Redx Pharma plc New Grant of Options (2030H)

December 02 2020 - 2:10AM

UK Regulatory

TIDMREDX

RNS Number : 2030H

Redx Pharma plc

02 December 2020

Redx Pharma plc

("Redx" or "the Company")

New Grant of Options

Alderley Park, 2 December 2020 Redx Pharma (AIM:REDX), the drug

discovery and development company focused on cancer and fibrosis,

announces new options awarded under the Redx All Employee Share

Option Scheme (the "Scheme") , as adopted on 1 July 2020.

The Board has authorised the conditional grant of additional

options to Lisa Anson (Chief Executive Officer) and Richard Armer

(Chief Scientific Officer) on 2 December 2020, both of whom are

classed as PDMRs, as set out further below. The options are being

granted at 56p per ordinary share, being the price of the Placing

and Open Offer announced earlier today, with the grant becoming

unconditional once the Placing Shares and the Open Offer Shares

have been admitted to trading on AIM, which is dependent, inter

alia, on the passing by Shareholders of certain resolutions at the

General Meeting of the Company being convened at 11.00 a.m. on 21

December 2020.

Once the option grant becomes unconditional, any subsequent

vesting will be subject to certain time and performance criteria

having been met.

Name Position Number Vesting Date Total Options

of Options Held Following

Conditionally the Conditional

Granted Grant

Lisa Anson Chief Executive

(Director/PDMR) Officer 451,145 2 December 2021

451,145 2 December 2022

451,144 2 December 2023

2 December 2023

(subject to performance

2,030,152 conditions) 11,683,586

Chief Scientific

Richard Armer Officer 231,250 2 December 2021

(PDMR) 231,250 2 December 2022

231,251 2 December 2023

2 December 2023

(subject to performance

1,040,627 conditions) 5,984,378

In addition, options over a further 1,350,000 Ordinary Shares of

1p each will be granted on 2 December 2020 to certain new staff of

the company under the Scheme on an unconditional basis. These

options will also be granted at 56p, and are not subject to

performance conditions.

Following the grants referred to above, and assuming the

associated conditions are met in relation to the conditional grant,

the Company will have granted options over a total of 28,057,964

Ordinary Shares representing 10.2 per cent. of the share capital in

issue following completion of the Placing and the associated issue

of 32,806,159 Ordinary shares to Redmile and Sofinnova in aggregate

pursuant to their conversion of GBP5,084,954.65 of the principal

amount of the convertible loan notes issued to them on 4 August

2020 (but ignoring any Ordinary Shares issued in the Open Offer,

the take-up of which is currently uncertain). In addition, certain

ex-employees continue to hold options, totalling 2,340,800 shares,

representing 0.9 per cent. of the share capital that will be in

issue following completion of the Placing and aforementioned

conversion (but not the Open Offer). The number of options that may

be awarded under the Scheme, and all prior share incentive plans,

remains limited such that the aggregate number of Ordinary Shares

of 1p each under option will be less than 15 per cent. of the total

issued share capital of the Company.

For further information, please contact:

Redx Pharma Plc T: +44 1625 469

918

Iain Ross, Chairman

Lisa Anson, Chief Executive

SPARK Advisory Partners (Nominated Adviser) T: +44 203 368

3550

Matt Davis/Adam Dawes

WG Partners LLP (Broker) T: +44 20 3705

9330

Claes Spång/Chris Lee/David Wilson

FTI Consulting T: +44 20 3727

1000

Simon Conway/Ciara Martin

About Redx Pharma Plc

Redx Pharma (AIM:REDX) is focused on the discovery and

development of novel targeted medicines for the treatment of cancer

and fibrotic disease, aiming to progress them to clinical proof of

concept. Redx's lead oncology asset, RXC004, is currently in a

phase 1 study in patients with advanced malignancies with top line

data expected in H1 2021 and the Company's selective ROCK2

inhibitor, RXC007, is expected to enter a phase 1 clinical study in

H1 2021.

The Company's core capability of converting medicinal chemistry

insights into differentiated and commercially attractive small

molecule drug candidates against clinically validated targets has

been recognized by others. Over the last three years the company

has completed four major preclinical stage deals with AstraZeneca,

Jazz Pharmaceuticals and Loxo Oncology (now Eli Lilly).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHXFLLBBLLBFBZ

(END) Dow Jones Newswires

December 02, 2020 02:10 ET (07:10 GMT)

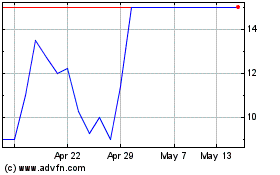

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Redx Pharma (LSE:REDX)

Historical Stock Chart

From Nov 2023 to Nov 2024