TIDMSAFE

RNS Number : 1308T

Safestore Holdings plc

15 March 2023

15 March 2023

Safestore Holdings plc

("Safestore", "the Company" or "the Group")

Result of Annual General Meeting

Annual General Meeting

The 2023 Annual General Meeting of Safestore Holdings plc was

held at midday today at the Company's registered office in

Borehamwood, Hertfordshire.

All resolutions were passed by the requisite majority by way of

a poll.

The following votes were cast in respect of the AGM

resolutions:

% of

Issued

Total Votes Share

Votes (excluding Capital Votes

Resolution Votes For % Against % withheld) Voted Withheld

To receive

the Annual

Report and

1 Accounts 188,081,670 99.87% 238,869 0.13% 188,320,539 86.56% 396,665

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To approve

the Directors'

Remuneration

2 Report 140,636,482 74.66% 47,726,385 25.34% 188,362,867 86.58% 354,337

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To appoint

Deloitte

3 LLP as auditor 187,941,338 99.85% 288,793 0.15% 188,230,131 86.52% 487,073

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To authorise

the Directors

to determine

the auditors'

4 remuneration 187,897,590 99.57% 807,541 0.43% 188,705,131 86.73% 12,073

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To declare

a final

dividend

of 20.40

pence per

ordinary

5 share 188,382,765 99.83% 323,395 0.17% 188,706,160 86.73% 11,044

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To elect

6 Jane Bentall 188,050,154 99.65% 654,388 0.35% 188,704,542 86.73% 12,662

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To re-elect

David Hearn

7 as a Director 167,107,467 88.55% 21,598,575 11.45% 188,706,042 86.73% 11,162

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To re-elect

Frederic

Vecchioli

8 as a Director 186,013,813 98.57% 2,691,064 1.43% 188,704,877 86.73% 12,327

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To re-elect

Andy Jones

9 as a Director 186,742,151 98.96% 1,962,726 1.04% 188,704,877 86.73% 12,327

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To elect

Gert van

de Weerdhof

10 as a Director 177,512,074 94.07% 11,191,303 5.93% 188,703,377 86.73% 13,827

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To re-elect

Ian Krieger

11 as a Director 175,666,204 93.10% 13,014,973 6.90% 188,681,177 86.72% 36,027

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To re-elect

Laure Duhot

12 as a Director 177,249,134 93.93% 11,455,743 6.07% 188,704,877 86.73% 12,327

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To re-elect

Delphine

Mousseau

13 as a Director 182,496,449 96.71% 6,206,928 3.29% 188,703,377 86.73% 13,827

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To authorise

political

donations

and political

14 expenditure 183,902,979 97.46% 4,799,655 2.54% 188,702,634 86.73% 14,570

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To authorise

the directors

to allot

relevant

15 securities 168,212,044 89.36% 20,019,116 10.64% 188,231,160 86.52% 486,044

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To authorise

the

dis-application

of pre-emption

16 rights 185,106,232 98.09% 3,599,728 1.91% 188,705,960 86.73% 11,244

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To authorise

market

purchases

of ordinary

17 shares 187,439,884 99.6% 742,727 0.39% 188,182,611 86.49% 534,593

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

To authorise

general

meetings

(other than

annual general

meetings)

to be called

on not less

than 14

clear days'

18 notice meetings 172,902,112 91.63% 15,804,048 8.37% 188,706,160 86.73% 11,044

---------------- ------------------ --------- -------------------- -------- ------------------------ -------- ---------------------

Resolutions 1 to 15 were ordinary resolutions, requiring more

than 50 per cent. of shareholders' votes to be cast in favour of

the resolutions. Resolutions 16 to 18 were special resolutions,

requiring at least 75 per cent. of shareholders' votes to be cast

in favour of the resolutions.

Where shareholders appointed the Chairman of the meeting as

their proxy with discretion as to voting, their votes were cast in

favour of the resolutions and their shares have been included in

the "votes for" column.

A "vote withheld" is not a vote in law and is not counted in the

calculation of the percentages of votes cast for and against a

resolution.

Commenting on the result of the AGM David Hearn, Chairman of

Safestore said:

"The financial results for the year ended 31 October 2022

reported considerable strategic and financial progress for the

Group, which was especially impressive on the back of an

exceptionally strong year in 2021. I and the Board continue to be

impressed by the dedication and resilience of the store and Head

Office teams which have been instrumental in delivering this

progress. After an almost 87% turnout, I am pleased that all

resolutions were duly passed and would like to thank our

shareholders for their continued support.

Whilst we received strong support for the Directors'

Remuneration Report (Resolution 2), it was only at 74.66 %. The

Board appreciates that the 2017 Remuneration Policy continues to

divide opinion amongst some shareholders, even though it was voted

through in 2017. Shareholder engagement indicates that some

shareholders who voted against the 2017 Remuneration Policy at its

inception, have a policy to vote against all future remuneration

reports that reflect the subsequent execution of it. From specific

conversations with some of our leading shareholders they have

confirmed that their vote against the Remuneration Report does not

reflect a vote against either the management or the Board and that

they accept fully that the payouts, reflect the outstanding value

creation for all shareholders over the past five years which has

been a significant benefit to all our stakeholders.

As such, this vote does not represent a vote against Safestore's

current Remuneration Policy, which received over-whelming

shareholder approval at Safestore's 2020 Annual General Meeting. We

are currently engaging with shareholders on the formation of our

2023 Remuneration Policy, which we expect to submit for shareholder

approval, at a General Meeting, later this year."

The current issued capital of Safestore Holdings plc is

217,568,672 ordinary shares.

In accordance with LR 9.6.2, copies of the resolutions passed as

special business have been submitted to the Financial Conduct

Authority's National Storage Mechanism and will shortly be

available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information, please contact:

Instinctif Partners

Guy Scarborough

Bryn Woodward 020 7457 2020

Notes to Editors

-- Safestore is the UK's largest self-storage group with 182

stores on 31 January 2023, comprising 130 wholly owned stores in

the UK (including 72 in London and the South East with the

remainder in key metropolitan areas such as Manchester, Birmingham,

Glasgow, Edinburgh, Liverpool, Sheffield, Leeds, Newcastle, and

Bristol), 29 wholly owned stores in the Paris region, 7 stores in

Spain, 10 stores in the Netherlands and 6 stores in Belgium. In

addition, the Group operates 7 stores in Germany under a Joint

Venture agreement with Carlyle.

-- Safestore operates more self-storage sites inside the M25 and

in central Paris than any competitor providing more proximity to

customers in the wealthiest and more densely populated UK and

French markets.

-- Safestore was founded in the UK in 1998. It acquired the

French business "Une Pièce en Plus" ("UPP") in 2004 which was

founded in 1998 by the current Safestore Group CEO Frederic

Vecchioli.

-- Safestore has been listed on the London Stock Exchange since

2007. It entered the FTSE 250 index in October 2015.

-- The Group provides storage to around 90,000 personal and business customers.

-- As of 31 January 2023, Safestore had a maximum lettable area

("MLA") of 7.852 million sq ft (excluding the expansion pipeline

stores) of which 6.095 million sq ft was occupied.

-- Safestore employs around 750 people in the UK, Paris, Spain, the Netherlands, and Belgium.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGNKPBPOBKDFND

(END) Dow Jones Newswires

March 15, 2023 14:00 ET (18:00 GMT)

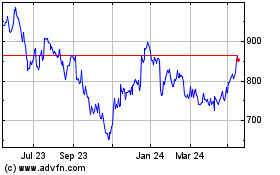

Safestore (LSE:SAFE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Safestore (LSE:SAFE)

Historical Stock Chart

From Jul 2023 to Jul 2024