TIDMSQS

RNS Number : 7667D

SQS Software Quality Systems AG

02 February 2015

2 February 2015

SQS Software Quality Systems AG

("SQS" or the "Company")

Acquisition of a majority of the issued share capital of Bit

Media S.p.A for EUR6.07 million

SQS Software Quality Systems AG (AIM: SQS.L), the world's

largest specialist supplier of software quality services, announces

that it has acquired 90% of the issued share capital of Bit Media

S.p.A ("Bit Media"), a testing services and systems analysis

provider to the financial services and public sectors,

headquartered in Italy, for a cash consideration of EUR6.07

million. The consideration for the acquisition was entirely funded

from the Company's existing cash reserves.

The acquisition of Bit Media gives SQS entry into the Italian

market, and provides a solid and substantial platform from which to

strengthen our service to the Company's existing Italian customers

and to expand further into the region through the cross selling of

services. Bit Media is closely aligned with SQS in terms of the

services it provides and its focus on the Banking, Financial

Services and Insurance ("BFSI") sectors and will bolster SQS'

capabilities within these key industries, which now account for

over 50% of the Company's revenues. There are also a number of

operational synergies across the two organisations that may result

in cost savings and improved efficiencies including providing the

existing Bit Media business with access to SQS's lower cost

offshore testing resources.

Bit Media has consistently demonstrated a healthy financial

performance. In its latest available audited statements for the

year ended 31 December 2013, Bit Media delivered revenues of

EUR11.5 million and a profit before tax of EUR1.1 million. Future

revenues are also underpinned by a substantial and secure order

backlog of EUR32.9 million over the next three years.

Bit Media is expected to benefit from the additional scale and

capabilities provided by being part of SQS, potentially leading to

new sales opportunities. In addition to new client opportunities,

SQS currently has a number of multi-national clients that have

operations or conduct business in Italy and have expressed an

interest for the Company to provide its services on a local basis

within the region. In addition, it is expected that there will be

opportunities to upsell SQS's existing services to Bit Media's

client base which consists of many excellent and long-established

relationships.

SQS has acquired 90% of Bit Media from the shareholders pursuant

to the terms of an acquisition agreement for a cash consideration

of EUR6.07 million. The Managing Director of Bit Media will retain

10% of the shares and is to remain with SQS, as managing Director

SQS Italy. The parties have agreed a call option in favour of SQS

and a put option in favour of the vendor, over the remaining 10% of

the shares that SQS is not acquiring at this time. Either party may

exercise its respective option at any time between the 3(rd) and

5(th) anniversary of completion of the acquisition, the valuation

of which will be determined with reference to Bit Media's latest

audited profit after tax at that time.

Commenting on the Acquisition, Livio Mariotti, Managing Director

of Bit Media, said: "We are confident that the global scale and

delivery capabilities of SQS will provide us with numerous new

business opportunities upon which we will focus our attention. We

therefore greatly look forward to being part of SQS."

Commenting on the Acquisition, Diederik Vos, Chief Executive

Officer of SQS, said: "We are delighted to announce the acquisition

of Bit Media. It is important for SQS to have a strong European

presence and with Italy being the 8th largest economy in the world

and the 3rd largest in the Eurozone this acquisition expands our

geographic reach into the strategically important Italian market.

As well as giving us a considerable presence and solid platform for

further growth in Italy, the acquisition provides opportunities for

us to market our services to Bit Media's existing client base and

to provide local testing services to our existing clients in the

region.

The acquisition comes with a solid order backlog. In addition,

it will further deepen our domain expertise within the fast growing

BFSI sector which currently accounts for the majority of our

revenues. As such we are confident that Bit Media will prove a

considerable asset to SQS going forward."

Enquiries:

SQS Software Quality Systems AG Phone: +49 (0) 2203 9154-0

Diederik Vos, Chief Executive Officer

Rene Gawron, Chief Financial Officer

Canaccord Genuity - Nomad and Joint Phone: +44 (0) 20 7523 8000

Broker

Simon Bridges / Peter Stewart / Cameron

Duncan

Westhouse Securities - Joint Broker Phone: +44 (0) 20 7601 6100

Robert Finlay / Antonio Bossi

Walbrook PR Limited Phone: +44 (0)20 7933 8780

Bob Huxford bob.huxford@walbrookpr.com

Sam Allen sam.allen@walbrookpr.com

About SQS Software Quality Systems

SQS is the world's leading specialist in software quality. This

position stems from over 30 years of successful consultancy

operations. SQS consultants provide solutions for all aspects of

quality throughout the whole software product lifecycle driven by a

standardised methodology, offshore automation processes and deep

domain knowledge in various industries. Headquartered in Cologne,

Germany, the company now employs approximately 3,900 staff. SQS has

offices in Germany, the UK, Australia, Egypt, Finland, France,

India, Ireland, Malaysia, the Netherlands, Norway, Austria,

Singapore, Sweden, Switzerland, South Africa, the UAE and the US.

In addition, SQS maintains a minority stake in a company in

Portugal. In 2014, SQS is expected to have generated revenues of

circa EUR268million.

SQS is the first German company to have a primary listing on

AIM, a market operated by the London Stock Exchange. In addition,

SQS shares are also traded on the German Stock Exchange in

Frankfurt am Main.

With over 7,000 completed projects under its belt, SQS has a

strong client base, including half of the DAX 30, nearly a third of

the STOXX 50 and 20 per cent of the FTSE 100 companies. These

include, among others, Allianz, Beazley, BP, Centrica, Commerzbank,

Daimler, Deutsche Post, Generali, JP Morgan, Meteor, Reuters, UBS

and Volkswagen as well as other companies from the six key

industries on which SQS is focussed.

For more information, see www.sqs.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQTTMBTMBIMBMA

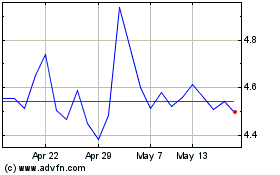

-1x Square (LSE:SQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

-1x Square (LSE:SQS)

Historical Stock Chart

From Jul 2023 to Jul 2024