Interim Results -8-

September 10 2009 - 2:00AM

UK Regulatory

| Adjusted earnings, being | 805 | 575 | 1,434 |

| profit after tax, before | | | |

| goodwill impairment and | | | |

| intangible amortisation | | | |

| and one-off professional | | | |

| costs | | | |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| Weighted average number | 10,798 | 12,168 | 11,832 |

| of shares | | | |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| Basic and diluted EPS | 6.3p | 3.5p | 9.2p |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| Adjusted EPS | 7.5p | 4.7p | 12.1p |

+---------------------------+--------------+--------------+--------------+

4. Dividends

+---------------------------+--------------+--------------+--------------+

| | Six months | Six months | Year ended |

| | to | to | |

+---------------------------+--------------+--------------+--------------+

| | 30 June 2009 | 30 June 2008 | 31 Dec 2008 |

+---------------------------+--------------+--------------+--------------+

| | GBP'000 | GBP'000 | GBP'000 |

+---------------------------+--------------+--------------+--------------+

| | (unaudited) | (unaudited) | (audited) |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| Dividends paid | | | |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| Final 2007, paid 30 April | | | |

| 2008 | | | |

+---------------------------+--------------+--------------+--------------+

| - 3.0p per share | - | 364 | 364 |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| Interim 2008, paid 10 | | | |

| October 2008 | | | |

+---------------------------+--------------+--------------+--------------+

| - 2.5p per share | - | - | 300 |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| Final 2008, paid 29 April | | | |

| 2009 | | | |

+---------------------------+--------------+--------------+--------------+

| - 3.1p per share | 334 | - | - |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| | | | |

+---------------------------+--------------+--------------+--------------+

| | 334 | 364 | 664 |

+---------------------------+--------------+--------------+--------------+

The directors propose to pay an interim dividend of 3.1p per share on 2 October

2009 to shareholders on the register at 18 September 2009.

Independent review report to Maintel Holdings Plc

Introduction

We have been engaged by the company to review the financial information in the

interim results for the six months ended 30 June 2009 which comprises the

consolidated statement of comprehensive income, the consolidated statement of

financial position, the consolidated statement of changes in equity, the

consolidated cash flow statement, and related explanatory notes.

We have read the other information contained in the interim results and

considered whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of financial

statements.

Directors' responsibilities

The interim results, including the financial information contained therein, are

the responsibility of and have been approved by the directors. The directors are

responsible for preparing the interim results in accordance with the rules of

the London Stock Exchange for companies trading securities on the Alternative

Investment Market which require that the interim results be presented and

prepared in a form consistent with that which will be adopted in the company's

annual accounts having regard to the accounting standards applicable to such

annual accounts.

Our responsibility

Our responsibility is to express to the company a conclusion on the condensed

set of financial statements in the interim results based on our review.

Our report has been prepared in accordance with the terms of our engagement to

assist the company in meeting the requirements of the rules of the London Stock

Exchange for companies trading securities on the Alternative Investment Market

and for no other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by virtue of and for

the purpose of our terms of engagement or has been expressly authorised to do so

by our prior written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity", issued by the Auditing

Practices Board for use in the United Kingdom. A review of interim financial

information consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK and Ireland) and

consequently does not enable us to obtain assurance that we would become aware

of all significant matters that might be identified in an audit. Accordingly, we

do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe

that the financial information in the interim results for the six months ended

30 June 2009 is not prepared, in all material respects, in accordance with the

rules of the London Stock Exchange for companies trading securities on the

Alternative Investment Market.

BDO STOY HAYWARD LLP

Chartered Accountants and Registered Auditors

London

9 September 2009

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EKLFBKKBEBBB

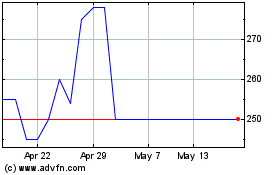

Maintel (LSE:MAI)

Historical Stock Chart

From Jun 2024 to Jul 2024

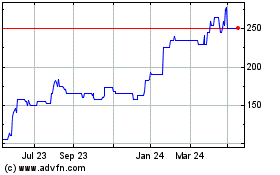

Maintel (LSE:MAI)

Historical Stock Chart

From Jul 2023 to Jul 2024