Board has delegated the day-to-day management of the

Company's investment portfolio and the administration, registrar

and corporate secretarial functions including the independent

calculation of the Company's NAV and the production of the Annual

Report and Financial Statements, which are independently audited.

Whilst the Board delegates responsibility, it retains

accountability for the functions it delegates and is responsible

for the systems of internal control.

Formal contractual agreements have been put in place between the

Company and providers of these services. On an ongoing basis, board

reports are provided at each quarterly board meeting from the

Investment Advisor, Administrator and Company Secretary and

Registrar; and a representative from the Investment Advisor is

asked to attend these meetings.

In accordance with Listing Rule 15.6.2 (2) R the Directors

formally appraise the performance and resources of the Investment

Advisor on an annual basis. In the opinion of the Directors their

continuing appointment of the Investment Advisor on the terms

agreed is in the interests of the Company and the shareholders.

The Investment Advisor was appointed on 31 May 2019.

The Board has reviewed the need for an internal audit function

and owing to the size of the Company and the delegation of

day-to-day operations to regulated service providers, an internal

audit function is not considered necessary. The Directors will

continue to monitor the systems of internal controls in place in

order to provide assurance that they operate as intended.

Principal Risks and Uncertainties

In respect of the Company's system of internal controls and its

effectiveness, the Directors:

-- are satisfied that they have carried out a robust assessment

of the emerging and principal risks facing the Group, including

those that would threaten its business model, future performance,

solvency or liquidity; and

-- have reviewed the effectiveness of the risk management and

internal control systems including material financial, operational

and compliance controls (including those relating to the financial

reporting process) and no significant failings or weaknesses were

identified.

The principal risks and uncertainties which have been identified

and the steps which are taken by the Board to mitigate them are as

follows:

Investment Risks

The Company is exposed to the risk that its investment portfolio

and the remaining investment property fail to perform in line with

the Company's objectives. The Company is exposed to the risk that

markets move adversely. The Board reviews reports from the

Investment Advisor at each quarterly Board meeting and at other

times when expedient, paying particular attention to the

diversification of the portfolio and to the performance and

volatility of underlying investments.

Operational Risks

The Company is exposed to the risk arising from any failures of

systems and controls in the operations of the Investment Advisor,

Administrator and the Corporate Broker. The Board and its

Committees regularly review reports from the Investment Advisor and

the Administrator on their internal controls.

Accounting, Legal and Regulatory Risks

The Company is exposed to the risk that it may fail to maintain

accurate accounting records, fail to comply with requirements of

its Prospectus or fail to adapt its processes to changes in law or

regulations. The accounting records prepared by the relevant

service providers are reviewed by the Investment Advisor. The

Administrator, Corporate Broker and Investment Advisor provide

regular updates to the Board on compliance with the Prospectus and

any changes in regulation.

Financial Risks

The financial risks, including market, credit, liquidity and

interest rate risk faced by the Company are set out in note 15 of

the Financial Statements. These risks and the controls in place to

reduce the risks are reviewed at the quarterly Board meetings.

Foreign Exchange Risk

The Company is exposed to currency risk given that the assets of

its subsidiaries are predominantly denominated in Euro but the

presentation currency of the Company is pounds sterling. The

Investment Advisor reports at least quarterly to the Board on the

strategy for managing this risk. Although the Company has the

ability to hedge this risk, it has not to date chosen to do so and

has no plans to make such arrangements.

COVID-19

The COVID-19 pandemic has been a significant influence on global

markets and has had an economic impact on certain companies held

within the Company's portfolio. The impact of the pandemic is

discussed further in the Chairman's statement, the Investment

Advisor's report and the report of the Audit Committee.

The Board seeks to mitigate and manage these risks through

ongoing review, policy-setting and enforcement of contractual

obligations and monitoring of the Company's investment portfolio.

The Board, Investment Advisor and the Corporate Broker also

continually monitor the investment environment in order to identify

any new or emerging risks.

Emerging Risks

The Board is alert to the identification of any new or emerging

risks through the ongoing monitoring of the Company's investment

portfolio and by conducting regular reviews of the Company's risk

assessment matrix. Should an emerging risk be identified the risk

assessment matrix is updated and appropriate mitigating measures

and controls will be agreed.

Non-Audit Services Policy

The Company has implemented a policy in relation to the

engagement of the external auditor, BDO Limited, to perform

non-audit services. As a Market Traded Company ("MTC"), since March

2020, the Company is classified as an EU/UK Public Interest Entity

("PIE") for the purposes of FRCs Ethical Standard. Accordingly, the

Audit Committee must consider whether or not the provision of such

non-audit services is compatible with the list of permissible

services under the FRC's UK Ethical Standards:

The Audit Committee reviews the need for non-audit services,

authorises such on a case by case basis, and recommends an

appropriate fee for such non-audit services to the Board.

The Board considers the actual, perceived and potential impact

upon the independence of the external auditor prior to engaging the

external auditor to undertake any non-audit service, as well as

confirming that any non-audit services are included on the list of

permissible services, as amended from time to time by the FRC.

The Board reserves the right to review the policy periodically

and, if required, amend it to ensure that the policy is compliant

with all applicable law and regulation and best practice.

Relations with Shareholders

The Board welcomes shareholders' views and places great

importance on communication with its shareholders. The Board

receives regular reports on the views of shareholders and the

Chairman and other Directors are available to meet shareholders if

required. The Investment Advisor meets with major shareholders on a

regular basis and reports to the Board on these meetings. Issues of

concern can be addressed by any shareholder in writing to the

Company at its registered address. The AGM of the Company provides

a forum for shareholders to meet and discuss issues with the

Directors and Investment Advisor of the Company. In addition, the

Company maintains a website (www.worsleyinvestors.com ) which

contains comprehensive information, including regulatory

announcements, share price information, financial reports,

investment objectives and strategy and investor contacts.

Promotion of the success of the Company

The Board acts in a manner which is considered to be:

-- in good faith;

-- likely to promote the continuing success of the Company; and

-- to the benefit of its shareholders as a whole.

Whilst the primary duty of the Directors is owed to the Company,

the Board considers as part of its discussions and decision making

process the interests of all stakeholders.

The Board is committed to maintaining high standards of

corporate governance and accountability.

As an investment company, the Company does not have any

employees and conducts its core operations through third party

service providers. Each provider has an established track record

and, through regulatory oversight and control, is required to have

in place suitable policies and procedures to ensure it maintains

high standards of business conduct, treats customers fairly, and

employs corporate governance best practice.

Particular consideration is given to the continued alignment

between the activities of the Company and those which contribute to

delivering the Board's strategy, which include the Investment

Advisor, the Corporate Broker and the Administrator.

The Board respects and welcomes the views of all stakeholders.

Any queries or areas of concern regarding the Company's operations

can be raised with the Company Secretary.

Signed on behalf of the Board by:

W. Scott

Chairman

15 July 2022

Audit Committee Report

Dear Shareholders,

I am pleased to present the Audit Committee's Report for the

year ended 31 March 2022, which covers the following topics:

-- Responsibilities of the Audit Committee and its key activities during the period,

-- Financial reporting and significant areas of judgement and estimation,

-- Independence and effectiveness of the external auditor, and

-- Internal control and risk management systems.

The Company remains in a transition period until the Curno

investment property is disposed of. The Audit Committee's

activities during the year have therefore concentrated on

maintaining an appropriate risk and control environment, providing

suitable disclosure of progress and residual risks in the Financial

Statements, ensuring ongoing engagement from service providers and

maintaining sufficient liquid funds to meet expenditure for

essential or justified items.

Responsibilities

The Audit Committee reviews and recommends to the Board for

approval or otherwise, the Financial Statements of the Company and

is the forum through which the independent external auditor reports

to the Board of Directors. The independent external auditor and the

Audit Committee, if either considers this to be necessary, will