TIDMTGR

RNS Number : 2751U

Tirupati Graphite PLC

02 December 2021

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018. Upon the

publication of this announcement, this information is considered to

be in the public domain.

2 December 2021

Tirupati Graphite plc

('Tirupati' or the 'Company')

Unaudited Half-Yearly Results

Tirupati Graphite plc (TGR.L, TGRHF.OTCQX), the specialist

graphite and graphene company developing sustainable new age

materials, is pleased to announce its Interim Results for the six

months ended 30 September 2021. The Company's operations include

primary graphite mining and processing in Madagascar, and a

specialty graphite, graphene and advanced materials operation in

India.

Growth & Development Highlights

-- Commissioned 9,000 tonnes per annum ("tpa") development at

greenfield Vatomina Project, Madagascar

-- First sales and shipment from Vatomina commenced in October

2021, commercial production expected to be declared in

the current quarter

-- Additional 54,000 tpa in three modules at Vatomina to follow

over a three-year period

-- Primary flake graphite production capacity from Madagascar

currently 12,000 tpa, targeted to reach 84,000 tpa by end

Calendar Year ("CY") 2024

-- Commenced development of second 18,000 tpa plant at Sahamamy, Madagascar

-- Scheduled for completion in Q2 CY 2022

-- Completion to Increase flake graphite capacity to 30,000

tpa during by end of Q2 CY 2022

-- Redevelopment of 100-kilo watt Sahamamy hydropower plant

on track to be commissioned in Q1 CY 2022

-- Acquisition agreement executed to acquire Suni Resources SA,

a Mozambique subsidiary of Battery Minerals subject to conditions

precedent (refer RNS dated 17 August 2021 )

-- to add two world-class graphite deposits in Mozambique

significantly increasing the Company's JORC compliant

mineral resource base by 152 million tonnes at 8.5% Total

Graphitic Carbon ("TGC"):

-- the construction initiated 100,000 tpa (2x50,000 tpa)

Montepuez Graphite Project; and

-- the advanced feasibility mining permitted 50,000 tpa

Balama Central Graphite Project

-- Provides the Company with medium and small flake graphite

resources to complement Madagascan Jumbo and Large flake

projects

-- Land secured for Patalganga, India, speciality graphite

project expansion to 4,800 tpa capacity

-- target commissioning by the end of Q2 CY 2022

-- increased capacity and product range to continue creating

markets in advance of larger speciality graphite projects

coming on-stream

-- Development of first of two 15,000 tpa speciality graphite projects continued with:

-- target completion by end of CY 2022

-- upon completion increases total capacity to 19,800 tpa

-- Stage 1 of Tirupati Graphene and Mintech Research Centre

("TGMRC") commissioned in July 2021 with

-- capability to manufacture Graphene products in kilogram

per day scale

-- capability to manufacture Aluminium Graphene Composite

in kilograms scale for bulk sample supply to application

developers for tests and product trials

-- Established high end ESG credentials by release of inaugural

Sustainability Report complying with GRI standards in October 2021

covering:

-- descriptions of green applications of graphite and graphene

and green technologies and processes developed by the Company

-- Company's approach to ESG and adoption reporting to GRI

standards and UNSD goals

-- Company's environmental activities including 38,000 tons

of waste reduction, >18,500 trees planted and other activities

supporting the Company's plans to achieve net zero emissions

and zero waste

-- details about the Company's "Shakuntalam" programmes which

includes social activities, employment generation and health

and safety initiatives undertaken

-- the Company's governance credentials and statements as

per QCA standards.

Operational and Financial Highlights

-- Completed an oversubscribed placing at a price of GBP0.90 per

ordinary share raise gross proceeds of GBP10 million

-- Strong balance sheet with cash in hand of GBP6.41 million at

period end, insignificant current liabilities and significant

investments already made in projects currently under development

-- The Company's only debt is the pre-IPO issued convertible loan

notes outstanding of GBP1.17 million which are convertible

at the IPO price of GBP0.45 per share

-- Operations of the proof of concept 3,000 tpa Sahamamy flake

graphite and 1,200 Patalganga expandable graphite projects

continued despite limitations caused by the second and third

phases of restrictions owing to the COVID-19 pandemic

-- Sahamamy project continued to demonstrate low cost high margin

performance, key operating metrics in the table below:

Six Months Ending 30 Sep 2021 30 Sep 2020

Cost of Production GBP255,193 GBP212,685

--------------- ----------------------------

Quantity of Production (MT(1) 1,060 MT 716 MT

)

--------------- ----------------------------

Cost per MT of Production GBP241/MT GBP297/MT

--------------- ----------------------------

Total Sales (MT) 950 MT 682 MT

--------------- ----------------------------

Total Revenues GBP560,058 GBP419,402

--------------- ----------------------------

Achieved Basket Price (per US$819/GBP590 US$778/ GBP615

MT) MT MT

--------------- ----------------------------

Gross Profit GBP304,865 GBP206,718

--------------- ----------------------------

Gross Margins (per MT) GBP321/MT GBP303/MT

--------------- ----------------------------

Gross Margin on Sales (%) 54% 49%

--------------- ----------------------------

Corporate and Administrative GBP1,141,387 GBP574,935

Costs

--------------- ----------------------------

EBIDTA GBP(836,522) GBP(368,217)

--------------- ----------------------------

Depreciation GBP172,853 GBP95,858

--------------- ----------------------------

Operating Profit/(Loss) GBP(1,009,375) GBP(464,075)

--------------- ----------------------------

1. MT = Metric Tonnes

As at 30 Sep 2021 31 March 2021

--------------- ----------------------------

Selected Balance Sheet items

Cash and cash equivalents GBP6,412,114 GBP1,644,189

--------------- ----------------------------

Net Assets GBP16,338,981 GBP8,181,563

--------------- ----------------------------

-- Tirupati Speciality Graphite Private Limited ("TSG"), which

houses the Company's specialty graphite, graphene and advanced

materials operation in India, recorded total revenues of c.GBP1.3

million during the period. Consolidation of TSG's financials

shall occur following the completion of acquisition, which

is pending final regulatory approvals in India

Outlook

-- Graphite remains designated as a critical raw material by US

and EU, being a key contributor to the green energy transition

and electrification of mobility.

-- The global flake graphite market is forecast to grow multiple

times over the decade, by the likes of UBS, World Bank, Roskill,

Benchmark Minerals owing to energy transition and other green

applications.

-- We believe our capacity build timing aligns with the markets.

-- We expect our flake graphite production and sales to exceed

4,000 tons in H2 of the current financial year to 31 March

2022. This is expected to increase to around 20,000 tons for

the year to March 2023 and continuing to rise from then.

-- We remain conservative on capacity utilisation given the global

challenges for movement of men and materials.

-- In addition to the primary flake graphite production, we also

expect the speciality graphite projects to evolve from its

current 1,200 tpa operations to exceed 5,000 tpa for the year

to March 2023 and rising to 15,000 tpa from the following year.

-- We expect commercialisation of at least one of the many bulk

graphene applications we are working on and remain prepared

to install additional capacities as markets are developed.

Shishir Poddar, Executive Chairman of Tirupati Graphite,

said:

"We have continued the strong progress made since our IPO in

December last year investing in and establishing new capacities for

increased production from our low cost, high margin flake graphite

operations in Madagascar, furthering the proof of concept

established with the 3,000 tpa upstream operations and 1,200 tpa

expandable graphite operations established prior to IPO. We have

also continued to develop our sustainable new age materials making

a mark in the world of advanced materials. With two projects having

been commissioned in the period under review and a further three

under investment and development, we will be adding significant

production capacities across our upstream and downstream businesses

from the next financial year onwards, which will be a game changing

transformation for us becoming a globally significant supplier of

primary flake graphite and speciality graphite.

"The significance of our pending acquisition of the Mozambique

graphite projects shouldn't be overlooked. The higher grade

resource with small and medium flake sizes are extensively used

including in the production of spherical graphite for battery

production. This complements in many ways with the predominantly

large and jumbo flakes from our Madagascar graphite projects and

strategically positions us to serve all growth markets for flake

graphite and moving far beyond the medium term development

plan.

"Graphite's importance in helping the world to meet net zero

targets is increasingly recognised and demand is expected to

increase exponentially in the coming years. We are leveraging the

expertise built over generations to establish Tirupati as a world

leader across the entire graphite value chain and in the past six

months we have extensively strengthened our leadership

positioning.

"Graphene and advanced materials using green technologies are

the feather in our cap. Our understanding and belief that our green

technologies for manufacturing graphene and advanced materials are

not only unique but application friendly was strengthened during

the period and we expect the hard work to bear fruits in the not so

distant future."

Enquiries:

Tirupati Graphite Plc admin@tirupatigraphite.co.uk

Puruvi Poddar - Chief of Corporate & Business +44 (0) 20 39849894

Development

Optiva Securities Limited (Broker)

Ben Maitland - Corporate Finance +44 (0) 20 3034 2707

Robert Emmet - Corporate Broking +44 (0) 20 3981 4173

FTI Consulting (Financial PR) +44 (0) 20 3727 1000

Ben Brewerton / Ojasvi G oel / Alessandro tirupati@fticonsulting.com

Rubin / Kelly Smith

https://www.tirupatigraphite.co.uk/

MANAGEMENT'S CONDENSED REPORT

In the nine months since our IPO, the Company has made strong

progress across its business divisions despite the challenges

related to impacts of the COVID-19 pandemic and continues on its

well-defined path to create value for our shareholders and

stakeholders and contributing to a greener world.

Graphite has unparalleled properties and a diversity of

applications such that there is a bit of invisible graphite in

nearly every aspect of our day-to-day life such as in our

smartphones, televisions, cars and many more. Graphene derived from

graphite, can be used in many applications that would help make the

world more sustainable.

Graphite's importance in helping the world to meet net zero

targets is increasingly recognised and demand is expected to

increase significantly in the coming years. The World Bank, among

others, is forecasting graphite output will need to jump by nearly

500 percent by 2050 to support the clean energy transition.

Graphite remains designated as a critical raw material by the US

and the EU, being a key contributor to the green energy transition

and electrification of mobility with limited and concentrated

current sources.

Tirupati is strongly positioned in the space of critical and new

age materials providing it with the opportunity to benefit from the

booming green economy and contribute to the global efforts of

mitigating climate change.

During the period, Tirupati has increased production from its

low cost, high margin mining operations in Madagascar. The Company

has also invested to expand the development pipeline with projects

that will significantly add to production capacity from next year

onwards. As such, it is forecasting significant primary production

growth in the second half and over the coming year with a near-term

target of increasing Madagascan flake graphite capacity to 30,000

tpa by Q2 CY 2022.

The Company has also been steadily building its technical and

commercial teams as it expands its production capacity with a view

to hitting its medium-term target in Madagascar of 84,000 tpa

primary flake graphite capacity by end CY 2024 making it a globally

significant supplier. It remains well positioned to maintain and

continue to improve on its already industry low operating margins

as it captures economies of scale benefits across its operations.

As its operating cashflows continue to grow, the Company expects to

be able to substantially fund future capacity developments in

Madagascar utilising its internal resources.

Some significant events that have occurred during the first six

months of the financial year which had an impact on the condensed

set of financial statements were as follows:

-- Proof of concept 3,000 tpa Sahamamy operations continued to

demonstrate low cost high margin performance with key operating

metrics (as disclosed in the earlier table above) underpinned

by:

-- Primary graphite production of 1,060 Metric Tonnes ("MT")

(H1 2020: 716 MT), representing a 48% increase period-on-period

-- Sales of 950 MT generating revenues of GBP560.1K (H1 2020:

GBP419.4k), representing a 33% increase period-on-period

-- Gross profits increasing by 47.5% to GBP304.9k (H1 2020: GBP206.7)

giving an achieved gross margin of 54.4% (H1 2020: 49.3%),

ahead by 5.1 percentage points period-on-period

-- Cost per MT of Production of GBP241/MT (H1 2020: GBP297/MT),

representing a reduction of 19% period-on-period

-- Development of the next 18,000 tpa plant commenced at Sahamamy

which is estimated to be commissioned in Q2 CY 2022 bringing

total production of primary flake graphite from Madagascar

to 30,000 tpa

-- Successful commissioning of Vatomina 9,000 tpa plant in September

2021 with debottlenecking and operational stabilisation ongoing,

first sales and shipment commencing from October 2021

-- Sahamamy 100-kilo watt hydropower plant redevelopment continuing

on track to be commissioned in Q1 2022

-- Second stage exploration programme at both Sahamamy and Vatomina

continued, circa 1620 metre diamond core drilling, 588 Augur

drills with circa 4,700 metre augur drilling and 21 trenches

executed up to 30 September 2021

-- Stage 1 of TGMRC commissioned in July 2021 introducing capability

of manufacturing Graphene Oxide ("GO"), reduced Graphene Oxide

("rGO") and its new Aluminium Graphene Composite ("Al-Gr Composite")

in kilograms (i.e. bulk) scale.

The Company continues to be well positioned to benefit from the

growing markets for flake graphite across applications as we

increase our production capacities.

In its downstream specialty graphite segment under TSG, where

demand growth is forecast to be exponential driven by demand from

EVs, energy storage, flame retardant and other growth sectors, the

Company is also expanding rapidly. With land allocation at

Patalganga, the Company moved to reinstate and fast-track its

Patalganga expansion project to uplift its specialty graphite

production capacity to 4,800 tpa, which is expected to come on

stream in Q3 CY 2022.

Alongside the development at Patalganga, the Company continued

to advance the first of the two larger scale 15,000 tpa plants at

its specialty graphite project, which is due for completion by the

end of 2022. By this time, the Company's specialty graphite

production capacity is expected to reach almost 20,000 tpa and with

the completion of the second 15,000 tpa unit, the total specialty

graphite capacity will be brought up to almost 35,000 tpa by 2024

under the Company's revised MTDP.

In July 2021, the Company opened the first stage of the Tirupati

Graphene and Mintech Research Centre ("TGMRC") which has the

capability to manufacture bulk quantities (i.e. kilograms scale) of

its GO, rGO and its Al-Gr Composite. TGMRC also boasts state of the

art lab facilities for pilot scale manufacture of high purity

graphite and development of mineral processing technology for flake

graphite. This high purity flake is being provided to prospective

customers for testing and trials. We are also working to optimise

the process and cost structure of bulk graphene manufacture as

commercial applications evolve.

We thank shareholders for supporting our oversubscribed placing

in April 2021 which raised gross proceeds of GBP10 million which we

are now utilising to progress the various growth projects as

outlined above.

Along with the items listed in note 8 of the Notes to the

Financial Statements, the principal risks and uncertainties for the

remaining six months of the financial year are as below:

1) Ongoing risks of global pandemic in relation to operations

and developments of the Company's projects;

2) Dependence on the Madagascar Primary Graphite Projects and

any adverse developments affecting the operations and development

of these projects;

3) Dependence on the Tirupati Specialty Graphite Projects and

any adverse developments affecting the operations and development

of these projects;

4) Geopolitical, Regulatory and Sovereign risks in relation to

operations and development in Madagascar and to a lesser extent,

operations and developments in India;

5) Markets, competition, and graphite price risks in respect of

graphite markets as a whole or specific graphite market segments

(i.e. primary graphite and specialty graphite) and with graphene

market developments.

In October 2021, we published our inaugural Sustainability

Report in compliance with GRI Standards, setting out our strong

environmental, social and governance (ESG) business practices and

commitments. We aim to be net zero for Scope 1 and 2 emissions from

our upstream operations by 2030.

We are leveraging the expertise built over generations to

establish Tirupati as a world leader across the entire graphite

value chain and in the past six months we have extensively

strengthened our leadership positioning as we seek to evolve as a

global leader.

Your board and management remain aligned with the interests of

shareholders with no equity interest sold to date by any

member.

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with International

Accounting Standards 34, Interim Financial Reporting, as adopted

by the EU; and

-- gives a true and fair view of the assets, liabilities, financial

position and profit/loss of the Group; and

-- the Interim Report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred

during the first six months of the financial year and their

impact on the set of interim financial statements; and a description

of the principal risks and uncertainties for the remaining

six months of the year.

-- the Interim Report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Shishir Poddar

Executive Chairman & Managing Director

30 November 2021

Unaudited Condensed Consolidated Statement of Comprehensive

Income

For the half-year ended 30 September 2021

Six Months Ending 30 September 2021 2020

GBP GBP

Notes

Continuing operations

Revenue 560,058 419,402

===================================== ====== ============== ============

Cost of Sales (255,193) (212,685)

Gross profit 304,865 206,718

===================================== ====== ============== ============

Administrative expenses 4 (1,314,240) (670,793)

Operating loss (1,009,375) (464,075)

Finance costs (75,833) (28,617)

Loss before income tax (1,085,208) (492,692)

Income tax (25,943) -

===================================== ====== ============== ============

Loss for the period attributable

to owners of the Company (1,111,151) (492,692)

===================================== ====== ============== ============

Other comprehensive income:

Items that may be reclassified

to profit or loss:

===================================== ====== ============== ============

Exchange differences on translation

of foreign operations (372,931) (99,771)

===================================== ====== ============== ============

Total comprehensive loss for

the year attributable to the

Group (1,484,082) (592,464)

===================================== ====== ============== ============

Earnings per share attributable Pence per Pence per

to owners of the Company share share

From continuing operations:

Basic 5 (1.71) (0.98)

Diluted 5 (1.61) (0.94)

The accompanying accounting policies and notes are an integral

part of these financial statements

Unaudited Condensed Consolidated Statement of Financial

Position

As at 30 September 2021

Group

=============================== ====== =============================

30 September

As at 2021 31 March 2021

=============================== ====== ============= ==============

GBP GBP

=============================== ====== ============= ==============

Notes

Non-current assets

=============================== ====== ============= ==============

Property, plant and equipment 3,988,867 3,020,142

=============================== ====== ============= ==============

Deferred tax 17,099 21,182

=============================== ====== ============= ==============

Deposits & Advances 3,862 1,872

=============================== ====== ============= ==============

Intangible assets 4,023,377 3,682,354

------------------------------- ------ ------------- --------------

Total non-current assets 8,033,205 6,725,550

------------------------------- ------ ------------- --------------

Current assets

===============================

Inventory 465,684 461,093

===============================

Trade and other receivables 6 2,835,954 1,102,868

===============================

Cash and cash equivalents 6,412,114 1,644,189

===============================

Total current assets 9,713,753 3,208,150

------------------------------- ------ ------------- --------------

Current liabilities

===============================

Trade and other payables 177,253 445,273

===============================

Total current liabilities 177,253 445,273

------------------------------- ------ ------------- --------------

Net current assets 9,536,499 2,762,877

------------------------------- ------ ------------- --------------

Non-current liabilities

=============================== ====== ============= ==============

Borrowings 7 1,169,000 1,283,000

=============================== ====== ============= ==============

Other payables 61,723 23,864

=============================== ====== ============= ==============

Total non-current liabilities 1,230,723 1,306,864

------------------------------- ------ ------------- --------------

NET ASSETS 16,338,981 8,181,563

------------------------------- ------ ------------- --------------

Equity

=============================== ====== ============= ==============

Share capital 8 2,155,195 1,871,084

=============================== ====== ============= ==============

Share premium account 8 19,784,377 10,426,988

=============================== ====== ============= ==============

Warrant reserve 130,557 130,557

=============================== ====== ============= ==============

Foreign exchange reserve (787,477) (414,546)

=============================== ====== ============= ==============

Retained losses (4,943,671) (3,832,520)

------------------------------- ------ ------------- --------------

Equity attributable to

owners of the Company 16,338,981 8,181,563

=============================== ====== ============= ==============

TOTAL EQUITY 16,338,981 8,181,563

------------------------------- ------ ------------- --------------

Unaudited Consolidated Statement of Changes in Equity

For the half-year ended 30 September 2021

Share capital Share premium Foreign Share Retained TOTAL

exchange warrants losses EQUITY

reserve reserve

GBP GBP GBP GBP GBP GBP

-------------- -------------- ---------- ---------- ------------ ------------

Balance at

1 April 2020 1,498,132 5,328,518 3,147 - (2,555,582) 4,274,215

-------------- -------------- ---------- ---------- ------------ ------------

Total comprehensive

income:

-------------- -------------- ---------- ---------- ------------ ------------

Loss for the

period - - - - (492,692) (492,692)

-------------- -------------- ---------- ---------- ------------ ------------

Forex exchange

loss - - (99,771) - - (99,771)

-------------- -------------- ---------- ---------- ------------ ------------

Transactions

with Equity

owners:

-------------- -------------- ---------- ---------- ------------ ------------

Shares issued 37,396 326,479 - - - 363,875

-------------- -------------- ---------- ---------- ------------ ------------

Balance at

30 September

2020 1,535,528 5,654,997 (96,624) - (3,048,274) 4,045,626

-------------- -------------- ---------- ---------- ------------ ------------

Balance at

1 April 2021 1,871,084 10,426,988 (414,546) 130,557 (3,832,521) 8,181,563

-------------- -------------- ---------- ---------- ------------ ------------

Total comprehensive

income:

-------------- -------------- ---------- ---------- ------------ ------------

Loss for the

period - - - - (1,111,151) (1,111,151)

-------------- -------------- ---------- ---------- ------------ ------------

Forex exchange

loss - - (372,931) - - (372,931)

-------------- -------------- ---------- ---------- ------------ ------------

Transactions

with Equity

owners:

-------------- -------------- ---------- ---------- ------------ ------------

Shares issued 284,111 9,357,389 - - - 9,641,500

-------------- -------------- ---------- ---------- ------------ ------------

Balance at

30 September

2021 2,155,195 19,784,377 (787,477) 130,557 (4,943,671) 16,338,981

-------------- -------------- ---------- ---------- ------------ ------------

The accompanying accounting policies and notes are an integral

part of these financial statements.

Share capital - Represents the nominal value of the issued share

capital.

Share premium account - Represents amounts received in excess of

the nominal value on the issue of share capital less any costs

associated with the issue of shares.

Retained earnings - Represents accumulated comprehensive income

for the year and prior periods.

Foreign exchange reserve - Represents exchange differences

arising from the translation of the financial statements of foreign

subsidiaries and the retranslation of monetary items forming part

of the net investment in those subsidiaries.

Share warrant reserve - Represents reserve for equity component

of warrants issued as per IFRS 2 share-based payments.

Unaudited Consolidated Statement of Cash Flows

For the half-year ended 30 September 2021

2021 2020

GBP GBP

------------ ----------

Cash used in operating activities

------------ ----------

Loss for the year (1,111,151) (492,692)

------------ ----------

Adjustment for:

------------ ----------

Depreciation 172,853 95,858

------------ ----------

Finance costs 75,833 28,617

------------ ----------

Income tax (25,943) -

------------ ----------

Working capital changes:

------------ ----------

Increase in inventories (4,591) (60,887)

------------ ----------

(Increase)/Decrease in receivables

- Operational (558,020) 167,697

------------ ----------

(Increase)/Decrease in receivables (1,816,841) -

- Capital Assets

------------ ----------

Decrease in payables (268,020) (14,905)

------------ ----------

Net cash used in operating activities (3,535,880) (276,312)

------------ ----------

Cash flows from investing activities:

------------ ----------

Purchase of tangible assets (968,725) (273,661)

------------ ----------

Increase in other non-current assets 2,093 4,051

------------ ----------

Net advances (219,089) 8,752

------------ ----------

Net cash from investing activities (1,185,721) (260,858)

------------ ----------

Cash flows from financing activities

------------ ----------

Proceeds from Shares issued (net

of costs) 9,641,500 363,875

------------ ----------

Convertible loan notes (redemption)/Issue (114,000) 513,000

------------ ----------

Finance cost (75,833) (28,617)

------------ ----------

Increase / (decrease) in other

longterm liabilities 37,859 (287,857)

------------ ----------

Net cash from financing activities 9,489,526 560,401

------------ ----------

Net increase in cash and cash equivalents 4,767,925 23,230

------------ ----------

Cash and cash equivalents at beginning

of period 1,644,189 46,640

------------ ----------

Cash and cash equivalents at end

of period 6,412,114 69,870

------------ ----------

The accompanying accounting policies and notes are an integral

part of these financial statements.

Notes to the Financial Statements

1. General information

Tirupati Graphite plc (the "Company") is incorporated in England

and Wales, under the Companies Act 2006. The registered office

address is given on Company Information page.

The Company is a public company, limited by shares. On 14

December 2020 the Ordinary Shares of the Company were admitted on

the official list of the FCA and to trading on the main market of

the London stock exchange through standard listing.

The principal activities of the Company and its subsidiaries

(the "Group") and the nature of the Group's operations is

production of flake graphite, a critical material used in diverse

applications. The half year period of the previous year was prior

to admission and in that period, the Company's only operating and

producing asset was a comparatively smaller scale, proof of concept

plant at its Sahamamy project in Madagascar. Alongside its

admission the Company raised equity capital to develop its various

projects under its MTDP. Thus, there was a material change in the

Company's activities during the six month period of the current

year compared to the same period in the previous year. We have

provided brief insights where relevant in the Notes to the

Financial Statement to depict changes in the Company's

activities.

These consolidated financial statements are presented in pounds

sterling since that is the currency of the primary economic

environment in which the Group and Company operates.

2. Significant accounting policies

Basis of preparation

The condensed consolidated interim financial statements for the

six months ended 30 September 2021 have been prepared in accordance

with IAS 34 'Interim Financial Reporting' and presented in

sterling. They do not include all of the information required in

annual financial statements in accordance with IFRS, and should be

read in conjunction with the consolidated financial statements for

the year ended 31 March 2021, which have been prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and in accordance

with the requirements of the Companies Act 2006. The report of the

auditors on those financial statements was unqualified.

The financial statements have been prepared under the historical

cost convention, except for the measurement to fair value certain

financial and digital assets and financial instruments.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates. In preparing these

condensed consolidated interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the financial statements for

the year ended 30 March 2021.

Going concern

The financial position of the Group and the Company, their cash

flows and liquidity positions are contained in the financial

statements. In April 2021, the Company raised equity capital to

adequately capitalise its development activities and in September

2021, the Company commissioned a second plant increasing its

installed capacity fourfold from 3,000 tpa to 12,000 tpa. From the

results of the operations, the Company believes that its capacity

has increased to a level at which it shall become profitable as the

new plant is debottlenecked and producing output is being ramped up

to full capacity.

Further, the Company remains adequately funded for its

investment needs for the next capacity expansion under construction

being the second 18,000 tpa plant at Sahamamy in Madagascar, which

is expected to complete and commission in Q2 2022.

Taking in to account the comments above, the Directors have, at

the time of approving the financial statements, a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future, given its current

cash resources, installed capacities and operations which now have

broken the threshold for the Company to meet all its non-investment

cash needs from revenues and additional capacities being built by

the Company for which it remains fully funded and which when

completed, are expected to add further additional operating cash

flows.

ADOPTION OF NEW AND REVISED STANDARDS AND INTERPRETATIONS

The Group has adopted all recognition, measurement and

disclosure requirements of IFRS, including any new and revised

standards and Interpretations of IFRS, in effect for annual periods

commencing on or after 1 January 2021. The adoption of these

standards and amendments did not have any material impact on the

financial result of position of the Group.

At the date of authorisation of these financial statements, the

following Standards and Interpretation, which have not yet been

applied in these financial statements, were in issue but not yet

effective:

Standard Description Effective date for annual

or Interpretation accounting period beginning

on or after

------------------ -------------------------------------------- ----------------------------

IAS 1 Amendments - Presentation and Classification 1 January 2023

of Liabilities as Current or Non-current

IAS 16 Amendments - Property, Plant and Equipment 1 January 2022

IAS 37 Provisions, Contingent Liabilities 1 January 2022

and Contingent Assets

IAS 8 Amendments - Definition of Accounting 1 January 2023

Estimates

IAS 1 Amendments - Disclosure of Accounting 1 January 2013

Policies

IFRS 3 Amendments - Business Combinations 1 January 2022

- Conceptual Framework

IFRS Annual Improvements to IFRS Standards 1 January 2022

2018-2020

------------------ -------------------------------------------- ----------------------------

The Group has not early adopted any of the above standards and

intends to adopt them when they become effective.

3. Segmental analysis

The Management believes, under IFRS 8 - "Segmental Information",

the Group operated in three primary business segments in 2021,

being Holding Companies Expenses, Mining Exploration and

Development and Graphite Mining Extraction.

Segmentation by continuing businesses

Segment results

Half year Half year Year ended

ended ended 31 March

30 Sep 2021 30 Sep 2020 2021

GBP GBP GBP

------------------------------------ ------------- ------------- ------------

Revenue to external customers

------------------------------------ ------------- ------------- ------------

Graphite Mining Extraction 560,058 419,402 1,123,426

(Loss) before income tax

------------------------------------ ------------- ------------- ------------

Holding Companies Expenses (729,334) (377,884) (1,002,218)

Mining Exploration and Development - (97,473) (239,555)

Graphite Mining Extraction (355,874) (17,335) (14,957)

Net assets/(liabilities)

------------------------------------ ------------- ------------- ------------

Holding Company Expenses 17,257,360 4,772,742 9,120,707

==================================== ============= ============= ============

Mining Exploration and Development - (494,041) (698,823)

==================================== ============= ============= ============

Graphite Mining Extraction (918,379) (233,075) (237,415)

------------------------------------ ------------- ------------- ------------

Segmentation by geographical area:

Half year Half year Year ended

ended ended 31 March

30 Sep 2021 30 Sep 2020 2021

GBP GBP GBP

------------------------------- ------------- ------------- ------------

Revenue to external customers

------------------------------- ------------- ---------------------------

UK 559,986 419,398 1,123,019

Mauritius - - -

Madagascar 72 4 407

(Loss) before income tax

------------------------------- ------------- ------------- ------------

UK (570,857) (372,376) (1,036,857)

Mauritius (158,477) (5,508) 785

Madagascar (355,874) (114,808) (220,658)

Net assets

------------------------------- ------------- ------------- ------------

UK 17,257,360 3,318,480 9,534,110

Mauritius - - 159,159

=============================== ============= ============= ============

Madagascar (918,379) (727,146) (1,508,800)

------------------------------- ------------- ------------- ------------

4. Expenses by nature

Half year Half year

ended ended

30 Sep 2021 30 Sep 2020

GBP GBP

The following items have been included

in arriving at operating loss

Depreciation (a) 172,853 95,858

======================================== ============= =============

Net foreign exchange loss 671 7,095

======================================== ============= =============

PR/IR Expenses 70,390 52,657

======================================== ============= =============

Professional Fees (b) 52,084 5,600

======================================== ============= =============

Remuneration of Board & Management (c) 438,704 243,992

======================================== ============= =============

Notes:

a) Increase in Depreciation in current year is due to start of

operations in Vatomina Project in Madagascar.

b) Professional Fees includes fees paid to Company's brokers,

lawyers, auditors and other advisors. The new retainer fee

structure was implemented post listing with effect from January

2021.

c) Increase in remuneration to the Bboard and Management is due

to strengthening of the management team post listing in line

with developments of the projects in Madagascar and India.

5. Earnings per share

Basic and diluted

Earnings per share is calculated by dividing the loss

attributable to the equity holders of the Company by the weighted

average number of Ordinary Shares in issue during the period.

Half year Half year

ended ended

30 Sep 2021 30 Sep 2020

Continuing operations:

-------------------------------------------- ------------- -------------

Loss attributable to equity holders of

the Company (GBP) (1,484,082) (592,464)

Weighted average number of ordinary shares

in issue 85,132,285 60,499,992

============================================ ============= =============

Loss per share (pence) (1.71) (0.98)

-------------------------------------------- ------------- -------------

30 Sep 2021 30 Sep 2020

Diluted number of ordinary shares in issue 92,114,998 63,298,148

============================================ ============ ============

Given the loss for the year, the diluted earnings per share was

the same as basic earnings per share as this would otherwise be

dilutive.

6. Trade & Other Receivables

30 Sep 2021 31 Mar 2021

------------------------------------ ------------ ------------

Trade Receivables - Operational 1,019,113 1,102,868

Trade Receivables - Capital Assets 1,816,841 -

------------------------------------ ------------ ------------

2,835,954 1,102,868

------------------------------------ ------------ ------------

7. Borrowings

During this period convertible loan notes ("CLN") worth

GBP114,000 were converted into equity. Interest on the outstanding

CLN's is chargeable at 12% per annum.

30 Sep 2021 31 Mar 2021

----------------------- ------------ ------------

Within one year - -

Between 2 and 5 years 1,169,000 1,283,000

----------------------- ------------ ------------

1,169,000 1,283,000

----------------------- ------------ ------------

The CLN's may be redeemed by the Company, at any time after the

first anniversary of the Initial Public Offering ("IPO") up to the

Maturity Date or by the Noteholder or the Company, on the Maturity

Date being the 31 May 2022.

Conversion of the CLN's can be made from 15 Business Days after

the date of completion of the Company's IPO to convert the CLN's

outstanding into fully paid Ordinary Shares at a price equal to the

price per share paid by investors participating in the IPO.

8. Share capital

30 Sep 31 Mar 31 Mar

30 Sep 2021 2021 2021 2021

Number GBP Number GBP

========================= ============ ========== =========== ==========

Allotted, called up and

fully paid

Ordinary shares of 2.5p

each 86,563,323 2,155,195 74,843,323 1,871,084

Shares were issued during the year as follows:

Cost of issue Number of shares

(GBP) issued

--------------------------------- -------------- -----------------

Shares issued from a placing on

15 April 2021 472,500 11,111,111

Shares issued from a placing on

28 July 2021 - 253,333

============== =================

472,500 11,364,444

-------------- -----------------

9. Financial instruments

Financial risk management

The Group has exposure to the following risks from its use of

financial instruments:

-- Capital risk management

-- Market risk

-- Credit risk

-- Liquidity risk

-- Currency risk

This note presents information about the Group's exposure to

each of the above risks, the Group's management of capital, and the

Group's objectives, policies and procedures for measuring and

managing risk.

The Board of Directors has overall responsibility for the

establishment and oversight of the Group's risk management

framework.

The Group's risk management policies are established to identify

and analyse the risks faced by the Group, to set appropriate risk

limits and controls, and to monitor risks and adherence to limits.

Risk management policies and systems are reviewed regularly to

reflect changes in market conditions and the Group's

activities.

The Group Audit Committee oversees how management monitors

compliance with the Group's risk management policies and procedures

and reviews the adequacy of the risk management framework in

relation to the risks faced by the Group.

Capital risk management

The Group manages its capital to ensure that entities in the

Group will be able to continue as a going concern while maximising

the return to stakeholders as well as sustaining the future

development of the business. In order to maintain or adjust the

capital structure, the Group may adjust dividends paid to

shareholders, return capital to shareholders, issue new shares or

sell assets to reduce debt.

The capital structure of the Group consists of net debt, which

includes loans, cash and cash equivalents, and equity attributable

to equity holders of the parent, comprising issued capital and

retained earnings.

Fair value of financial assets and liabilities

Valuation, Book value Fair value Book value Fair value

Methodology Sep 2021 Sep 2021 Mar 2021 Mar 2021

and hierarchy GBP GBP GBP GBP

========================= =============== =========== =========== =========== ===========

Financial assets

Cash and cash

equivalents (a) 6,412,114 6,412,114 1,644,189 1,644,189

Loans and receivables,

net of impairment (a) 2,835,954 2,835,954 1,102,868 1,102,868

========================= =============== =========== =========== =========== ===========

Total at amortised

cost 9,248,069 9,248,069 2,747,057 2,747,057

========================================== =========== =========== =========== ===========

Financial liabilities

Trade and other

payables (a) 177,253 177,253 445,273 445,273

Borrowings and

provisions (a) 1,169,000 1,169,000 1,283,000 1,283,000

Lease Liabilities (a) 61,723 61,723 23,864 23,864

Total at amortised

cost 1,407,976 1,407,976 1,752,137 1,752,137

------------------------------------------ ----------- ----------- ----------- -----------

Valuation, methodology and hierarchy

(a) The carrying amounts of cash and cash equivalents, trade and

other receivables, trade and other payables and deferred income,

and Borrowings are all stated at book value. All have the same fair

value due to their short-term nature.

Market risk

Market price risk arises from uncertainty about the future

valuations of financial instruments held in accordance with the

Group's investment objectives. These future valuations are

determined by many factors but include the operational and

financial performance of the underlying investee companies, as well

as market perceptions of the future of the economy and its impact

upon the economic environment in which these companies operate.

Credit risk

Credit risk is the risk that counterparties to financial

instruments do not perform their obligations according to the terms

of the contract or instrument. The Group is exposed to counterparty

credit risk when dealing with its customers and certain financing

activities.

The immediate credit exposure of financial instruments is

represented by those financial instruments that have a net positive

fair value by counterparty at 30 September 2021. The Group

considers its maximum exposure to be:

Sep 2021 Mar 2021

GBP GBP

Financial assets

Cash and cash equivalents 6,412,114 1,644,189

Loans and receivables, net of impairment 2,835,954 1,102,868

------------------------------------------ ---------- ----------

9,248,069 2,747,058

------------------------------------------ ---------- ----------

All cash balances are held with an investment grade bank who is

our principal banker. Although the Group has seen no direct

evidence of changes to the credit risk of its counterparties, the

current focus on financial liquidity in all markets has introduced

increased financial volatility. The Group continues to monitor the

changes to its counterparties' credit risk.

Liquidity risk

Liquidity risk is the risk the Group will encounter difficulty

in meeting its obligations associated with financial liabilities as

they fall due. The Board are jointly responsible for monitoring and

managing liquidity and ensures that the Group has sufficient liquid

resources to meet unforeseen and abnormal requirements. The current

forecast suggests that the Group has sufficient liquid

resources.

Available liquid resources and cash requirements are monitored

using detailed cash flow and profit forecasts these are reviewed at

least quarterly, or more often as required. The Directors decision

to prepare these accounts on a going concern basis is based on

assumptions which are discussed in the going concern note

above.

The following are the contractual maturities of financial

liabilities:

Carrying Contractual 6 months 6 to 12 1 to 2 2 to 5

amount cash flows or less months years years

30 September

2021 GBP GBP GBP GBP GBP GBP

Non-derivative

financial

liabilities

Trade and

other payables 177,253 - 177,253 - - -

Borrowings 1,169,000 - - - - 1,169,000

Cash flow management

The Group produces an annual budget which it updates quarterly

with actual results and forecasts for future periods for profit and

loss, financial position and cash flows. The Group uses these

forecasts to report against and monitor its cash position. If the

Group becomes aware of a situation in which it would exceed its

current available liquid resources, it would apply mitigating

actions involving reduction of its cost base. The Group employs

working capital management techniques to manage the cash flow in

periods of peak usage.

Currency risk

The Group operates internationally and is exposed to foreign

exchange risk. Foreign exchange risk arises from future commercial

transactions and recognised assets and liabilities denominated in a

currency that is not the functional currency of the relevant Group

entity. The Group's primary currency exposure is to US Dollar,

which is the currency of all intra-group transactions as well as

denomination of selling price of the products. The Group also has

some exposure to Malagasy ariary due to its operating subsidiaries

in Madagascar.

Considering the natural hedge available the Group currently

doesn't hedge the currency risk. The Group's and Company's exposure

to foreign currency risk at the end of the reporting period is

summarised below. All amounts are presented in GBP equivalent.

USD MGA USD MGA

Group Sep 2021 Sep 2021 Mar 2021 Mar 2021

GBP GBP GBP GBP

Cash and cash equivalents 173,790 62,370 90,236 66,118

Trade & other receivables 432,759 560,729 522,400 489,622

Trade & other payables (29,741) (147,291) (151,353) (301,816)

--------------------------- ---------- ---------- ---------- ----------

Net Exposure 576,808 475,808 461,283 253,924

--------------------------- ---------- ---------- ---------- ----------

Sensitivity Analysis

As shown in the table above, the Group is primarily exposed to

changes in the GBP:USD & GBP:MGA exchange rates. The table

below shows the impact in GBP on pre-tax profit and loss of a 10%

increase/ decrease in the GBP to USD exchange rate, holding all

other variables constant. Also shown is the impact of a 10%

increase/decrease in the GBP to MGA exchange rate, being the other

primary currency exposure.

Sep 2021 Group

GBP

GBP:USD exchange rate increases by 10% 7,458

GBP:USD exchange rate decreases by 10% (8,234)

GBP:MGA exchange rate increases by 10% 31,870

GBP:MGA exchange rate decreases by 10% (35,258)

Sep 2020 Group

GBP

GBP:USD exchange rate increases by 10% 268

GBP:USD exchange rate decreases by 10% (293)

GBP:MGA exchange rate increases by 10% 20,615

GBP:MGA exchange rate decreases by 10% (22,888)

10. Related party transactions

Tirupati Carbons and Chemical Pvt Limited (TCCPL) is an entity

incorporated in India. The Company is connected to TCCPL in that

both Shishir Poddar and Hemant Poddar were both directors and

shareholders of TCCPL during the year. At half-year end, included

within debtors was an amount of Nil (Mar 2021: Nil) and revenue

recorded for the period of Nil (Mar 2021: Nil) from TCCPL.

Tirupati Speciality Graphite Private Limited (TSG) is an entity

incorporated in India. The Company is connected to TSG in that both

Shishir Poddar and Hemant Poddar were both directors and

shareholders of TSG during the year. At half year end, a net amount

was receivable of GBP1,092,904 (Mar 2021 - GBP250,656) and revenue

of GBP56,610 (Mar 2021 - GBP238,602) from TSG.

Haritmay Ventures LLP (HV) is an entity incorporated in India

and engaged in manufacturing proprietary tailor-made flake graphite

processing machinery and equipment which the Company uses in its

projects. The Company is connected to HV in that Shishir Poddar is

partner and shareholder of HV during the year. At year end, a net

amount was receivable of GBP355,822 (Mar 2021 - GBP72,552) and

revenue of Nil (Mar 2021 - Nil) from HV.

Optiva Securities Limited is an entity incorporated in the

United Kingdom. The Company is a stock brokerage firm connected to

the Company being the sole broker of the Company and Christian

Gabriel St.John-Dennis one of the directors of the Company and

holding a position with Optiva Securities Limited during the year.

At year end, the Company incurred brokerage and consultancy fees,

business development fees of GBP440,500 (Mar 2021- GBP378,402).

11. Events after the reporting period

On 4(th) November 2021 the Ordinary Shares of the Company

commenced cross-trading on the OTCQX(R) Best Market ("OTCQX") in

the United States ("U.S."), under the ticker symbol "TGRHF".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLBDDSDGDGBB

(END) Dow Jones Newswires

December 02, 2021 01:59 ET (06:59 GMT)

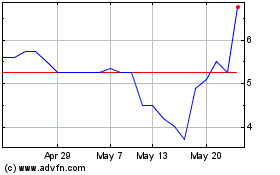

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jul 2023 to Jul 2024