TIDMPDL

RNS Number : 1060W

Petra Diamonds Limited

08 December 2023

08 December 2023 LSE: PDL

Petra Diamonds Limited

("Petra" or "the Company")

Initial sales results for Tender 3 FY 2024

Petra announces initial sales results for Tender 3 of FY 2024,

at which 462.8 kcts were sold for a total of US$58.7 million,

representing a c. 20% increase in like-for-like[1] prices compared

to Tender 2 FY 2024, which closed in October 2023. Final sales for

this third cycle are scheduled to close next week, with around 31

kcts from Williamson mine on tender at the Company's sales

facilities in Belgium, and some 25 kcts from the South African

operations planned to be sold to local clients to meet our South

African Diamond Beneficiation obligations.

Richard Duffy, Chief Executive Officer of Petra, said:

"The 20% increase in like-for-like(1) prices for our third

tender of FY 2024 supports the view that diamond prices have likely

bottomed. We believe actions taken by major producers to curb

supply and the two-month Indian moratorium that comes to an end on

15 December 2023, together with strengthened retail sales in the

US, have improved market conditions as inventory levels across the

pipeline rebalance. Ongoing discipline by the key players is

important to provide some price stability in the new year."

Rough diamond sales results for the respective periods are set

out below(1) :

Tender Tender Variance Tender YTD YTD

3 (initial) 2 3

FY 2024 FY 2024 FY 2023 FY 2024 FY 2023

Dec-23 Sep/Oct-23 Dec-22 Tenders Tenders

1-3 1-3

(initial)

Diamonds sold

(carats) 462,794 444,029 4% 303,300 1,603,017 1,264,722

Sales (US$ million) 58.7 40.5 45% 41.5 178.5 202.8

Average price

(US$/ct) 127 91 39% 137 111 160

Revenue from

Exceptional

Stones(2) (US$

million) 0.0 0.0 n.a. 0.0 0.0 0.0

-------------------- ------------ ----------- --------- --------- ---------- ---------

Note 1: Excludes all Koffiefontein sales results since it has

been classified as a discontinued operation in the Group's FY 2023

accounts.

Note 2: Exceptional Stones are defined as rough diamonds for

US$15 million or more each.

Sales

A total of 411.7kcts of goods from Cullinan Mine and Finsch were

sold, yielding US$48.3 million, and 51.0kcts from Williamson

yielding US$10.4 million.

The current cycle also includes 31.3kcts from Williamson to be

tendered at our Belgium facility and around 25kcts from the South

African operations planned to be sold to South African customers

next week. These sales will be included in the final results of

this third tender cycle and in the Company's H1 FY 2024 financial

results.

The provisional results of Tender 3 bring FY 2024 YTD revenue

from rough diamond sales to US$178.5 million, compared to US$202.8

million in the first three tenders of FY 2023, excluding

Koffiefontein. Year-on-year volume variances were affected by the

deferral of certain FY 2023 sale parcels, which were sold as part

of Tender 1 of FY 2024.

Mine by mine average prices for the respective periods are set

out in the table below:

US$/carat Tender 3 Tender 2 YTD FY 2024 YTD FY 2023 FY 2023

FY 2024 FY 2024 Tenders 1-3 Tenders 1-3

(initial) Sep/Oct-23 (initial)

Dec-23

Cullinan

Mine 133 78 110 154 139

Finsch 94 83 101 121 110

Williamson 203 203 203 280 280

------------ ----------- ----------- ------------- ------------- --------

Like-for-like prices

Like-for-like rough diamond prices for goods sold improved by c.

20.0% on Tender 2 FY 2024, driven by over 20% increases in the

prices achieved for goods smaller than 2cts, while 2 to 10.8ct

parcels saw increases in the mid-teens. Year to date like-for-like

prices are down 13.2% compared to the equivalent three tenders of

FY 2023.

Product mix

The balance of price movements is attributable to product mix,

with an improved contribution from higher-value single stones from

Cullinan Mine, including a 12.6ct blue stone that sold for US$6.2

million, while Finsch and Williamson saw marginally reduced overall

qualities in their product offering, although both remained within

the expected range of product variability.

For further information, please contact:

Investor Relations, London Telephone: +44 20 7494 8203

Patrick Pittaway investorrelations@petradiamonds.com

Julia Stone

Kelsey Traynor

Financial PR (Camarco)

Gordon Poole Telephone: +44 20 3757 4980

Owen Roberts petradiamonds@camarco.co.uk

Elfie Kent

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and

a supplier of gem quality rough diamonds to the international

market. The Company's portfolio incorporates interests in three

underground mines in South Africa (Finsch, Cullinan Mine and

Koffiefontein) and one open pit mine in Tanzania (Williamson). The

Koffiefontein mine is currently on care and maintenance in

preparation of closure.

Petra's strategy is to focus on value rather than volume

production by optimising recoveries from its high-quality asset

base in order to maximise their efficiency and profitability. The

Group has a significant resource base which supports the potential

for long-life operations.

Petra strives to conduct all operations according to the highest

ethical standards and only operates in countries which are members

of the Kimberley Process. The Company aims to generate tangible

value for each of its stakeholders, thereby contributing to the

socio-economic development of its host countries and supporting

long-term sustainable operations to the benefit of its employees,

partners and communities.

Petra is quoted with a premium listing on the Main Market of the

London Stock Exchange under the ticker 'PDL'. The Company's loan

notes due in 2026 are listed on the Irish Stock Exchange and

admitted to trading on the Global Exchange Market. For more

information, visit www.petradiamonds.com.

1 Like-for-like refers to the change in realised prices between

tenders and excludes revenue from all single stones and Exceptional

Stones, while normalising for the product mix impact

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTRBTTMTTMTMJ

(END) Dow Jones Newswires

December 08, 2023 02:00 ET (07:00 GMT)

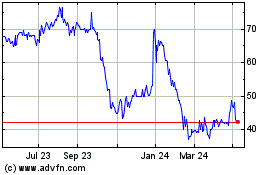

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

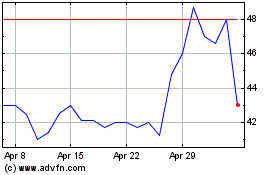

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024