Hunting PLC (LSE: HTG), the precision engineering group, today

issues a year-end trading update ahead of announcing its 2023 Final

Results on Thursday 29 February 2024.

All financial data noted below remains subject to audit.

Highlights

- 2023 trading and financial outturn in-line with previous

guidance and market expectations, with EBITDA in the range of

$96-$100m. Group revenue is expected to be in the range of

$925-$930m.

- EBITDA margin of c.10.5% has been delivered during the year, up

from 7% in 2022, and on-track to meet the 2025 target of c.14-16%

as guided at the Capital Markets Day in September 2023.

- Hunting’s sales order book continues to improve following

further material order wins within the Subsea and OCTG

(Accessories) product groups. The Group’s total sales order book

now stands at c.$575m, up 12% from the end of Q3 2023 and up 21%

from the 2022 year-end.

- Strong cash generation delivered in Q4 2023, with total cash

and bank / (borrowings)1 at year-end expected to be $nil, in line

with the guidance provided in October 2023.

- Disposal of residual oil and gas production assets completed in

Q4 2023, to further streamline the Group’s operating

activities.

- Launch of the Hunting 2030 Strategy in September 2023.

- 2024 EBITDA expectations unchanged at c.$125-$135m, driven by

the strong order book noted above.

Jim Johnson, Chief Executive of Hunting, commented:

“I am really proud of the performance of the team during 2023,

as they have delivered another year of strong revenue growth for

the Group, with EBITDA nearly doubling compared to 2022 as industry

activity accelerated during the year.

“The Group’s diverse product lines, including energy-related and

non-oil and gas have enabled Hunting to deliver solid top line

growth in the year, with sales into South America being strong as

drilling in Guyana and Brazil increased, while activity across Asia

Pacific accelerated as drilling momentum in India and the Middle

East improved.

“2024 will see another year of EBITDA growth underpinned by our

strong sales order book, which is now up 21% compared to a year

ago.”

Trading Statement

Trading in Q4 2023 has remained in line with management’s

expectations with EBITDA anticipated to be in the range of

$96-$100m for the full year.

The Group’s sales order book has continued to strengthen through

the quarter and now approaches a record level of c.$575m, following

a further large order win for titanium stress joints and OCTG

Accessories for clients operating in the Black Sea and South

America respectively.

The Group’s balance sheet remains strong, with total cash and

bank / (borrowings)1 of c.$nil at year-end, reflecting the expected

strong collections in the final quarter of 2023.

Product Lines

Sales within the Group’s OCTG product lines, including Premium

Connections and Accessories, are likely to be up c.53% compared to

the $259m reported in 2022. This has been led by strong activity in

Asia Pacific and South America, supported by good progress within

North America.

Perforating Systems reports a c.3-4% decrease in revenue

compared to 2022 in part due to the c.20% decline in the North

American rig count reported in the year. The segment has delivered

record international sales in the year as North American well

completion techniques are adopted globally. This international

growth supports the Company’s belief in its ability to deliver its

strategic ambitions laid out at the Capital Markets Day in

September 2023.

Hunting’s Subsea product lines have reported strong year-on-year

growth, with revenue up c.40% in 2023 from $69m in 2022. The Spring

business has secured a number of large orders for its titanium

stress joint technology in the year in Guyana as well as the Black

Sea, the latter being a new market for the Group which was awarded

in mid-October.

The Group’s Advanced Manufacturing businesses also report strong

growth in the year, with revenue up c.45% in 2023 from $75m in

2022. The Dearborn business unit has reported good progress in the

development of non-oil and gas sales, while supply chain

constraints reported within the Electronics business unit have

continued to ease throughout the year which has supported continued

revenue growth.

Other Manufacturing, which includes the Group’s well testing and

trenchless businesses, has delivered revenue growth of c.5% in the

year, up from $71m in 2022.

The overall share of non-oil and gas revenue is expected to

increase to c.8% of total revenue, up from 6.5% in 2022.

Operating Segments

The North America operating segment has delivered a strong year

of EBITDA growth, as demand for Premium Connections and Accessories

accelerated throughout the year. As noted above, sales into South

America, driven particularly by the US Manufacturing business unit,

have accelerated as drilling and development activity in Brazil and

Guyana continued to grow strongly. The segment’s OCTG businesses

have also benefited from a strong performance in Canada, as the rig

count has remained steady throughout the year. Within Advanced

Manufacturing, the Electronics and Dearborn businesses have

delivered good revenue and EBITDA growth in the year, with

Dearborn’s financial performance improving strongly from Q2 2023

onwards. As noted above, during Q4 2023, the segment completed the

sale of Hunting’s residual oil and gas production assets located in

the US. This disposal further streamlines the Group’s

activities.

The Hunting Titan operating segment has reported stable results

in the year, despite the declining US onshore rig count throughout

the year. The segment has continued to commercialise its H-3

Perforating System™ and in the second half of 2023 launched the H-4

Self Oriented Perforating System™, which is seeing good customer

acceptance.

The Subsea Technologies operating segment was formed on 1

January 2023 and, during the year, has benefited from the increased

investment in international offshore drilling activity. The

Stafford business unit has delivered a strong performance in the

year, with revenue in October and November reaching record levels.

The Spring business unit has continued to secure new orders for its

titanium and steel stress joints, primarily in Guyana but also in

the Black Sea. Enpro Subsea’s business unit has seen an increase in

momentum since H1 2023 following receipt of a number of major

orders in H2, which will drive performance through 2024.

The EMEA operating segment has reported an improvement in

revenue in the year supported by the Tubacex contract and reduced

its operating losses in the year, compared to the prior year.

The Asia Pacific operating segment reported a strong increase in

revenue and EBITDA in the year driven by the CNOOC contract,

followed by the Cairn Oil and Gas (Vedanta) contract, which was

commenced in the year.

2024 Trading Expectations

Given the record sales order book noted above, the Board

believes that 2024 will see further growth to EBITDA with the

projected outcome in line with current market expectations of

$125-$135m.

Notes to Editors:

About Hunting PLC

Hunting is a global engineering group that provides

precision-engineered equipment and premium services, which add

value for our customers. Established in 1874, it is a premium

listed public company traded on the London Stock Exchange. The

Company maintains a corporate office in Houston and is

headquartered in London. As well as the United Kingdom, the Company

has operations in China, Indonesia, Mexico, Netherlands, Norway,

Saudi Arabia, Singapore, United Arab Emirates and the United States

of America.

The Group reports in US dollars across five operating segments:

Hunting Titan; North America; Subsea Technologies; Europe, Middle

East and Africa (“EMEA”) and Asia Pacific.

Hunting PLC’s Legal Entity Identifier is

2138008S5FL78ITZRN66.

Note 1 -Total cash and bank / (borrowings) comprises cash and

cash equivalents less bank debt and excludes the long-term

shareholder loan of $3.9 million and IFRS 16 lease liabilities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240109984252/en/

Hunting PLC Jim Johnson, Chief Executive Bruce Ferguson,

Finance Director Tel: +44 (0) 20 7321 0123

Buchanan Ben Romney Barry Archer Tel: +44 (0) 20 7466

5000

or

lon.IR@hunting-intl.com

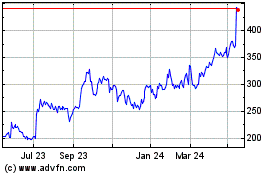

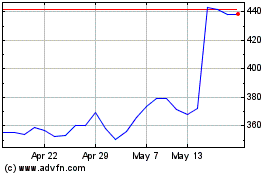

Hunting (LSE:HTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hunting (LSE:HTG)

Historical Stock Chart

From Nov 2023 to Nov 2024