TIDMURU

RNS Number : 9851X

URU Metals Limited

02 May 2023

2 May 2023

URU Metals Limited

("URU")

Update from ZEB Nickel Corp

URU notifies that ZEB Nickel Corp. announced on 1 May 2023 post

close, the filing of its audited Year-End Financial Statements and

associated Management Discussion and Analysis. Copies of these can

be obtained on SEDAR at: www.sedar.com and will be available on the

Company's website at: www.zebnickel.com.

In addition, ZEB Nickel Corp. also issued a clarifying press

release on 1 May 2023 post close.

URU successfully completed the disposal of the Zeb Project,

located in Limpopo, South Africa (the "Project") to ZEB Nickel

Corp. in August 2021 and the Project remains the primary focus of

URU, through its 73.81% interest in ZEB Nickel Corp. and URU's

continuing role as the technical adviser on the Project.

The ZEB Nickel Corp. announcements are as follows:

Zeb Nickel Corp. Files 2022 Year End Financial Statements and

Management Discussion and Analysis

Vancouver, BC, May 1, 2023 - ZEB Nickel Corp. (ZBNI:TSX-V)

(OTC:ZBNIF) ("Zeb" or the "Company") today announced that it has

filed its audited Year-End Financial Statements and associated

Management Discussion and Analysis for the year ended December 31,

2022.

Shareholders can obtain copies of the Company's audited Year-End

Financial Statements and associated Management Discussion and

Analysis on SEDAR at: www.sedar.com and on the Company's website

at: www.zebnickel.com .

Zeb Nickel Issues Clarifying Press Release

Vancouver, BC, May 1, 2023 - ZEB Nickel Corp. (ZBNI:TSX-V)

(OTC:ZBNIF) ("Zeb" or the "Company") announces that a s a result of

a review by the British Columbia Securities Commission of the

Company's press release dated March 15, 2022 and certain other

disclosures, the Company is issuing this press release to clarify

and retract certain disclosures with respect to the Company's

Zebediela nickel project (the "Project" or the "Zeb Project").

In the aforementioned press release it referred to an "existing"

preliminary economic estimate on the Project. In addition, the

Company has also made disclosures of a mineral resource estimate on

nickel mineralization in the Lower Zone Uitloop II body at the

Project (the "Historical Resource Estimate") that was completed by

MSA Geoservices (Pty) Ltd (MSA) in March 2012 that did not fully

comply with the requirements of National Instrument 43-101.

The Company clarifies that the press release was referring to

the Historical PEA and not to any subsequent economic assessment.

The Zeb Project property does not contain a current mineral

resource estimate and there is no preliminary economic estimate. In

addition, the following disclosure is provided with respect to the

Historical Resource Estimate. The Historical Resource Estimate used

categories that conformed to CIM Definition Standards on Mineral

Resources and Mineral Reserves (CIM, 2010) at the time of

completion of the Historical Resource Estimate. The Historical

Resource Estimate has an effective date of March 31, 2012 and

estimated an Indicated Resource of 485.4 million tonnes averaging

0.245% Ni, with an additional Inferred Resource of 1,115.1 million

tonnes at 0.248% Ni, using a cut-off grade of 0.1% TNi (Total

Nickel). The Historical Resource Estimate used a nickel price of

US$8.50 per pound or US$18,739.00 per ton. The mineral resources

were quoted as TNi and were restricted to mineralization in the

"Sulphide Zone". They were stated as in-situ with no geological

losses applied. The mineralization in the Uitloop II body was

constrained by a TNi grade-derived envelope. Although the intrusive

body is largely coincident with this, there is no uniform

geological control on the mineralization across the body.

Additional drilling was determined to be required to further

investigate the morphology of the mineralized envelope and to

in-fill sparsely-drilled areas. The Company's drill program planned

for 2023 is intended to determine a current estimate of mineral

resources on the Zeb Project and the extent to which the Historical

Resource Estimate may be considered current. The Historical

Resource Estimate is not supported by a compliant NI 43-101

technical report, and the Historical Resource Estimate should not

be relied on until it has been verified and supported by a

compliant NI 43-101 technical report.

No qualified person has done sufficient work to classify any of

the Historical Resource Estimate as current mineral resources or

mineral reserves and the Company is not treating the Historical

Resource Estimate as current mineral resources or mineral reserves.

Investors are cautioned that the Historical Resource Estimate does

not mean or imply that economic deposits exist on the Zeb

Project.

Richard Montjoie has supervised the preparation of the

scientific and technical contained in this press release and has

approved the disclosure herein. Mr. Montjoie is the CEO & VP

Exploration of the Company and is not, therefore, independent of

the Company. Mr. Montjoie is a registered member of the South

African Council for Natural Scientific Professions (SACNASP)

membership number 400131/09. Mr. Montjoie holds a M.Sc. Honors in

Economic Geology from the University of Witwatersrand, South

Africa, and is fellow of the Geological Society of South Africa

(GSSA).

About the Company and Project

Zeb Nickel Corp is focused on exploring for and developing

world-class mineral deposits, with a focus on metals that are

critical in the production of rechargeable batteries, such as

nickel, graphite, lithium, cobalt, manganese, copper and aluminum.

The Company is currently focused on developing its flagship Zeb

Nickel Project, located in Limpopo, South Africa. The Zeb Nickel

Project is a developing Class 1 nickel sulfide project

strategically located in the Bushveld Complex in South Africa.

ZBNI announcement ends

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

URU's obligations under Article 17 of MAR.

For further information, please contact:

URU Metals Limited

John Zorbas

(Chief Executive Officer) +1 416 504 3978

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker)

Ewan Leggat

Harry Davies-Ball + 44 (0) 203 470 0470

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBFLLBXELFBBD

(END) Dow Jones Newswires

May 02, 2023 02:00 ET (06:00 GMT)

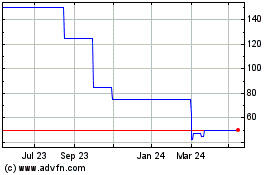

Uru Metals (LSE:URU)

Historical Stock Chart

From Oct 2024 to Nov 2024

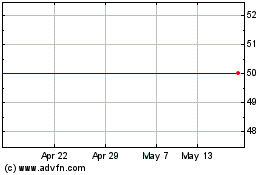

Uru Metals (LSE:URU)

Historical Stock Chart

From Nov 2023 to Nov 2024