TIDMLPA

RNS Number : 3681Q

LPA Group PLC

28 June 2022

LPA GROUP PLC

Interim unaudited results for the six months ended 31 March

2022

LPA Group plc ("LPA" or the "Group"), the high reliability LED

lighting, electronic and electro-mechanical system designer and

manufacturer , announces its results for the six months to 31 March

2022.

KEY POINTS

6 months 6 months

to 31 March to 31 March

2022 2021

unaudited unaudited

Order Book GBP30.8m GBP26.2m

--------------------------- ------------- -------------

Order Entry GBP12.1m GBP13.0m

--------------------------- ------------- -------------

Revenue GBP8.6m GBP9.3m

--------------------------- ------------- -------------

Underlying (Loss)/Profit* GBP(0.6m) GBP0.2m

--------------------------- ------------- -------------

(Loss)/Profit before Tax GBP(0.6m) GBP0.1m

--------------------------- ------------- -------------

(Loss)/Earnings Per Share (2.84)p 1.67p

--------------------------- ------------- -------------

Net Debt at period end GBP2.5m GBP1.9m

--------------------------- ------------- -------------

(*) Operating (loss)/profit before Share Based Payments and

Exceptional Costs

Paul Curtis, CEO, commented:

"As anticipated our results for the first half are loss making

as we continued to see customer driven delays across several of our

major projects.

Our order book remains resilient, and we are beginning to

achieve better clarity in schedules and future delivery

requirements from our customers which will result in a stronger

second half.

I have concluded a strategy and in-depth detailed business

review and we are working hard to implement this to diversify our

markets, develop products and strengthen our workforce to support

our aspirations for future growth."

Paul Curtis

CEO

27 June 2022

Enquiries: www.lpa-group.com Tel:

---------------------------------------- ------------------- -------------

LPA Group Plc

Robert B Horvath Chairman 01799 512844

Paul Curtis CEO 01799 512858

Chris Buckenham CFO 01799 512859

020 7220

finnCap NOMAD and Broker 0500

Ed Frisby / Abigail Kelly / Tim Harper

(Corporate Finance)

Tim Redfern / Charlotte Sutcliffe

(ECM)

About LPA

LPA Group plc (AIM: LPA) is a market leading designer,

manufacturer and supplier of high reliability LED lighting,

electronic and electro-mechanical systems, and a distributor of

engineered components.

Focused on transport (rail and aviation), defence,

infrastructure and industrial markets and supplying into hostile

and challenging environments, LPA is known for engineering

solutions to improve product reliability, reducing maintenance and

life cycle costs.

The Group has three sites across the UK, selling to customers in

the UK and overseas. Two of these are design and manufacturing

sites: LPA Connection Systems - electro-mechanical systems for

rail, aviation and industrial, and LPA Lighting Systems - LED

lighting and electronic systems for rail and infrastructure. The

third site is LPA Channel Electric - a value added distributer of

engineered components for rail, aerospace and defence.

With over 160 years of UK design and manufacture, and with

origins in the first ever light installed in 'Electric Avenue',

Brixton; innovation is core to LPA and to the products and services

supplied to our customers worldwide.

For more information visit www.lpa-group.com .

Regulatory Information

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

CHAIRMAN'S STATEMENT

As I stated in my FY21 annual Chairman's Statement the

continuing trend of customer delay in our project-based work puts a

strain on our ability to fully recover our overhead and so it has

continued in the first half of the year which has been tough. I

also commented that we had a strong order book and that the future

workload gave the management team a great deal of security from

which to reshape the business plan and the management structure to

look for wider opportunities in the electronic and electrical

equipment market place. This also remains true. We rely on our

customers "scheduling" to draw down on our products as part of

their overall build and with over 65% of our sales this period

being subject to scheduling, we continue to suffer from their build

programme delays.

We are seeing a pickup in the second half for the aviation and

rail industry projects, but supply chain issues will continue to

frustrate our ability to get orders 'out of the door'. At the

present time the macroeconomic factors (notably the impact of

higher wages and inflation) are generally challenging but we

believe that in our customer base we have a strong advantage in

having local manufacturing facilities able to deliver quality

products. We have won further work and we have not lost any of our

major projects.

Sales in the first half were GBP8,625k (2021: GBP9,296k) with a

consequent operating loss of GBP587k (2021: operating profit of

GBP134k). This has resulted in a loss per share of 2.84p (2021:

basic earnings per share of 1.67p). Gearing is 17.6% (2021: 14.8%),

order entry GBP12.1m (2021: 13.0m) with a closing order book up

17.8% at a record GBP30.8m (2021: GBP26.2m). The Board considers it

prudent to continue the pause in dividend payments, however this

remains under constant review.

Our in-depth detailed business review is complete. We will

rebalance the business between project work and routine products

and diversify into different markets to reduce our dependency on

rail. We have actively looked at business opportunities and will

continue to do so in support of the strategy. We are well on our

way with our investment in people and our manufacturing sites

productivity initiatives which include additional certifications

across these sites and facilities.

We have some great people in the Group, and we have plans to

bring in more, particularly across our sales teams and to enhance

our design capabilities. We are delighted to have recruited Andrea

Hector as the new Managing Director for our distribution business

and are actively recruiting a Managing Director for our

electro-mechanical systems business.

As my predecessor stated concern for Environment, Social

responsibility, and Governance ("ESG") is not new to us. Our logo

and strapline 'long life reliability does not cost the earth'

continues to demonstrate our commitment to producing quality,

reliable, long life products capable of delivering many years of

service. Our LED Lighting, which was the first to be installed in a

major worldwide passenger train fleet ten years ago, was designed

to last up to twice as long as the competition. We are actively

looking for apprentices and to engage with the science departments

of local schools and we have continued to organise charitable

events to support local and national organisations. Our 'Guiding

Light Principle', published on our website and in our Annual Report

sets out our commitment as does our adoption of the QCA Corporate

Governance Code. We have few major energy consuming activities and

most, if not all, of the byproducts of our operations are recycled.

We design out waste. We are actively working to reduce our

environmental footprint.

Robert B Horvath

Chairman

27 June 2022

Chief Executive's Report

The last 12 months' trading environment has been unprecedented

in recent history. Our delight in the success of winning a number

of large scale and high-profile projects has been somewhat dampened

by the global delays and rescheduling by our transportation

customers. I have worked hard on the Group's strategy and detailed

business review over the past six months and implementation is now

underway.

Looking forward, in our drive for growth and to reduce our

dependency on the Rail market, we previously reported on the launch

of our new Plane Power connector range. I am happy to report that

this is trading as expected and continues to be well received by

our customer base. Following on from this we launched our new Plane

Power Crocodile cable carrier system in the period and, again, I am

pleased to report our first UK order and its selection for use at

the new and prestigious Western Sydney airport being built in

Australia. These wins demonstrate that the work being undertaken in

product development and new distribution channels is the correct

strategy and starting to show returns. Our engineering department

continues to evaluate new initiatives that could further enhance

our Plane Power offering and our business model is being

restructured and resourced to ensure the continuous development of

products to feed into our newly developed sales channels.

During the period we also started the process of obtaining both

the IRIS and AS9100 quality approvals at our electro-mechanical

systems site. It is envisaged that these will be obtained by the

end of the calendar year and will reinforce our credentials for

major rail customers at both home and abroad. They will also enable

us to offer our leading engineering capability to the Aviation and

Defence markets, where our distribution business enjoys an

excellent customer base and reputation.

Our distribution business continues to pursue new franchise

opportunities with a view to not only strengthening our existing

markets but also to move into more industrial niches, such as the

Energy sector. This is a key area of development for the coming

years and, with our newly appointed MD in place for this site, we

are confident in the drive and focus that this strategy will now

receive and the resulting success.

Our lighting and electronic systems business has finished the

heavy load of the design engineering stage of many of its major

projects and, coupled with changes to working methods and

resources, is now poised to better support our push for further

expansion into new customers and products. The recent employment of

a German-based sales resource in support of the DACH rail market is

a key appointment in support of this strategy. This, coupled with

further planned appointments and expansion of our global

distribution network, benefiting from our talented engineering

expertise, shall ensure realisation of the further growth

aspirations of the business.

The development of the Group into an engineering leader covering

multiple markets is a medium-term strategy but one for which we are

well placed and resourced. The changes to working methods, systems

and people have been intense over the last year but should lessen

as we move forward. Our record order book is testament to our

products and the people we have, supporting us in our development

plans, be it organic or acquisition. We remain prudent but

confident and excited in the future for the Group.

Paul Curtis

CEO

27 June 2022

CONSOLIDATED INCOME STATEMENT

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 22 21 21

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Revenue Note 4 8,625 9,296 18,265

Cost of Sales (7,206) (7,185) (14,558)

----------- ----------- ---------

Gross Profit 1,419 2,111 3,707

Distribution Costs (714) (758) (1,562)

Administrative Expenses (1,292) (1,330) (2,710)

Other Operating Income - 111 217

Underlying Operating (Loss)/Profit (568) 154 (274)

Share Based Payments (8) (11) (28)

Exceptional Costs (11) (9) (46)

---------------------------------------- ----------- ----------- ---------

Operating (Loss)/Profit (587) 134 (348)

Finance Income 40 11 47

Finance Costs (42) (48) (86)

(Loss)/Profit before Tax (589) 97 (387)

Taxation 215 109 353

(Loss)/Profit for the Period (374) 206 (34)

=========== =========== =========

Attributable to:

- Equity holders of the parent (374) 206 (34)

=========== =========== =========

(Loss)/Earnings per share Note

5

- Basic (2.84)p 1.67p (0.27)p

- Diluted (2.84)p 1.62p (0.27)p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 22 21 21

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

(Loss)/Profit for the Period (374) 206 (34)

----------- ----------- ---------

Other comprehensive income

Items that will not be reclassified

to profit or loss:

Actuarial Gain on Pension Scheme 512 399 1,849

Tax on Actuarial Gain (129) (86) (601)

Other Comprehensive Income Net

of Tax 383 313 1,248

----------- ----------- ---------

Total Comprehensive Income

for the Period 9 519 1,214

=========== =========== =========

CONSOLIDATED BALANCE SHEET

As at As at As at

31 Mar 22 31 Mar 30 Sept

21 21

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Non-Current Assets

Intangible Assets 1,452 1,409 1,405

Tangible Assets 5,156 5,350 5,188

Right of Use Assets 1,259 1,318 1,245

Retirement Benefits 4,494 2,424 3,943

12,361 10,501 11,781

----------- ----------- ---------

Current Assets

Inventories 4,780 4,069 4,702

Trade and Other Receivables 3,755 4,369 4,111

Current Tax Receivable 218 77 55

Cash and Cash Equivalents 501 1,285 1,358

----------- ----------- ---------

9,254 9,800 10,226

----------- ----------- ---------

Total Assets 21,615 20,301 22,007

Current Liabilities

Bank Loan (189) (189) (191)

Lease Liabilities (358) (374) (323)

Trade and Other Payables (3,698) (3,541) (4,180)

(4,245) (4,104) (4,694)

----------- ----------- ---------

Non-Current Liabilities

Bank Loan (2,030) (2,220) (2,123)

Lease Liabilities (394) (449) (354)

Deferred Tax Liabilities (799) (415) (723)

(3,223) (3,084) (3,200)

----------- ----------- ---------

Total Liabilities (7,468) (7,188) (7,894)

Net Assets 14,147 13,113 14,113

=========== =========== =========

Equity

Share Capital 1,348 1,276 1,345

Investment in Own Shares (324) (324) (324)

Share Premium Account 943 730 929

Share-Based Payment Reserve 64 129 60

Merger Reserve 230 230 230

Retained Earnings 11,886 11,072 11,873

Equity Attributable to Shareholders

of the Parent 14,147 13,113 14,113

=========== =========== =========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 22 21 21

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Opening equity 14,113 12,551 12,551

----------- ----------- ---------

(Loss)/Profit for the period (374) 206 (34)

Actuarial gain on pension scheme

(net of tax) 383 313 1,248

----------- ----------- ---------

Total comprehensive income

for the period 9 519 1,214

----------- ----------- ---------

Transactions with owners:

Proceeds from issue of shares 17 32 300

Share-based payments 8 11 28

Tax on share-based payments - - 20

----------- ----------- ---------

Closing equity 14,147 13,113 14,113

=========== =========== =========

CONSOLIDATED CASH FLOW STATEMENT

6 months 6 months

to to Year to

31 Mar 22 31 Mar 30 Sept

21 21

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

(Loss)/Profit Before Tax (589) 97 (387)

Finance Costs 42 48 86

Finance Income (40) (11) (47)

Operating (Loss)/Profit (587) 134 (348)

Adjustments for:

Amortisation of Intangible Assets 41 47 111

Depreciation of Tangible Assets 246 256 484

Depreciation of Right of Use

Assets 114 138 273

(Gain) on disposal of Tangible

Assets - (5) -

Loss on disposal of Intangible

Assets - - 53

Equity settled Share Based Payments 8 11 28

Operating cash flow before

movements in

working capital (178) 581 601

Movements in Working Capital:

(Increase) in Inventories (78) (101) (734)

Decrease/(Increase) in Trade

and Other Receivables 356 1,060 1,336

(Decrease)/Increase in Trade

and Other Payables (479) (627) (8)

Cash (outflow)/generated from

operations (379) 913 1,195

Income Taxes Received - - 77

Defined Benefit Pension Contributions

less Settlements - (50) (83)

Net cash (outflow)/inflow from

operating activities (379) 863 1,189

----------- ----------- ---------

Purchase of Software - (16) (16)

Purchase of Property, Plant

& Equipment (67) (40) (100)

Proceeds from Sale of Property,

Plant & Equipment - 5 -

Expenditure on Capitalised Development

Costs (89) (52) (167)

Net cash outflow in investing

activities (156) (103) (283)

----------- ----------- ---------

Repayment of Bank Loan (94) (92) (187)

Principal elements of Lease

Liabilities (203) (212) (420)

Interest Paid (42) (48) (86)

Proceeds from Issue of Share

Capital 17 32 300

Net cash outflow in financing

activities (322) (320) (393)

----------- ----------- ---------

Net (decrease)/increase in Cash

and Cash Equivalents (857) 440 513

Cash and Cash Equivalents at

start of the period 1,358 845 845

Cash and Cash Equivalents at

end of the Period 501 1,285 1,358

=========== =========== =========

Reconciliation of cash and

cash equivalents

Cash and Cash Equivalents in

Current Assets 501 1,285 1,358

=========== =========== =========

NET DEBT

An analysis of the change in net debt is shown below:

Bank Lease Cash and

Loan Liabilities Cash Equivalents Net Debt

GBP000 GBP000 GBP000 GBP000

At 1 October 2021 2,313 677 (1,357) 1,633

New Lease

Obligations &

Modifications - -26 278 - 278

Interest Costs 26 16 - 42

Repayment of

Borrowings/Lease

Liabilities (120) (219) 339 -

Other Cash

Absorbed - - 517 517

2,219

At 31 March 2022 2,4219 752 (501) 2,470

================== ========================== ========================== ======================

Notes to the financial statements

----------------------------------

Note 1 BASIS OF PREPARATION

These interim financial statements are for the six months ended

31 March 2022. They do not include all the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Group for the

year ended 30 September 2021.

These interim financial statements have been prepared in

accordance with the requirements of UK adopted International

Accounting Standards . These financial statements have been

prepared under the historical cost convention with the exception of

certain items which are measured at fair value.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 30 September 2021. The

accounting policies have been applied consistently throughout the

Group for the purposes of preparation of these interim financial

statements and are expected to be followed throughout the year

ending 30 September 2022.

Note 2 Summary of Significant Accounting Policies

Use of judgements and estimates

In preparing these interim financial statements management is

required to make judgements on the application of the Group's

accounting policies and make estimates about the future. Actual

results may differ from these assumptions. The significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those described in the consolidated financial statements

for the year ended 30 September 2021.

New standards and interpretation adopted by the Group

There has been no impact of new standards and interpretations

adopted in the period.

Note 3 GOING CONCERN

The Group's business activities and the factors likely to affect

its future performance together with the Group's treasury policy,

its approach to the management of financial risk, and its exposure

to liquidity and credit risks are outlined fully in the Annual

Report & Accounts 2021 which details macro-economic impacts

including those related to Covid-19 and supply chain

disruption.

These economic uncertainties however continue to make

forecasting more difficult. Significant rail project delays have

continued in the period that could not have been foreseen, new

disruptive factors including the Russian invasion of Ukraine

creating heightened inflationary pressures, whilst the Group has no

trade directly with either Country. The Directors have assessed

these and sensitised forecasts accordingly.

In assessing going concern the Directors note that whilst

current economic conditions continue to create uncertainty, with a

particular focus on the supply chain and inflationary pressures,

the Group: (i) is expected to return to profitability through the

second half of its 2022 financial year and continue to trade

profitably in the near term; (ii) has in place adequate working

capital facilities for its forecast needs; (iii) has a strong

current order book with significant further opportunities in its

market place; and (iv) has proven adaptable in past periods of

adversity over many years. Therefore, the Directors believe that it

is well placed to manage its business risks successfully.

Having assessed all aspects of the business and the likely

effectiveness of mitigating actions that the Directors would

consider undertaking or have undertaken, the going concern basis

has been adopted in preparing these interim financial statements.

The continued pause on the Group's dividend policy and voluntary

contributions to the defined benefit pension fund have both

assisted ensure positive cash funds at 31 March 2022.

In reaching this conclusion, the Directors, after making

enquiries, inclusive but not limited to updated forecasts and

expectations, liabilities and risks and ongoing support from the

Group's bank, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future.

Note 4 Operating Segments

All of the Group's operations and activities are based in, and

its assets located in, the United Kingdom. For management purposes

the Group comprises three product groups (in accordance with IFRS

8) - electro-mechanical systems, engineered component distribution

and lighting & electronic systems (which collectively design,

manufacture and market industrial electrical and electronic

products) - less centre costs, which operate across three market

segments - Rail; Aerospace & Defence, Industrial & Other.

It is on this basis that the Board of Directors assess Group

performance. The split is as follows:

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

22 21 21

Unaudited Unaudited Audited

Electro-mechanical systems 2,972 4,520 7,761

Engineered Component Distribution 1,663 1,604 3,410

Lighting & Electronic systems 3,990 3,172 7,094

Operational Revenue 8,625 9,296 18,265

========== ========== ========

All revenue originates in the UK. An analysis by market segments

and geographical markets is given below:

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

22 21 21

Unaudited Unaudited Audited

Rail 70% 77% 77%

Aerospace & Defence 13% 7% 10%

Industrial & Other 17% 16% 13%

100% 100% 100%

========== ========== ========

United Kingdom 70% 70% 69%

Rest of Europe 20% 18% 19%

Rest of the World 10% 12% 12%

100% 100% 100%

===== ===== =====

Note 5 (Loss)/EARNINGS PER SHARE

The calculations of earnings per share are based upon the

(loss)/profit after tax attributable to ordinary equity

shareholders and the weighted average number of ordinary shares in

issue during the period, less investment in own shares.

Details are as follows:

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

22 21 21

Unaudited Unaudited Audited

(Loss)/Profit for the period

- GBP000 (374) 206 (34)

---------- ---------- --------

Weighted average number of ordinary

shares in issue during the period

(million) 13.161 13.378 12.590

Dilutive effect of share options - 0.392 -

(million)

Number of shares for diluted

earnings per share (million) 13.161 13.770 12.590

========== ========== ========

Basic (loss)/earnings per share (2.84)p 1.67p (0.27)p

Diluted (loss)/earnings per share (2.84)p 1.62p (0.27)p

Basic and diluted earnings per share are based on the weighted

average number of ordinary shares and share options in issue during

the period. For the period ended 31 March 2022 and year ended 30

September 2021, the basic and diluted loss per share are equal

since where a loss is incurred the effect of outstanding share

options and warrants is considered anti-dilutive and is ignored for

the purpose of the loss per share calculation.

Note 6 INFORMATION

LPA Group Plc is the Group's ultimate parent company. It is

incorporated in England and Wales and domiciled in the UK, Company

Number 686429. The address of LPA Group Plc's registered office,

which is also its principal place of business, is Light & Power

House, Shire Hill, Saffron Walden, CB11 3AQ, UK. LPA Group Plc's

shares are quoted on the AIM market of the London Stock

Exchange.

LPA Group Plc's consolidated interim financial statements are

presented in Pounds Sterling (GBP000), which is also the functional

currency of the parent company. These interim financial statements

have been approved for issue by the Board of Directors on 27 June

2022. The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 September 2021 have been filed with the Registrar

of Companies. The auditor's report on those financial statements

was unmodified and did not contain statements under Section 498(2)

or Section 498(3) of the Companies Act 2006.

Copies of this Interim Report are being sent to shareholders who

have requested to receive a hard copy. Shareholders are encouraged

to access copies which are available on the Company's website (

www.lpa-group.com ). Interim Reports will no longer be published as

the Company continues to focus on the reduction of waste and carbon

footprint. A printout of the Interim Report will also be available

by request from the Company's Registrar, or the Company's

registered office, address as above or by email:

investors@lpa-group.com .

Shareholders are encouraged to visit our website where useful

links and assistance have been provided including our Registrars to

assist utilisation of digital channels and receipt of future

dividends and our Brokers who provide equity research.

Note 7 COMPANY INFORMATION

Company contacts

Directors Robert B Horvath Independent Chairman

Paul Curtis Chief Executive Officer

Chris Buckenham Chief Financial Officer

Andrew Jenner Senior Independent Director

Gordon Wakeford Independent Director

Secretary Chris Buckenham

Registered Light & Power House, Shire Hill, Saffron Walden,

Office CB11 3AQ, UK

Registered

Number 00686429

Website www.lpa-group.com

Nominated finnCap

Adviser & Broker 1 Bartholomew Close

London

EC1A 7BL

Auditors RSM UK Audit LLP Bankers Barclays Bank Plc

2nd Floor, North Wing Abacus House

East Castle Park, Castle

City House, Hills Hill

Road Cambridge

Cambridge CB3 0AN

CB2 1RE

Registrars Link Group Solicitors Eversheds Sutherland

10(th) Floor (International) LLP

Central Square 115 Colmore Row

29 Wellington Street Birmingham

Leeds LS1 4DL B3 3AL

Trading subsidiaries

LPA Group Plc headquarters is situated at, and all LPA Group

entities have their registered address at, Light & Power House,

Shire Hill, Saffron Walden, CB11 3AQ, UK .

Trading addresses:

LPA Group entities operate as distinct businesses through

appointed Executive Teams.

Light & Power House, Shire Hill, Saffron Walden, CB11 3AQ,

UK

LPA Industries Ltd / Haswell Engineers Ltd - trading as LPA

Connection Systems

LPA House, Ripley Drive, Normanton, West Yorkshire, WF6 1QT,

UK

Excil Electronics Ltd - trading as LPA Lighting Systems

Bath Road, Thatcham, Berkshire, RG18 3ST, UK

Channel Electric Equipment Ltd - trading as LPA Channel

Electric

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAXKXAFAAEFA

(END) Dow Jones Newswires

June 28, 2022 02:00 ET (06:00 GMT)

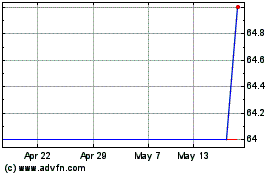

Lpa (LSE:LPA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lpa (LSE:LPA)

Historical Stock Chart

From Dec 2023 to Dec 2024