TIDMGRP

RNS Number : 3127G

Greencoat Renewables PLC

01 March 2018

Greencoat Renewables PLC

Final results announcement and declaration of maiden

dividend

ISE: GRP LSE: GRP

Dublin, 1 March, 2018 | Greencoat Renewables PLC ("Greencoat

Renewables" or the "Company") the sector-focused renewable

infrastructure company, today announces its final results for the

period from 15 February 2017 to 31 December 2017 as well as

declaring its maiden dividend.

Financial Highlights

-- Issuance of 270 million ordinary shares in an oversubscribed IPO and subsequent listing on the Irish Stock

Exchange's Enterprise Securities Market and the London Stock Exchange's Alternative Investments Market in July.

-- Placing of a new EUR250 million revolving credit facility with a syndicate of five domestic and international

banks, delivering the capital structure to fund future acquisitions.

-- Drawdown of EUR71 million in period to fully remove the existing project finance debt facility (equivalent to 21%

of GAV)

-- Net operating cash flow of EUR11.8 million for the period, from acquisition to 31 December 2017.

Portfolio Highlights

-- Seed portfolio includes ownership of two operating onshore wind farms comprising 136.7MW of capacity.

-- Assets generated 182.3GWh of electricity, 4% below budget for the period; due to lower than average wind speeds

experienced during the period.

-- Announced in December 2017 intention to acquire 36.3MW Dromadda More wind farm from Impax Asset Management for

EUR88.4 million.

-- Post period end, announced in February 2018 an intention to acquire 9.2MW Lisdowney wind farm for EUR22.5

million.

-- Acquisition pipeline remains attractive with GRP well positioned to consolidate further opportunities in the

Irish onshore wind market during the course of 2018.

Dividend and Shareholder Returns

-- NAV per share decreased from 98.0 cent per share at IPO to 96.6 cent per share at 31 December 2017, driven by a

decline in power price forecasts beyond the REFIT period as well as lowered short-term inflation forecasts.

-- Maiden dividend of 2.61 cent per share with respect to the period from IPO to the 31 December 2017 in line with

stated target dividend policy, with an ex-dividend date of 8 March 2018, record date of 9 March 2018 and payment

date of 29 March 2018.

-- The Company is targeting a dividend of 6.0 cent per share for the 2018, to be paid in equal quarterly instalments

commencing May 2018.

Key Metrics | At 31 December 2017

Market capitalisation EUR288.9 million

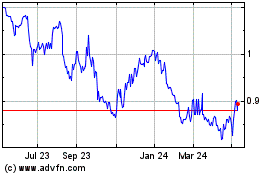

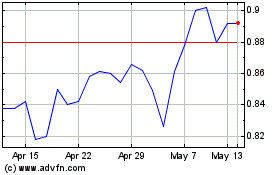

Share price 107.0 cent

Expected dividends with respect to the period EUR7.1 million

Expected dividends with respect to the period per share 2.61 cent

GAV EUR332.1 million

NAV EUR260.9 million

NAV per share 96.6 cent

Ronan Murphy, Chairman of Greencoat Renewables PLC, said:

"I am delighted with the Company's achievements in its first

year and very pleased to announce our maiden dividend of 2.61c. The

outlook for the Company is positive, we have a high-quality

operating portfolio, a capital structure aligned for growth

opportunities, and a strong position in an attractive secondary

market for wind assets".

Bertrand Gautier, Partner of Greencoat Capital, the Investment

Manager, said:

"We are very pleased to have achieved a significant number of

key milestones in 2017, including the successful IPO, the

subsequent EUR250 million credit facility as well as executing over

EUR400m of acquisitions over the past year. The underlying assets

have performed well during the period and we are well positioned to

continue to grow our portfolio in 2018 and beyond."

2017 Annual Report

A copy of the 2017 Annual Report has been submitted to the

National Storage Mechanism and will shortly be available for

inspection at www.morningstar.co.uk/uk/NSM. The annual report will

also shortly be available on the Company's website at

www.greencoat-renewables.com where further information on the

Company can also be found.

Details of the conference call for analysts and investors:

A conference call for analysts and investors will be held at

8.30am GMT on 1(st) of March 2018. To register for the call please

contact FTI Consulting on +353 1 765 0800, or by email at

greencoat@fticonsulting.com

For further information, please contact:

Greencoat Capital LLP +44 20 7832 9400

Bertrand Gautier

Paul O'Donnell

FTI Consulting (Investor Relations & Media)

Jonathan Neilan greencoat@fticonsulting.com

Melanie Farrell +353 1 765 0886

Davy Corporate Finance (NOMAD and

ESM Adviser)

Fergal Meegan +353 1 679 6363

Barry Murphy

RBC Capital Markets (Joint Broker)

Matthew Coakes

Jonathan Hardy +44 20 7653 4000

GREENCOAT RENEWABLES PLC

ANNUAL REPORT

FOR THE PERIOD FROM 15 FEBRUARY 2017 TO 31 DECEMBER 2017

Company Information

Registered Company Number

Directors

-------------------------------------------------- ---------------------------------------

Rónán Murphy (appointed 16 June 2017)* 598470

-------------------------------------------------- ---------------------------------------

Emer Gilvarry (appointed 16 June 2017)*

-------------------------------------------------- ---------------------------------------

Kevin McNamara (appointed 16 June 2017)*

-------------------------------------------------- ---------------------------------------

Paul O'Donnell (appointed 15 February 2017 and Registered Office

-------------------------------------------------- ---------------------------------------

resigned 16 June 2017) Riverside One

-------------------------------------------------- ---------------------------------------

Bertrand Gautier (appointed 15 February 2017 and Sir John Rogerson's Quay

-------------------------------------------------- ---------------------------------------

resigned 16 June 2017) Dublin 2

-------------------------------------------------- ---------------------------------------

Andrea Finegan (appointed 03 March 2017 and

-------------------------------------------------- ---------------------------------------

resigned 16 June 2017)

-------------------------------------------------- ---------------------------------------

Registered Auditor

-------------------------------------------------- ---------------------------------------

BDO

-------------------------------------------------- ---------------------------------------

Investment Manager Beaux Lane House

-------------------------------------------------- ---------------------------------------

Greencoat Capital LLP Mercer Street Lower

-------------------------------------------------- ---------------------------------------

3(rd) Floor, Burdett House Dublin 2

-------------------------------------------------- ---------------------------------------

15-16 Buckingham Street

-------------------------------------------------- ---------------------------------------

London WC2N 6DU

-------------------------------------------------- ---------------------------------------

Legal Advisers

-------------------------------------------------- ---------------------------------------

McCann Fitzgerald

-------------------------------------------------- ---------------------------------------

Company Secretary Riverside One

-------------------------------------------------- ---------------------------------------

Andrea Finegan Sir John Rogerson's Quay

-------------------------------------------------- ---------------------------------------

3(rd) Floor, Burdett House Dublin 2

-------------------------------------------------- ---------------------------------------

15-16 Buckingham Street

-------------------------------------------------- ---------------------------------------

London WC2N 6DU

-------------------------------------------------- ---------------------------------------

ESM Adviser, NOMAD and Broker

-------------------------------------------------- ---------------------------------------

J&E Davy

-------------------------------------------------- ---------------------------------------

Administrator Davy House

-------------------------------------------------- ---------------------------------------

Northern Trust International Fund 49 Dawson Street

-------------------------------------------------- ---------------------------------------

Administration Services (Ireland) Limited Dublin 2

-------------------------------------------------- ---------------------------------------

Georges Court

-------------------------------------------------- ---------------------------------------

56-62 Townsend Street

-------------------------------------------------- ---------------------------------------

Dublin 2 Account Banks

-------------------------------------------------- ---------------------------------------

Allied Irish Banks plc.

-------------------------------------------------- ---------------------------------------

40/41 Westmoreland Street

-------------------------------------------------- ---------------------------------------

Depositary Dublin 2

-------------------------------------------------- ---------------------------------------

Northern Trust International Fiduciary

-------------------------------------------------- ---------------------------------------

Services (Ireland) Limited Northern Trust International Fiduciary

-------------------------------------------------- ---------------------------------------

Georges Court Services (Ireland) Limited

-------------------------------------------------- ---------------------------------------

56-62 Townsend Street Georges Court

-------------------------------------------------- ---------------------------------------

Dublin 2 56-62 Townsend Street

-------------------------------------------------- ---------------------------------------

Dublin 2

-------------------------------------------------- ---------------------------------------

Registrar

-------------------------------------------------- ---------------------------------------

Computershare Investor Services

-------------------------------------------------- ---------------------------------------

(Ireland) Limited

-------------------------------------------------- ---------------------------------------

Heron House, Corrig Road

-------------------------------------------------- ---------------------------------------

Sandyford Industrial Estate

-------------------------------------------------- ---------------------------------------

Dublin 18

-------------------------------------------------- ---------------------------------------

* - Non executive directors.

At a Glance

Summary

Greencoat Renewables PLC is a sector-focused listed renewable

infrastructure company, investing in renewable electricity

generation assets, with an initial focus on wind assets in Ireland.

The Company's aim is to provide investors with an annual dividend

that increases progressively whilst growing the capital value of

its investment portfolio in the long term through reinvestment of

excess cash flow and the prudent use of portfolio leverage.

Defining Characteristics

Greencoat Renewables PLC was designed for investors from first

principles to be simple, transparent and low risk.

-- The Group is initially focused on investing solely in operating Irish wind assets.

-- Wind is the most mature and largest scale renewable technology.

-- Ireland has a long established regulatory regime, high wind resource and c.EUR8 billion of wind farms expected to

be in operation in the short to medium term.

-- The Group is wholly independent and thus avoids conflicts of interests in its investment decisions.

-- The Irish-based, independent Board governs the Group and actively monitors the efficient operation of the assets,

and works in conjunction with an experienced investment management team.

-- The Group only invests in wind farms that have an appropriate operational track record (or price adjustment

mechanism).

-- Low leverage (including no asset level leverage) is important to ensure a high level of cash flow stability and

higher tolerance to downside sensitivities.

-- The Group invests only in euro assets and thus does not incur material currency risk.

Chairman's Statement

I am very pleased that we are publishing the first annual report

for Greencoat Renewables PLC, relating to the period ended 31

December 2017. The Group's first year has been a very busy one with

a number of important milestones reached, both financially and

operationally.

In broad terms these achievements were the acquisition of a high

quality portfolio, the successful raising of EUR270 million and

subsequent listing on ESM of the Irish Stock Exchange and AIM of

the London Stock Exchange as well as the associated financial

reorganisation.

I would again like to thank our new shareholders for their

support, as well as ISIF and AIB for the role they played in the

early stages of the business. I am happy to report that all of the

Company's immediate goals have been achieved, and I believe its

prospects are strong. Lastly, as a result of the Company being

incorporated on 15 February 2017, it should be noted that the

financial statements cover the period from incorporation to 31

December 2017.

Business Strategy

The Company's strategy remains unchanged. It aims to provide

attractive risk adjusted returns to shareholders through a target

annual dividend of 6.0 cent per share that increases progressively

while growing the capital value of its investment portfolio.

The Company is targeting an IRR of 7 to 8 per cent. (net of

expenses and fees) on the issue price of the ordinary shares to be

achieved over the longer term via active management of the

investment portfolio, reinvestment of excess cash flows and the

prudent use of leverage.

The Company intends to hold assets in its investment portfolio

for the long term.

Ireland has an EU obligation to ensure that 16 per cent. of

primary energy use is derived from renewable sources, expected to

be largely from onshore wind, by 2020. Since 1995, Ireland has

provided owners of operating wind farms with a supportive

regulatory framework. Irish wind farms benefit from a 15 year

inflation-linked floor price under the REFIT regime, while allowing

wind farms to capture prices above the floor.

Performance

The Portfolio generated 182.3GWh from date of acquisition to 31

December 2017, slightly below budget as a result of lower than

expected wind speeds, with operational availability on budget.

There were no material unplanned outages or issues affecting any of

the assets in the period. As a result, the Portfolio generated

operating cash flow of EUR11.8 million.

Dividends and Returns

In line with the initial target dividend, the Company will

declare a dividend of 2.61c per share on 1 March 2018, to be paid

on 29 March 2018, corresponding to an annualised 6.0c per share

dividend for the period from IPO to 31 December 2017.

The 2018 target dividend is 6.0 cent per share, expected to be

paid quarterly in May, August, November with the final quarterly

dividend payable in February 2019.

NAV per share decreased slightly in the period from 98.0 cent

per share at IPO to 96.6 cent per share at 31 December 2017, driven

by a decline in power price forecasts beyond the REFIT period as

well as lowered short term inflation forecasts.

Acquisitions and Equity Raising

2017 was a busy year in Ireland's secondary wind market, and we

are delighted with the acquisitions made. In March 2017, the

Company acquired its 136.7MW seed portfolio in a single transaction

from Brookfield consisting of the 100.0MW Knockacummer wind farm

and the 36.7MW Killhills wind farm.

In December 2017, we announced agreement to acquire the 36.3MW

Dromadda More wind farm from Impax Asset Management. This

acquisition is expected to complete in April 2018 when the asset is

formally commissioned. In February 2018, we announced the

acquisition of the 9.2MW Lisdowney wind farm from a group of local

developers.

Both recently acquired assets benefit from more than 14 years of

secured pricing as all are contracted under the REFIT 2. We are

pleased to have the capability to acquire from such a wide range of

vendors. This underpins our ability to acquire and consolidate

assets in the secondary wind market.

Gearing

As outlined at the time of the IPO, the Group intended to

replace the existing project finance facility to enable the

acquisition of further operating assets in the secondary wind

market. In December 2017, the Group put in place a three year

EUR250 million Revolving Credit Facility with a syndicate of five

domestic and international banks.

The Revolving Credit Facility was used to retire the remaining

EUR71 million of project finance debt associated with Greencoat

Renewables' 137MW portfolio of seed assets, equating to 21 per

cent. of GAV at 31 December 2017. After completion of the post year

end acquisitions, leverage will equate to approximately 41 per

cent. of GAV.

The Group's policy is to keep overall Group level borrowings at

a prudent level (limited to 60 per cent. of GAV) in order to reduce

risk, while ensuring that the Group is always at least fully

invested thus using shareholders' capital efficiently. Over the

medium term we would expect gearing to be c.40 per cent.

Outlook

As planned, the significant financial reorganisation in 2017 has

provided us with a stable, simplified structure and positions the

Group to deliver future growth.

The Irish wind market remains a very attractive jurisdiction

with a stable and supportive regulatory regime. Wind remains the

dominant renewable technology and the Group is in a good position

to benefit as electricity production from wind becomes an

increasingly important part of Ireland's generation mix.

The Group continues to benefit from the unique relationships and

local expertise of the Investment Manager in terms of acquiring

further assets. We continue to see a large number of attractive

secondary market opportunities, and are maintaining focus on only

the most value accretive.

The Board is supportive of value-accretive growth through

further wind farm investments, and such acquisitions will be in the

shareholders' interest:

-- Providing additional economies of scale at Group level;

-- Increasing market power with service providers and asset sellers; and

-- Increasing liquidity in our shares.

The Board remains confident in the Company's outlook for the

future, and in the disciplined approach of the Investment Manager

to possible future acquisitions and the continued careful

management of the existing Portfolio.

Annual General Meeting

Our first AGM will take place on 26 April 2018 at 2:00 pm at the

offices of J&E Davy, Davy House, 49 Dawson Street, Dublin 2,

Ireland. Details of the formal business of the meeting are set out

in the notice of AGM, which is sent to shareholders with the Annual

Report. We look forward to meeting shareholders on that

occasion.

Conclusion

In conclusion, we are very pleased with the progress that the

Company has made since listing in July 2017. I would like to thank

my fellow Directors, Emer Gilvarry and Kevin McNamara, for their

stewardship and advice during the period, particularly through the

IPO process. Finally, I would like to acknowledge the

professionalism and engagement of the Investment Manager, which

contributed significantly to our successful first year of

operations.

Rónán Murphy

Chairman

28 February 2018

Investment Manager's Report

The Investment Manager

Greencoat Capital is a leading investment manager in the

renewable energy market, with more than EUR2 billion of funds under

management. The Investment Manager's experience spans across wind

and Solar PV asset investment and operation. All of the skills and

experience required to manage the Group's investments lie within a

single Investment Manager. The team is led by Bertrand Gautier and

Paul O'Donnell.

Bertrand has over 25 years of operational, financial and

investment experience, of which the last 8 years were focused

solely on renewables. Bertrand has been a Partner of the Investment

Manager since joining in 2010. Prior to Greencoat Capital, he spent

3 years at Terra Firma Capital Partners where he managed a variety

of leveraged buyout and refinancing transactions, and oversaw the

management of portfolio businesses. Before joining Terra Firma in

2007, he spent 5 years at Merrill Lynch as part of the M&A

Advisory Group in the Infrastructure and Industrials team. Prior to

that, he gained extensive operational experience over 8 years in

several French engineering SMEs.

Paul has over 15 years of investment experience, of which the

last 10 have been focused solely on renewables. Paul joined the

Investment Manager in 2009 and has specialised in managing

investments in the wind and solar generation sectors, working

across development, operations, technology, and financing. In that

time, Paul oversaw Airvolution Energy, a UK based wind developer

which has developed and constructed over 60MW of wind assets as

well as Lumicity, a UK solar developer which developed over 60MW of

solar assets. Paul has been a Partner of the Investment Manager

since 2016, and has been based in Dublin since 2013. Paul started

his career with PwC Ireland in Dublin.

The Investment Manager is authorised and regulated by the

Financial Conduct Authority in the UK and is a full scope AIFM.

Overview

The Investment Manager is very pleased with the milestones

achieved in the period to 31 December 2017 and at the start of

2018. All of the reorganisation goals which were targeted at IPO

have been achieved and the Group begins 2018 with a simple, stable

structure and in a strong position to deliver NAV accretive

growth.

As a new business, the Group made significant changes to its

capital structure over the course of 2017 as a consequence of both

the acquisition of the Portfolio and the listing of the Company's

Shares on the AIM of the London Stock Exchange and ESM of the Irish

Stock Exchange in July 2017. Specifically, there were a number of

significant one-off events adding complexity to our first set of

financial statements. These included:

-- Set-up and listing of the Company with EUR270 million equity raised at IPO;

-- Redemption of the pre-IPO funding instruments from AIB and ISIF (used to fund the acquisition of the Portfolio)

subsequent to IPO;

-- Retirement in December 2017 of the project finance debt (associated with the Portfolio) and placement of a EUR250

million Revolving Credit Facility;

-- The planned grid outage at Knockacummer, an asset representing the significant majority of the Group's generating

capacity.

Investment Portfolio

The Group's investment portfolio as at 31 December 2017

consisted of interests in SPVs which held the following underlying

operating wind farms:

Wind farm Turbines Operator Location Refit Net MW

-------------- ---------- ------------ --------------- --------- -------

Knockacummer Nordex Brookfield Co. Cork REFIT 1 100.0

Killhills Enercon Brookfield Co. Tipperary REFIT 2 36.7

Total 136.7

-------------------------------------------------------------------- -------

Portfolio generation for the period from acquisition of the seed

portfolio in March 2017 to 31 December 2017 was 182.3 GWh, 4 per

cent. below budget. This was a result of wind resource for the

period being below average. As stated in the Company's Admission

Document, wind resource should not be considered a source of either

upside or downside in the long term.

2017's variation to budget was comfortably within expected

statistical boundaries. The annual standard deviation of wind speed

is 6 per cent. and the annual standard deviation of generation is

10 per cent. (2 per cent. over 25 years).

As all assets are contracted to the REFIT scheme, there was no

variation in power price capture.

The following table provides a breakdown of performance by wind

farm:

Wind Farm Period Actual Generation (GWh) Budget Generation (GWh) Variance

-------------- ----------- ------------------------ ------------------------ ---------

Killhills Mar - Dec 67.3 70.2 - 4%

Knockacummer Mar - Dec 115.0 120.1 - 4%

Total 182.3 190.3 - 4%

--------------------------- ------------------------ ------------------------ ---------

Overall portfolio availability was in line with budget. The only

notable event being the pre-planned outage to the Glenlara

substation at Knockacummer:

-- The works undertaken during the pre-planned grid outage relating to the Glenlara substation were largely

completed on schedule as Knockacummer re-energised 4 days later than expected on 27 October 2017 due to some

grid-related interruption from Hurricane Ophelia;

-- The planned work involved a full upgrade to the local substations to which Knockacummer is connected. During the

outage, the wind farm underwent an accelerated maintenance and upgrade programme. The remaining work on the

grid's transmission connection is expected to be completed in the first half of 2018. This will involve a short

outage to facilitate the reconnection after which the wind farm will be fully transmission connected.

Health and Safety

In October 2017, the meteorological mast at Killhills collapsed

due to a shear failure at the base in the foundation connections.

This was reported to the Health and Safety Authority in Ireland as

a dangerous occurrence and the root cause for the collapse is

currently under investigation. There were no other incidents in the

period to 31 December 2017.

The Group commissioned a health and safety audit across its

assets in November 2017 by an independent consultant. The audit

focused on the absolute standard of health and safety procedures,

consistency of reporting across the Portfolio and industry

benchmarking. No material areas of concern were identified.

Acquisitions

Seed Portfolio

On 9 March 2017, the Company invested EUR318.1 million to

acquire 100 per cent. of the seed portfolio consisting of

Knockacummer and Killhills wind farms from Brookfield. Initial

funding for this transaction was provided by AIB and ISIF.

Knockacummer is a 100MW wind farm in County Cork consisting of

forty 2.5MW Nordex N90 turbines. Knockacummer is eligible for

support under REFIT 1 until the end of 2027.

Killhills is a 36.7 MW wind farm in County Tipperary consisting

of thirteen 2.3MW Enercon E82 turbines. Killhills is eligible for

support under REFIT 2 until the end of 2030.

Both wind farms represent a high quality seed portfolio, and

both benefit from long-dated REFIT contracts.

Subsequent Acquisitions

On 21 December 2017, the Company announced the agreement to

acquire Dromadda More from Impax Asset Management for EUR88.4

million. Dromadda More is a 36.3MW wind farm in County Kerry

consisting of 11 Vestas V112 turbines and will benefit from a full

15 years of REFIT 2 support. Completion of the transaction is

expected to occur in April 2018 following successful commissioning

of the wind farm.

On 16 February 2018, the Group acquired 100 per cent. of the

9.2MW Lisdowney wind farm for EUR22.5 million. Lisdowney has 4

Enercon E82 turbines and is eligible for support under REFIT 2 for

the next 14 years.

Financial Performance

Portfolio generation was in line with management expectations

resulting in portfolio net operating cash generation of EUR11.8m

for the period.

Investment Performance

NAV at 31 December 2017 was EUR260.9 million (96.6 cent per

share):

-- NAV at IPO was EUR264.6 million (98.0 cent per share);

-- The portfolio DCF valuation decreased by EUR4.9 million reflecting decline of long term power price and downward

revision of Irish inflation by the Central Bank of Ireland;

-- Cash balances decreased by EUR96.3 million, driven by retirement of project finance debt and settlement of

liabilities;

-- Net assets at Group level increased by EUR5.2 million; and

-- Aggregate Group debt decreased by EUR92.2 million, following a EUR90 million repayment of the project finance

facility utilising proceeds from the IPO in August 2017 and project debt swap.

The share price at 31 December 2017 was 107 cent representing an

11 per cent. premium to NAV.

Reconciliation of Statutory Net Assets to Reported NAV

As at As at

31 December 2017 25 July 2017(1)

-------------------------------------- ------------------ -----------------

EUR'000 EUR'000

DCF valuation 306,532 311,436

Shareholder loan interest receivable 1,855 1,855

Cash (wind farm SPVs) 8,409 4,557

Fair value of investments 316,796 317,848

Cash (Group) 14,794 114,935

Other relevant assets/(liabilities) 428 (4,810)

GAV 332,018 427,973

Aggregate Group Debt (71,169) (163,391)

NAV 260,849 264,582

Reconciling items(2) 1,237 0

Statutory net assets 262,086 264,582

Shares in issue 270,000,000 270,000,000

NAV per share (cent) 96.6 98.0

-------------------------------------- ------------------ -----------------

(1) The Company listed on 25 July 2017 and this was the first

published NAV of the Group

(2) The reconciling item reflects a deferred tax asset in

Holdco

NAV Sensitivities

NAV is equal to GAV less Aggregate Group Debt.

GAV is the sum of:

-- DCF valuations of the Group's investments;

-- Cash (at Group and wind farm SPV level); and

-- Other relevant assets and liabilities of the Group.

The DCF valuation of the Group's investments represents the

largest component of GAV and the key sensitivities are considered

to be the discount rate used in the DCF valuation and long term

assumptions in relation to energy yield, power prices and

inflation.

Base case energy yield assumptions are P50 (50 per cent.

probability of exceedance) forecasts produced by expert consultants

based on long term wind data and operational history. The P90 (90

per cent. probability of exceedance over a 10 year period) and P10

(10 per cent. probability of exceedance over a 10 year period)

sensitivities reflect the future variability of wind and the

uncertainty associated with the long term data source being

representative of the long term mean. Given their basis on long

term operating data, it is not anticipated that base case energy

yield assumptions will be adjusted (other than any wind energy

true-ups with compensating purchase price adjustments).

Long term power price forecasts are provided by a leading market

consultant, updated quarterly and adjusted by the Investment

Manager where more conservative assumptions are considered

appropriate. The independent forecasts are never adjusted upwards.

Base case real power prices increase from approximately EUR67/MWh

(2030) to approximately EUR73/MWh (2040). The sensitivity below

assumes a 10 per cent. increase or decrease in power prices

relative to the base case for every year of the asset life, which

is relatively extreme (a 10 per cent. variation in short term power

prices, as reflected by the forward curve, would have a much lesser

effect).

Asset life is assumed to be 25 years. Although the industry is

considering that asset life could be extended, the Investment

Manager is not providing sensitivity in respect of asset life

extension given the number of variables to be considered at the

present time.

The base case long term CPI assumption is 2.00 per cent..

Gearing

On 19 December 2017, the Group entered into a 3-year EUR250

million Revolving Credit Facility with a syndicate of 5 domestic

and international banks: AIB, BNP Paribas, Commerzbank, RBC and

Santander. This was the Company's intention at listing in order to

deliver the targeted capital structure (i.e. retiring seed

portfolio project finance debt) and to enable funding of future

acquisitions of operating assets in the secondary wind market.

The Group made its first drawdown on the facility on 19 December

2017 to fully refinance and retire the project finance facility and

associated interest rate swap, which had been part of the

acquisition of the Portfolio.

As at 31 December 2017, the Group had EUR71.2 million of debt

outstanding, equating to 21 per cent. of GAV.

All borrowing is at the Group level. There is no remaining asset

level debt.

Outlook

The outlook for the Group remains positive with a growing

secondary wind market, and a stable policy backdrop for Irish wind

assets, and a reliable wind resource underpinned by the REFIT

contracts.

Secondary wind farm market

We see a strong and growing pipeline of opportunities in the

secondary wind asset market in Ireland, with a range of high

quality assets which the Group is well-placed to acquire. Since IPO

in July 2017, we have been involved in 11 separate processes, many

of which are ongoing but the acquisition of 2 assets since IPO

demonstrates our execution on the strategy. In particular, we have

seen a number of ongoing processes for sub 20MW assets, where we

believe the Group is very well positioned. This underpins that we

continue to see the benefit of our long relationships and

experience in Ireland, as well as our expertise in the renewable

infrastructure market.

Irish renewables market

The Irish onshore wind market continues to expand rapidly. In

2017, over 500MW became operational, taking the capacity to over

3.4GW of operating wind farms, with installed capacity set to grow

to over 4.0GW by the end of 2019, representing a c.EUR8bn market

size.

The level of wind penetration on the Irish electricity system

continues to grow and has increased from 50 per cent.

non-synchronised penetration through to 60 per cent. in 2017. As

part of the process of integrating European electricity markets,

the EU introduced a regional integration initiative. This sees the

all-island electricity market deepening its ties with the UK and

French markets. The new market arrangements (referred to as I-SEM)

are designed to integrate the all-island electricity market with

European electricity markets, enabling the free flow of energy

across borders. Both the increased level of non-synchronised

penetration and the new I-SEM market would benefit increased

renewable electivity generation deployment on the Irish grid.

Since IPO, the Irish Government has announced the consultancy

process around a new REFIT programme for wind, which will run

beyond 2019. This REFIT should provide further long-term depth to

the secondary market, underpinned by the continued strong build out

we have seen under REFIT 2.

While the structure and level of the new REFIT is not directly

relevant to the value of the Group's Portfolio or to the value of

any short to medium term pipeline, it shows the continued

governmental support for the renewable energy sector, not least for

reasons of security of supply.

Board of Directors

The Directors are of the opinion that the Board, as a whole,

comprises an appropriate balance of skills, experience and

diversity. The Board is comprised of individuals from relevant and

complementary backgrounds offering experience in investment,

financial, and business skills, as well as in the energy sector

from both a public policy and a commercial perspective.

Rónán Murphy, Chairman (appointed 16 June 2017)

Rónán Murphy, aged 60, was previously senior partner of PWC

Ireland, a position he was elected to in 2007 and was re-elected to

for a further four year term in July 2011. Rónán joined PWC in

1980, qualifying in 1982, and was admitted to the partnership in

1992. Rónán was a member of the PWC EMEA leadership board from 2010

to 2015. Rónán is also a non-executive director of Icon plc, Davy

and Liberty Insurance.

Rónán holds a Bachelor of Commerce degree and Masters in

Business Studies from University College Dublin and is a Fellow of

the Institute of Chartered Accountants.

Kevin McNamara, Chairman of the Audit Committee (appointed 16

June 2017)

Kevin McNamara, aged 63, has more than 25 years' experience in

the energy sector. Kevin enjoyed a long career with ESB

International, including leading the investment division of ESB

International Investments. More recently Kevin was CFO of Amarenco

Solar, a solar business focused on the Irish and French markets and

prior to this CEO of Airvolution Energy, a UK wind development

business.

Kevin holds a Bachelor of Commerce degree from University

College Dublin and is a Fellow of the Institute of Chartered

Accountants.

Emer Gilvarry (appointed 16 June 2017)

Emer Gilvarry, aged 60, is chair of Mason Hayes & Curran

(Solicitors). Prior to taking up the position of Chair, Emer was

the managing partner for two consecutive terms from 2008 to 2014.

She is also a former head of the firm's litigation group (2001 to

2008). Emer is a former board member of Aer Lingus plc. She is

currently a board member of the Economic and Social Research

Institute and the Ireland Funds.

Emer holds a Bachelor of Law degree from University College

Dublin (BCL).

Other Irish Public Company Directorships

In addition to their directorships of the Company, the below

Directors currently hold the following Irish public company

directorships:

Rónán Murphy Icon plc

The Directors have all offered themselves for re-election and

resolutions concerning this will be proposed at the AGM.

Conflicts of Interest

The Directors have declared any conflicts or potential conflicts

of interest to the Board of Directors which has the authority to

approve such situations. The Company Secretary maintains the

Register of Directors' Conflicts of Interests which is reviewed

quarterly by the Board and when changes are notified. The Directors

advise the Company Secretary and the Board as soon as they become

aware of any conflicts of interest. Directors who have conflicts of

interest do not take part in discussions which relate to any of

their conflicts.

Directors' Report

The Directors present their Annual Report, together with the

consolidated financial statements of Greencoat Renewables PLC for

the period from incorporation on 15 February 2017 to 31 December

2017.

Principal Activity and Business Review

A detailed discussion of the individual project performance and

a review of the business in the period are covered in the

Investment Manager's Report.

Results for the Year

The consolidated financial statements for the financial period

ended 31 December 2017 are set out in detail including the results

for the period which are set out in the Consolidated Statement of

Comprehensive Income.

Future Developments

The Company's future outlook is discussed in the Investment

Manager's Report.

Investment Objective

The Company's aim is to provide attractive risk-adjusted returns

to shareholders through an annual dividend (6.0c for 2017 on an

annualised basis) that increases progressively whilst growing the

capital value of its investment portfolio. The Company is targeting

an IRR of 7 to 8 per cent. (net of expenses and fees) on the issue

price of the ordinary shares to be achieved over the longer term

via active management of the investment portfolio, reinvestment of

excess cash flows and the prudent use of leverage. The Company

intends to hold assets in its investment portfolio for the long

term.

Investment Policy

The Group intends to increase its portfolio of renewable energy

generation assets within the Eurozone with a focus on Ireland. Key

investment criteria include:

-- During the first 24 months from IPO, the Group will be invested in operational wind energy assets in Ireland.

-- Thereafter, Ireland will remain a key country of focus for the Group as no less than 60 per cent. of GAV will be

invested in Ireland.

-- The Group can also invest, in aggregate, up to 40 per cent. of GAV in operational wind energy or solar assets in

other relevant countries (being Belgium, Finland, France, Germany and the Netherlands).

-- The Company will generally avoid using non-recourse debt at the asset level; aggregate debt at Company level will

not be more than 60 per cent. of GAV at drawdown.

The Company utilised investment from AIB and ISIF to acquire its

Portfolio during the period and placed a Revolving Credit Facility

to fund future investments. This has enhanced the Group's

attractiveness to sellers since execution risk is greatly

diminished, with the Group effectively being a cash buyer.

The Group will look to repay its drawn debt facilities by

refinancing them in the equity markets at appropriate times in

order to refresh its debt capacity. While debt facilities are

drawn, the Company benefits from an increase in investor returns

because borrowing costs are below the underlying return on

investments.

Group Structure and Share Capital

The Company is incorporated in the Republic of Ireland. The

Group is wholly independent and is not tied to any particular

utility or developer. All of the ordinary shares in the Company are

quoted on ESM of the Irish Stock Exchange and on AIM of the London

Stock Exchange. The Group comprises of the Company, Holdco and

Holdco 2. Holdco and Holdco 2 invest in the underlying portfolio

companies.

The Company has one class of ordinary shares which carry no

rights to fixed income. Shareholders are entitled to all dividends

paid by the Company and, on a winding up, provided the Company has

satisfied all of its liabilities, the Shareholders are entitled to

all of the surplus assets of the Company.

All shareholders have the same voting rights in respect of the

share capital of the Company.

Shareholders are entitled to attend and vote at general meetings

of the Company and, on a poll, to one vote for each ordinary share

held.

The rights and obligations to the ordinary shares are set out in

the Company's articles of association which are available on the

Company's website: www.greencoat-renewables.com.

Authority to Purchase Own Shares

The current authority of the Company to make market purchases of

up to 14.99 per cent. of its issued share capital expires at the

conclusion of the first AGM. Special resolution 9 will be proposed

at the forthcoming AGM seeking renewal of such authority until the

next AGM (or 30 June 2019, whichever is earlier). The purchases

will only be made for cash at prices below the estimated prevailing

NAV per share and where the Board believes such purchases will

result in an increase of the NAV per share. Any shares repurchased

under this authority will either be cancelled or held in treasury

at the discretion of the Board for future resale in appropriate

market conditions.

The Directors believe that the renewal of the Company's

authority to purchase shares, as detailed above, is in the best

interests of shareholders as a whole and therefore recommend

shareholders to vote in favour of special resolution 9.

Discount Control

As part of the Company's discount control policies, the Board

intends to propose a continuation vote by shareholders if the share

price trades at a significant discount to NAV. If in any financial

year, the shares have traded on average, at a discount in excess of

10 per cent or more to the NAV per share in any financial year, the

Board will propose a special resolution at the Company's next

annual general meeting that the Company cease to continue in its

present form. Notwithstanding this, the Board could consider buying

back its own shares in the market if the share price is trading at

a material discount to NAV, providing it is in the interests of the

shareholders to do so.

Major Interests in Shares

Significant shareholdings as at 31 December 2017 are detailed

below.

Shareholder Ordinary shares held %

-----------------------------------

31 December 2017

----------------------------------- -----------------------

Ireland Strategic Investment Fund 28.15%

Newton Investment Management 6.20%

Irish Life Investment Managers 5.71%

Allied Irish Banks 5.56%

Investec Wealth & Investment 4.91%

Farringdon Capital Management 3.65%

Close Asset Management 3.65%

M&G Investment Management 3.35%

----------------------------------- -----------------------

Companies Act 2014 Disclosures

The Directors disclose the following information:

-- The Company's capital structure is detailed in note 14 of the consolidated financial statements and all

shareholders have the same voting rights in respect of the share capital of the Company. There are no

restrictions on voting rights that the Company is aware of, nor any agreement between holders of securities that

result in restrictions on the transfer of securities or on voting rights;

-- There exist no securities carrying special rights with regard to the control of the Company;

-- The Company does not have an employees' share scheme;

-- The rules concerning the appointment and replacement of Directors are contained in the Company's Articles of

Association and the Companies Act 2014;

-- There exist no agreements to which the Company is party that may affect its control following a takeover bid; and

-- There exist no agreements between the Company and its Directors providing for compensation for loss of office

that may occur because of a takeover bid.

Key Performance Indicators

The Board believes that the key metrics detailed within the

report, which are typical for investment funds, will provide

shareholders with sufficient information to assess how effectively

the Group is meeting its objectives.

Ongoing Charges

31 December 2017

----------------------- -----------------

Total management fee* 0.44%

Directors' fees* 0.04%

Ongoing expenses* 0.34%

----------------------- -----------------

Total 0.82%

----------------------- -----------------

* On-going charges represent the period from IPO to 31 December

2017 and as such, are not annualised.

Directors' Indemnity

Directors' and Officers' liability insurance cover is in place

in respect of the Directors. The Company's Articles of Association

provide, subject to the provisions of Ireland and UK legislation,

an indemnity for Directors in respect of costs which they may incur

relating to the defence of any proceedings brought against them

arising out of their positions as Directors, in which they are

acquitted or judgement is given in their favour by the Court.

Except for such indemnity provisions in the Company's Articles

of Association and in the Directors' letters of appointment, there

are no qualifying third party indemnity provisions in force.

Environmental, Social and Governance Policies

The Group invests in wind farms and the environmental benefits

of renewable energy are widely known.

The Group relies on the Investment Manager to apply appropriate

policies to the investments the Group makes. The policies in place

at the Investment Manager outline the Group's approach to

responsible investing, as well as the environmental standards which

it aims to meet. Responsible investing principles have been applied

to each of the investments made.

These policies require the Group to make reasonable endeavours

to procure the ongoing compliance of its portfolio companies with

its policies on responsible investment. Further details on these

policies may be found on the Company's website:

www.greencoat-renewables.com

The Investment Manager monitors compliance at the investment

phase and reports on an ongoing basis to the Board.

Global Greenhouse Gas Emissions

As the Group has outsourced operations to third parties, there

are no significant greenhouse gas emissions to report from the

operations of the Group.

In relation to the Group's investee companies, the level of

greenhouse gas emissions arising from the low volume of electricity

imports and from operation and maintenance activity is not

considered material for disclosure purposes. Further, as the assets

are renewable energy generators, they reduce carbon dioxide

emissions on a net basis (at a rate of approximately 0.4tn CO2 per

MWh).

Employees and Officers of the Company

The Company does not have any employees but instead engages

experienced third parties to operate the assets in which it owns.

The Directors of the Company are listed in this report. The Group's

policy on diversity is detailed in the Corporate Governance.

Principal Risks and Risk Management

In the normal course of business, each investee company has a

rigorous risk management framework with a comprehensive risk

register that is reviewed and updated regularly and approved by its

board. The key risks to the performance of the Group, identified by

the Board, are detailed below.

The Board maintains a risk matrix considering the risks

affecting both the Group and the investee companies. This risk

matrix is updated annually to ensure that procedures are in place

to identify, mitigate and minimise the impact of risks should they

crystallise. This enables the Board to carry out a robust

assessment of the risks facing the Group, including those principal

risks that would threaten its business model, future performance,

solvency or liquidity.

As it is not possible to eliminate risks completely, the purpose

of the Group's risk management policies and procedures is not to

eliminate risks, but to reduce them and to ensure that the Group is

adequately prepared to respond to such risks and to minimise any

impact if the risk develops.

Risks Affecting the Group

Investment Manager

The ability of the Group to achieve its investment objective

depends heavily on the experience of the management team within the

Investment Manager and more generally on the Investment Manager's

ability to attract and retain suitable staff. The sustained growth

of the Group depends upon the ability of the Investment Manager to

identify, select and execute further investments which offer the

potential for satisfactory returns.

The Investment Management Agreement includes key man provisions

which would require the Investment Manager to employ alternative

staff with similar experience relating to investment, ownership,

financing and management of renewable energy projects should, for

any reason, any key man cease to be employed by the Investment

Manager. The Investment Management Agreement ensures that no

investments are made following the loss of key men until suitable

replacements are found and there are provisions for a reduction in

the investment management fee during the loss period. It also

outlines the process for their replacement with the Board's

approval. The key men are also shareholders in the Company.

Regulatory Risk

The Investment Manager is the UK-authorised AIFM of the Company,

an Irish AIF. Should the Investment Manager cease to be authorised

as an AIFM in the EU as a result of Brexit, the Company would need

to appoint a replacement AIFM and could suffer losses as a result

of the transition. The Board regularly discusses regulatory risks

and the Investment Manager reports to it on AIFMD compliance

matters. The Investment Manager also consults with its own and the

Company's legal adviser as well as the Company's NOMAD in relation

to its plans to ensure that the Company can continue to be AIFMD

compliant after Brexit.

Financing Risk

The Group will finance further investments either by borrowing

or by issuing further shares. The ability of the Group to deliver

enhanced returns and consequently to realise expected NAV growth is

dependent on access to debt facilities and equity capital markets.

There can be no assurance that the Group will be able to borrow

additional amounts or refinance on reasonable terms or that there

will be a market for further shares.

Investment Returns Become Unattractive

A significantly strengthening economy may lead to higher future

interest rates which could make the listed infrastructure asset

class relatively less attractive to investors. In such

circumstances, it is likely that there will be an increase in

inflation (to which the revenues and costs of the investee

companies are either indexed or significantly correlated) or an

increase in power prices (due to greater consumption of power) or

both. Both would increase the investment return and thus would

provide a degree of mitigation against higher future interest

rates.

Risks Affecting Investee Companies

Regulation

As the renewable energy market has matured and costs of new

capacity have reduced, member states have generally revised their

supports for the sector to reduce the benefits available to new

renewable power generation projects. However, in order to maintain

investor confidence, Ireland (and other relevant countries) have to

date largely ensured that benefits already granted to operating

renewable energy generation projects (which the Group is invested

in) are exempt from future regulatory change adversely affecting

those benefits.

If these policies were to change, such that subsidy supports

presently available to the renewable energy sector were to be

reduced or discontinued, it could have a material adverse effect on

the business, financial position, results of operations and future

growth prospects of the Group, as well as returns to investors.

Electricity Prices

Since 1995, Ireland has provided operating wind farms with a

supportive regulatory framework (REFIT 1 and REFIT 2) offering an

inflation linked floor price up to 15 years, while allowing wind

farms to capture prices above the floor. Under REFIT, wind farms

are provided with pricing certainty and no downside exposure to

electricity price as the REFIT price is cEUR80/MWh whereas the 2017

Irish wholesale electricity price was EUR47/MWh.

When operating outside of REFIT (at the latest December 2027 for

REFIT 1 or December 2030 for REFIT 2 contracted wind farms), the

Group may trade in the relevant electricity market on a merchant

basis and its financial performance would be therefore subject to

the wholesale power price prevalent at the time. In general,

independent forecasters expect Irish wholesale power prices to rise

in real terms from current levels, driven by higher gas and carbon

prices. A difference in the achieved wholesale price of electricity

to that which is expected could have a material adverse effect on

the business, financial position, results of operation and future

growth prospects of the Group, as well as returns to investors.

Wind Resource

The investee companies' revenues are dependent upon wind

conditions, which will vary across seasons and years within

statistical parameters. The standard deviation of energy production

is 10 per cent. over a 12 month period (2 per cent. over 25 years).

Since long term variability is low, there is no significant

diversification benefit to be gained from geographical

diversification across weather systems.

The Group does not have any control over the wind resource and

has designed its dividend policy such that it can withstand

significant short term variability in production relating to wind.

Before investment, the Group carries out extensive due diligence

and relevant historical wind data is available over a substantial

period of time. The other component of wind energy generation, a

wind farm's ability to turn wind into energy, is mitigated by

generally purchasing wind farms with a proven operating track

record.

When acquiring wind farms that have only recently entered into

operation, only limited operational data is available. In these

instances, the acquisition agreements with the vendors of these

wind farms may include a "wind energy true-up" which would apply

once at least one year's operational data has become available or

the acquisition price would be adjusted to reflect wind

uncertainty. Under this true-up, the net load factor will be

reforecast based on all available data and the purchase price will

be adjusted, subject to de minimis thresholds and caps.

Asset Life

Wind turbines may have shorter lives than their expected

lifespan of 25 years. In the event that the wind turbines do not

operate for the period of time assumed by the Group in its business

model or require higher than expected maintenance expenditure to do

so, it could have a material adverse effect on investment

returns.

The Group invests in companies that own operating wind farms

with an appropriate track record. The Group performs regular

reviews and ensures that maintenance is performed on all turbines

across the wind farm portfolio. Regular maintenance ensures the

wind turbines are in good working order, consistent with their

expected life-spans.

Market Structure Change (I-SEM)

The island of Ireland has a wholesale electricity market, the

SEM, which is a gross mandatory pool market, centrally dispatched,

where the licensed transmission system operators are responsible

for forecasting wind and demand. As a consequence, wind generators

are not "balance responsible". The regulatory authorities in

Ireland and Northern Ireland are developing a new integrated single

electricity market, I-SEM, which will align SEM with electricity

markets across Europe and is expected to go live in 2018. One of

the material changes is that it introduces "balance responsibility"

wind generators. This introduces a potential cost to the wind

operators. There are examples from comparable markets, such as

United Kingdom, where a similar framework is in place.

It is anticipated that the Group would contract with third party

service providers with relevant experience to manage this risk.

However the present uncertainty as to how balance responsibility

will be addressed and the structuring of the underlying "balancing"

market could have an adverse effect on the Group.

Health and Safety and the Environment

The physical location, operation and maintenance of wind farms

may, if inappropriately assessed and managed, pose health and

safety risks to those involved. Wind farm operation and maintenance

may result in physical injury or industrial accidents, particularly

if an individual were to fall from height, fall or be crushed in

transit from a vessel to an offshore installation or be

electrocuted. If an accident were to occur in relation to one or

more of the Group's investments and if the Group were deemed to be

at fault, the Group could be liable for damages or compensation to

the extent such loss is not covered by insurance policies. In

addition, adverse publicity or reputational damage could ensue

The Board reviews health and safety at each of its scheduled

Board meetings and Kevin McNamara serves as the appointed Health

and Safety Director. The Group engages an independent health and

safety consultant to ensure the ongoing appropriateness of its

health and safety policies.

Wind farms have the potential to cause environmental hazards or

nuisances to their local human populations, flora and fauna and the

surrounding natural environment. Wind farms can receive complaints

relating to specific environmental issues, or compliance with

planning consents and other relevant permits. Separately, the

planning regulations in Ireland historically included a planning

exemption for underground grid connections. There have been

challenges to the basis on which this exemption has been determined

and there is currently uncertainty around how the industry will

resolve this challenge. The Group continues to monitor any

development, taking legal advice where necessary, and addresses

these as and when required.

Going Concern and Financial Risk

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

are set out in the Investment Manager's Report. The Group faces a

number of risks and uncertainties, as set out above. Details of the

financial instruments used along with the financial risk management

objectives and policies of the Group, including exposure to price

risk, interest rate risk, credit risk and liquidity risk are

discussed in note 17 to the consolidated financial statements.

The Group continues to meet day-to-day liquidity needs through

its cash resources.

As at 31 December 2017, the Group had net current assets of

EUR16.5 million and had cash balances of EUR14.8 million (excluding

cash balances within investee companies), which are sufficient to

meet current obligations as they fall due. The major cash outflows

of the Group are costs relating to the acquisition of new assets,

which are discretionary. Future major cash outflows of the Group

will be payment of dividends, which are also discretionary.

The Group had EUR71.2 million of outstanding debt as at 31

December 2017. The Group is expected to continue to comply with the

covenants of its banking facilities going forward.

The Directors have reviewed Group forecasts and projections

which cover a period of not less than 12 months from the date of

this report, taking into account foreseeable changes in investment

and trading performance, which show that the Group has sufficient

financial resources.

On the basis of this review, and after making due enquiries, the

Directors have a reasonable expectation that the Company and the

Group have adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the consolidated financial

statements.

Disclosure of Information to Independent Auditor

The Directors believe that they have taken all steps necessary

to make themselves aware of any relevant audit information and have

established that the Group's statutory auditors are aware of that

information. In so far as they are aware at the time that this

report was approved, there is no relevant audit information of

which the Group's statutory auditors are unaware.

Auditor

BDO, Statutory Audit Firm, were appointed auditors during the

financial period and have expressed their willingness to continue

in office in accordance with Section 383 (2) of the Companies Act,

2014.

The Directors will propose the reappointment of BDO as the

Company's auditor and resolutions concerning this and the

remuneration of the Company's auditor will be proposed at the

AGM.

Audit Committee

Pursuant to the Company's articles of association the Board had

established an Audit Committee that in all material respects meets

the requirements of Section 167 of the Companies Act 2014. The

Audit Committee was fully constituted and active during the period

from IPO to 31 December 2017. For more information, see the Audit

Committee Report.

Annual Accounts

The Board is of the opinion that the Annual Report, taken as a

whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the performance,

strategy and business model of the Company.

The Directors recommend that the Annual Report, the Directors'

Report and the Independent Auditor's Report for the period ended 31

December 2017 are received and adopted by the shareholders and a

resolution concerning this will be proposed at the AGM.

Accounting Records

The Directors believe they have complied with the requirements

of Section 281 to Section 285 of the Companies Act, 2014 with

regard to accounting records by employing accounting personnel with

the appropriate expertise and by providing adequate resources to

the financial function. The accounting records of the Company are

maintained by Northern Trust International Fund Administration

Services (Ireland) Limited at Georges Court, 54-62 Townsend Street,

Dublin 2, Ireland.

Subsequent Events

Significant subsequent events have been disclosed in note 21 to

the consolidated financial statements.

Corporate Governance

The Corporate Governance Report is set out within this

report.

Directors and Company Secretary

The following Directors held office as at 31 December 2017:

Directors

Rónán Murphy (non-executive Chairman)

Emer Gilvarry (non-executive Director)

Kevin McNamara (non-executive Director)

Company Secretary

Andrea Finegan

The biographical details of the Directors are set out in this

Annual Report.

Changes in Directors during the Year

Bertrand Gautier, Paul O'Donnell and Andrea Finegan resigned as

Directors of the Board on 16 June 2017. Rónán Murphy, Emer Gilvarry

and Kevin McNamara were appointed to the Board on 16 June 2017.

Each will stand for re-appointment at the Company's Annual General

Meeting on 26 April 2018.

Directors' and Company Secretary Interests in shares in the

Company

Directors' and Company Secretary's interests in Company shares

as at 31 December 2017 are detailed below.

The Directors and the Company Secretary had no interests in the

share capital at their date of appointment.

Shareholder Ordinary shares of EUR0.01 each held as at

------------------------

31 December 2017

------------------------ -------------------------------------------

Rónán Murphy 100,000

Kevin McNamara 50,000

Emer Gilvarry Nil

Andrea Finegan Nil

------------------------ -------------------------------------------

The Company does not have any share option scheme in place.

Dividend

The Board is recommending a total aggregate dividend of

EUR7,047,000, equivalent to 2.61 cent per share to be declared on 1

March 2018 with respect to the period from IPO to 31 December

2017.

Political Donations

No political donations were made during the period ending 31

December 2017.

Longer Term Viability

The Company is a member of the AIC and complies with the AIC

Code. In accordance with the AIC Code, the Directors are required

to assess the prospects of the Group over a period longer than the

12 months associated with going concern. The Directors conducted

this review for a period of 10 years, which it deemed appropriate,

given the long term nature of the Group's investments which are

modelled over 25 years, coupled with its long term strategic

planning horizon.

In considering the prospects of the Group, the Directors looked

at the key risks facing both the Group and the investee companies,

focusing on the likelihood and impact of each risk as well as any

key contracts, future events or timescales that may be assigned to

each key risk.

As a sector-focused infrastructure fund, the Group aims to

produce stable and progressive dividends while preserving the

capital value of its investment portfolio on a real basis. The

Directors believe that the Group is well placed to manage its

business risks successfully over both the short and long term and

accordingly, the Board has a reasonable expectation that the Group

will be able to continue in operation and to meet its liabilities

as they fall due for a period of at least 10 years.

While the Directors have no reason to believe that the Group

will not be viable over a longer period, they are conscious that it

would be difficult to foresee the economic viability of any company

with any degree of certainty for a period of time greater than 10

years.

Directors' Compliance Statement

The Directors, in accordance with Section 225(2)(a) of the

Companies Act 2014, acknowledge that they are responsible for

securing the Company's compliance with its "relevant obligations".

"Relevant obligations" in the context for the Company, are the

Company's obligations under:

-- The Companies Act 2014, where a breach of the obligations would be a category 1 or category 2 offence.

-- The Companies Act 2014, where a breach of the obligation would be a serious Market Abuse or Prospectus offence.

-- Tax law.

Pursuant to Section 225(2)(b) of the Companies Act 2014, the

Directors confirm that:

-- A compliance policy statement has been drawn up by the Company in accordance with Section 225(3)(a) of the

Companies Act 2014 setting out the Company's policies (that, in the directors' opinion, are appropriate to the

Company) respecting compliance by the Company with its relevant obligations.

-- Appropriate arrangements and structures that in their opinion, are designed to secure material compliance with

the Company's relevant obligations, have been put in place; and

-- A review has been conducted, during the financial period, of the arrangements and structures referred to above.

By order of the Board

Rónán Murphy Kevin McNamara

Director Director

28 February 2018 28 February 2018

Directors' Remuneration Report

This report has been prepared by the Directors in accordance

with the requirements of the Companies Act 2014. A resolution to

consider the Directors' Remuneration Report will be proposed at the

AGM.

The Company's Auditor is required to give their opinion on the

information provided on Directors' remuneration detailed below and

this is explained further in its report to shareholders. The

remainder of this report is outside the scope of the external

audit.

Annual Statement from the Chairman of the Board

The Board, consists solely of non-executive Directors and is

considered to be entirely independent. The Board considers at least

annually the level of the Board's fees, in accordance with the AIC

Code.

Remuneration Policy

As at the date of this report, the Board comprised 3 Directors,

all of whom are non-executive. The Company has established a

Remuneration Committee which comprises all of the Directors and the

Chair is Emer Gilvarry.

Each of the Directors was appointed to the Remuneration

Committee with effect from 25 June 2017, the date of listing on ESM

of the Irish Stock Exchange and AIM of the London Stock Exchange.

The Remuneration Committee did not meet from that date to 31

December 2017. The Committee shall meet at such times as the

Committee Chairman shall require.

Each Director receives a fixed fee per annum based on their

roles and responsibility within the Company and the time commitment

required. It is not considered appropriate that Directors'

remuneration should be performance related and none of the

Directors are eligible for pension benefits, share options, long

term incentive schemes or other benefits in respect of their

services as non-executive Directors of the Company. The total

remuneration of non-executive Directors has not exceeded the limit

set out in the Articles of Association of the Company.

The Company's Articles of Association empower the Board to award

a discretionary bonus where any Director has been engaged in

exceptional work on a time spent basis to compensate for the

additional time spent over their expected time commitment.

The Articles of Association provide that Directors retire and

offer themselves for re-election at the first AGM after their

appointment and at least every 3 years thereafter. In accordance

with corporate governance best practice, the Company expects

Directors to be re-elected annually.

All of the Directors have been provided with letters of

appointment which stipulate that their initial term shall be for 3

years, subject to re-election.

A Director's appointment may at any time be terminated by and at

the discretion of either party upon 6 months' written notice. A

Director's appointment will automatically end without any right to

compensation whatsoever if they are not re-elected by the

Shareholders. A Director's appointment may also be terminated with

immediate effect and without compensation in certain other

circumstances.

The terms and conditions of appointment of non-executive

Directors are available for inspection from the Company's

registered office.

The Company's remuneration policy has applied from listing on 25

July 2017, and the Directors do not envisage any changes to the

remuneration policy in the next accounting period.

Annual Report on Remuneration

The table below (audited information) shows all remuneration

earned by each individual Director during the period:

Date of Appointment Directors' fees per annum Paid from appointment to 31

December 2017

--------------------------------- --------------------- -------------------------- --------------------------------

Rónán Murphy

(chairman) 16 June 2017 EUR100,000 EUR54,231

Kevin McNamara 16 June 2017 EUR50,000 EUR27,115

Emer Gilvarry 16 June 2017 EUR50,000 EUR27,115

--------------------------------- --------------------- -------------------------- --------------------------------

Total EUR108,461

-------------------------------------------------------- -------------------------- --------------------------------

None of the Directors received any other remuneration or

additional discretionary payments during the period from the

Company. None of Bertrand Gautier, Paul O'Donnell or Andrea Finegan

received any fees during their tenure on the Board. Each resigned

from office on 16 June 2017.

On behalf of the Board,

Emer Gilvarry

Chair of the Remuneration Committee

28 February 2018

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and the consolidated financial statements in accordance with

applicable law and regulations.