Tritax EuroBox PLC Sale of asset in Bochum, Germany for EUR46.8 million (2628V)

November 30 2023 - 8:47AM

UK Regulatory

TIDMEBOX TIDMBOXE

RNS Number : 2628V

Tritax EuroBox PLC

30 November 2023

Sale of asset in Bochum, Germany for EUR46.8 million

Tritax EuroBox plc (the "Company"; tickers: EBOX (Sterling),

BOXE (Euro)) has successfully exchanged contracts for the sale of

its multi-unit warehouse in Bochum, Germany for a price of EUR46.8

million to a leading pan-European real estate investment manager.

The sale price is marginally below the valuation as at 31(st) March

2023.

Summary

-- 37,047 sqm building, purchased in November 2018 for consideration of EUR37.8 million.

-- A recently signed new lease in unit 3 was agreed 35% above the unit's current passing rent.

-- The headline sale price of EUR46.8 million is 3% below the

external valuation as at 31(st) March 2023, reflecting a net

initial yield of 4.88%.

-- Proceeds will be primarily used to pay down the Revolving

Credit Facility as part of the programme to reduce the leverage in

the Company.

Background

The 37,047 sqm prime logistics property in Bochum, Germany was

acquired by the Company in November 2018. In August 2023, we

announced the agreement of a new seven-year lease with LUCHS Gmbh

at a level 35% above the current passing rent. The business plan

for the asset has been completed, including a 23% increase in

overall rent since acquisition. The sale enables the Company to

realise a profitable disposal.

In the Interim Results announcement in May 2023, we outlined our

intention to undertake asset disposals of at least EUR150 million

over a 12-18-month period. The programme's aim is to lower the loan

to value (LTV) ratio towards our preferred percentage range in the

low 40s and to fund existing opportunities from within the

portfolio. Following the sale of Hammersbach in the summer, this

disposal demonstrates further progress of this programme and brings

gross sales signed so far to c.EUR111 million.

Company commentary

Alina Iorgulescu, Investment Director, Tritax EuroBox plc,

commented:

"The sale of Bochum is the second asset sold from our German

portfolio following the completion of the asset management plan.

The transaction continues the progress of the disposal programme

outlined in our interim results and is aligned with our strategy of

recycling capital to reduce leverage and fund higher-returning

portfolio opportunities. The sale to a leading pan-European real

estate investor, at a level close to valuation, highlights the

liquidity of the properties in our portfolio, and evidences the

continued investor interest in high-quality logistics assets.

Further disposals have been identified and we remain confident of

achieving our target loan to value percentage of low 40s over the

next 6 to 12 months."

Further information

Tritax EuroBox plc

+44 (0) 20 8051 5070

Phil Redding - CEO

Mehdi Bourassi - CFO

Charles Chalkly - Investor Relations

Kekst CNC (Media enquiries)

Tom Climie / Guy Bates

07760 160 248 / 07581 056 415

tritax@kekstcnc.com

Notes

Tritax EuroBox plc invests in and manages a well-diversified

portfolio of Continental European logistics real estate. These

assets fulfil crucial roles in logistics and distribution supply

chains, and are located in established logistics markets near major

population centres across core Continental European countries.

Our high-quality portfolio is highly sustainable, offers

predictable and predominantly inflation-linked income and has

opportunities for capital growth through active asset management.

These attributes underpin our ability to generate attractive

returns for Shareholders over the long term.

The Manager, Tritax Management LLP, has assembled a

full-service, pan-European capability for the Company, combining

in-house leadership and strategic expertise with close partnerships

with leading European developers and asset managers.

The Manager comprises a skilled, diverse team of real estate

professionals with expertise across investment, asset management,

development, finance, business analysis, research and

communications. This is supplemented with specialist, on-the-ground

developers, and asset and property managers with strong market

standings in the Continental European logistics sector.

Further information on the Company is available at:

tritaxeurobox.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCWPGACGUPWGWU

(END) Dow Jones Newswires

November 30, 2023 08:47 ET (13:47 GMT)

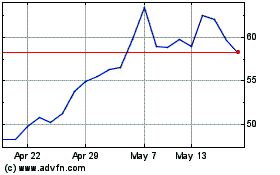

Tritax Eurobox (LSE:EBOX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tritax Eurobox (LSE:EBOX)

Historical Stock Chart

From Nov 2023 to Nov 2024