TIDMRTC

RNS Number : 5998D

RTC Group PLC

18 May 2012

RTC Group Plc ("RTC", "the Company" or "the Group")

Preliminary results for the year ended 31 December 2011

RTC Group Plc, a support services group, which provides

recruitment and conferencing services, is pleased to announce its

preliminary results for the year ended 31 December 2011.

HIGHLIGHTS

- Group revenue from continuing operations of GBP29.5m (2010: GBP19.6m)

- Group operating loss from continuing operations before

exceptional items of GBP87,000 (2010: GBP492,000)

- Loss for the year attributable to equity holders of GBP611,000 (2010: GBP958,000)

- Loss per share from continued and discontinued operations of 5.10p (2010: 10.62p)

- Dividends the Board believes that it would not be prudent to

use financial resources to declare a final dividend at this time

(2010: nil)

- Recruitment made an operating profit before exceptional items

of GBP211,000 (2010: GBP210,000)

- Conferencing made an operating profit of GBP35,000 (2010: loss GBP277,000)

Commenting on the results Bill Douie, Chairman, said:

"Our strategic plan has identified significant opportunities to

build on our expertise in managed service operations globally, in

development of our presence in India, in the services to SME

industrial clients through our branch network in England and in

labour supply in the UK. Implementation of the management

development and re-structuring programme has given us a team

capable of pursuing those opportunities."

ENQUIRIES:

RTC Group Plc Tel: 01332 861 844

Bill Douie, Executive Chairman

Andy Pendlebury, Chief Executive

Allenby Capital Limited Tel: 020 3328 5656

Jeremy Porter, Corporate Finance

Mark Connelly, Corporate Finance

Chairman's Statement

I am pleased to present the final report for the year ended

31(st) December 2011.

GROUP

2011 has been the first complete year when the Group has traded

in its new reorganised structure. Although the Derby Conference

Centre is not an obvious core business in a recruitment company it

is a sound and profitable business and serves to provide, in

addition, a Head Office for the Group. All other businesses in the

Group are involved in Recruitment and fall into three divisions: UK

white collar recruitment, International Managed Service and UK

labour supply.

TRADING

ATA Recruitment Limited

UK white collar recruitment provides personnel, both permanent

and contract, mainly to industrial clients in vertical markets

through our premises in the Derby Conference Centre and to the SME

industrial market through six UK branches. Both markets have

continued to make steady progress. In the period under review,

revenues were up 16% at GBP15.825m, generating an operating profit

of GBP357,000 (2010 : GBP15,000)

International Managed Service has continued to expand its

operations in NATO premises in Afghanistan. Revenues in 2011 were

up 221% at GBP7,088m but significant operating difficulties during

a period of rapid turnover increases resulted in an operating loss

of (GBP66,000) (2010 : profit GBP169,000). All of the operational

problems have now been eliminated and the business is running

profitably.

Ganymede Solutions Limited had another good year in its

traditional markets of Rail, Infrastructure, Trades and labour. An

initial entry into the Telecoms sector was not successful and

resulted in a material non-recurring loss of GBP378,000 in the

first half of the year. Revenues were up 74% at GBP4.843m and

operating profit, before exceptional items, were GBP194,000 (2010 :

GBP26,000).

The Derby Conference Centre continued to make steady

improvements in performance in a difficult market environment.

Revenues were up 36% in the period under review at GBP1.763m,

generating an operating profit of GBP35,000 (2010 : loss

GBP277,000).

Non - recurring item. As announced in our interim statement, our

entry into the Telecoms industry, whilst providing contractors to

high quality end-user clients, was serviced through a third party

agent who proved to be of inferior quality, resulting in an

exceptional loss of GBP378,000. This business area has been

discontinued and investigations by the relevant authorities into

potential fraud by the third party are ongoing.

As a direct consequence, Group liquidity was adversely affected

and movements between dollar, euro and sterling accounts, which

would not normally have taken place, led to exchange losses and

costs of GBP274,000.

Overall Group trading performance, built on three growing

recruitment businesses, improved at the operating profit level, but

the final outcome was materially adversely affected by both the

growing pains in the Managed Services division and our unsuccessful

entry into Telecoms contract recruitment.

CAPITAL INVESTMENT

During the year, although capital investment was limited by the

need to divert the majority of incoming cash flow into working

capital to finance growth in trading volumes, it was possible to

continue the upgrade of the Derby Conference Centre premises as

further space was brought back into use.

DIVIDENDS

Your directors believe that it would not be prudent to use

financial resources to declare a final dividend at this time.

MANAGEMENT

During the year, development of our management structure at all

levels continued apace and following the year-end a re-structure

has taken place following the creation of two operating divisions,

each with its own management team reporting direct to the CEO and

three Operations Directors have been appointed. These moves, in

addition to reflecting the qualities of the affected individuals

and the growth of the underlying businesses are also necessary to

provide an appropriate level of management to ensure the capture of

growth opportunities which have been identified in our strategic

plan.

THE GROUP BOARD

During the year we appointed our two key senior managers and a

Non - Executive Director, John T White, to the Group Board, who

were all confirmed at the Annual General Meeting on 22(nd) June

2011. Since the year end Gary Hewett, Executive Director, has left

the Group.

ISSUE OF NEW EQUITY

Under the authority granted at the Annual General Meeting in

2010, we announced on 3 May 20011, a subscription of new shares in

the Company, by certain directors and senior management, raising

GBP396,000 net of expenses.

BALANCE SHEET

As at 31 December 2011 the Group had net assets of GBP637,000

(2010: 849,000). Group borrowings at the end of the year stood at

GBP3,149,000 (2010: GBP2,231,000) leaving GBP2,051,000 undrawn of

the Group's GBP5.2m invoice discounting facility.

CORPORATE GOVERNANCE

RTC Group takes very seriously its corporate governance

obligations. Whilst we recognise the potential input of an

appropriate number of Non-Executive Directors we presently feel

that the appointment of one is adequate at this stage in the Group

growth profile. We are indebted to John White for his help and

guidance in 2011.

OUTLOOK

The Group has now completed a major and essential

re-organisation and is entirely focused on recruitment services

with the addition of conferencing activities at our Head Office

premises. Major inroads have been made in international markets led

by our contract to serve NATO establishments in Afghanistan and the

establishment, post year end, of our new 90% owned company in

India. Operating difficulties in the International Division have

also been eliminated. Our strategic plan has identified significant

opportunities to build on our expertise in managed service

operations globally, in development of our presence in India, in

the services to SME industrial clients through our branch network

in England and in labour supply in the UK. Implementation of the

Management development and re-structuring programme has given us a

team capable of pursuing those opportunities.

We look forward to further growth of revenues and a material

improvement in underlying profitability in 2012.

STAFF

We continue to enjoy the benefits of a growing team of loyal and

conscientious management and staff. They have my admiration and

thanks and I feel privileged to work with them.

W.J.C. Douie, Chairman 17 May 2012

Consolidated Statement of Comprehensive Income

Year ended 31 December 2011

2011 2010

Notes GBP'000 GBP'000

Revenue 5 29,519 19,639

Cost of sales (25,517) (16,720)

------------------------------------- ------ ----- ---------------------- -------------------

Gross Profit 4,002 2,919

Administrative expenses (4,467) (3,353)

------------------------------------- ------ ----- ---------------------- -------------------

Operating Loss (465) (434)

------------------------------------- ------ ----- ---------------------- -------------------

Analysed as

Operating Loss before exceptional

items 5 (87) (492)

Administrative (expenses) /

income - exceptional 7 (378) 58

------------------------------------- ------ ----- ---------------------- -------------------

Operating Loss after exceptional

items (465) (434)

------------------------------------- ------ ----- ---------------------- -------------------

Financing expense (96) (18)

------------------------------------- ------ ----- ---------------------- -------------------

Loss before tax (561) (452)

Income tax 6 62 18

------------------------------------- ------ ----- ---------------------- -------------------

Net Loss from continuing operations (499) (434)

Loss from discontinued operations 4 (112) (524)

------------------------------------- ------ ----- ---------------------- -------------------

Loss for the year and total

comprehensive income for the

year attributable to equity

holders of the parent (611) (958)

------------------------------------- ------ ----- ---------------------- -------------------

Basic and diluted:

Loss per share - continuing

operations (pence) 3 (4.17) (4.81)

Loss per share - discontinued

operations (pence) 3 (0.93) (5.81)

------------------------------------- ------ ----- ---------------- -------------------

Loss per share - continuing

and discontinued operations

(pence) 3 (5.10) (10.62)

------------------------------------- ------ ----- ---------------- -------------------

There is no dilutive effect of share options

Consolidated Statement of Changes in Equity

Year ended 31 December 2011

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

account reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2011 90 2,117 50 30 (1,438) 849

Loss and total comprehensive

income for the year - - - - (611) (611)

Share issue (net

of expenses) 45 351 - - - 396

Share based payment

reserve - - - 3 - 3

At 31 December 2011 135 2,468 50 33 (2,049) 637

------------------------------ --------- --------- ------------ --------- ------------ --------

Year ended 31 December 2010

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

account reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2010 90 2,117 50 38 (480) 1,815

Loss and total comprehensive

income for the year - - - - (958) (958)

Share based payment

reserve - - - (8) - (8)

At 31 December 2010 90 2,117 50 30 (1,438) 849

------------------------------ --------- --------- ------------ --------- ------------ --------

The Share based payment reserve comprises of the cumulative

share option charge under IFRS 2 less the value of any share

options that have been exercised or have lapsed.

Consolidated Statement of Financial Position

As at 31 December 2011 2011 2010

Notes GBP'000 GBP'000 GBP'000 GBP'000

Assets

Non current assets

Property, plant and equipment 292 279

Deferred tax asset 132 70

------------------------------- ------

424 349

Current assets

Inventories 14 10

Trade and other receivables 6,444 4,787

6,458 4,797

------------------------------- ------ -------- -------- -------- ----------

Total assets 6,882 5,146

------------------------------- ------ -------- -------- -------- ----------

Liabilities

Current liabilities

Trade and other payables (3,096) (2,066)

Current borrowings (3,149) (2,231)

Total current liabilities (6,245) (4,297)

Net assets 5 637 849

------------------------------- ------ -------- -------- -------- ----------

Equity attributable to

equity holders of the

parent

Share capital 135 90

Share premium 2,468 2,117

Capital redemption reserve 50 50

Share based payment reserve 33 30

Accumulated losses (2,049) (1,438)

------------------------------- ------ -------- -------- -------- ----------

Total equity 637 849

------------------------------- ------ -------- -------- -------- ----------

The financial statements were approved and authorised for issue

by the Board and were signed on its behalf on 17 May 2012 by:

A Bailey Director

A M Pendlebury Director

Consolidated Statement of Cash Flows

Year ended 31 December 2011

2011 2010

------------------------------------------- -------- ---------

GBP'000 GBP'000

Cash flows from operating activities

Operating result from continuing

operations (465) (432)

Adjustments for:

Employee equity settled share options 3 (8)

Depreciation 156 153

Loss on sale of property, plant 5 -

and equipment

Change in inventories (4) 1

Change in trade and other receivables (1,657) (2,400)

Change in trade and other payables 1,030 652

------------------------------------------- -------- ---------

Cash generated from operations (932) (2,034)

Interest paid (96) (18)

Income tax received - 97

------------------------------------------- -------- ---------

Net cash from/(used in) operating

activities (1,028) (1,955)

------------------------------------------- -------- ---------

Cash flows from investing activities

Purchases of property, plant and

equipment (174) (24)

Proceeds from sale of property,

plant and equipment - 40

Net cash from/(used in) investing

activities (174) 16

------------------------------------------- -------- ---------

Cash flows from financing activities

------------------------------------------- -------- ---------

Proceeds from issue of share capital 396 -

------------------------------------------- -------- ---------

Net cash inflow from financing activities 396 -

------------------------------------------- -------- ---------

Net (decrease)/increase in cash

and cash equivalents from continuing

operation (806) (1,939)

------------------------------------------- -------- ---------

Cash movement from discontinued

operations

Operating Activities (112) (130)

Cash movements from discontinued

operations investing activities - (14)

------------------------------------------- -------- ---------

Net (decrease) in cash and cash

equivalents from discontinued operations (112) (144)

------------------------------------------- -------- ---------

Total net (decrease) in cash and

cash equivalents (918) (2,083)

------------------------------------------- -------- ---------

Cash and cash equivalents at the

beginning of the year (2,231) (148)

------------------------------------------- -------- ---------

Cash and cash equivalents at the

end of the year (3,149) (2,231)

------------------------------------------- -------- ---------

Notes

1. CORPORATE INFORMATION

The announcement of audited results of the Group for the year

ended 31 December 2011 was authorised for issue in accordance with

a resolution of the directors on 17 May 2012. RTC Group Plc is a

public limited company incorporated and domiciled in England whose

shares are publicly traded. The principal activities of the Group

are described in note 5.

The financial information included in this announcement has been

compiled in accordance with International Financial Reporting

Standards ("IFRS"), including International Accounting Standards

("IAS") and interpretations issued by the International Accounting

Standards Board ("IASB") and its committees, and as adopted by the

EU. This announcement does not however contain sufficient

information to comply with IFRS.

The accounting policies adopted are consistent with those

described in the annual financial statements for the year ended 31

December 2010. There have been no significant changes in the basis

upon which estimates have been determined, compared to those

applied at 31 December 2010 and no change in estimate has had a

material effect on the current period.

2. DIVIDENDS

The Board do not recommend the payment of a final dividend for

the year.

3. LOSS PER SHARE

The calculation of basic and diluted earnings per share from

continuing and discontinued operations is based on a loss after tax

expense of GBP611,000 (2010: loss GBP958,000) and a weighted

average of 11,974,276 (2010: 9,022,564) shares in issue.

The outstanding share options were not considered to be dilutive

in 2011 nor 2010.

4. Discontinued Operations

In August 2011, the Board decided to discontinue the activity of

Global Choice Recruitment Ltd. (2010: on 25 June 2010, the Board

decided to discontinue funding the Group's Training Division and

hence the Board of Catalis Limited put this company into

administration). The loss for the discontinued operations is stated

after charging:

2011 2010

GBP'000 GBP'000

Revenue 76 1,458

Cost of sales (109) (1,044)

-------- --------

Gross Profit/(loss) (33) 414

Administrative expenses - normal (79) (694)

-------- --------

Operating loss (112) (280)

Financing income/(expense) - -

-------- --------

Loss on ordinary activities before taxation (112) (280)

Attributable income tax expense - -

Loss on disposal of discontinued operations (244)

-------- --------

Net loss attributable to discontinued operations (112) (524)

-------- --------

Details of net assets disposed as a result of the administration

of Catalis Limited and the associated loss for the period resulting

from this are as follows:

2011 2010

GBP'000 GBP'000

Non current assets

Property plant and equipment - 202

Current assets - 321

Current liabilities - (279)

--------- --------

Net assets disposed of - 244

Consideration - -

--------- --------

Loss on disposal - (244)

--------- --------

5. Segmental Analysis

The Group is a provider of Recruitment and Conferencing Services

and operates a division for each, made up from a number of legal

entities. Segmental information is provided below in respect of

Recruitment and Conferencing operations. The Group manages its

divisions, the trading performance and working capital by

monitoring operating profit before exceptional items and centrally

manages Group taxation, capital structure and spend, including net

equity and net debt.

The Conferencing division services are wholly provided in the

UK. A growing proportion of the Recruitment division revenues now

derive from overseas activities.

Revenues are generated from permanent and temporary recruitment

in the Recruitment division and from the provision of a

conferencing and hotel facility in Derby for the Conferencing

division.

All revenues have been invoiced to external customers. Revenues

of GBP7.1m (2010: GBP2.2m) in the recruitment division were derived

from a single external customer.

The segmental analysis of revenue, gross margin, operating

profit before exceptional goodwill write off and net assets is as

follows: -

2011 2010

GBP'000 GBP'000

Revenue

Recruitment 27,756 18,344

Conferencing 1,763 1,295

29,519 19,639

-------- ---------

Gross Margin

Recruitment 2,964 2,356

Conferencing 1,038 563

4,002 2,919

-------- ---------

Operating (loss) from

continuing operations

before exceptional items

Recruitment 211 210

Conferencing 35 (277)

Group costs (333) (425)

-------- ---------

(87) (492)

2011 2010

GBP'000 GBP'000

Other information

Depreciation:

Recruitment 68 86

Conferencing 88 122

-------- --------

156 208

-------- --------

Capital expenditure:

Recruitment 106 24

Conferencing 68 14

-------- --------

174 38

-------- --------

2011 2011 2011 2010 2010 2010

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Assets Liabilities Net Assets Liabilities Net

Recruitment 5,828 (5,555) 273 4,548 (3,977) 571

Conferencing 604 (305) 299 403 (212) 191

Non-trading/Group 449 (385) 64 195 (108) 87

-------- ------------ -------- -------- ------------ --------

Continuing 6,881 (6,245) 636 5,146 (4,297) 849

Discontinued

Recruitment 1 - 1 - - -

Training - - - - - -

-------- ------------ -------- -------- ------------ --------

Total 6,882 (6,245) 637 5,146 (4,297) 849

-------- ------------ -------- -------- ------------ --------

All assets and liabilities are held in the United Kingdom.

6. Income Tax

Continuing operations 2011 2010

GBP'000 GBP'000

Analysis of tax :-

Current Tax

UK corporation tax - -

Adjustment in respect of

previous periods - (3)

- (3)

Deferred Tax

Origination and reversal (62) -

of temporary differences

Adjustment in respect of

previous periods - (15)

--------------------------- -------- --------

Tax (62) (18)

--------------------------- -------- --------

7. Exceptional Administrative Costs

2011 2010

GBP'000 GBP'000

Profit on disposal of property plant and equipment - 121

Reorganisation costs - (63)

Provision for bad debt 378 -

-------- --------

378 58

-------- --------

As further explained in the Chairman's statement, during the

year the Group has experienced a non recurring bad debt of

GBP378,000, including legal fees to date, from a 3(rd) party

agent.

Report & Accounts

The above financial information does not constitute the

Company's statutory accounts for the years ended 31 December 2011

or 2010 but is derived from those accounts. The auditor has

reported on these accounts; their report was unqualified, did not

draw any matters by way of emphasis without qualifying their report

and did not contain statements under s498(2) or (3) Companies Act

2006 or equivalent preceding legislation.The statutory accounts for

2010 have been filed with the Registrar of Companies.

Full audited accounts of RTC Group plc for the year ended 31

December 2011 will be dispatched to shareholders, made available on

the Company's website at www.rtcgroupplc.co.uk and will be

available from the Company's registered office:- The Derby

Conference Centre, London Road, Derby, DE24 8UX in advance of the

AGM.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFUFDWFESEII

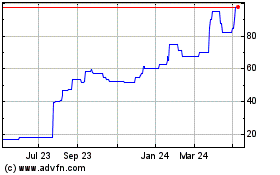

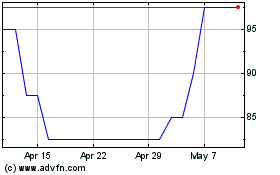

Rtc (LSE:RTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rtc (LSE:RTC)

Historical Stock Chart

From Jul 2023 to Jul 2024