4.3 The Bookbuild will be carried out on the basis of the

Placing Price of 19p per Placing Share payable to Jefferies by all

Placees whose bids are successful. The number of the Placing Shares

to be allocated and issued to each Placee will be determined by

Jefferies in consultation with the Company following completion of

the Bookbuild. Further details of the Placing, including its

completion, will be announced on a regulatory information service

("RIS") following the completion of the Bookbuild.

4.4 To bid in the Bookbuild, Placees should communicate their

bid by telephone to their usual sales contact at Jefferies. Each

bid should state the number of Placing Shares which the prospective

Placee wishes to subscribe for at the Placing Price. Bids may be

scaled down by Jefferies on the basis referred to in paragraph 8

below.

4.5 The Bookbuild is expected to close no later than 4.30 p.m.

(London time) on 22 January 2015, but may be closed earlier or

later at Jefferies' discretion. Jefferies may, in agreement with

the Company, accept bids that are received after the Bookbuild has

closed. The Company reserves the right (upon the agreement of

Jefferies) to reduce or seek to increase the amount to be raised

pursuant to the Placing, in its absolute discretion.

4.6 Each prospective Placee's allocation will be determined by

Jefferies in consultation with the Company and will be confirmed

orally by Jefferies as agent of the Company following the close of

the Bookbuild. That oral confirmation will constitute an

irrevocable legally binding commitment upon that person (who will

at that point become a Placee) in favour of Jefferies and the

Company to subscribe for the number of Placing Shares allocated to

it at the Placing Price on the terms and conditions set out in this

Appendix and in accordance with the Company's articles of

association.

4.7 Each Placee will also have an immediate, separate,

irrevocable and binding obligation, owed to Jefferies as agent of

the Company, to pay Jefferies (or as it may direct) in cleared

funds, an amount equal to the product of the Placing Price and the

number of Placing Shares that such Placee has agreed to subscribe

for and the Company has agreed to allot and issue to that

Placee.

4.8 Jefferies may choose to accept bids, either in whole or in

part, on the basis of allocations determined in consultation with

the Company and may scale down any bids for this purpose on such

basis as it may determine. Jefferies may also, notwithstanding

paragraphs 4.5 and 4.6 above, subject to the prior consent of the

Company (i) allocate Placing Shares after the time of any initial

allocation to any person submitting a bid after that time and (ii)

allocate Placing Shares after the Bookbuild has closed to any

person submitting a bid after that time.

4.9 A bid in the Bookbuild will be made on the terms and subject

to the conditions in this announcement and will be legally binding

on the Placee on behalf of which it is made and except with

Jefferies' consent will not be capable of variation or revocation

after the time at which it is submitted.

4.10 Irrespective of the time at which a Placee's allocation

pursuant to the Placing is confirmed, settlement for all Placing

Shares to be acquired pursuant to the Placing will be required to

be made at the same time on the basis explained below under

"Registration and Settlement".

4.11 All obligations under the Bookbuild and Placing will be

subject to fulfilment of the conditions referred to below under

"Conditions of the Placing" and to the Placing not being terminated

on the basis referred to below under "Termination of the Placing

Agreement".

4.12 By participating in the Bookbuild, each Placee will agree

that its rights and obligations in respect of the Placing will

terminate only in the circumstances described below and will not be

capable of rescission or termination by the Placee.

4.13 To the fullest extent permissible by law, neither Jefferies

nor any of its affiliates shall have any liability to Placees (or

to any other person whether acting on behalf of a Placee or

otherwise). In particular, neither Jefferies nor any of its

affiliates shall have any liability (including to the fullest

extent permissible by law, any fiduciary duties) in respect of

their conduct of the Bookbuild or of such alternative method of

effecting the Placing as Jefferies and the Company may

determine.

5. Conditions of the Placing

5.1 The obligations of Jefferies under the Placing Agreement in

respect of the Placing are conditional on, amongst other

things:

5.1.1 agreement being reached between the Company and Jefferies

on the terms of the Placing, including the number of Placing Shares

to be allocated and issued to each Placee and publication of an

announcement by the Company regarding completion of the Placing,

through a RIS, as soon as reasonably practicable thereafter;

5.1.2 the Shareholder Resolutions being approved by the

requisite majority of Shareholders attending and voting at the

General Meeting;

5.1.3 the allotment of the Placing Shares by the Company, subject only to Admission;

5.1.4 the warranties contained in the Placing Agreement being

true and accurate in every respect and not misleading on the date

of the Placing Agreement and at Admission, as though they had been

given and made on such date by reference to the facts and

circumstances then subsisting;

5.1.5 the Company complying with all of its obligations under

the Placing Agreement to the extent the same fall to be performed

or satisfied prior to Admission;

5.1.6 Admission taking place by 8.00 a.m. (London time) on 10

February 2015 (or such later date as the Company and Jefferies may

otherwise agree) (the " Admission Date"); and

5.1.7 in the sole opinion of Jefferies, there shall not have

been a material adverse change in, or affecting, the

condition(financial, operational, legal or otherwise) or the

earnings, management, business affairs, solvency or prospects of

the Company or of its subsidiaries (taken as a whole), whether or

not arising in the ordinary course of the business and whether or

not foreseeable at the date of the Placing Agreement (a "Material

Adverse Change") since the date of the Placing Agreement.

5.2 If any of the conditions contained in the Placing Agreement

in relation to the Placing are not fulfilled or waived by

Jefferies, by the time or date where specified (or, in each case,

such later time and/or date as the Company and Jefferies may

agree), the Placing will not proceed and the Placee's rights and

obligations hereunder in relation to the Placing Shares shall cease

and terminate at such time and each Placee agrees that no claim can

be made by the Placee in respect thereof.

5.3 Jefferies may, at its absolute discretion and upon such

terms as it thinks fit, waive compliance by the Company with the

whole or any part of any of the Company's obligations in relation

to the conditions in the Placing Agreement save that the condition

in the Placing Agreement relating to Admission taking place may not

be waived. Any such extension or waiver will not affect Placees'

commitments as set out in this announcement.

5.4 None of Jefferies, the Company or any other person shall

have any liability to any Placee (or to any other person whether

acting on behalf of a Placee or otherwise) in respect of any

decision they may make as to whether or not to waive or to extend

the time and/or the date for the satisfaction of any condition to

the Placing nor for any decision they may make as to the

satisfaction of any condition or in respect of the Placing

generally, and by participating in the Placing each Placee agrees

that any such decision is within the absolute discretion of

Jefferies.

6. Termination of the Placing Agreement

6.1 Jefferies may at any time prior to Admission terminate the

Placing Agreement by giving notice in writing to the Company, if,

amongst other things:

6.1.1 the Company's application for Admission has been refused

by the London Stock Exchange or, in the judgement of Jefferies

acting in good faith in pursuance of its duties under the Placing

Agreement, will not be granted; or

6.1.2 there has been a Material Adverse Change and, in the

opinion of Jefferies, the effect of such change is that it would

materially prejudice the success of the Placing or the distribution

of Placing Shares; or

6.1.3 there has occurred:

(a) any government regulation or other occurrence of any nature

whatsoever which, in the reasonable opinion of the Jefferies,

seriously and adversely affects or will or is reasonably likely

seriously and adversely to affect the business of the Group taken

as a whole; or

(b) a suspension or material limitation in trading in securities

generally on the London Stock Exchange's market for listed

securities, a general moratorium on commercial banking activities

in London or New York or a material disruption in commercial

banking or securities settlement or clearance services in the

United Kingdom or United States of America, an incident of

terrorism or the outbreak or escalation of hostilities involving

the UK, any other EU Member State or the USA or the declaration by

the UK, any other EU Member State or the USA of a national

emergency or war or the occurrence of any other calamity or crisis

resulting in a change in financial, political, market or economic

conditions or currency exchange rates in the UK or US, which, in

Jefferies' reasonable opinion, makes it impractical or inadvisable

to continue with the Placing.

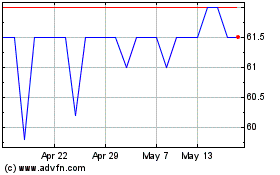

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Jul 2023 to Jul 2024