Petra Diamonds Sales results for Tender 6 of FY 2022

June 30 2022 - 5:20AM

UK Regulatory

TIDMPDL

FOR IMMEDIATE RELEASE

30 June 2022 LSE: PDL

Petra Diamonds

Sales results for Tender 6 of FY 2022

Like-for-like diamond prices up 7.7% on previous tender

Richard Duffy, Chief Executive Officer of Petra Diamonds (Petra), said:

"The Tender 6 results conclude a strong year for Petra's diamond sales both in

terms of pricing and the demand we have seen. The significant interest shown at

Tender 6 bears testament to the ongoing strength of the rough diamond market.

We have seen pricing support across our product mix, with particular strength

in the prices of both white and coloured gem-quality stones over the last 12

months."

Petra announces the results of Tender 6 of FY 2022, at which 569,496 carats

were sold for a total of US$93.0 million, bringing total sales for FY 2022 to

US$584.5 million across Petra's mining operations.

Tender 6 Tender 5 FY 22 FY 21

June 2022 May 2022 12 months to 12 months to

30 Jun 2022 30 Jun 2021

Diamonds sold 569,496 635,806 3,536,371 3,960,475

(carats)

Sales (US$ million) 93.0 86.1 584.5 406.9

Like-for-like rough diamond prices increased by 7.7% on Tender 5 (announced on

3 May 2022) while full year like-for-like prices increased 41.5% compared to FY

2021, with the balance of price movement attributable to product mix. Strong

demand, with resultant price increases, was evident across all size and quality

categories.

No Exceptional Stones were sold during this tender cycle. During FY 2022,

revenue from Exceptional Stones totalled US$89.0 million (US$75.2 million from

Cullinan Mine and US$13.8 million from Williamson) compared to US$62.0 million

Exceptional Stone revenue (all from Cullinan Mine) in the previous year. Petra

classifies 'Exceptional Stones' as rough diamonds that sell for US$5 million or

more each.

Mine by mine prices for Tender 6 are set out in the table below:

US$/carat Tender 6 Tender 5 FY 22 FY 21

June 2022 May 2022 12 months to 12 months to

30 Jun 2022 30 Jun 2021

Cullinan Mine1 151 111 169 111

Finsch 140 122 118 77

Koffiefontein 614 431 581 419

Williamson1 272 341 384 150

Note 1: Prices for both Cullinan Mine and the Williamson mine include proceeds

from the sale of Exceptional Stones, noting that there were a number of high

value Exceptional Stones from the Cullinan Mine and a high value Exceptional

Stone at the Williamson mine in FY 2022.

The Company will provide further details of operating results when it releases

its FY 2022 Trading Update on 19 July 2022.

Tender 1 of FY 2023 is expected to take place August/September 2022.

Ends

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494 8203

Jill Sherratt

investorrelations@petradiamonds.com

Patrick Pittaway

Julia Stone

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Group's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 230 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Group aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Group's US$336.7 million notes due in 2026

are listed on the Irish Stock Exchange and admitted to trading on the Global

Exchange Market. For more information, visit www.petradiamonds.com.

END

(END) Dow Jones Newswires

June 30, 2022 05:20 ET (09:20 GMT)

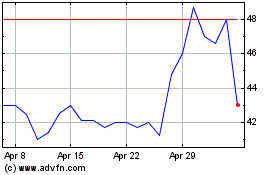

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

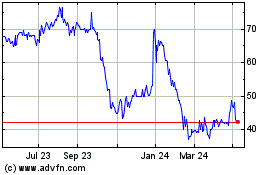

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024