TIDMEZJ

RNS Number : 6771T

easyJet PLC

26 July 2022

26 July 2022

easyJet plc

Trading statement for the three months ended 30 June 2022

easyJet's key areas of transformation continue to deliver, with

Q3 financial performance improved despite costs from industry wide

operational issues

-- Q3 group headline loss before tax of GBP114m, included:

o GBP133m cost impact from disruption

o GBP36m loss from FX balance sheet revaluations

-- Q3 headline EBITDAR profit of GBP103m (Q3 FY19: GBP313m)

-- easyJet's transformation continues to deliver

o Network optimisation driving positive demand with Q4 load

factors booked slightly ahead of FY19

o Step-changed ancillaries continuing to deliver with Q3

ancillary yield 55% above FY19

o easyJet holidays generated GBP16m profit in the quarter

-- easyJet is currently c.83% hedged for fuel in Q4 at c.US$705 per metric tonne

Summary

In Q3 easyJet flew 22m passengers(1) , more than seven times

higher than the same period last year, representing 87% of FY19

capacity. Load factors continued to build over the quarter,

reaching highs of 92% in June. The unprecedented ramp up across the

aviation industry, coupled with a tight labour market, has resulted

in widespread operational challenges culminating in higher levels

of cancellations than normal. Despite this, easyJet operated 95% of

its planned schedule in Q3.

A ction taken to remove capacity and build resilience into Q4,

due to caps imposed by London Gatwick and Amsterdam Schiphol

alongside wider challenges within Europe has resulted in July

operations to date being much improved. easyJet remains focused on

ensuring smooth operations this summer and will continue to fine

tune our schedule if required.

Airline ancillary yield per passenger of GBP22.07 continues to

outperform pre pandemic levels, up 55% on the same period in 2019.

easyJet holidays generated GBP16m of profit in the quarter as it

carried 0.4 million customers, passing its previous highest profit

of GBP10m(4) in a full year. The holidays business remains on track

to carry 1.1m passengers in the full year.

Bookings have built through the quarter as demand for easyJet's

leading network remains solid. Q4 is currently 71% booked, load

factor slightly ahead of 2019 and sold ticket yield is 13% above

FY19.

easyJet is seeing yields track positively through the first half

of FY23, with October half-term currently booked in line with FY19

on capacity at 95% of FY19 levels.

Commenting, Johan Lundgren, easyJet Chief Executive said:

"Delivering for customers this summer remains our highest

priority. During the quarter we carried seven times more customers

than the same time last year and operated 95% of our schedule. We

have taken action to build the additional resilience needed this

summer and the operation has now normalised.

"Despite the loss this quarter due to the short-term disruption

issues, the return to flying at scale has demonstrated that the

strategic initiatives launched during the pandemic are delivering

now and with more to come. This includes a step-change in ancillary

yields, increasing 55% versus the same period in 2019, and a record

profit of GBP16m generated in the quarter by easyJet holidays which

is on track to serve 1.1 million customers in the full year.

"easyJet expects capacity to be c.90% of Q419 across our network

of major European airports, with load factors targeted above

90%."

Capacity

During Q3 easyJet flew 87% of FY19 capacity(2) , in line with

the guidance and a significant increase on the same period last

year where easyJet flew 16% of FY19 capacity. Load factor was 88%,

as guided, due to increasing customer demand post travel

restrictions easing.

Passenger(1) numbers in the quarter increased to 22.0 million

(Q3 FY21: 3.0 million).

April May June Q3 Q3

2022 2022 2022 FY22 FY21

Number of flights 44,917 48,335 46,793 140,045 24,682

------- ------- ------- -------- -------

Passengers (thousand)(1) 6,932 7,424 7,645 22,001 2,985

------- ------- ------- -------- -------

Seats flown (thousand) 8,034 8,596 8,306 24,936 4,495

------- ------- ------- -------- -------

% of FY19 capacity

flown 86% 88% 86% 87% 16%

------- ------- ------- -------- -------

Load factor (3) 86% 86% 92% 88% 66%

------- ------- ------- -------- -------

Financials

Total group revenue for the quarter ending 30 June 2022

increased to GBP1,755 million (Q3 FY21: GBP213 million). Passenger

revenue increased to GBP1,152 million (Q3 FY21: GBP152 million) and

ancillary revenue increased to GBP603 million (Q3 FY21: GBP61

million) primarily due to the increase in capacity flown. Airline

ancillary revenue per seat of GBP19.47 (Q3 FY21: GBP13.14)

continues to benefit from cabin bags and bundles delivering

incremental revenue.

Group headline costs for the quarter ending 30 June 2022 were

GBP1,869 million (Q3 FY21: GBP531 million), primarily driven by the

higher level of capacity flown compared to the same period last

year as well as the operational challenges seen through the period

which have resulted in GBP133m of disruption costs.

Group headline loss before tax for the quarter ending 30 June

2022 was GBP114 million, a GBP204 million improvement compared to

the GBP318 million loss in Q3 FY2 1. Included in the headline loss

was a GBP36 million loss from balance sheet FX revaluations.

easyJet continues to have a strong investment grade balance

sheet and has one of the lowest net debts in European aviation. As

at 30 June 2022, easyJet's net debt was GBP0.2 billion (31 March

2022: GBP0.6 billion) including cash and cash equivalents and money

market deposits of GBP3.9 billion.

Disruption management and current operations

As previously disclosed, proactive action was taken to build in

additional resilience including the consolidation of capacity in Q3

and Q4, in conjunction with other measures. Given easyJet's high

frequency network, over 70% of affected customers were moved onto

an alternate flight within 24 hours.

We believe that these capacity/cost impacts are a one-off this

summer as we would expect all parties to build greater resilience

in time for 2023 peak periods.

Slot addition

During the third quarter easyJet won 18 daily slots (9 slot

pairs) at Lisbon airport, achieving growth in a highly slot

constrained airport. These slots will result in easyJet becoming

the second largest airline at the airport. The additional capacity

enabled by the new slots will be deployed starting in October.

Approved aircraft purchase

After obtaining shareholder approval earlier this month, easyJet

has agreed to purchase an additional 56 A320neo family aircraft for

delivery between FY26 and FY29, as well as converting 18 planned

deliveries of A320neo aircraft to 18 A321 neo aircraft. These

aircraft will continue the modernisation of the easyJet fleet,

delivering both cost and sustainability benefits to easyJet, as

well as facilitating further up-gauging of the fleet.

Sustainability

easyJet has signed a Letter of Intent with Airbus to support the

development of carbon removal technology and to explore the

opportunity to secure a future supply of carbon removal credits

from direct air capture technology.

In addition, easyJet and Rolls-Royce announced a ground-breaking

new partnership to develop technology for hydrogen combustion

engines with the potential to power narrow body aircraft. Both

parties have agreed to work together on a series of engine tests on

the ground starting later this year, and also have a shared

ambition to take the technology to the air.

easyJet has committed to achieve net-zero carbon emissions by

2050 and we believe that zero carbon emission technology will

ultimately enable us to achieve "net-zero" flying. easyJet remains

committed to net zero and will announce its Net Zero Pathway later

this year.

Outlook

easyJet currently expects capacity in Q4 to be c.90% of Q4'19

with load factors above 90%. easyJet's Q4 schedule is now 71%

booked, 1ppt ahead of this point in FY19. Q4 sold ticket yield is

currently 13% above FY19.

easyJet is currently c.83% hedged for fuel in Q4 of FY22 at

c.$705 per metric tonne, c. 60% hedged for fuel in H1 of FY23 at c.

$784 per metric tonne and c. 33% hedged for fuel in H2 of FY23 at

c. $879 per metric tonne. The spot price on 22 July 2022 was around

$1,090.

For further details please contact easyJet plc :

Institutional investors and analysts:

Michael Barker Investor Relations +44 (0) 7985 890 939

Adrian Talbot Investor Relations +44 (0) 7971 592 373

Media:

Anna Knowles Corporate Communications +44 (0) 7985 873 313

Edward Simpkins FGS Global +44 (0) 7947 740 551 / (0) 207 251

3801

Dorothy Burwell FGS Global +44 (0) 7733 294 930 / (0) 207 251

3801

A copy of this Trading Statement is available at

http://corporate.easyjet.com/investors

Notes

1. Represents the number of earned seats flown. Earned seats

include seats that are flown whether or not the passenger turns up

as easyJet is a no-refund airline, and once a flight has departed a

no-show customer is generally not entitled to change flights or

seek a refund. Earned seats also include seats provided for

promotional purposes and to staff for business travel.

2. Capacity based on actual number of seats flown.

3. Represents the number of passengers as a proportion of the

number of seats available for passengers. No weighting of the load

factor is carried out to recognise the effect of varying flight (or

"sector") lengths.

4. easyJet holidays highest FY profit of GBP10m was in FY13 and

includes hotel only commission, this was under the prior business

model

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUVVNRUOUBUAR

(END) Dow Jones Newswires

July 26, 2022 02:00 ET (06:00 GMT)

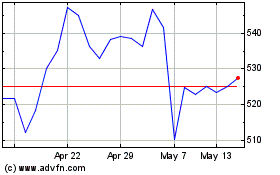

Easyjet (LSE:EZJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Easyjet (LSE:EZJ)

Historical Stock Chart

From Nov 2023 to Nov 2024